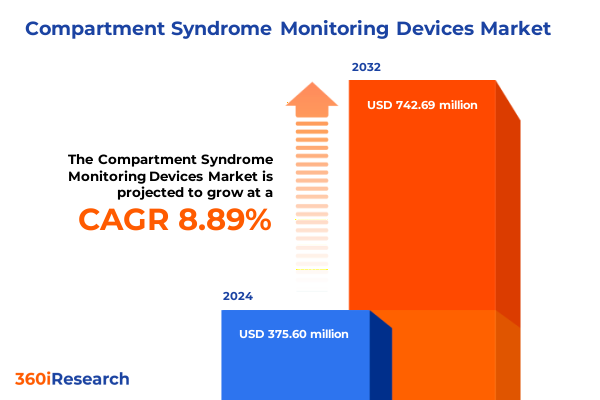

The Compartment Syndrome Monitoring Devices Market size was estimated at USD 402.42 million in 2025 and expected to reach USD 437.87 million in 2026, at a CAGR of 9.14% to reach USD 742.69 million by 2032.

Revealing the Imperative Role of Precision Monitoring Technologies in Anticipating and Mitigating Life-Threatening Compartment Syndrome Emergencies

Compartment syndrome represents a critical vascular condition in which elevated pressures within a confined fascial compartment compromise tissue perfusion, risking irreversible damage to muscle, nerve, and limb function. Early detection is paramount, as delays in diagnosis and intervention can lead to life-threatening complications and significant morbidity. Historically, clinicians have relied on manual invasive pressure measurements and subjective clinical assessments, which carry inherent procedural risks and variability. However, the convergence of cutting-edge sensor technologies and digital connectivity is transforming the way care teams monitor intracompartmental pressures, promising a new era of precision, speed, and safety in diagnostic protocols.

In recent years, stakeholders across the healthcare continuum have intensifying interest in devices capable of delivering continuous, real-time data on compartment pressures, guided by predictive analytics and wireless transmission. By integrating seamless end-to-end monitoring solutions, clinicians can detect subtle changes in tissue dynamics, initiate timely surgical interventions, and potentially reduce the incidence of adverse outcomes. Moreover, these innovations are reshaping clinical pathways, unlocking opportunities for outpatient procedures, remote patient management, and post-acute rehabilitation monitoring.

Unveiling How Wireless Connectivity Artificial Intelligence and Miniaturization Are Revolutionizing Compartment Syndrome Monitoring Landscape

The compartment syndrome monitoring landscape is undergoing a seismic transformation fueled by relentless miniaturization of sensing elements, proliferation of wireless communication protocols, and the rise of artificial intelligence–driven diagnostics. What once demanded bulky, tethered equipment has evolved into sleek, implantable modules and wearable interfaces capable of continuous surveillance. At the same time, hybrid architectures are emerging, combining the robustness of invasive pressure measurement with the convenience of wireless data transfer.

Furthermore, the infusion of machine learning algorithms is enabling predictive trend analysis, alerting care teams to evolving pressure elevations before clinical thresholds are breached. As digital health platforms mature, interoperability with electronic medical records and telemedicine portals is becoming standard, enhancing care coordination and facilitating longitudinal outcome studies. Consequently, providers and payers alike are reimagining patient pathways to capitalize on these advancements, shifting emphasis from reactive intervention to proactive management.

Examining the Far-Reaching Ripple Effects of 2025 United States Tariffs on Global Supply Chains Pricing and Strategic Sourcing Decisions in the Sector

In 2025, new rounds of tariff adjustments by the United States government imposed elevated duties on imported medical components, significantly affecting specialized sensor modules, microelectromechanical assemblies, and wireless communication chips integral to compartment syndrome monitoring devices. These levies have incrementally increased input costs, compelling manufacturers to reevaluate sourcing strategies and renegotiate supply contracts. As a result, the sector has witnessed intensified collaboration with domestic suppliers, joint investments in localized production capacity, and selective redesign of key components to mitigate exposure to tariff volatility.

In parallel, the cumulative impact of these tariffs has exerted pricing pressure across product portfolios, particularly within high-precision, premium-tier offerings where proprietary materials and advanced semiconductor processes are essential. To navigate this environment, leaders have adopted a dual-track approach: securing long-term supplier agreements with tariff mitigation clauses and accelerating research into alternative materials and sensor architectures. Consequently, the 2025 tariff landscape has acted as both a catalyst for supply chain resilience and a crucible for innovation, ultimately reshaping competitive dynamics and value propositions across the monitoring ecosystem.

Unlocking Comprehensive Segmentation Perspectives That Illuminate Technology Product Type End User Application and Pricing Tier Dynamics Across the Market

Insights drawn from a granular analysis of technology segmentation reveal a nuanced interplay between evolving sensor modalities and system architectures. Hybrid platforms that integrate wireless data transmission with miniaturized invasive pressure sensors are gaining traction among trauma centers seeking immediacy of data without the constraints of tethered equipment. Conversely, invasive approaches continue to advance, with continuous monitoring systems leveraging microfluidic channels and disposable catheters that feed intermittent measurement modules, thereby enhancing operational flexibility in surgical and post-operative settings. Non-invasive alternatives, in turn, are diversifying to encompass optical sensors that detect hemodynamic changes, pressure sensors embedded in wearable sleeves, and ultrasound sensor arrays that offer non-contact measurement-all driving broader adoption across ambulatory care pathways.

Equally compelling are the dynamics emerging from the product type segmentation, which splits the market between robust continuous monitoring systems, compact handheld monitors, implantable sensors designed for long-term surveillance, and versatile wireless monitoring devices. Within the wireless subset, Bluetooth compatibility has become the de facto standard for bedside and in-hospital connectivity, while Wi-Fi enabled devices are increasingly deployed in outpatient and telehealth scenarios where broader network integration supports remote oversight by multidisciplinary teams.

Examining end-user preferences uncovers a clear bifurcation between ambulatory care centers prioritizing portability and streamlined workflows, and hospitals-particularly level one and level two trauma centers-driving demand for high-throughput systems capable of simultaneous multi-site monitoring. Moreover, military facilities and orthopedic clinics have emerged as specialized pockets of growth, leveraging ruggedized form factors and tailored software interfaces to meet unique operational requirements, from field deployments to complex reconstructive procedures.

Application segmentation further underscores the technology’s versatility-from critical deployments in military medicine where rapid diagnosis can dictate mission success, to post-surgical rehabilitation programs that monitor tissue recovery trajectories. Sports medicine practitioners are integrating non-invasive optical and pressure sensors to assess compartmental stress in athletes, while trauma care teams within critical care units and emergency departments rely on invasive continuous monitors to guide immediate clinical decisions.

Finally, pricing tier segmentation offers valuable insights into buyer behavior and value recognition. Premium and ultra-premium high-end models, characterized by advanced analytics and fully integrated digital dashboards, dominate well-funded hospital networks and specialized trauma units. In contrast, basic and entry-level low-end devices serve cost-sensitive clinics and outpatient facilities seeking foundational monitoring capabilities at a lower capital threshold. Meanwhile, advanced basic and standard mid-range offerings strike a balance by packaging key performance features with manageable price tags, enabling broader market penetration without compromising core functionalities.

This comprehensive research report categorizes the Compartment Syndrome Monitoring Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Decoding Regional Dynamics Shaping Adoption Innovation and Collaborative Opportunities Across the Americas EMEA and Asia Pacific Healthcare Ecosystems

Regional adoption patterns in the Americas are shaped by progressive reimbursement frameworks and widespread acceptance of remote patient monitoring, resulting in accelerated uptake across both hospital networks and community care settings. North American innovators and clinical consortia have also fostered public-private collaborations, funding pilot deployments that validate the clinical and economic benefits of continuous compartment pressure surveillance, particularly in high-volume trauma repositories.

Across Europe, the Middle East, and Africa, regulatory harmonization under the Medical Device Regulation has streamlined approval pathways but also heightened compliance requirements, prompting vendors to fortify their quality management systems. Consequently, market entrants with robust clinical evidence and localized support infrastructures are securing strategic partnerships with leading hospital chains and military health services, capitalizing on regional initiatives aimed at modernizing critical care equipment and enhancing trauma response capabilities.

In the Asia-Pacific region, rapid expansion of healthcare infrastructure, fueled by government investments and rising per-capita medical expenditure, has generated significant demand for both invasive and non-invasive monitoring modalities. Cost sensitivity in emerging markets is balanced by high-end private hospital networks that seek best-in-class technologies, resulting in a two-track market structure. Local manufacturers and multinational corporations alike are establishing joint ventures and licensing agreements to navigate diverse regulatory landscapes and capture growth in this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Compartment Syndrome Monitoring Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Innovative Leadership Strategies and Collaborative Milestones of Established and Emerging Market Players Driving Compartment Syndrome Monitoring Advancements

Within the competitive arena, established medical device conglomerates and nimble specialist firms are vying for leadership through differentiated product roadmaps and strategic alliances. Legacy players have been enhancing their portfolios by acquiring sensor technology startups, integrating proprietary signal processing algorithms to reinforce their continuous monitoring platforms. Meanwhile, pioneering startup ventures are forging partnerships with academic research centers to co-develop non-invasive ultrasound sensor arrays and AI-driven predictive software, securing early adoption within select trauma units.

Collaborative milestones include joint validation studies between major device manufacturers and leading academic hospitals, which have underscored the clinical efficacy of real-time pressure monitoring in reducing fasciotomy rates. In parallel, technology firms specializing in wireless hybrid solutions have inked distribution agreements with global surgical device distributors, expanding their geographic reach. Collectively, these corporate strategies reflect a dual focus on technological differentiation and expansive market access, setting the stage for ongoing innovation cycles and competitive repositioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Compartment Syndrome Monitoring Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- ConvaTec Group PLC

- Covidien LLC

- DePuy Synthes

- GE Healthcare Technologies Inc.

- Hill-Rom Holdings, Inc.

- Integra LifeSciences Holdings Corporation

- KCI

- Medtronic plc

- Mölnlycke Health Care AB

- Paul Hartmann AG

- Philips Healthcare

- Siemens Healthineers AG

- Smith & Nephew plc

- Stryker Corporation

- Terumo Corporation

- Zimmer Biomet Holdings, Inc.

Strategic Playbook for Industry Pioneers Outlining Tactical Approaches to Technology Integration Partnerships and Value Optimization in Monitoring Solutions

To capitalize on evolving opportunities, industry leaders should accelerate investment in wireless hybrid sensor platforms, combining the precision of invasive pressure measurement with the agility of real-time data transmission. By fostering interdisciplinary partnerships with artificial intelligence specialists and software integrators, organizations can deliver predictive analytics modules that augment clinical decision support and reduce time-to-intervention.

Furthermore, companies must proactively engage with suppliers to establish tariff mitigation strategies, such as long-term procurement agreements and co-investment in local manufacturing capabilities. This approach not only safeguards margin integrity but also enhances supply chain resilience in the face of geopolitical shifts. Simultaneously, pursuing value-based pricing frameworks that align device performance with documented clinical outcomes will strengthen reimbursement positioning and foster wider adoption across diverse care settings.

Finally, expanding portfolios to span the full spectrum of pricing tiers-from entry-level basic monitors to ultra-premium integrated ecosystems-will enable organizations to address the distinct needs of trauma centers, ambulatory clinics, and military facilities. Cultivating modular design principles and scalable software architectures will support seamless upselling pathways and deliver a coherent user experience across the product continuum.

Detailing Rigorous Multi-Source Research Methodology Combining Primary Expert Engagement Secondary Data Analysis and Quality Assurance Protocols

This analysis draws upon a rigorous mixed-methods research framework. Primary data was collected through in-depth interviews with key opinion leaders, including trauma surgeons, biomedical engineers, and procurement directors across hospitals and military health systems. These insights were complemented by on-site device demonstrations and observational studies conducted in both urban level one trauma centers and rural orthopedic clinics.

Secondary research encompassed a systematic review of peer-reviewed clinical trials, patent filings, and regulatory submissions under the FDA and Medical Device Regulation. Furthermore, competitive intelligence was gathered by analyzing corporate press releases, investor briefings, and technology showcase events. All data streams underwent triangulation through cross-validation protocols, ensuring that findings reflect both market realities and emerging innovation vectors. Rigorous quality assurance measures, including periodic peer reviews and methodological audits, underpin the credibility and actionable value of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Compartment Syndrome Monitoring Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Compartment Syndrome Monitoring Devices Market, by Product Type

- Compartment Syndrome Monitoring Devices Market, by Technology

- Compartment Syndrome Monitoring Devices Market, by Application

- Compartment Syndrome Monitoring Devices Market, by End User

- Compartment Syndrome Monitoring Devices Market, by Region

- Compartment Syndrome Monitoring Devices Market, by Group

- Compartment Syndrome Monitoring Devices Market, by Country

- United States Compartment Syndrome Monitoring Devices Market

- China Compartment Syndrome Monitoring Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights to Chart the Future Trajectory of Compartment Syndrome Monitoring and Empower Decision Makers with Strategic Clarity

The convergence of advanced sensor technologies, digital connectivity, and data analytics is reshaping the paradigm for compartment syndrome monitoring. As continuous and non-invasive platforms gain clinical validation, the industry is poised to transition from periodic, subjective assessments to predictive, evidence-based interventions. At the same time, geopolitical forces and tariff pressures are hastening supply chain resilience and regional manufacturing strategies, underscoring the importance of agile sourcing and value-driven product design.

Segmentation insights illuminate the diverse demands across care settings and pricing tiers, revealing clear pathways for targeted innovation and market entry. Regional dynamics further highlight the interplay between reimbursement frameworks, regulatory landscapes, and infrastructure investments, guiding companies toward the most fertile growth corridors. By synthesizing these critical insights and implementing the strategic recommendations herein, decision makers can navigate complexity with confidence and chart a clear course toward sustainable leadership in the compartment syndrome monitoring domain.

Empower Your Organization With Cutting Edge Market Research Insights by Engaging Ketan Rohom to Secure the Definitive Report and Drive Strategic Growth

To gain immediate access to the comprehensive market intelligence on compartment syndrome monitoring devices and empower your strategic initiatives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. With his deep understanding of the evolving competitive landscape, technology drivers, and regional dynamics, Ketan can guide you through the report’s extensive insights and tailor a solution package optimized for your organization’s needs. Engage with Ketan to schedule a personalized consultation, explore bespoke research add-ons, and secure unparalleled visibility into segmentation trends, tariff impacts, and actionable growth levers. Your journey to informed decision-making starts with a direct conversation-connect today and transform your market approach with the definitive resource in compartment syndrome monitoring analysis.

- How big is the Compartment Syndrome Monitoring Devices Market?

- What is the Compartment Syndrome Monitoring Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?