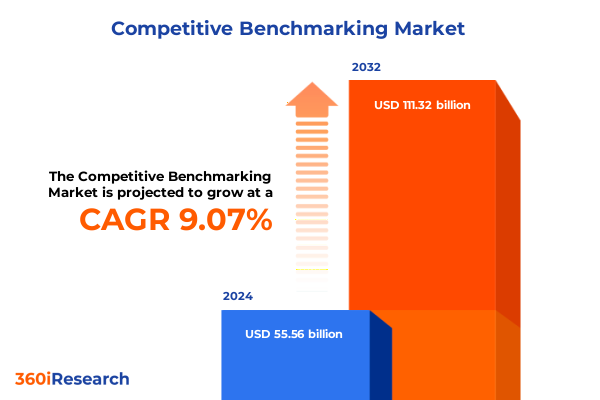

The Competitive Benchmarking Market size was estimated at USD 60.35 billion in 2025 and expected to reach USD 65.62 billion in 2026, at a CAGR of 9.14% to reach USD 111.32 billion by 2032.

How rigorous competitive benchmarking frameworks equip executives with actionable intelligence to outperform peers in an evolving business landscape

In today’s hypercompetitive environment, organizations face relentless pressure to innovate, optimize operations, and respond to evolving customer expectations. This executive summary serves as a concise orientation to the broader competitive benchmarking analysis, illuminating how data-driven intelligence can guide decision-makers toward nimble, informed strategies. By establishing a structured framework for evaluating processes, products, and performance against industry peers, businesses can cultivate a culture of continuous improvement and sustainable differentiation. The introduction outlines the scope of the research, clarifies the analytical lens applied to cross-industry comparisons, and highlights the central objective: to equip senior leaders with actionable insights that bolster market positioning and operational efficiency.

The analysis examines a diverse spectrum of benchmarking domains, encompassing service delivery models, software-based analytics platforms, and a rich array of performance metrics. By integrating qualitative assessments with quantitative measurements, the research provides a holistic view of competitive dynamics across multiple sectors. Moreover, this section articulates the methodology’s foundational principles, ensuring that readers understand the rigorous data validation, expert interviews, and triangulated secondary sources that underpin the subsequent findings. Ultimately, the introduction underscores the critical role of competitive benchmarking as both a diagnostic instrument for identifying performance gaps and a strategic compass for charting a course toward excellence.

Unprecedented technological convergence and digital transformation are reshaping competitive paradigms and leveling the analytics playing field for businesses of all sizes

Rapid technological advancements, shifting regulatory landscapes, and changing customer behaviors have catalyzed transformative shifts across virtually every industry. Organizations are no longer merely collecting data; they are democratizing insights through intuitive analytics applications and embedding artificial intelligence within decision-making processes. This transition has redefined competitive advantage, favoring those who harness integrated ecosystems of business intelligence, customer feedback channels, and real-time performance management platforms.

Simultaneously, the proliferation of cloud-based solutions has lowered barriers to entry for analytics capabilities, enabling small and medium enterprises to access sophisticated tools once reserved for large corporations. This disruption has generated a more level playing field, compelling market incumbents to innovate both in their service offerings and in the underlying technological stack. Additionally, the digital transformation imperative has spurred the emergence of hybrid operational models that merge virtual collaboration, agile development methodologies, and continuous feedback loops. These dynamics collectively signify a watershed moment, wherein the ability to rapidly iterate on processes and products in response to granular performance insights has become the defining hallmark of market leaders.

How the recalibration of United States tariffs in 2025 is driving adaptive benchmarking models that account for cost volatility and supply chain resilience

In 2025, the imposition and adjustment of United States tariffs have exerted a cumulative influence on benchmarking practices, particularly in sectors reliant on cross-border supply chains and imported software components. Tariff realignments have introduced cost variability that complicates price-to-performance comparisons, prompting benchmark analyses to factor in localized supply disruptions and input price fluctuations. Organizations have responded by diversifying sourcing strategies, shifting toward domestic providers where possible, and recalibrating competitiveness metrics to reflect total landed costs rather than solely list price differentials.

Moreover, the tariff environment has underscored the importance of flexible benchmarking criteria that can accommodate regulatory volatility. Companies are increasingly integrating scenario-based analyses, stress-testing performance under multiple tariff scenarios to gauge resilience. In turn, benchmarking platforms are evolving to support dynamic input parameters, empowering decision-makers to simulate the impact of proposed tariff changes on operational costs, product margins, and service-level agreements. This iterative approach not only enhances the robustness of comparative evaluations but also fosters strategic agility in responding to emerging trade policies.

Revealing critical segmentation-driven variations in how organizations adopt and benefit from diverse benchmarking methodologies across industries and scales

Insights drawn from market segmentation reveal distinct dynamics across offerings and organizational contexts. Within the technology domain, software analytics platforms-encompassing business intelligence solutions, customer feedback instruments, financial modeling applications, performance management suites, social media analytics interfaces, and web traffic analysis tools-demonstrate higher acceleration of adoption compared to service-based engagements. This trend reflects the growing emphasis on in-house analytics maturity, as firms seek real-time, automated insights to inform strategic directives.

Benchmarking level plays a pivotal role in shaping comparative analysis, with external benchmarking against industry peers emerging as a critical driver for identifying market-leading practices, while internal benchmarking fosters cross-functional knowledge sharing and process standardization. Concurrently, the choice between qualitative metrics-such as customer satisfaction indices and innovation capability assessments-and quantitative metrics-such as key performance indicators and throughput measurements-steers organizations toward different improvement pathways. Meanwhile, the type of benchmarking undertaken, whether financial, performance, process, product, reputation, or strategic, influences the granularity of insights and the recommended course corrections.

Further, organizational scale has proven deterministic in benchmarking sophistication. Large enterprises leverage integrated, enterprise-grade platforms capable of consolidating multi-regional data, whereas small and medium enterprises frequently adopt nimble, cloud-native solutions that deliver targeted insights with minimal implementation overhead. Finally, end-user industries-from aerospace and defense through automotive, banking and finance, construction and real estate, consumer goods, education, energy and utilities, government, healthcare, technology and telecommunications, manufacturing, media and entertainment, to travel and hospitality-exhibit tailored benchmarking priorities aligned to sector-specific performance drivers. Hence, segmentation underscores the necessity of customized benchmarking frameworks that resonate with the unique operational parameters of each offering, benchmark level, metric type, benchmarking typology, organizational size, and industry vertical.

This comprehensive research report categorizes the Competitive Benchmarking market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Benchmarking Level

- Benchmarking Criteria

- Type

- End-User

Comparative analysis of contrasting regional benchmarking approaches highlights unique drivers and maturity levels in the Americas EMEA and AsiaPacific markets

Regional landscapes exhibit pronounced differences in benchmarking maturity, shaped by economic structures, regulatory regimes, and cultural attitudes toward performance management. In the Americas, organizations benefit from a robust ecosystem of analytics vendors and professional services firms, supported by a regulatory environment that encourages data transparency. This region’s emphasis on rapid digital transformation has accelerated the uptake of cloud-based analytics tools and agile benchmarking practices, particularly in sectors such as technology, financial services, and consumer retail.

Conversely, Europe, the Middle East, and Africa display a heterogeneous picture driven by divergent economic stages and policy frameworks. Western European markets often lead in advanced process and strategic benchmarking, buoyed by stringent regulatory standards and a strong emphasis on cross-border collaboration. Middle Eastern entities are increasingly investing in performance benchmarking to support large-scale infrastructure projects, while African markets prioritize cost-efficiency assessments to optimize resource allocation. Throughout this expansive region, data sovereignty considerations and localized compliance requirements necessitate benchmarking instruments capable of accommodating diverse regulatory landscapes.

In the Asia-Pacific arena, high-growth economies are forging ahead with technology-driven benchmarking innovations. Nations with strong manufacturing bases are adopting process and product benchmarking to drive operational excellence, while service-oriented markets are embracing reputation and customer experience measures to differentiate in crowded marketplaces. The rapid expansion of digital ecosystems, coupled with government-led initiatives to foster smart industries, has created fertile ground for integrated benchmarking solutions that support continuous improvement and cross-sector knowledge transfer.

This comprehensive research report examines key regions that drive the evolution of the Competitive Benchmarking market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How competitive pressures are fueling strategic alliances and technological advancements among leading benchmarking solution providers

Leading providers of benchmarking solutions are advancing the state of the art through strategic partnerships, platform integrations, and investments in artificial intelligence. Established technology firms with broad analytics portfolios continue to extend their capabilities, embedding predictive modeling, natural language processing, and advanced visualization into core offerings. These innovations enable organizations to distill actionable insights from complex data streams and to surface early warning signals for performance deviations.

Meanwhile, specialized benchmarking service providers are carving out niches by delivering deep domain expertise and tailored advisory engagements. By coupling industry-specific best practices with interactive benchmarking dashboards, these firms facilitate more precise peer-group comparisons and targeted improvement initiatives. Collaborative ecosystems between software vendors, management consultancies, and data providers are also gaining traction, yielding end-to-end benchmarking solutions that cover everything from data ingestion and normalization to insight generation and implementation support.

Smaller, agile entrants in the benchmarking market are differentiating through user-centric design and low-code configurability, enabling rapid deployment and customization. Their offerings often appeal to small and medium enterprises seeking cost-effective yet powerful analytics capabilities without the complexity of enterprise-grade implementations. Collectively, the competitive landscape is characterized by both consolidation among leading players and dynamic innovation from disruptive challengers, underscoring the ongoing evolution of benchmarking as a strategic discipline.

This comprehensive research report delivers an in-depth overview of the principal market players in the Competitive Benchmarking market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.T. Kearney, Inc.

- Accenture PLC

- Bain & Company, Inc.

- Boston Consulting Group

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- Forrester Research, Inc.

- Frost & Sullivan Inc.

- Gartner, Inc.

- GlobalData PLC

- Google LLC by Alphabet Inc.

- Guidehouse Inc.

- Informa PLC

- Information Services Group, Inc.

- International Business Machines Corporation

- International Data Corporation

- Ipsos SA

- Kantar Global Holdings S.à r.l.

- KPMG International Limited

- L.E.K. Consulting LLC

- Marsh & McLennan Companies, Inc.

- McKinsey & Company

- Mintel Group Ltd.

- PricewaterhouseCoopers LLP

- Roland Berger GmbH

- S&P Global Inc.

- The Nielsen Company

- ZS Associates, Inc.

Actionable strategies for leaders to harness integrated analytics governance and scenario planning to elevate benchmarking outcomes

To remain at the forefront, industry leaders must integrate advanced analytics platforms with comprehensive data governance frameworks. This entails establishing cross-functional teams that break down silos between finance, operations, marketing, and IT, thereby ensuring that performance insights circulate swiftly to decision-makers. By prioritizing investments in scalable software that supports both qualitative and quantitative benchmarking criteria, executives can align improvement initiatives with overarching strategic goals.

Furthermore, organizations should leverage scenario planning to stress-test their performance under varying trade and regulatory conditions, particularly given the ongoing tariff fluctuations. Embedding these simulations within benchmarking dashboards equips leaders with foresight into potential cost and supply chain disruptions. At the same time, customizing benchmarking approaches to reflect organizational size and industry-specific drivers will enhance relevance and user adoption, driving deeper engagement with the results.

Finally, cultivating an innovation-driven culture is paramount. Executives should incentivize cross-industry knowledge exchange, pilot emerging analytics technologies, and establish continuous feedback loops that reward adaptability. By doing so, they not only refine existing processes but also uncover transformative opportunities, positioning their companies to thrive amid rapid market evolution.

A comprehensive, multi-phased methodology combining expert interviews surveys and rigorous data triangulation for credible benchmarking insights

This report’s findings derive from a robust research methodology combining primary interviews, secondary analysis, and quantitative survey data. Leading subject-matter experts from diverse industries were consulted to validate benchmarking frameworks, while internal performance metrics from participant organizations informed the development of comparative models. Secondary sources included peer-reviewed journals, industry white papers, and reputable technology vendor disclosures to ensure a comprehensive understanding of emerging trends.

Quantitative survey instruments were distributed across a broad spectrum of enterprises, capturing data on adoption rates, performance improvements, and tool preferences. Responses were normalized to account for organizational scale and regional variances, enabling equitable comparison. The benchmarking criteria were meticulously defined to balance rigorous quantitative measures, such as throughput efficiency and financial ratios, with qualitative dimensions like customer sentiment and innovation culture.

Data triangulation techniques were applied throughout the analysis to reconcile discrepancies between primary and secondary inputs. Statistical validation ensured that observed patterns held significance beyond sampling error, and iterative workshops with industry panels refined the interpretation of findings. This comprehensive approach underpins the report’s credibility and provides stakeholders with confidence in the strategic recommendations and conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Competitive Benchmarking market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Competitive Benchmarking Market, by Offering

- Competitive Benchmarking Market, by Benchmarking Level

- Competitive Benchmarking Market, by Benchmarking Criteria

- Competitive Benchmarking Market, by Type

- Competitive Benchmarking Market, by End-User

- Competitive Benchmarking Market, by Region

- Competitive Benchmarking Market, by Group

- Competitive Benchmarking Market, by Country

- United States Competitive Benchmarking Market

- China Competitive Benchmarking Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Why embracing flexible benchmarking frameworks informed by advanced analytics is critical for driving sustainable competitive advantage in 2025 and beyond

In an increasingly data-centric world, competitive benchmarking has emerged as an indispensable tool for strategic decision-making and performance optimization. By illuminating best practices, revealing performance gaps, and enabling scenario-based planning, organizations can navigate complexity with greater confidence and precision. The insights outlined in this executive summary underscore the necessity of adopting flexible, technology-empowered benchmarking frameworks that adapt to evolving market conditions and regulatory landscapes.

Segmentation-driven analysis highlights the divergent imperatives across offerings, benchmarking levels, criteria, types, organizational sizes, and end-user industries, emphasizing the value of tailored benchmarking strategies. Regional perspectives reveal that while methodological maturity varies, the core objective remains consistent: to drive continuous improvement and long-term competitive advantage. Moreover, the evolving landscape of benchmarking solution providers demonstrates a convergence between domain expertise and technological innovation, creating a fertile environment for best-in-class performance management.

Ultimately, the organizations that seize these insights and implement the recommended strategies will be best positioned to transform data into decisive action. As leaders confront challenges such as tariff volatility, digital disruption, and shifting customer demands, the strategic application of benchmarking will serve as both a compass and a catalyst for sustainable growth.

Reach out to Associate Director Ketan Rohom to secure your competitive benchmarking report and transform insights into strategic advantage

Don’t let insights remain untapped-reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive competitive benchmarking report and elevate your strategic intelligence to the next level. Embark on a data-driven journey that equips your organization to respond swiftly to market shifts, capitalize on emerging opportunities, and maintain a competitive edge in an era defined by rapid innovation. Connect with Ketan to explore customized licensing options, enterprise-wide access, and supplementary advisory services that ensure you extract maximal value from the research findings. Your next strategic milestone awaits-contact Ketan today and transform insights into action.

- How big is the Competitive Benchmarking Market?

- What is the Competitive Benchmarking Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?