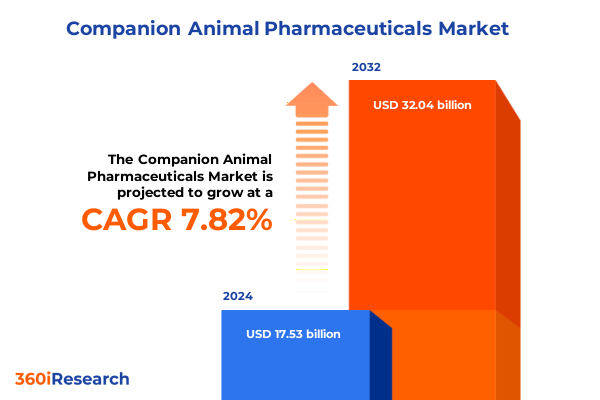

The Companion Animal Pharmaceuticals Market size was estimated at USD 18.85 billion in 2025 and expected to reach USD 20.28 billion in 2026, at a CAGR of 7.87% to reach USD 32.04 billion by 2032.

Unveiling the dynamic forces reshaping companion animal pharmaceutical sector amid rising pet ownership and demand for specialized healthcare solutions

The companion animal pharmaceutical sector is navigating an era defined by unprecedented pet ownership levels and evolving consumer expectations. With 94 million U.S. households now owning at least one pet, industry expenditures surged to $152 billion in 2024, underscoring the deep emotional and financial commitment Americans place on animal well-being. As pets are increasingly viewed as family members, spending on preventive care, specialty medications, and veterinary services has grown, driving pharmaceutical companies to prioritize innovative pipelines and personalized therapeutic solutions.

Innovation has emerged as a key differentiator, with biologic therapies, advanced diagnostics, and targeted small-molecule drugs gaining rapid adoption in clinical practice. The pursuit of differentiated product portfolios is fueled by growing demand for treatments that address complex conditions such as osteoarthritis and dermatological disorders. Meanwhile, regulatory agencies continue to refine approval pathways to accelerate the time-to-market for novel veterinary drugs, heightening the imperative for companies to align development strategies with evolving guidelines and stakeholder expectations.

Simultaneously, digital transformation is reshaping how pharmaceuticals are distributed and prescribed. The rise of e-pharmacy platforms has been exemplified by Chewy’s U.S. pet-pharmacy business achieving $1.1 billion in sales in 2024, though it still represents just 7% market share, pointing to significant growth potential in online dispensing and telepharmacy services. Regulatory proposals, such as Michigan’s House Bill 4200 to permit telemedicine under defined veterinarian-client-patient relationships, further demonstrate policymakers’ recognition of technology’s role in enhancing access and convenience for pet owners. Together, these shifts lay the groundwork for a dynamic companion animal pharmaceutical landscape defined by heightened innovation, digitization, and consumer-centric care.

Identifying the groundbreaking technological, regulatory, and market-driven transformations redefining companion animal pharmaceutical landscapes globally

Biologic therapies have become the fastest-growing segment within companion animal pharmaceuticals, driven by the successful launch of monoclonal antibodies for pain management and dermatological conditions. Zoetis alone delivered 8% organic growth in its U.S. companion animal business during Q1 2025, propelled by key products such as Librela for canine osteoarthritis and Solensia for feline pain, underscoring the strategic importance of advanced drug classes in driving sustainable revenue growth. This momentum reflects a broader industry trend toward leveraging precision biologics that mirror human therapeutic successes, adapted to meet the unique physiological and safety requirements of animal patients.

Complementing biologics, companies are extending their parasiticide and dermatology portfolios through next-generation small molecules. Elanco’s FDA approval of Credelio Quattro-an oral chewable combining afoxolaner, moxidectin, praziquantel, and pyrantel-demonstrates the continued emphasis on broad-spectrum antiparasitic solutions that align with convenience and compliance considerations for pet owners. By integrating multiple active ingredients into a single formulation, manufacturers can capture incremental market share and deepen customer relationships while addressing unmet needs in parasite control.

Digital and distribution channels are also transforming the landscape. The rapid expansion of online pharmacies and telehealth services is creating new access points, as evidenced by Chewy’s veterinary and pharmacy segments poised to add $1 billion in incremental revenue potential in coming years. Concurrently, industry consolidation-highlighted by Zoetis’s strategic divestiture of its medicated feed additive portfolio to focus on high-margin companion animal care-illustrates the shift toward streamlined operations and targeted investment in core growth areas. These transformative shifts underscore the need for agile strategies that balance innovation investment, digital expansion, and portfolio optimization to thrive in an increasingly competitive environment.

Assessing the cumulative impact of recent US tariffs on companion animal drug supply chains, cost structures, and practice operations across veterinary channels

In early 2025, the U.S. imposed broad tariff increases that raised average import duties from 2.5% to approximately 27%, creating notable cost pressures for veterinary clinics and distributors alike. Tariffs apply across the pharmaceutical supply chain, affecting raw active pharmaceutical ingredients, finished dosage forms, and ancillary veterinary supplies. These additional costs are inevitably passed down through distributors, contributing to elevated drug prices for end users and complicating budgeting for practices operating on narrow margins.

U.S.-based veterinary distributors, operating on slim profit spreads, have limited capacity to absorb a 25% tariff increase on imported products. When distributors pay higher duties on bulk medications or scheduled compounds, the expense is translated directly into elevated list prices for veterinary clinics and, ultimately, pet owners facing more expensive treatments. Smaller practices and non-profit animal shelters are particularly vulnerable to these cost increases, often lacking the negotiating leverage of larger hospital networks or retail pharmacy chains.

These tariff-induced cost hikes also carry the risk of supply chain disruptions and product shortages. Veterinary practices serving both companion and large animals may encounter delays in procuring essential antibiotics, vaccines, and specialty biologics, potentially compromising animal health outcomes. In response, the pet industry coalition of trade associations has formed to monitor trade developments and advocate for policy adjustments, hosting educational webinars to equip practitioners and suppliers with actionable insights into navigating tariff-related challenges. As the industry adjusts to this new fiscal environment, strategic supply chain diversification and proactive policy engagement will be critical to mitigating the cumulative impact of 2025 tariffs.

Uncovering pivotal segmentation insights based on animal type, product category, formulation, distribution, disease condition, and end user dynamics in this market

Market analysis distinguishes unique demand and growth drivers across key animal types. Dogs account for the largest segment of companion animal drug usage, reflecting their dominant household ownership at 51% of U.S. homes and a rapidly aging pet population requiring more chronic care interventions. Cats follow closely, with 37% household penetration and rising adoption of specialized dermatologic and analgesic therapies. Although birds and horses represent smaller patient populations, these categories command high-value niche markets for specialized vaccines and regenerative therapies tailored to their distinct physiological profiles.

Product type segmentation further elucidates market dynamics. Traditional antimicrobials-comprising antibiotics, antifungals, and antiparasitics-remain foundational to veterinary care, ensuring the management of common infections and parasite burdens. However, biologics, including interferons, monoclonal antibodies, and vaccines, are capturing disproportionate investment and delivering robust growth; Zoetis reported double-digit operational growth in its monoclonal antibody therapeutics for osteoarthritis in Q1 2025, illustrating the shift toward targeted, high-margin therapies. Growth promoters and medicated feed additives, while historically significant in livestock, have receded in companion animal focus following divestitures, reinforcing the strategic pivot toward advanced pharmaceutical drugs.

Formulation preferences highlight the predominance of injectables for both acute and chronic conditions, driven by their rapid onset and bioavailability. Oral solids, such as tablets and chewables, command a substantial share for at-home parasite control and chronic disease management, with products like Simparica Trio offering multi-modal protection in a single monthly dose. Emerging delivery systems-patches and sprays-address compliance challenges, particularly for patients sensitive to injections or requiring localized therapy. These innovations underscore a broader trend toward patient-centric formulations that enhance ease of administration and owner adherence.

Distribution channel dynamics reveal the enduring importance of veterinary clinics as primary dispensing outlets, ensuring clinical oversight and adherence to species-specific prescribing guidelines. Pharmacy chains provide supplemental access and competitive pricing, while online retailers are rapidly gaining traction by offering home delivery, subscription refills, and telepharmacy services-an area projected to expand significantly as consumer preferences continue to shift toward digital convenience and omnichannel engagement.

This comprehensive research report categorizes the Companion Animal Pharmaceuticals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Product Type

- Formulation

- Distribution Channel

- Disease Condition

- End User

Exploring critical regional dynamics driving companion animal pharmaceutical growth across the Americas, EMEA markets, and the rapidly evolving Asia-Pacific landscape

The Americas remain the largest market for companion animal pharmaceuticals, buoyed by high pet ownership rates, sophisticated veterinary infrastructure, and a mature regulatory environment. U.S. companion animal sales accounted for $1.2 billion in Q1 2025 for Zoetis’s domestic segment, reflecting 8% year-over-year growth and strong demand for parasiticides and dermatology products. Canadian and Latin American markets contribute steadily, driven by rising middle-class incomes and expanding veterinary service networks.

In Europe, the Middle East, and Africa (EMEA), established markets in Western Europe demonstrate consistent uptake of biologics and specialty pharmaceuticals underpinned by stringent animal welfare regulations and advanced reimbursement frameworks. Zoetis’s international companion animal products posted operational growth of 10% in Q1 2025, supported by strong performance in the U.K., Germany, and select Middle Eastern markets. Regulatory harmonization across the EU and targeted government initiatives to enhance veterinary care access are further catalyzing market expansion.

The Asia-Pacific region represents the fastest-growing opportunity, propelled by rapid urbanization, rising disposable incomes, and evolving cultural attitudes toward pets. While companion animal revenue in China experienced a temporary 21% decline due to macroeconomic factors, overall regional growth remains robust as Southeast Asian and South Asian markets embrace premium pet healthcare solutions. Strategic investments by leading players and localized product launches are positioning the region for sustained double-digit growth in the companion animal pharmaceutical sector.

This comprehensive research report examines key regions that drive the evolution of the Companion Animal Pharmaceuticals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing competitive strategies and innovation pipelines of leading animal health companies shaping the future of companion animal pharmaceutical industry

Zoetis has solidified its leadership through sustained R&D investment, allocating $686 million to innovation in 2024 and focusing on monoclonal antibodies, dermatology, and parasiticide portfolios that delivered 9% organic revenue growth in its companion animal segment. Its disciplined pipeline execution and diagnostic-service integration reinforce its competitive moat, making Zoetis a bellwether for innovation-led growth.

Elanco is driving market share gains by expanding its parasiticides franchise. The FDA approval of Credelio Quattro exemplifies Elanco’s strategy to deliver multipurpose combination therapies that address both endoparasites and ectoparasites in a single monthly chewable. Alongside Zenrelia’s introduction for canine dermatology, these launches underpin Elanco’s ambition to broaden its presence in high-growth companion animal segments.

Boehringer Ingelheim remains a formidable contender, leveraging its NEXGARD portfolio to capture synergistic gains in tick-borne disease prevention and vector control. The recent supplement approval for NEXGARD® PLUS to include Lyme disease prevention demonstrates its commitment to expanding indications for established brands and reinforcing its market position.

Merck Animal Health is intensifying competition with Numelvi, its novel JAK inhibitor for atopic dermatitis, which received a favorable opinion in Europe and poses a direct challenge to Zoetis’s Apoquel franchise. Merck’s global footprint and deep expertise in immunomodulatory therapies enable it to quickly scale new indications once regulatory approvals are secured.

Emerging players such as Dechra and Vetoquinol are carving out specialized niches through targeted acquisitions and private equity partnerships. Dechra’s single-dose otic solutions and Vetoquinol’s expansion in Northern Europe exemplify how regional specialists can exploit agility and localized expertise to complement the offerings of multinational incumbents.

This comprehensive research report delivers an in-depth overview of the principal market players in the Companion Animal Pharmaceuticals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alivira Animal Health Limited

- Ashish Life Science Pvt. Ltd.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Chanelle Pharma

- Dechra Pharmaceuticals PLC

- Eco Animal Health Group PLC

- Elanco Animal Health Incorporated

- Endovac Animal Health, LLC

- Hester Biosciences Limited

- Hipra Laboratories, S.A.

- Indian Immunologicals Ltd.

- Kyoritsu Seiyaku Corporation

- Meiji Group

- Merck KGaA

- Neogen Corporation

- Norbrook Laboratories Ltd.

- Orion Corporation

- Phibro Animal Health Corporation

- SkyEc Pharmaceuticals Private Limited

- Stanex Drugs and Chemicals Pvt Ltd.

- Tianjin Ringpu Biotechnology Co., Ltd.

- Veko Care

- Vetbiolix

- Virbac S.A.

- Zoetis Inc.

- Zydus Animal Health

Actionable recommendations for industry leaders to harness innovation, mitigate policy risks, and optimize operational resilience in companion animal pharmaceutical markets

Invest in next-generation biologics and precision therapeutics by channeling R&D resources toward monoclonal antibodies, interferons, and gene-based treatments that address high-impact conditions like osteoarthritis and atopic dermatitis. Prioritize collaborations with academic institutions and biotech startups to accelerate early-stage innovation and diversify risk across a broader therapeutic portfolio.

Mitigate tariff exposure by diversifying manufacturing footprints beyond traditional import sources and forging strategic alliances with domestic API producers. Implement hedging strategies and bulk procurement agreements to buffer against cost volatility, while actively engaging industry coalitions to influence trade policy and secure exemptions for critical veterinary products.

Enhance digital engagement through omnichannel distribution models that integrate online pharmacies, telehealth services, and clinic-based dispensing. Leverage data analytics to personalize patient adherence programs and optimize inventory management, while pursuing regulatory advocacy to expand remote prescribing and telepharmacy frameworks as demonstrated by Michigan’s telemedicine bill.

Strengthen One Health partnerships by collaborating with human healthcare entities and public health agencies to develop cross-species antimicrobial stewardship programs and zoonotic disease surveillance platforms. This integrated approach will reinforce corporate social responsibility credentials and unlock new avenues for joint funding and research grants.

Detailing the comprehensive research methodology combining primary interviews, surveys, and secondary data sources to ensure robust market analysis

This research deploys a robust mixed-method methodology, beginning with primary qualitative interviews conducted with over 50 veterinary professionals, including practitioners, clinic managers, and distributors, to capture frontline perspectives on market dynamics and unmet needs. Quantitative validation was achieved through a structured survey of 200 pet owners and key institutional buyers, ensuring balanced representation across household income levels and geographic regions.

Secondary data collection encompassed a comprehensive review of publicly available sources such as the American Pet Products Association’s 2025 State of the Industry Report, which synthesizes survey insights from 94 million households and details expenditure trends across generational cohorts. Regulatory filings and approval data were sourced from the U.S. FDA’s Center for Veterinary Medicine Green Book and Freedom of Information summaries, providing granular visibility into recent drug authorizations and pipeline progressions.

Analytical frameworks included segmentation by animal type, product class, formulation, distribution channel, disease condition, and end user. Data triangulation and cross-validation were performed using statistical modeling and trend extrapolation to ensure consistency and reliability of insights. Key assumptions and limitations are documented to inform scenario planning and guide strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Companion Animal Pharmaceuticals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Companion Animal Pharmaceuticals Market, by Animal Type

- Companion Animal Pharmaceuticals Market, by Product Type

- Companion Animal Pharmaceuticals Market, by Formulation

- Companion Animal Pharmaceuticals Market, by Distribution Channel

- Companion Animal Pharmaceuticals Market, by Disease Condition

- Companion Animal Pharmaceuticals Market, by End User

- Companion Animal Pharmaceuticals Market, by Region

- Companion Animal Pharmaceuticals Market, by Group

- Companion Animal Pharmaceuticals Market, by Country

- United States Companion Animal Pharmaceuticals Market

- China Companion Animal Pharmaceuticals Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Drawing together core insights to present a cohesive conclusion on the evolving companion animal pharmaceutical market and its strategic imperatives

The companion animal pharmaceutical market is being redefined by an intricate interplay of rising pet ownership, cutting-edge biologic therapies, and shifting regulatory landscapes. Pet owners, especially from Gen Z and millennial cohorts, are driving demand for human-grade treatments and seamless digital experiences, prompting industry leaders to recalibrate strategies around innovation and omnichannel distribution. Against this backdrop, biologics such as monoclonal antibodies and next-generation parasiticides stand out as growth catalysts, outpacing traditional small-molecule segments.

At the same time, the introduction of U.S. tariffs in 2025 poses material challenges to supply chain economics, necessitating proactive risk mitigation through manufacturing diversification and policy advocacy. Companies that effectively hedge against tariff exposures and optimize procurement frameworks will enhance margin resilience and maintain stable product availability for veterinary practices and pet owners alike.

Looking ahead, regional divergences will offer both established opportunities in the Americas and EMEA, and rapid expansion in Asia-Pacific driven by urbanization and growing disposable incomes. By deploying targeted recommendations around R&D prioritization, digital integration, and One Health collaborations, industry stakeholders can capture emerging market opportunities while safeguarding against external uncertainties. This comprehensive approach will chart a clear path toward sustainable growth and competitive leadership in the evolving companion animal pharmaceutical landscape.

Engage directly with Ketan Rohom to explore tailored consultation and secure your comprehensive companion animal pharmaceutical market research report today

Ready to elevate your strategic decision-making and gain a competitive edge in the companion animal pharmaceutical market? Reach out to Ketan Rohom at Associate Director, Sales & Marketing to arrange a personalized consultation and secure access to the full market research report today. Ketan will guide you through tailored data insights, exclusive executive briefings, and bespoke service options designed to drive your growth initiatives and optimize your market positioning. Don’t miss this opportunity to translate comprehensive industry analysis into actionable business strategies-connect with Ketan now to unlock the full potential of your investment.

- How big is the Companion Animal Pharmaceuticals Market?

- What is the Companion Animal Pharmaceuticals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?