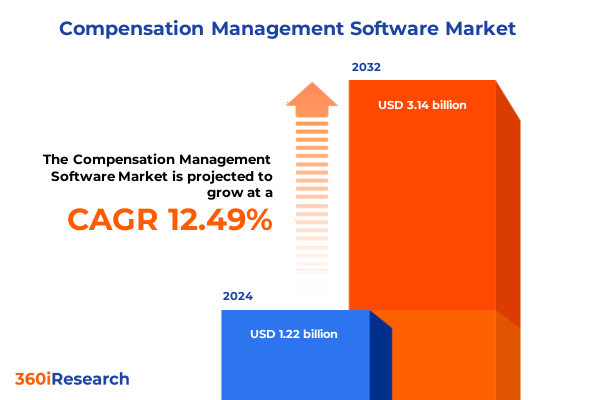

The Compensation Management Software Market size was estimated at USD 3.77 billion in 2025 and expected to reach USD 4.00 billion in 2026, at a CAGR of 7.20% to reach USD 6.14 billion by 2032.

Introducing a Holistic Framework for Understanding the Critical Role of Compensation Management Software in Shaping Modern Workforce Dynamics

Compensation management software has emerged as a cornerstone technology for modern enterprises seeking to align employee rewards with organizational objectives. At its core, this class of solutions automates the design, administration, and monitoring of pay structures, bonus plans, and equity programs. By centralizing disparate processes that once relied heavily on manual spreadsheets and fragmented tools, compensation management platforms offer a unified environment where HR teams can ensure accuracy, consistency, and compliance across the entire employee lifecycle.

Over the past decade, the landscape of compensation technology has evolved dramatically. What began as basic rule-based engines for calculating salaries and bonuses has expanded into sophisticated suites integrating machine learning-driven analytics, real-time dashboards, and seamless connectivity to broader human capital management ecosystems. This progression has been fueled by the need for greater transparency, faster decision cycles, and heightened scrutiny from regulators and stakeholders, all of which demand systems capable of adapting to changing organizational priorities.

Moreover, the strategic significance of compensation management software extends far beyond administrative efficiency. By providing actionable insights into pay equity, performance correlations, and market benchmarking, these platforms empower executives and managers to make data-backed decisions that enhance employee engagement and retention. As pressure mounts to demonstrate both fiscal discipline and talent stewardship, the ability to track and forecast compensation outcomes has become indispensable for enterprises intent on sustaining competitive advantage.

Ultimately, this report delivers a detailed analysis of the forces reshaping the compensation management software market. Readers will discover how transformative shifts in technology and regulation, the impact of recent tariff measures, nuanced segmentation trends, regional disparities, and competitive dynamics converge to define the present and future state of this critical domain.

Examining Pivotal Technological and Organizational Transformations that Are Disrupting Compensation Management Practices Across Industries Worldwide

Technological acceleration continues to redefine the contours of compensation management, driving organizations to reevaluate their processes and platforms. Cloud-based architectures now serve as the backbone for many compensation suites, offering agility, scalability, and continuous delivery of new features. Concurrently, the rise of artificial intelligence and predictive analytics has introduced the ability to forecast compensation trends, identify pay-outliers, and simulate “what-if” scenarios with unprecedented precision. These advancements have made it possible for HR leaders to shift from backward-looking reporting to proactive, strategy-driven reward planning.

Alongside digital innovations, organizational expectations have also transformed. A growing emphasis on employee experience has prompted the integration of intuitive self-service portals and mobile applications, ensuring that individuals can access, understand, and engage with their compensation information at any time. This heightened transparency fosters trust and drives engagement by enabling employees to see the links between performance metrics and reward outcomes, thereby creating a more motivated workforce.

Furthermore, regulatory frameworks across multiple jurisdictions have intensified the need for robust compensation governance. New legislation targeting pay equity, mandatory disclosure of pay ratios, and heightened audit requirements demand systems capable of producing granular, verifiable records. In response, compensation management solutions have evolved to include embedded compliance modules, automated audit trails, and multilingual support for global payroll operations, ensuring adherence to diverse legal landscapes.

In this era of rapid change, hybrid deployment models have emerged as another disruptive force. Many enterprises now adopt a blend of public and private cloud services, or retain critical data on-premise while leveraging public cloud services for non-sensitive workloads. This hybrid approach balances security, performance, and cost considerations, reflecting a trend toward more nuanced IT strategies that cater to both digital native organizations and those with legacy infrastructure.

Assessing the Overall Cumulative Consequences of United States 2025 Tariff Adjustments on Compensation Management Software Cost Structures and Service Provision

The tariff adjustments enacted by the United States in early 2025 have sent ripples through the wider technology supply chain, affecting both hardware and software ecosystems. While compensation management platforms are predominantly delivered via cloud services, underlying infrastructure components-such as servers, networking equipment, and data center hardware-have fallen within the ambit of increased import duties. As a result, cloud service providers and on-premise solution vendors alike have faced higher capital expenditures, creating the potential for cost pass-through to end customers.

In the context of on-premise deployments, organizations relying on locally hosted servers and storage systems have encountered elevated procurement costs. These elevated costs have driven some enterprises to accelerate their migration to public or hybrid cloud models, where the tariffs on underlying infrastructure are often absorbed by the service provider or distributed across broader customer bases. Nevertheless, contract negotiations with implementation partners and maintenance vendors have become more complex, as these stakeholders seek to recalibrate service fees in response to tariff-induced inflationary pressures.

Cloud-native software vendors have navigated this environment by optimizing data center footprints and renegotiating supplier agreements to mitigate the impact of tariffs. Some have diversified their infrastructure portfolios by leveraging local data centers or regional cloud zones to circumvent cross-border equipment costs. Others have revised licensing structures to align with consumption-based billing models, thereby sharing the burden of cost escalations with customers and offering greater financial flexibility.

Overall, the cumulative effect of 2025 tariff measures has underscored the importance of adaptable deployment strategies and agile procurement practices. Enterprises that proactively reevaluate their vendor agreements, explore alternative infrastructure arrangements, and embrace consumption-oriented pricing have positioned themselves to absorb short-term cost pressures while maintaining their path toward digital transformation.

Uncovering Strategic Insights Across Segmentation Dimensions Including Deployment Models Components Applications Enterprise Sizes and Industry Verticals

A deep dive into the compensation management software market reveals distinct patterns across various segmentation dimensions. In terms of deployment models, the industry has bifurcated into cloud and on-premise solutions. Public cloud offerings continue to gain traction for organizations prioritizing rapid scalability and minimal infrastructure management, while private cloud environments appeal to enterprises requiring heightened data security. Hybrid cloud arrangements further blend these approaches by enabling sensitive workloads to reside within private environments while public services handle non-critical processes.

Component analysis exposes a dual focus on software functionality and professional services. Core software modules deliver tools for pay-structure modeling, equity plan administration, and analytics, while consulting services assist clients with strategic planning and regulatory adherence. Implementation services facilitate system integration and data migration, and ongoing support and maintenance offerings ensure that platforms remain updated, secure, and optimized for evolving business requirements.

From an application standpoint, the compensation management spectrum encompasses several key areas. Compensation analytics-spanning descriptive, predictive, and prescriptive layers-empowers users to understand historical pay distributions, forecast future payroll budgets, and prescribe optimal reward structures. Employee self-service portals grant staff visibility into their individual compensation details, and seamless payroll management workflows synchronize with core HR and finance systems. Performance management modules, which often integrate goal-setting and talent calibration tools, complete the ecosystem by linking pay to merit and organizational outcomes.

Enterprise size also influences product adoption and feature prioritization. Large corporations demand comprehensive suites capable of automating complex multi-national payroll processes and aligning executive incentives with strategic KPIs. Meanwhile, small and medium enterprises-further categorized into medium, micro, and small entities-often seek modular, cost-effective solutions that scale with growth while minimizing upfront investment. This dynamic has encouraged vendors to introduce tiered offerings tailored to each organizational tier.

Finally, industry verticals impart unique requirements on compensation platforms. Financial services organizations emphasize strict compliance reporting and audit readiness, healthcare providers prioritize integration with workforce management systems for shift-based staffing, IT and telecom firms demand agile reward configurations to match fast-moving product cycles, and retail and consumer goods companies focus on seasonal pay variations and commission-based incentive programs.

This comprehensive research report categorizes the Compensation Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Industry Vertical

- Deployment

- Enterprise Size

Illuminating Critical Regional Variations Driving the Adoption and Evolution of Compensation Management Software Across Major Global Markets

Regional market dynamics exhibit pronounced variations shaped by technological maturity, regulatory landscapes, and cultural factors. In the Americas, particularly within North America, early adopters have embraced sophisticated cloud and AI-enabled compensation platforms. The United States, with its patchwork of federal and state regulations governing pay equity and disclosure requirements, has driven demand for solutions that can generate transparent reports and maintain audit trails across diverse jurisdictions.

In Europe, Middle East and Africa, regulatory complexity underscores the market’s cautious but deliberate uptake of advanced compensation technologies. GDPR mandates and evolving legislative frameworks around pay transparency have prompted organizations to favor private cloud or on-premise deployments. At the same time, variations in labor laws and social dialogue structures-such as European works councils-have encouraged features that manage multi-country statutory pay components and support localized compliance workflows.

Across Asia-Pacific, the compensation management software market reflects both high-growth economies and established commercial hubs. In Australia and Japan, organizations have rapidly integrated self-service and analytics modules to enhance employee engagement. Emerging markets in Southeast Asia and India, while contending with budgetary constraints and data sovereignty considerations, are increasingly exploring public cloud models to reduce infrastructure overhead. Additionally, regional players are customizing solutions to align with local languages, currency conventions, and statutory benefit schemes.

By understanding these regional nuances, vendors and buyers alike can navigate deployment decisions, vendor partnerships, and feature roadmaps to ensure that compensation strategies resonate with local expectations while leveraging global best practices.

This comprehensive research report examines key regions that drive the evolution of the Compensation Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Organizations Driving Innovation Competitive Positioning and Partnership Strategies in the Compensation Management Software Ecosystem

The competitive landscape of compensation management software features a blend of established global platforms and specialized niche providers. Major enterprise software vendors have fortified their compensation suites by integrating broader human capital management capabilities, thus offering one-stop solutions that address talent acquisition, performance management, and succession planning alongside reward administration.

Meanwhile, specialized players have differentiated themselves through a focus on advanced analytics, user experience, and seamless ecosystem integrations. These vendors often collaborate with payroll processors and benefits administrators to deliver end-to-end compensation workflows, from envelope calculations to pay-statement delivery. Strategic partnerships with consulting firms and system integrators enable them to scale complex deployments and navigate industry-specific regulatory landscapes.

In addition to software capabilities, competitive positioning frequently hinges on the strength of professional services. Companies that provide comprehensive implementation roadmaps, change management support, and ongoing advisory services tend to establish deeper customer relationships. Furthermore, vendor roadmaps that emphasize AI-driven optimization, mobile-first design, and open APIs position these organizations to address dynamic market demands and emerging technology paradigms.

As market consolidation continues, alliances and acquisitions have reshaped the vendor ecosystem. Larger vendors have assimilated niche competitors to broaden their analytical portfolios, while smaller providers have sought capital infusion or exit opportunities to expand their geographic reach. Ultimately, this dynamic has fostered an environment where innovation, strategic partnerships, and service excellence remain key differentiators.

This comprehensive research report delivers an in-depth overview of the principal market players in the Compensation Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atos SE

- Automatic Data Processing, Inc.

- Ceridian HCM, Inc.

- Cornerstone OnDemand, Inc.

- Genpact Ltd.

- Infosys Limited

- International Business Machines Corporation

- Oracle Corporation

- PayScale Inc.

- SAP SE

- Sutherland Global Services, Inc.

- Ultimate Kronos Group, Inc.

- Willis Towers Watson Public Limited Company

- Wipro Limited

- Workday, Inc.

Delivering Actionable Recommendations to Guide Industry Leaders in Optimizing Compensation Management Strategies and Enabling Sustainable Growth

Industry leaders should prioritize investments that enhance analytical capabilities, enabling more precise modeling of compensation scenarios and the identification of equity gaps. By leveraging both descriptive and predictive analytics, organizations can proactively address pay-equity concerns and optimize incentive structures to align with performance goals. Furthermore, embedding prescriptive guidance within compensation workflows ensures that decision makers receive actionable recommendations at the point of plan design.

Adopting a hybrid deployment strategy can help mitigate the financial impact of external cost pressures, including imported hardware tariffs. Organizations can retain proprietary or sensitive data in private or on-premise environments while offloading less critical workloads to public cloud platforms. This blended approach balances security requirements with the need for agility and cost efficiency, especially in regions subject to evolving trade regulations.

To address disparate requirements across enterprise sizes and industry verticals, vendors and buyers alike should embrace modular architectures. This flexibility allows small and medium enterprises to access core compensation capabilities while enabling large enterprises to extend functionality with advanced analytics, global payroll orchestration, and bespoke compliance modules. Prioritizing configurability over customization reduces deployment timelines and total cost of ownership.

Lastly, strategic partnerships with local integrators and compliance specialists will prove invaluable. As compensation regulations continue to evolve, particularly around pay transparency and data privacy, organizations must stay ahead of legal requirements. Engaging with trusted advisors ensures that compensation programs remain transparent, equitable, and aligned with both internal policies and external obligations.

Detailing Rigorous Research Methodology Featuring Primary Expert Interviews Secondary Data Analysis and Comprehensive Quality Assurance Measures

This research employed a multi-stage methodology designed to ensure both breadth and depth of insight. The initial phase comprised comprehensive secondary research, which included review of vendor white papers, regulatory filings, industry journals, and reputable technology reports. These sources established a foundational understanding of market dynamics, competitive offerings, and regulatory developments.

Building upon secondary findings, the study incorporated primary interviews with seasoned professionals across HR, finance, and IT functions. These discussions provided qualitative context on deployment challenges, feature priorities, and change management strategies. In parallel, vendor briefings offered clarity on product roadmaps, service models, and innovation pipelines, fostering an accurate view of future trends.

Quantitative data underwent rigorous triangulation to validate key observations. Data points from public financial disclosures, procurement records, and usage metrics were cross-referenced with insights from consulting firms and system integrators. This triangulation process strengthened the credibility of the analysis and minimized reliance on any single information source.

Throughout the research lifecycle, the study team maintained strict quality assurance protocols. Draft findings were peer-reviewed by domain experts and revised according to structured feedback loops. Regular alignment sessions ensured that emerging data and market shifts were promptly incorporated, resulting in a robust, reliable, and comprehensive assessment of the compensation management software landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Compensation Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Compensation Management Software Market, by Component

- Compensation Management Software Market, by Application

- Compensation Management Software Market, by Industry Vertical

- Compensation Management Software Market, by Deployment

- Compensation Management Software Market, by Enterprise Size

- Compensation Management Software Market, by Region

- Compensation Management Software Market, by Group

- Compensation Management Software Market, by Country

- United States Compensation Management Software Market

- China Compensation Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Strategic Insights Unveiled Throughout This Report Emphasizing the Pivotal Role of Compensation Management Software in Future Organizational Success

In conclusion, compensation management software stands at the nexus of technology, regulation, and organizational strategy. As enterprises navigate increasingly complex pay structures and shifting compliance landscapes, these platforms serve as enablers of transparency, efficiency, and equitable reward distribution. The convergence of cloud computing, advanced analytics, and hybrid deployment models has redefined how organizations approach compensation planning and execution.

Segmentation insights underscore the varied needs across deployment types, component categories, application areas, enterprise sizes, and vertical markets. Regional disparities highlight the influence of local regulations, technological readiness, and cultural preferences, guiding both vendors and buyers to adopt tailored strategies. Competitive dynamics continue to evolve as leading providers differentiate through integrated ecosystems, data-driven innovations, and strategic alliances.

As the market absorbs the impact of recent tariff measures and adapts to relentless technological advancement, organizations must remain agile and strategic in their compensation management approaches. The actionable recommendations presented herein offer a roadmap for aligning compensation frameworks with broader business objectives, while the detailed segmentation and regional analyses provide the contextual foundation for informed decision making.

Ultimately, mastering compensation management software is not merely a matter of system selection but a strategic imperative that shapes talent engagement, financial performance, and long-term competitiveness.

Empowering Your Teams with Comprehensive Market Research on Compensation Management Software Connect with Ketan Rohom to Unlock Insights for Decisive Action

To explore the full depth of compensation management software trends and gain unparalleled insights tailored to your strategic needs, reach out directly to Ketan Rohom. As the Associate Director of Sales & Marketing, he is uniquely positioned to guide you through the nuanced findings of this market research and clarify how they apply to your organization. Engaging with Ketan will grant you access not only to this comprehensive report but also to customized consultation that aligns with your specific objectives. Take the next step toward optimizing your compensation strategies by partnering with an expert who understands both the technological intricacies and business implications of modern payroll and reward management. Secure your copy of the report today and transform data-driven market intelligence into decisive competitive advantage.

- How big is the Compensation Management Software Market?

- What is the Compensation Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?