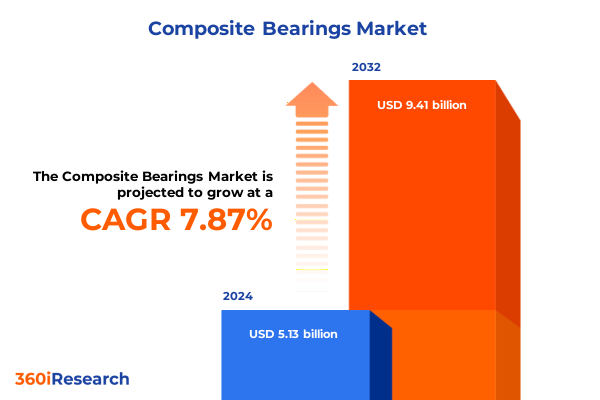

The Composite Bearings Market size was estimated at USD 5.46 billion in 2025 and expected to reach USD 5.81 billion in 2026, at a CAGR of 8.08% to reach USD 9.41 billion by 2032.

Unlock Loaded advantages: foundational exploration of material innovations and application dynamics shaping composite bearings today

Composite bearings are revolutionizing the way industries address friction management, weight reduction, and durability under extreme operating conditions. By combining high-performance polymers with reinforcing fibers, these engineered solutions deliver enhanced wear resistance and chemical inertness compared to traditional metal bearings. This report’s introduction delineates the foundational concepts underpinning composite bearing technology, outlining material families such as PEEK, phenolic resin, PTFE, and UHMWPE. Furthermore, the introduction highlights the significant shift toward lightweight designs in aerospace and automotive sectors, driven by fuel efficiency targets and regulatory pressure. By immersing readers in the core attributes of composite bearings, this section sets the stage for a nuanced exploration of market dynamics, emerging growth drivers, and evolving end-user requirements.

Transitioning from material characteristics to application landscapes, the introduction emphasizes how composite bearings are increasingly replacing metal and ceramic alternatives in high-temperature, corrosive, and high-load scenarios. Readers will gain an appreciation for the interplay between lubrication options-grease-lubricated, oil-lubricated, and self-lubricating- and operational performance. In doing so, the introduction underscores both the technical sophistication and the commercial promise of composite bearings, synthesizing cross-sector insights to frame the subsequent deep dives into transformative shifts, tariff impacts, and segment-level intelligence.

Revolutionizing Motion Control through Advanced Polymer Blends and Digitalization in Composite Bearing Applications

The composite bearings landscape has undergone transformative shifts driven by technological breakthroughs, industry convergence, and sustainability mandates. Recent advancements in resin chemistry and fiber reinforcement techniques have expanded performance envelopes, enabling bearings that withstand higher temperatures and more aggressive chemical environments. This evolution has been catalyzed by cross-pollination between the medical and aerospace sectors, where rigorous certifications for biocompatibility and flight-critical safety spur material innovations with far-reaching industrial applications.

Simultaneously, the drive for decarbonization has reshaped product roadmaps. Manufacturers are integrating materials that reduce system-level energy consumption through lower friction coefficients, facilitating compliance with tightening emissions standards. Digitalization trends have also influenced product design, with condition-monitoring sensors embedded within bearing housings to provide real-time data on load cycles, temperature fluctuations, and lubricant health. These smart bearings exemplify the convergence of mechanical engineering and Industry 4.0, allowing predictive maintenance models to minimize unplanned downtime. Together, these transformative shifts have elevated composite bearings from niche solutions to foundational components in next-generation machinery and vehicle platforms.

Analyzing the Strategic Repercussions of United States 2025 Tariff Adjustments on Composite Bearing Supply Chains

In 2025, the United States implemented updated tariffs on imported composite bearing materials and finished assemblies, aimed at protecting domestic manufacturers while responding to global trade imbalances. These measures have reverberated across supply chains, compelling end-use industries to reassess sourcing strategies and negotiate long-term contracts. While certain high-performance polymers faced rate increases averaging 7.5%, strategic exemptions were carved out for bearing products destined for critical infrastructure and defense applications. As a result, some raw material suppliers have recalibrated production, prioritizing domestic capacity expansions to mitigate cost volatility during customs clearance.

The tariff regime has also accelerated vertical integration efforts, as machining houses and original equipment manufacturers explore in-house compounding and molding capabilities. Early adopters report that localizing material processing not only reduces exposure to import duties but also shortens lead times, enhancing responsiveness to sudden demand spikes. However, smaller entities without sufficient capital to invest in production assets face procurement challenges and may shift toward lower-cost alternatives or consider partnerships to access tariff-free supply channels. Overall, the cumulative impact of the 2025 tariff adjustments is reshaping the competitive landscape, favoring agile players with robust supply networks and integrated production footprints.

Decoding Composite Bearing Market Segmentation Dynamics: Materials, Configurations, and Industry-Specific Preferences

Disaggregating the composite bearings market by end-use industry reveals divergent adoption curves. Aerospace applications, characterized by stringent weight and performance requirements, have driven demand for high-temperature PEEK bearings, while automotive manufacturers are investing in cost-efficient UHMWPE variants for under-the-hood and chassis systems. In the electrical and electronics segment, PTFE-based plain bearings are favored for their dielectric properties, whereas industrial machinery users lean toward phenolic resin roller bearings to balance load capacity and cost. Medical equipment producers require off-the-shelf ball bearings with FDA-compliant materials and self-lubricating features, contrasting with the oil and gas sector’s preference for grease-lubricated, flanged configurations that endure abrasive drilling environments.

Material differentiation further stratifies the market, as PEEK commands a premium across high-performance niches, and phenolic resin offers a mid-tier balance of mechanical strength and affordability. PTFE’s low friction coefficient secures its place in applications requiring minimal maintenance, while UHMWPE appeals to industries prioritizing cost efficiency and impact resistance. Product type segmentation underscores the prevalence of plain bearings in steady-state applications, rolling out to ball and roller bearings when rotational precision and load distribution become paramount. Lubrication type and configuration slices add depth to this picture; grease-lubricated radial bearings remain ubiquitous across maintenance-friendly installations, whereas oil-lubricated thrust bearings address axial load challenges in hydraulic systems. Finally, mounting type insights show a clear bifurcation between cylindrical housings used in retrofits and flanged designs for new equipment builds.

This comprehensive research report categorizes the Composite Bearings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Type

- Lubrication Type

- Configuration

- Mounting Type

- End Use Industry

Mapping Regional Growth Patterns and Innovation Drivers Shaping the Composite Bearings Landscape Globally

Regional analysis illustrates a tapestry of demand drivers and innovation hotspots. In the Americas, North American aerospace and automotive OEMs anchor growth, investing in localized R&D for lightweight bearing solutions that support electric vehicle platforms and next-generation aircraft. Latin American industrial sectors, particularly agriculture and mining, are gradually embracing composite bearings for their corrosion resistance and reduced maintenance footprint, though adoption remains nascent relative to mature markets.

Across Europe, Middle East & Africa, stringent environmental regulations and the push toward circular economy principles are accelerating the uptake of recyclable composite bearings. European manufacturers are collaborating with chemical producers to develop bio-based phenolic resins, while Middle Eastern energy players deploy self-lubricating radial bearings in onshore and offshore drilling rigs. In the Asia-Pacific region, burgeoning manufacturing hubs in Southeast Asia and India are scaling production of cost-competitive UHMWPE and PTFE bearings to serve both domestic infrastructure projects and export markets. Japan and South Korea continue to lead on high-performance PEEK applications, underpinned by strong automotive and electronics clusters. These regional nuances underscore the necessity of tailored go-to-market strategies and supply chain configurations that align with local regulations, end-user expectations, and innovation ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Composite Bearings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders and Innovators Leveraging Material Science and Digital Alliances for Competitive Edge

Leading entities in the composite bearings arena are differentiating through material science investments, manufacturing scale, and strategic alliances. Established polymer producers are integrating vertically to offer end-to-end bearing solutions, spanning compounding, molding, and precision machining. Concurrently, niche specialists are carving out competitive positions by focusing on high-temperature and corrosive-environment applications, securing defense and medical contracts through rigorous quality management systems.

Collaborations between bearing manufacturers and digital technology firms are also reshaping competitive dynamics. By embedding sensor platforms and data analytics capabilities, these alliances are delivering predictive maintenance services that enhance uptime for critical infrastructure and industrial clients. Joint ventures between European resin innovators and Asia-Pacific machining groups are further optimizing cost structures, enabling rapid regional scaling of premium product lines. Amid these developments, agility in responding to tariff shifts and material availability remains a defining trait of market leaders, who leverage expansive supplier networks and flexible production footprints to maintain throughput and service continuity.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composite Bearings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Composite Standard Bearings Co., Inc.

- Igus GmbH

- ILJIN Materials Co., Ltd.

- NB Corporation

- NSK Ltd.

- NTN Corporation

- RBC Bearings Inc.

- Schaeffler AG

- SKF AB

- The Timken Company

Crafting a Proactive Strategy Embracing Advanced Materials, Agile Manufacturing, and Digital Supply Network Capabilities

To capitalize on emerging opportunities in the composite bearings market, industry leaders should prioritize integrated material development programs that align polymer chemistry innovations with specific end-use requirements. By forging partnerships with resin suppliers and research institutions, firms can co-develop next-generation composites that deliver incremental performance gains while addressing sustainability metrics. Simultaneously, investing in modular manufacturing cells will afford production flexibility, enabling rapid format changes between cylindrical and flanged mounting configurations without significant retooling.

Furthermore, leaders must architect digital supply chains that incorporate real-time tariff monitoring and automated procurement workflows. This approach will facilitate dynamic sourcing decisions, balancing cost, lead times, and duty considerations. On the commercial front, developing value-added service models-such as condition monitoring subscriptions bundled with bearing sales-will deepen customer engagement and lock in long-term maintenance contracts. Lastly, expanding testing facilities in key regions will accelerate product validation, supporting local certifications and reducing time-to-market for innovative bearing designs.

Elucidating Our Unbiased Multi-Tiered Investigation Integrating Expert Interviews and Comprehensive Secondary Data Streams

This research employs a multi-tiered methodology combining primary interviews, secondary data aggregation, and rigorous validation processes. Primary insights were gathered through structured interviews with key stakeholders, including bearing designers, material scientists, procurement heads, and maintenance engineers across diverse end-use industries. In parallel, secondary research encompassed technical journals, patent filings, regulatory databases, and company disclosures to map technological trajectories and competitive dynamics.

Data triangulation ensured the integrity of qualitative observations and quantitative indicators without assigning specific market values. Cross-validation rounds were conducted with independent industry experts to refine thematic interpretations and confirm emerging trends. The report’s segmentation framework was constructed by cross-referencing product catalogs, material specifications, and application use cases, enabling coherent alignment between industry requirements and bearing attributes. Throughout the process, adherence to best practices in market research ethics and transparency was maintained, ensuring that findings reflect an unbiased and comprehensive overview of the composite bearings ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composite Bearings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composite Bearings Market, by Material

- Composite Bearings Market, by Product Type

- Composite Bearings Market, by Lubrication Type

- Composite Bearings Market, by Configuration

- Composite Bearings Market, by Mounting Type

- Composite Bearings Market, by End Use Industry

- Composite Bearings Market, by Region

- Composite Bearings Market, by Group

- Composite Bearings Market, by Country

- United States Composite Bearings Market

- China Composite Bearings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesis of Critical Trends and Strategic Imperatives Guiding the Evolution of Composite Bearings

Composite bearings stand at the convergence of advanced materials engineering and digital innovation, poised to reshape mechanical systems across aerospace, automotive, industrial, medical, and energy sectors. The interplay of emerging resin chemistries, additive manufacturing capabilities, and embedded sensor technologies is ushering in a new era of performance and reliability. As tariff landscapes evolve and regional regulatory regimes tighten, firms with agile supply chains, strategic partnerships, and forward-looking R&D agendas will capture disproportionate value.

Ultimately, the trajectory of composite bearings will be defined by the industry’s ability to balance material cost, environmental impact, and system-level efficiency gains. Organizations that embrace integrated development pathways, leverage digital tools for predictive maintenance, and tailor solutions to regional market idiosyncrasies will emerge as the true pioneers. This report offers a roadmap for navigating the complexities of this dynamic market, equipping decision-makers with the insights needed to harness composite bearings as a catalyst for next-generation product innovation and operational excellence.

Unlock Exclusive Market Intelligence and Expert Support by Connecting with Ketan Rohom for Strategic Growth Opportunities

To explore the comprehensive findings and strategic implications detailed in this market research report, don’t miss the opportunity to connect with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with this report will empower you with actionable intelligence, enabling you to refine your competitive positioning and innovate your product roadmap. Reach out today to secure your copy and unlock tailored insights that can drive your growth initiatives forward, leveraging advanced analyses and expert commentary to inform critical business decisions.

- How big is the Composite Bearings Market?

- What is the Composite Bearings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?