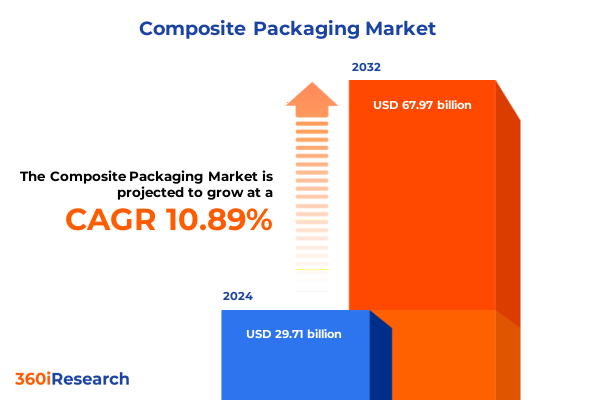

The Composite Packaging Market size was estimated at USD 33.02 billion in 2025 and expected to reach USD 36.31 billion in 2026, at a CAGR of 10.86% to reach USD 67.97 billion by 2032.

Unlocking the Integral Role of Composite Packaging in Modern Industries and the Key Drivers Shaping Its Evolution Across Global Supply Chains

Composite packaging has emerged as a cornerstone of modern supply chains, seamlessly blending materials such as corrugated paper, aluminum, foams, and polymer composites to deliver solutions that are durable, cost-effective, and increasingly sustainable. The integration of diverse substrates provides protection against mechanical damage, moisture infiltration, and contaminant exposure, supporting complex logistics networks and a heightened focus on product integrity. Moreover, composite packaging’s adaptability to varied form factors-from rigid bottles and jars to flexible pouches and films-enables brand owners to tailor packaging to the functional and experiential needs of end users across sectors such as food and beverage, healthcare, and cosmetics, while also addressing the last-mile delivery demands driven by e-commerce growth.

How Sustainability Mandates, Advanced Materials Innovation, and Industry 4.0 Automation Are Reshaping Composite Packaging Value Chains

The composite packaging sector is undergoing profound transformation as sustainability imperatives converge with regulatory overhaul and rapid technological innovation. New mandates such as the European Union’s Packaging and Packaging Waste Regulation emphasize circularity by imposing requirements on material reuse, recyclability, and extended producer responsibility, accelerating the shift toward recyclable or refillable formats that close the loop on resource use. Concurrently, advancements in material science-ranging from nanocomposite films that deliver enhanced barrier performance to high-performance polymers engineered for reduced weight-are enabling manufacturers to achieve premium functionality with thinner, lighter structures that minimize waste generation. In parallel, adoption of Industry 4.0 practices, including automation in production lines and digital supply-chain platforms, is improving operational agility and enabling real-time traceability, fostering resilience against disruptions and ensuring compliance with evolving regulatory thresholds.

Navigating the 2025 Tariff Turbulence on Composite Packaging Inputs with Agile Sourcing, Strategic Nearshoring, and Compliance Expertise

The imposition of elevated tariffs on imported packaging materials in 2025 has intensified cost pressures and prompted strategic realignments across the composite packaging ecosystem. In April 2025, the U.S. government enacted a 145 percent duty on most Chinese imports outside steel and aluminum, combined with a baseline 25 percent tariff on steel and aluminum sourced globally, directly affecting composite structures that incorporate these metals or metalized films. The immediate impact has been twofold: first, material-intensive formats such as aluminum‐based bottles and laminated sheets saw input costs surge, squeezing manufacturer margins; second, supply-chain complexities grew, driving brands to reexamine origin declarations, tariff classifications, and supplier relationships to mitigate duty liabilities. Although a 90-day reciprocal tariff reduction agreement temporarily lowered key rates to 30 percent, uncertainty around its extension underscores the imperative for diversified sourcing strategies and agile procurement frameworks that blend domestic production capabilities with regional partners. As a result, composite packaging leaders are increasingly investing in nearshore manufacturing, strengthening partnerships with U.S. suppliers of polymer composites, and leveraging trade-compliance expertise to navigate shifting policies without transferring undue cost burdens to end consumers.

Revealing How Product Type, Material Innovation, Closure Design, Industry Application, and Channel Strategy Converge to Define Composite Packaging Excellence

An in-depth look at composite packaging reveals nuanced opportunities when evaluated across multiple segmentation criteria. By product type, rigid containers such as bottles and jars excel in high-barrier applications for pharmaceuticals and specialty chemicals, while pouches deliver lightweight convenience and shelf impact for food, beverage, and personal-care products, and sheets and films offer customizable barrier performance and print fidelity for flexible packaging and wrap applications; tubs and buckets, by contrast, are optimized for bulk and industrial sectors where reclosable functionality is essential. Within material type, metal composites-including aluminum and steel panels-remain indispensable for applications requiring exceptional barrier and structural strength; paper composites, spanning corrugated paper, laminated paper, and molded fiber, address the growing demand for renewable, recyclable substrates; and plastic composites-specifically polyethylene, polypropylene, and PVC blends-are engineered to balance cost, durability, and recyclability in demanding logistics environments. Closure type further differentiates the market, with heat-sealed ends ensuring tamper evidence in single-serve pouches, screw caps providing resealability across rigid formats, and snap-on lids catering to convenience and reusability in tubs and buckets. End-use industry dynamics underscore the importance of tailored solutions: automotive and industrial segments value chemical resistance and mechanical robustness, cosmetics and personal care prioritize premium aesthetics and safety, food and beverage demand stringent hygiene and shelf life, and healthcare and pharmaceuticals require validated barrier and sterility. Finally, distribution channel preferences bifurcate customer engagement models, as offline retail continues to favor tactile package design and point-of-sale visibility, while online channels necessitate compact, damage-resistant formats that withstand fulfillment processes.

This comprehensive research report categorizes the Composite Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Closure Type

- End User Industry

- Distribution Channel

Understanding Regional Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific That Are Steering Composite Packaging Innovation and Adoption

Composite packaging performance and adoption vary significantly across global regions due to divergent regulatory landscapes, consumer expectations, and infrastructure capabilities. In the Americas, robust domestic metal and paper composite manufacturing networks support high-volume production, while U.S. state-level extended producer responsibility laws catalyze investment in recyclable formats and post-consumer recycled content. Europe, Middle East & Africa have rapidly embraced circular-economy mandates under the EU’s Packaging and Packaging Waste Regulation, driving growth in recyclable paper composites and refill systems, even as debates around regulatory simplification and alignment of EPR schemes underscore the complexity of pan-regional compliance. Meanwhile, Asia-Pacific leads in both market scale and innovation, with emerging economies scaling production of plastic composites to meet booming e-commerce demand, while developed markets like Japan and South Korea focus on advanced barrier films and automated packaging lines to support export-oriented supply chains.

This comprehensive research report examines key regions that drive the evolution of the Composite Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Industry Pioneers Are Leveraging R&D, Renewable Energy, and Collaborative Innovation to Lead the Composite Packaging Frontier

Leading composite packaging providers are differentiating through strategic commitments to sustainability, innovation, and integrated service offerings. Amcor has set an ambitious goal to design all packaging to be recyclable, reusable, or compostable by 2025, backed by annual R&D investments of approximately USD 100 million and collaborations with recyclers to scale PCR feedstocks, positioning itself to meet emerging EPR requirements and capture premium brand partnerships. Tetra Pak, a pioneer in aseptic carton solutions, has achieved a 25 percent reduction in value-chain GHG emissions and 54 percent in its own operations since 2019, while sourcing 94 percent of its energy from renewables, demonstrating the viability of decarbonized composite packaging systems without compromising product safety or shelf life. Mondi continues to set benchmarks in sustainable innovation, earning ten WorldStar Packaging Awards in 2025 for breakthrough designs and inaugurating FlexStudios, a collaborative innovation hub in Germany aimed at accelerating customer co-creation of circular flexible packaging solutions that align form, function, and recyclability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composite Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor plc

- Berry Global Group Inc.

- Canfab Packaging Inc.

- Constantia Flexibles Group GmbH

- Coveris Holdings S.A.

- Crown Holdings Inc.

- DS Smith plc

- Graphic Packaging Holding Company

- GWP Packaging Ltd.

- Huhtamäki Oyj

- International Paper Company

- Mondi plc

- Najmi Industries Limited

- Sealed Air Corporation

- Smurfit Kappa Group plc

- Sonoco Products Company

- TOPPAN Inc.

- UFlex Limited

- WestRock Company

- Zipform Packaging Pty Ltd.

Empowering Industry Leaders to Future-Proof Their Composite Packaging Strategies Through Material Diversification, Digital Traceability, and Circular Partnerships

To thrive amid intensifying regulation, raw-material uncertainty, and accelerating sustainability expectations, composite packaging leaders should first diversify material sourcing by developing hybrid composites that blend regional feedstocks and recycled content, thereby buffering against tariff volatility and supply disruptions. Second, investing in digital twin and blockchain technologies will enhance traceability and compliance reporting, enabling rapid adaptation to evolving EPR frameworks and bolstering brand transparency. Third, forging strategic alliances with logistics providers and recycling infrastructure partners can establish circular ecosystems, ensuring end-of-life material collection and repurposing while unlocking symbiotic value flows. Fourth, unlocking cost synergies through modular manufacturing footprints-combining centralized R&D hubs with decentralized production cells-will enable swift responses to localized demand spikes and regulatory shifts. Finally, embedding sustainability criteria into closed-loop design processes-prioritizing monomaterial formats and refillable systems-will align product roadmaps with both consumer preferences and long-term environmental mandates.

Delivering Robust Insights Through a Comprehensive Research Framework Combining Executive Interviews, Regulatory Analysis, and Data Triangulation

This report synthesizes insights from a rigorous blend of primary and secondary research. Primary research comprised in-depth interviews with senior executives, packaging engineers, and sustainability officers across leading manufacturers, brand owners, and regulatory bodies to capture first-hand perspectives on material selection, production technologies, and compliance strategies. Secondary research encompassed analysis of industry publications, regulatory filings, corporate sustainability reports, and global trade data to validate market dynamics and tariff developments. Quantitative data points were triangulated through cross-referencing customs statistics, trade agreements, and publicly disclosed procurement pricing. Additionally, a comprehensive validation workshop with external subject-matter experts ensured the robustness and relevance of the findings. The combination of qualitative and quantitative methodologies yields a holistic, actionable understanding of composite packaging’s current state and future trajectory.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composite Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composite Packaging Market, by Product Type

- Composite Packaging Market, by Material Type

- Composite Packaging Market, by Closure Type

- Composite Packaging Market, by End User Industry

- Composite Packaging Market, by Distribution Channel

- Composite Packaging Market, by Region

- Composite Packaging Market, by Group

- Composite Packaging Market, by Country

- United States Composite Packaging Market

- China Composite Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Consolidating Strategic Imperatives and Collaborative Approaches to Drive Sustainable and Resilient Composite Packaging Solutions Across Markets

Composite packaging stands at the nexus of efficiency, performance, and sustainability, catalyzed by a confluence of material innovations, regulatory imperatives, and digital enablers. As tariffs continue to reshape supply-chain calculus and circular-economy mandates gain momentum, companies must balance near-term cost pressures with long-term resilience objectives. By capitalizing on advanced composites that integrate recycled content, embracing automation for agile production, and nurturing collaborative ecosystems for end-of-life management, stakeholders can transform these challenges into competitive advantages. The coming years will reward those who adopt a systems approach-synchronizing product design, sourcing, manufacturing, and reverse logistics-to deliver composite packaging solutions that satisfy brand demands, exceed consumer expectations, and uphold environmental stewardship.

Invest in Expert Insights to Navigate Composite Packaging Market Dynamics and Secure Your Competitive Edge with a Tailored Research Report

Elevate your strategic initiatives with our definitive market research report on composite packaging that cuts through complexity with in-depth analysis and actionable insights. Reach out to Associate Director, Sales & Marketing, Ketan Rohom, to discuss how this comprehensive resource can empower your organization to navigate evolving regulations, optimize supply chains, and seize emerging opportunities across product types, materials, closures, end-use industries, and distribution channels. Connect with Ketan to secure your report and gain unparalleled visibility into the composite packaging landscape that is shaping the future of sustainable, resilient, and cost-efficient solutions.

- How big is the Composite Packaging Market?

- What is the Composite Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?