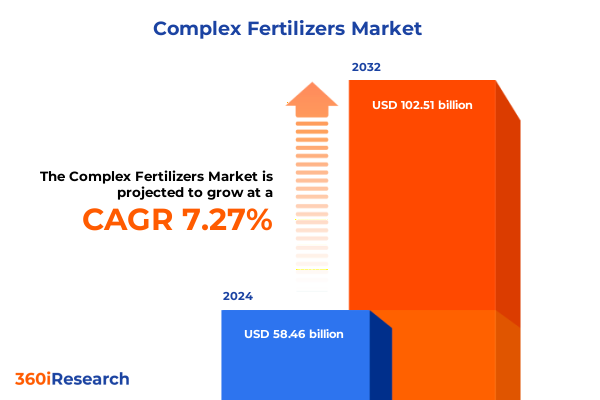

The Complex Fertilizers Market size was estimated at USD 62.68 billion in 2025 and expected to reach USD 66.95 billion in 2026, at a CAGR of 7.27% to reach USD 102.51 billion by 2032.

Introducing the Dynamic World of Complex Fertilizers Where Nutrient Innovations and Sustainable Practices Converge to Drive Agricultural Productivity

Agricultural systems worldwide are under mounting pressure to boost productivity while preserving precious natural resources. Complex fertilizers-formulations combining two or more essential nutrients-have become indispensable in this quest, enabling precise nutrient delivery, reducing input waste, and bolstering crop yields. This executive summary introduces the multifaceted role these products play in addressing soil fertility challenges, climate variability, and stringent environmental regulations.

By integrating macronutrients such as nitrogen, phosphorus, and potassium into single blends, complex fertilizers simplify logistics for farmers and distributors alike. They promote balanced plant nutrition, mitigate the risk of nutrient antagonism, and improve application efficiency. As a result, complex blends are increasingly favored over single-nutrient alternatives, particularly in regions where multiple nutrient deficiencies coexist.

Transitioning to these advanced nutrient solutions not only drives yield optimization but also aligns with global sustainability goals. They support reduced greenhouse gas emissions per unit of crop produced, lower nutrient run-off into water bodies, and enable precision agriculture practices based on real-time soil and crop health data. This report opens with an in-depth introduction to the market’s evolving dynamics, setting the stage for subsequent sections that delve into transformative trends, trade impacts, segmentation strategies, and regional nuances.

Emerging Trends and Disruptive Technologies Reshaping the Complex Fertilizer Sector Toward Precision Agriculture and Environmental Stewardship

The landscape of complex fertilizers is undergoing a profound transformation fueled by breakthroughs in digital agriculture, biotechnology, and environmental stewardship. Precision nutrient management platforms now integrate satellite imagery, drone-based sensors, and variable-rate application machinery to deliver site-specific fertilization, minimizing waste and maximizing crop response. Concurrently, enhanced efficiency fertilizers-engineered with coatings or inhibitors-extend nutrient release profiles, improving uptake and reducing environmental losses.

On the sustainability front, bio-based and organic complex formulations are gaining traction, drawing on renewable feedstocks such as amino acids, seaweed extracts, and microbial inoculants. These innovations address consumer demands for eco-friendly agriculture and align with tightening regulatory frameworks aimed at curbing nutrient pollution. Parallel developments in green ammonia production through renewable-powered electrolysis offer a low-carbon pathway for nitrogen sourcing, potentially reshaping fertilizer supply chains.

Moreover, industry consolidation and strategic partnerships between chemical producers, technology providers, and ag-tech startups are accelerating the deployment of integrated nutrient management solutions. This confluence of digital tools, biostimulant technologies, and eco-conscious manufacturing is redefining value propositions throughout the complex fertilizers ecosystem, marking a new era of data-driven, sustainable crop nutrition.

Assessing the Multifaceted Consequences of Recent U.S. Trade Tariffs on Fertilizer Imports and the Response of Domestic Agriculture’s Supply Chains

In early 2025, the United States introduced sweeping tariffs on fertilizer imports from key trading partners, fundamentally altering cost structures and supply chain configurations. A 25 percent levy on non-USMCA imports from Canada and Mexico initially applied to potash and other mineral fertilizers, while the tariff on Canadian energy resources and potash was subsequently reduced to 10 percent effective March 7, under Executive Order 14231 to address critical mineral needs without fully reinstating higher duties. Concurrently, the tariff on Chinese agricultural imports climbed from 10 to 20 percent as part of broader trade measures aimed at countering perceived security threats.

These measures have translated into tangible challenges for American farmers. Higher duties on potash-a key potassium source-and nitrogenous fertilizers have elevated production costs and squeezed profit margins, prompting growers in regions such as the Midwest to pivot toward lower-input crops like soybeans despite corn’s historical profitability. Industry bodies including the Agricultural Retailers Association and The Fertilizer Institute have urged the administration to negotiate carve-outs or critical mineral designations for key nutrient imports, warning that sustained tariffs could undermine U.S. agricultural competitiveness.

Amid these pressures, domestic policy responses have emerged. The U.S. Department of Agriculture announced investments under the Fertilizer Production Expansion Program to bolster local manufacturing capacity across multiple states, aiming to diversify supply sources and temper price volatility. Nevertheless, the combined impact of higher import levies, potential retaliatory tariffs on U.S. exports, and evolving trade agreements continues to drive supply chain realignments and strategic sourcing decisions across the industry.

Unveiling Product, Form, and Application Dimensions That Define the Structure and Competitive Dynamics of the Complex Fertilizers Market

Market participants differentiate offerings by nutrient composition, tailoring products to specific soil and crop requirements by leveraging NK, NP, NPK, and PK blends. NK fertilizers address scenarios where potassium supplementation is essential alongside limited phosphorus, while NP formulations cater to fields requiring phosphorus enhancement without additional potassium or nitrogen. NPK blends remain the most versatile, providing balanced macronutrient delivery in a single application, and PK variants support potassium and phosphorus supplementation in nutrient-depleted soils.

Form innovations are equally pivotal. Granular complexes continue to dominate traditional broadcast applications, offering ease of transport and storage. Liquid formulations have diversified into emulsion, suspension, and water-soluble categories, each engineered for compatibility with fertigation systems, foliar sprays, or blended tank mixes. Powdered complexes, prized for their high nutrient concentration and blending flexibility, enable custom nutrient profiles in on-farm blending operations and specialty crop nutrition programs.

Application insights reveal distinct patterns across crop segments. Complex fertilizers remain integral to cereals and grains production, where uniform nutrient distribution drives large-scale yields. In fruits and vegetables, tailored formulations-often delivered through soluble or suspension concentrates-support precise micronutrient management for quality and market appearance. Oilseeds and pulses leverage complex blends to meet dual nutrient needs during critical growth stages, and turf and ornamentals sectors benefit from slow-release complexes that maintain aesthetic quality with minimal environmental impact.

This comprehensive research report categorizes the Complex Fertilizers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

Exploring Regional Nuances in Complex Fertilizer Demand and Infrastructure Across the Americas, EMEA, and Asia-Pacific Agricultural Landscapes

In the Americas, robust distribution networks and integrated retail channels support widespread access to complex fertilizers, underpinned by advanced logistics infrastructures that facilitate granular, liquid, and powder form deliveries. North American growers increasingly adopt variable-rate application tools, prompting suppliers to expand digital service offerings and co-develop nutrient management platforms. In Latin America, rising demand for high-yielding crops has driven stakeholders to customize complex blends for local soil profiles, further supported by government programs aimed at enhancing food security.

The Europe, Middle East & Africa region is characterized by stringent nutrient stewardship regulations, which incentivize producers to innovate with enhanced efficiency and bio-based complexes that reduce run-off and comply with evolving environmental standards. In the European Union, the Farm to Fork strategy has accelerated adoption of low-input nutrient solutions, while Middle Eastern nations invest in fertilizer manufacturing to backstop domestic food production. Across Africa, emerging infrastructure improvements and donor-backed agricultural initiatives are expanding complex fertilizer utilization, although affordability remains a key barrier in remote markets.

Asia-Pacific’s diverse agricultural landscape spans high-intensity, technology-driven operations in Japan, South Korea, and Australia to smallholder-dominated systems in Southeast Asia and India. Government subsidies and digital adoption incentives in these markets are propelling a shift from single-nutrient products to complex formulations designed for rice, maize, and horticultural crops. However, supply chain disruptions-driven by raw material price volatility and logistical constraints-continue to challenge consistent access, steering stakeholders toward localized production and strategic partnerships.

This comprehensive research report examines key regions that drive the evolution of the Complex Fertilizers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Driving Innovation, Strategic Collaborations, and Competitive Positioning Within the Complex Fertilizer Industry

Leading companies in the complex fertilizers arena distinguish themselves through integrated portfolios, proprietary technologies, and forward-looking sustainability commitments. Global chemical giants leverage extensive R&D networks to develop coated granules, polymer-enhanced release systems, and nutrient stabilizers that extend field performance. These organizations often engage in joint ventures with regional distributors to optimize logistics and accelerate market penetration in emerging territories.

Mid-tier players focus on niche segments by offering bespoke formulations tailored to high-value crops, deploying on-farm blending services and agronomic advisory teams to solidify grower relationships. They capitalize on digital platforms that integrate soil analytics, weather data, and crop modeling, delivering prescriptive nutrient recommendations. Meanwhile, specialized biotech startups are pioneering microbially enhanced complexes that harness beneficial microbes to improve nutrient uptake and soil health.

Across the board, strategic alliances between fertilizer producers and precision agriculture technology firms are proliferating. These collaborations yield bundled solutions-combining complex formulations with sensor platforms, data analytics dashboards, and service agreements-to drive differentiated value propositions. As sustainability metrics become core to procurement decisions, major players are publishing transparent lifecycle assessments, investing in circular economy projects, and integrating carbon credit frameworks to meet corporate and end-user decarbonization goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Complex Fertilizers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acron Group

- CF Industries Holdings Inc

- Chambal Fertilisers & Chemicals Ltd

- Coromandel International Limited

- Deepak Fertilisers And Petrochemicals Corporation Limited

- EuroChem Group AG

- Gujarat State Fertilizers & Chemicals Ltd

- Haifa Group

- Hubei Xingfa Chemicals Group

- ICL Group Ltd

- Indian Farmers Fertiliser Cooperative Limited

- K+S Aktiengesellschaft

- Nutrien Ltd

- OCI NV

- OCP Group S.A.

- Paradeep Phosphates Ltd

- PhosAgro Public Joint Stock Company

- Rashtriya Chemicals & Fertilizers Limited

- SABIC Agri-Nutrients Company SJSC

- SQM SA

- The Fertilisers and Chemicals Travancore Limited

- The Mosaic Company

- Wesfarmers

- Wilmar International

- Yara International ASA

Actionable Strategies for Industry Leaders to Enhance Resilience, Adopt Sustainable Practices, and Capitalize on Value-Driving Opportunities

Industry leaders should proactively fortify supply chain resilience by diversifying raw material sources and investing in nearshore or onshore manufacturing capacity. Such measures can mitigate exposure to geopolitical risks and tariff volatility while enhancing responsiveness to local market needs. Simultaneously, integrating precision application technologies-including remote sensing and variable-rate spreaders-will optimize nutrient efficiency, reduce input costs, and reinforce sustainability credentials.

To capitalize on emerging value pools, stakeholders are advised to expand service-based offerings that pair complex fertilizers with data-driven agronomy support. By developing subscription-style models and performance-based partnerships, suppliers can deepen customer engagement and generate recurring revenue. Additionally, pursuing collaborative ventures with technology innovators and academic institutions will accelerate the development of next-generation enhanced efficiency and bio-based complexes, securing competitive advantage.

Finally, cultivating robust stakeholder dialogues with regulators, environmental groups, and community advocates will shape balanced policy frameworks. Active participation in industry consortia can influence nutrient stewardship standards, facilitate critical mineral carve-outs, and position organizations as responsible partners in sustainable agriculture. Through these concerted efforts, industry leaders will be well-positioned to thrive in an evolving complex fertilizer landscape.

Detailing a Robust Research Framework Combining Primary Expert Interviews, Rigorous Secondary Analysis, and Validation to Ensure Data Integrity

This research adheres to a rigorous, multi-tiered methodology to ensure comprehensive and accurate insights. Primary data gathering involved structured interviews with key stakeholders-including farmers, cooperatives, and distribution partners-across major producing regions. Such direct engagement elicited first-hand perspectives on application practices, cost pressures, and innovation adoption.

Secondary analysis incorporated publicly available sources, including government reports, academic studies, and trade association publications, to contextualize primary findings within broader industry trends. Market intelligence databases and import-export statistics were examined to validate supply chain shifts and tariff impacts. Where possible, data triangulation was employed, cross-referencing multiple sources to confirm consistency and reliability.

To enhance data integrity, preliminary findings underwent peer review by a panel of agronomy experts and supply chain analysts. Segmentation definitions were refined through iterative feedback to accurately reflect product, form, and application categories. Finally, quality assurance processes-covering data verification, editorial review, and compliance checks-ensured that all content meets the highest standards of accuracy, relevance, and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Complex Fertilizers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Complex Fertilizers Market, by Product Type

- Complex Fertilizers Market, by Form

- Complex Fertilizers Market, by Application

- Complex Fertilizers Market, by Region

- Complex Fertilizers Market, by Group

- Complex Fertilizers Market, by Country

- United States Complex Fertilizers Market

- China Complex Fertilizers Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesizing Key Takeaways on Market Evolution, Strategic Imperatives, and the Path Forward for Stakeholders in Complex Fertilizers

The complex fertilizers market stands at the intersection of technology, sustainability, and global trade dynamics. This summary has illuminated how digital agriculture and eco-innovations are driving transformative shifts, reshaping product portfolios and stakeholder collaborations. It has also underscored the significant repercussions of U.S. tariff policies in 2025, which are redefining supply chains and prompting strategic realignments across agriculture sectors.

Segmentation insights reveal the nuanced roles of product types and forms in addressing diverse crop requirements, while application patterns highlight the importance of tailored nutrition strategies for cereals, fruits, oilseeds, and turf sectors. Regional analysis further demonstrates how infrastructure maturity, regulatory frameworks, and market development pathways influence fertilizer adoption and distribution models.

By profiling leading companies and outlining actionable strategies, this report equips stakeholders with clear imperatives to enhance resilience, optimize nutrient efficiency, and drive growth through innovation. With a transparent methodology and expert validation underpinning these insights, decision-makers can confidently navigate the evolving complex fertilizer landscape.

Secure Your Complete Complex Fertilizers Market Analysis Report Today to Gain Unparalleled Insights from Our Expert Associate Director

For a comprehensive exploration of the complex fertilizers market-detailed analysis, expert perspectives, and actionable insights-connect with Ketan Rohom, Associate Director, Sales & Marketing. He will guide you through our full research deliverables, discuss custom data requirements, and facilitate immediate access to the complete report. Elevate your strategic decision-making today by reaching out to Ketan and securing exclusive market intelligence tailored to your organization’s needs.

- How big is the Complex Fertilizers Market?

- What is the Complex Fertilizers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?