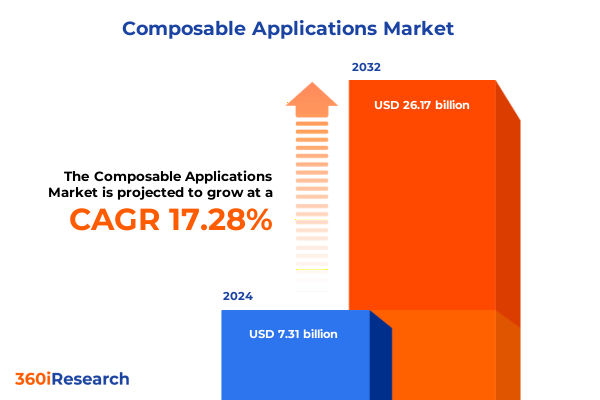

The Composable Applications Market size was estimated at USD 8.59 billion in 2025 and expected to reach USD 9.92 billion in 2026, at a CAGR of 17.25% to reach USD 26.17 billion by 2032.

Understanding the Emergence of Composable Applications as a Game-Changing Force Reshaping Enterprise Software Development Strategies Globally

Composable applications are revolutionizing enterprise technology landscapes by embracing modularity, agility, and reusability, ushering in a new era of rapid software assembly. This approach deviates from traditional monolithic development, enabling organizations to assemble configurable business capabilities through interoperable building blocks. As global digital initiatives accelerate, decision-makers are prioritizing composable strategies to reduce time-to-market, foster innovation, and manage evolving customer demands. Consequently, composable architectures are emerging as a cornerstone of modern IT ecosystems, integrating seamlessly with DevOps practices and cloud-native principles to deliver scalable, resilient solutions.

Furthermore, composable applications facilitate cross-functional collaboration by decoupling development teams and empowering them to innovate independently within well-defined service interfaces. This shift encourages organizations to reimagine legacy systems, transforming them into composable assets while mitigating technical debt. In addition to driving developer productivity, these architectures support continuous deployment pipelines and microservices frameworks, aligning business priorities with technical roadmaps. Ultimately, the introduction of composable applications marks a strategic inflection point for enterprises seeking to navigate digital disruption, enhance operational efficiency, and unlock new revenue streams through adaptive, scalable software solutions.

Examining the Transformative Shifts in Technology and Business Models That Are Accelerating Adoption of Composable Architecture Across Industries

The composable application market is witnessing a convergence of transformative shifts in both technology and business models that are accelerating its adoption across industries. Cloud computing, API-led connectivity, and containerization technologies are enabling granular service decomposition, making it feasible to compose enterprise-grade applications with unprecedented flexibility. Additionally, the proliferation of low-code and no-code environments is democratizing development, allowing business users to craft custom workflows and interfaces without deep programming expertise, thus widening the ecosystem of contributors to software innovation.

Moreover, strategic partnerships between technology vendors, system integrators, and independent software vendors are creating end-to-end composable ecosystems that streamline integration and management. These alliances frequently result in marketplaces of pre-built components, fostering an environment of reuse and extension that amplifies productivity. Simultaneously, escalating security and compliance requirements are impelling architectures to embed robust governance frameworks at the component level, ensuring that modularity does not compromise control. As digital transformation initiatives intensify, organizations are recalibrating their value propositions and operating models to harness composable design principles, redefining what enterprise applications can achieve in terms of agility and resilience.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Composable Application Ecosystems Including Supply Chains and Cost Structures

The introduction of new United States tariffs in 2025 has exerted a cumulative impact on composable application ecosystems by influencing the cost and availability of critical infrastructure components. Hardware dependencies such as servers, networking equipment, and specialized accelerators have experienced elevated import costs, prompting organizations to reassess their on-premises versus cloud deployment decisions. Consequently, many enterprises are favoring cloud-native strategies to sidestep tariff-related overhead and obtain flexible, pay-as-you-go access to compute and storage resources, thereby alleviating capital expenditure pressures.

In addition to hardware implications, licensing and subscription models for middleware platforms and integration tools have been indirectly affected. Some software vendors have adjusted pricing to counterbalance increased operational expenses linked to tariff-induced supply chain constraints. This has led procurement teams to explore open-source alternatives and negotiate more favorable cloud-based terms, seeking to mitigate cost escalation. As a result, composable application roadmaps are increasingly emphasizing hybrid cloud deployments that balance on-premises resilience with the agility of public and private clouds. This strategic recalibration enables organizations to maintain architectural consistency while optimizing cost structures under evolving trade conditions.

Unveiling Key Segmentation Insights Based on End User Industry Deployment Model Component and Organization Size Driving Market Dynamics

Key segmentation insights reveal the diverse drivers influencing composable application adoption across end user industries, deployment models, components, and organization sizes. Based on end user industry, demand dynamics vary significantly among financial services and insurance entities seeking secure, compliant workflows; government and defense agencies prioritizing modular mission-critical systems; healthcare and life sciences organizations focusing on data interoperability and patient engagement; IT and telecom providers aiming to accelerate service delivery; manufacturing firms striving for digital thread integration; and retail and e-commerce businesses optimizing omnichannel experiences. Each sector leverages composable principles to address unique operational imperatives, with some industries adopting rapid proof-of-concept cycles while others emphasize rigorous validation and governance.

When examining deployment models, organizations choose between on premises and cloud-based environments according to latency, security, and control requirements. The cloud segment encompasses hybrid cloud configurations blending private cloud environments with public cloud scalability, as well as dedicated private cloud instances and fully managed public clouds. These models offer varying degrees of flexibility, cost predictability, and compliance alignment, enabling enterprises to calibrate their infrastructural blueprint in concert with strategic objectives. Within component segmentation, platforms are subdivided into development tools for interface and workflow creation; infrastructure tools for runtime management and monitoring; and integration tools for APIs and event-driven orchestration. Complementing these platforms, services include consulting to architect solutions, implementation to deploy and configure modules, and support and maintenance to ensure long-term resilience and continuous optimization.

Finally, organization size influences adoption pathways, with large enterprises investing in enterprise-wide frameworks and robust governance to manage complexity at scale. Small and medium enterprises, in turn, often embrace rapid deployment cycles through medium enterprises that have dedicated IT teams or smaller enterprises that partner with managed service providers to bridge capability gaps. This segmentation matrix underscores that composable application strategies are neither one-size-fits-all nor static, but rather dynamic constructs shaped by organizational priorities and resource considerations.

This comprehensive research report categorizes the Composable Applications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End User Industry

- Deployment Model

- Component

- Organization Size

Highlighting the Key Regional Insights Across the Americas Europe Middle East Africa and Asia-Pacific That Shape Composable Application Adoption

Regional disparities play a pivotal role in shaping composable application strategies, reflecting economic maturity, regulatory environments, and technological infrastructures. In the Americas, innovation hubs and cloud adoption trends are fostering robust ecosystems for rapid prototyping and scalable digital services. North American enterprises are at the forefront of integrating composable principles into enterprise resource planning and customer relationship management platforms, while Latin American markets are increasingly leveraging modular designs to address localized logistical challenges and digital inclusion objectives.

Europe, the Middle East, and Africa present a heterogeneous landscape where regulatory frameworks such as data sovereignty mandates and industry-specific compliance standards influence architectural preferences. European organizations often prioritize private or hybrid cloud architectures to maintain control over sensitive data, whereas Middle Eastern entities are investing heavily in national cloud infrastructures as part of broader digital transformation agendas. In Africa, innovative use cases are emerging in fintech and public services, where modular, low-code solutions help bridge connectivity gaps and amplify digital government services.

Asia-Pacific is characterized by a dual-speed digital economy, with advanced markets driving AI-infused composable platforms while emerging economies focus on cost-effective, cloud-native deployments. Regional technology powerhouses are accelerating investments in container orchestration, API marketplaces, and developer ecosystems to support rapid rollout of new services. Across these geographies, strategic alliances with global and local technology providers are enabling the transfer of best practices and the customization of composable solutions to meet diverse market demands.

This comprehensive research report examines key regions that drive the evolution of the Composable Applications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Deep Dive Into Key Companies Leading the Composable Applications Market Through Strategic Partnerships Innovation and Ecosystem Development

Leading technology providers are shaping the composable applications landscape through strategic investments in platform enhancements, partnership ecosystems, and developer enablement programs. Modular software vendors are expanding their marketplaces of pre-built microservices and connectors, fostering a vibrant community of partners and independent developers who contribute specialized modules. Simultaneously, infrastructure providers are integrating serverless and container services that underpin composable designs, offering managed runtime environments and telemetry tools to support observability and resilience.

In parallel, consulting and system integration firms are carving out differentiated practices centered on composable architecture advisory services. These firms blend industry knowledge with technical expertise to guide enterprises through proof-of-concept phases, governance framework establishment, and large-scale rollouts. They are increasingly embedding proprietary accelerators and best-practice frameworks into their engagement models, expediting time-to-value. Moreover, emerging start-ups focused on AI-driven code generation and no-code orchestration are entering the fray, challenging incumbents to evolve their offerings and compelling larger players to incorporate advanced automation into their development toolchains.

These converging efforts among platforms, infrastructure, services, and new entrants underscore the competitive dynamics driving composable application innovation. Organizations seeking to harness this momentum must evaluate vendor roadmaps, partnership strategies, and ecosystem vitality to ensure alignment with long-term transformation goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composable Applications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Amazon.com Inc.

- Appian Corporation

- Cisco Systems Inc.

- Contentstack

- Dell Technologies Inc.

- Elastic NV

- Informatica

- International Business Machines Corporation

- Kong Inc.

- Mendix Technology B.V.

- Microsoft Corporation

- MuleSoft

- Oracle Corporation

- OutSystems

- Salesforce Inc.

- SAP SE

- ServiceNow, Inc.

- TIBCO Software Inc.

- VMware Inc.

Actionable Recommendations for Industry Leaders to Accelerate Deployment Maximize Value and Mitigate Risks in Composable Application Strategies

To successfully navigate the composable applications landscape, industry leaders should prioritize the establishment of clear governance policies and architectural guardrails that balance flexibility with control. By defining standardized interfaces and versioning strategies early in the project lifecycle, organizations can mitigate integration risks and accelerate component reuse. Additionally, embracing an API-first mindset will foster interoperability across legacy systems and emerging microservices, ensuring seamless data flow and reducing development bottlenecks.

Equally important is the cultivation of cross-functional teams that blend business analysts, citizen developers, and IT professionals, thus democratizing innovation and promoting shared accountability for outcomes. Investing in skills development programs and collaborative platforms will enhance proficiency with low-code/no-code tools while reinforcing best practices for secure and compliant deployments. Furthermore, organizations should adopt a pilot-driven approach, selecting high-impact use cases that demonstrate tangible value quickly, and then scaling these proofs-of-concept to broader enterprise initiatives.

Finally, leaders must continuously monitor tariff policies, regional regulatory changes, and technology roadmaps to adapt deployment strategies proactively. By implementing a hybrid multi-cloud framework, enterprises can optimize cost structures, enhance resilience, and future-proof their composable architectures against evolving trade conditions and geo-political risks.

Explaining the Robust Research Methodology Employed to Deliver Comprehensive and Unbiased Insights into the Composable Applications Market

The research underpinning this analysis integrates primary and secondary methodologies to ensure comprehensive, unbiased insights. Primary research involved in-depth interviews and workshops with senior IT executives, solution architects, and digital transformation leaders across multiple industries, providing qualitative depth to emerging trends and real-world use case evaluations. These engagements were complemented by detailed surveys capturing adoption drivers, technology preferences, and deployment challenges, yielding a nuanced understanding of composable application dynamics.

Secondary research encompassed rigorous analysis of industry publications, regulatory filings, vendor technical documentation, and thought leadership reports, synthesizing perspectives from cloud providers, middleware vendors, system integrators, and end-user organizations. This phase also involved cross-referencing technology adoption indices and economic indicators to contextualize regional and tariff-related influences. Analytical frameworks such as SWOT, PESTEL, and Porter’s Five Forces were applied to structure the competitive landscape assessment, ensuring that strategic factors and external drivers were systematically evaluated.

To validate findings, a multi-stage triangulation process reconciled primary and secondary insights, identifying convergences and discrepancies before finalizing the narrative. The research approach emphasized transparency and repeatability, with documented data sources, interview guides, and analytical models available upon request to support due diligence and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composable Applications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composable Applications Market, by End User Industry

- Composable Applications Market, by Deployment Model

- Composable Applications Market, by Component

- Composable Applications Market, by Organization Size

- Composable Applications Market, by Region

- Composable Applications Market, by Group

- Composable Applications Market, by Country

- United States Composable Applications Market

- China Composable Applications Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Evolution of Composable Applications and Their Strategic Implications for Forward-Thinking Organizations

Composable applications represent a strategic inflection point in enterprise technology evolution, offering unprecedented agility, modularity, and resilience. The shift from monolithic systems to component-based architectures has redefined development paradigms, enabling organizations to respond rapidly to market changes and evolving customer expectations. As transformative forces such as cloud-native services, API ecosystems, and low-code platforms continue to mature, the competitive landscape will favor enterprises that embrace composable principles to optimize operational efficiency and foster innovation.

Looking ahead, the interplay between regulatory considerations, regional deployment strategies, and evolving tariff environments will shape architectural roadmaps and vendor ecosystems. Organizations that successfully integrate composable architectures into their digital portfolios will be better positioned to navigate complexity, manage cost pressures, and unlock the full potential of data-driven applications. Ultimately, composable strategies are more than a technical trend; they constitute a foundational shift in how businesses design, deploy, and sustain software capabilities, ensuring long-term adaptability and strategic differentiation.

Drive Your Business Forward with an Exclusive Invitation to Connect with Ketan Rohom for In-Depth Insights and Report Access

Take the next step in harnessing the power of composable application architecture by securing your comprehensive market research report. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through the insights and strategic recommendations that will elevate your organization’s digital transformation journey. Engaging with this tailored resource ensures you gain unparalleled visibility into the technological shifts, industry-specific dynamics, and competitive landscapes that are shaping the future of enterprise software.

By connecting with Ketan, you will receive personalized support in interpreting complex data, aligning findings with your strategic objectives, and identifying actionable pathways to expedite deployment and maximize ROI. Don’t miss the opportunity to leverage exclusive analyses on tariff impacts, regional variances, and segmentation insights that can inform critical decision-making. Reach out today and empower your leadership team with the clarity needed to make informed investments in composable applications.

- How big is the Composable Applications Market?

- What is the Composable Applications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?