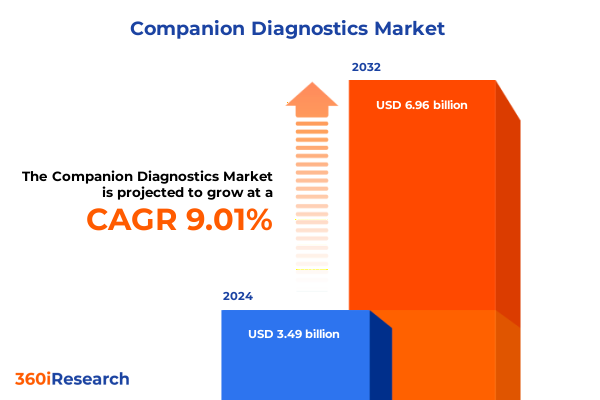

The Companion Diagnostics Market size was estimated at USD 3.79 billion in 2025 and expected to reach USD 4.13 billion in 2026, at a CAGR of 9.04% to reach USD 6.96 billion by 2032.

Exploring the Driving Forces Behind Companion Diagnostics: Precision Medicine Integration, Regulatory Milestones, and Collaborative Innovation for Improved Patient Outcomes

Companion diagnostics has emerged as a fundamental enabler of precision medicine, guiding therapeutic decision-making by identifying biomarkers that predict patient response to targeted therapies. These specialized assays integrate seamlessly with drug development pipelines, providing clinicians with critical insights into genetic, proteomic, and molecular profiles that inform treatment selection. Over the past decade, the scope of companion diagnostics has expanded beyond oncology into areas such as infectious diseases, genetic disorders, and pharmacogenomics, reflecting a broader shift toward personalized healthcare across multiple therapeutic domains.

In parallel with technological advances, the companion diagnostics paradigm has been shaped by evolving regulatory frameworks. Regulatory agencies have established clear pathways for co-development and parallel approval of drugs and their companion assays, fostering an environment of collaboration between diagnostics developers and pharmaceutical manufacturers. Recent guidance on biomarker-driven therapies has underscored the importance of analytical and clinical validation, streamlining review processes for assays that demonstrate robust performance in targeted patient populations.

Collaborative research frameworks between diagnostics and therapeutics developers have accelerated co-validation studies, minimizing time to market and aligning assay performance metrics with drug efficacy endpoints. Significant investments and partnerships among biotech firms, academic centers, and technology providers continue to fuel innovation and expand the clinical utility of companion diagnostics.

Against this backdrop of innovation and regulatory support, this report synthesizes the most significant trends driving the companion diagnostics market. It offers a comprehensive overview of transformative shifts in technology, evaluates the impact of trade policies, and presents in-depth segmentation analyses covering product types, applications, end users, and distribution channels. By examining regional dynamics and profiling leading companies, this executive summary equips stakeholders with actionable insights to navigate the companion diagnostics landscape and capitalize on emerging opportunities.

How Technological Innovation and Evolving Regulatory Policies Are Shaping the Future of Companion Diagnostics for Personalized Healthcare Delivery

In recent years, the companion diagnostics field has undergone transformative shifts driven by the convergence of high-throughput technologies and advanced data analytics. Next generation sequencing has enabled comprehensive genomic profiling across multiple genes, while multiplex immunohistochemistry assays facilitate simultaneous detection of protein markers, accelerating biomarker discovery and guiding targeted therapies.

The integration of artificial intelligence and machine learning has further enhanced assay interpretation, as adaptive algorithms reduce reliance on manual scoring and improve reproducibility. The FDA’s artificial intelligence and machine learning action plan and recent draft guidance on AI-enabled device software functions have provided a clear regulatory framework for Software as a Medical Device, encouraging developers to adopt lifecycle management practices that ensure safety and effectiveness.

Simultaneously, liquid biopsy approaches have emerged as minimally invasive companion diagnostics, leveraging circulating tumor DNA to monitor treatment response and disease progression in real time. Clinicians increasingly demand rapid turnaround times and longitudinal monitoring capabilities, driving advancements in assay sensitivity and specificity for blood-based CDx platforms.

Moreover, the shift toward decentralized testing models and point-of-care diagnostics is redefining companion diagnostic deployment. Advances in microfluidics and portable sequencing systems are enabling on-site biomarker analysis outside centralized laboratories, reducing time to result and expanding access to precision medicine in outpatient and resource-limited settings.

Assessing the Cumulative Impact of 2025 United States Tariffs on Global Companion Diagnostics Supply Chains and Strategic Resilience Planning

In April 2025, the U.S. administration implemented a comprehensive tariff package imposing a baseline 10% import duty on medical devices and equipment, with higher reciprocal tariffs targeting select trading partners. Simultaneously, negotiations between the U.S. and European Union have proposed a consolidated 15% tariff rate on European imports, though exemptions for critical goods such as medical devices are being discussed to avoid disruption of clinical supply chains.

These measures reflect a broader effort to counter perceived unfair trade practices, but they carry significant implications for companion diagnostics developers reliant on global supply chains. According to GlobalData, the reinstatement of Section 301 tariffs on Class I and II medical instruments could intensify cost pressures and incentivize supply chain diversification away from high-tariff jurisdictions.

Leading diagnostic manufacturers are actively evaluating mitigation strategies. For example, Johnson & Johnson estimated a $400 million impact on its MedTech division in 2025, citing duties on non-USMCA compliant imports from China, Canada, and Mexico. This headwind underscores the urgency for companies to reassess sourcing strategies and adapt pricing agreements with healthcare providers.

Industry associations have lobbied intensively for targeted exemptions. The American Hospital Association, supported by AdvaMed, has urged policymakers to carve out medical devices from sweeping import duties, warning that tariffs could drive up healthcare costs and disrupt patient access to critical diagnostics.

Looking ahead, organizations are likely to accelerate investments in regional manufacturing hubs and nearshoring initiatives to mitigate tariff exposure. While government negotiations may yield exemptions or phased relief, the cumulative impact of U.S. tariffs in 2025 will continue to shape strategic planning for companion diagnostics pipelines, emphasizing resilience and localization in manufacturing and distribution.

Integrating Market Segmentation Insights Across Product Types, Applications, End Users, and Distribution Channels in the Companion Diagnostics Ecosystem

Analysis across product modalities reveals that immunohistochemistry remains a foundational assay, offering robust protein expression profiling, while in situ hybridization continues to enable precise chromosomal abnormality detection. At the same time, next generation sequencing is being applied in both targeted panels and comprehensive transcriptome analyses, and whole genome sequencing has unlocked broader discovery applications. Meanwhile, polymerase chain reaction assays, including both digital and quantitative formats, continue to deliver rapid and highly sensitive mutation detection, reinforcing their position in routine clinical workflows.

From an application perspective, companion diagnostics are being deployed across oncology and infectious diseases, with an expanding footprint in genetic disorders and pharmacogenomics. This breadth of use cases underscores the versatility of CDx technologies in supporting therapeutic development and personalized treatment strategies. In terms of end users, academic research institutions drive early-stage validation studies, diagnostic laboratories and hospital networks facilitate high-throughput clinical testing, and pharmaceutical companies integrate companion diagnostics into drug development and commercialization pathways. Distribution channels are also evolving, with strategic procurement via direct tenders for large healthcare systems, distribution through regional partners, and growing digital fulfillment through online platforms to reach smaller laboratories and remote clinics.

The interplay of these segmentation dimensions highlights how market participants tailor their offerings to specific clinical needs, optimize supply chain configurations, and identify high-growth niches by aligning technological capabilities with end-user demands.

This comprehensive research report categorizes the Companion Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Evaluating Regional Dynamics in Companion Diagnostics Adoption Across the Americas, Europe Middle East Africa, and Asia-Pacific Markets

Regionally, the Americas continue to lead in companion diagnostics adoption, driven by mature pharmaceutical markets in the United States and Canada where regulatory clarity and reimbursement frameworks have fostered high utilization rates. The presence of leading biopharmaceutical companies and extensive clinical trial networks accelerates CDx integration with novel oncology and rare disease therapies. Conversely, Latin America, while nascent, shows growing interest via public–private partnerships and the expansion of diagnostic infrastructure.

In Europe, Middle East & Africa, heterogeneous healthcare systems and diverse regulatory landscapes present both challenges and opportunities. Western European countries benefit from centralized health technology assessment and progressive coverage policies, enabling faster uptake of companion diagnostics, whereas emerging markets in Eastern Europe, the Middle East, and Africa are investing in laboratory modernization to bridge gaps in molecular diagnostic capabilities. Cross-border regulatory initiatives, such as the European In Vitro Diagnostic Regulation, are promoting harmonized standards and enhancing market access.

The Asia-Pacific region is characterized by dynamic growth, fueled by large patient populations, increasing healthcare spending, and strong government support for biotechnology innovation. China and Japan are at the forefront of CDx adoption, with domestic companies collaborating with global partners to co-develop tailored assays. Southeast Asian markets are rapidly scaling molecular diagnostic capacity, leveraging cost-effective platforms and telemedicine frameworks to expand precision medicine reach. Collectively, these regional trends underscore the necessity for differentiated strategies that account for regulatory, economic, and infrastructural variables across key geographies.

This comprehensive research report examines key regions that drive the evolution of the Companion Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biotechnology and Diagnostic Players Driving Innovation, Partnerships, and Market Expansion in the Evolving Companion Diagnostics Landscape

Global leadership in companion diagnostics is anchored by a select group of pioneering firms that combine technological prowess with strategic partnerships. F. Hoffmann-La Roche has consolidated its position through acquisitions and collaborations, integrating digital pathology solutions with its immunohistochemistry platforms to deliver streamlined workflows and AI-driven image analysis. Illumina continues to shape the next generation sequencing landscape, advancing turnkey gene panels and cloud-based bioinformatics services that enable real-time genomic interpretation and clinical decision support.

Thermo Fisher Scientific’s broad portfolio, spanning PCR-based assays and high-throughput sequencing reagents, underpins its ability to serve diverse laboratory environments, while its focused investments in microfluidics and lab automation enhance throughput and reproducibility. Qiagen leverages its molecular diagnostics expertise to deliver flexible testing solutions, particularly in liquid biopsy and digital PCR modalities, capitalizing on partnerships with pharmaceutical developers to co-create biomarker assays.

Agilent Technologies has differentiated through integrated platforms that combine microarray, sequencing, and mass spectrometry capabilities, enabling multiplexed target identification for complex biomarker signatures. Emerging players such as Guardant Health and Foundation Medicine are driving innovation in non-invasive CDx, with liquid biopsy assays that detect circulating tumor DNA mutations for dynamic disease monitoring. Across this competitive landscape, sustained growth depends on strategic alliances between diagnostics providers, biopharmaceutical sponsors, and technology innovators to co-develop assays that align with evolving treatment paradigms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Companion Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Abnova Corporation

- Agendia, Inc.

- Agilent Technologies, Inc.

- Almac Group

- Amoy Diagnostics Co., Ltd.

- ARUP Laboratories

- Bio-Techne Corporation

- Biogenex Laboratories, Inc

- bioMérieux SA

- Danaher Corporation

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Guardant Health, Inc

- ICON PLC

- Illumina, Inc.

- Invivoscribe Technologies, Inc.

- Myriad Genetics, Inc.

- NG biotech

- QIAGEN N.V.

- R-Biopharm AG

- Siemens AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Actionable Strategic Recommendations for Stakeholders to Leverage Emerging Technologies, Optimize Supply Chains, and Enhance Regulatory Engagement in Companion Diagnostics

In light of the converging technological and regulatory trends, industry leaders should prioritize end-to-end integration of next generation sequencing into clinical workflows by fostering collaborations with bioinformatics vendors to streamline data analysis and interpretation. In parallel, organizations must engage proactively with regulatory authorities to align on adaptive AI/ML frameworks, submitting detailed lifecycle management plans and demonstrating Good Machine Learning Practice in accordance with FDA’s draft guidance on AI-enabled device software functions.

To mitigate geopolitical and trade-related risks, diagnostic manufacturers should diversify supply chains by establishing regional manufacturing hubs in low-tariff jurisdictions and nearshoring critical reagent production. Such localization strategies will reduce dependency on high-tariff imports and improve responsiveness to local market needs. Additionally, companies should explore point-of-care and decentralized testing models, investing in microfluidic and portable sequencing devices that enable rapid on-site biomarker detection in outpatient settings.

Finally, forging strategic alliances with pharmaceutical partners throughout the drug development lifecycle will ensure that companion diagnostics are fully integrated into clinical trial designs, optimizing patient stratification and accelerating approval timelines. By adopting these actionable measures, industry stakeholders can strengthen their competitive position and drive sustainable growth in the evolving companion diagnostics ecosystem.

Outlining a Comprehensive Research Methodology Combining Primary Interviews, Secondary Data, and Rigorous Segmentation Analysis for Companion Diagnostics Insights

In compiling this comprehensive analysis, a rigorous multi-tiered research approach was employed. Secondary research involved extensive review of regulatory frameworks, industry white papers, company reports, and peer-reviewed literature to establish a foundational understanding of companion diagnostics technologies, market drivers, and policy developments. Primary research included in-depth interviews with key opinion leaders, including laboratory directors, regulatory experts, and senior executives from diagnostics and pharmaceutical companies, to validate trends and capture insights on strategic initiatives and investment priorities.

Quantitative data collection leveraged a bottom-up approach, aggregating technology adoption rates, assay throughput statistics, and regional deployment figures derived from publicly available registries and proprietary databases. Insights were further refined through cross-validation with top-down estimates based on clinical trial activity, drug approval pipelines, and healthcare expenditure metrics. A segmentation framework was developed to examine market dynamics across product types, applications, end users, and distribution channels, ensuring a comprehensive lens on growth opportunities and competitive positioning.

Analytical rigor was maintained through triangulation of data sources and iterative feedback loops with industry stakeholders. Limitations and assumptions are documented in the full report to provide transparency, fostering confidence in the robustness of the conclusions and recommendations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Companion Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Companion Diagnostics Market, by Product Type

- Companion Diagnostics Market, by Application

- Companion Diagnostics Market, by End User

- Companion Diagnostics Market, by Distribution Channel

- Companion Diagnostics Market, by Region

- Companion Diagnostics Market, by Group

- Companion Diagnostics Market, by Country

- United States Companion Diagnostics Market

- China Companion Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Reflections on the Transformative Role of Companion Diagnostics in Precision Medicine and Strategies for Sustained Innovation and Growth in the Sector

Companion diagnostics stand at the forefront of precision medicine, driving deeper insights into patient-specific biology and enabling targeted therapeutic strategies. The confluence of advanced sequencing technologies, AI-driven data analytics, and evolving regulatory frameworks has reshaped diagnostic paradigms, transforming the drug development process and improving clinical outcomes. Despite challenges posed by geopolitical uncertainties and trade policies, the sector has demonstrated resilience through strategic supply chain diversification and localized manufacturing initiatives.

As diagnostic and pharmaceutical stakeholders navigate segmentation nuances and regional intricacies, a clear emphasis on collaboration, technological adoption, and proactive regulatory engagement will be critical. The insights and recommendations outlined in this executive summary provide a strategic roadmap for harnessing the full potential of companion diagnostics. By aligning technological capabilities with clinical needs and market realities, organizations can unlock new opportunities for patient-centric innovation and sustainable growth within the rapidly evolving landscape of precision healthcare.

Engage with Associate Director Ketan Rohom to Access the Full Companion Diagnostics Market Research Report and Unlock Tailored Insights for Strategic Growth

To obtain the full suite of actionable insights and exhaustive market analysis covering technology trends, regulatory landscapes, and competitive strategies within the companion diagnostics field, contact Ketan Rohom, Associate Director, Sales & Marketing. Ketan will provide expert consultation, discuss tailored research deliverables, and facilitate access to a detailed report that illuminates growth prospects across product segments, applications, and geographies. Engage with him today to secure your organization’s competitive edge and drive strategic decision-making with data-driven intelligence. Take the next step toward optimizing your companion diagnostics portfolio by reaching out directly to Ketan Rohom for bespoke research and support on implementing these insights into your business strategy.

- How big is the Companion Diagnostics Market?

- What is the Companion Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?