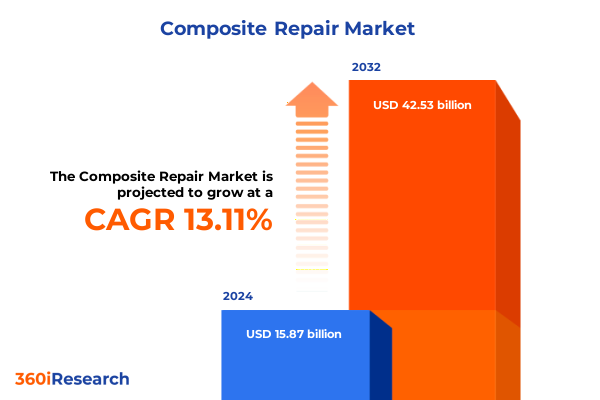

The Composite Repair Market size was estimated at USD 15.87 billion in 2024 and expected to reach USD 17.89 billion in 2025, at a CAGR of 13.11% to reach USD 42.53 billion by 2032.

Emerging Dynamics in Composite Repair: Understanding the Critical Role of Advanced Materials, Techniques, and Market Forces Driving Industry Transformation

The composite repair sector has emerged as a critical nexus between advanced materials science and essential maintenance practices across multiple high-value industries. As composite materials become increasingly prevalent in aerospace, automotive, marine, energy, and infrastructure applications, the need to preserve structural integrity through effective repair techniques has never been more urgent. The evolution of composite repair encompasses not only mechanical restoration but also the intricate chemistry of adhesives and resins, the precision of nondestructive testing, and the logistics of supply chain management. This introduction illuminates the foundational drivers behind composite repair, highlighting how the interplay of material innovations and operational imperatives creates a landscape rich with strategic opportunities and technical challenges.

Navigating this complex landscape requires an appreciation for both legacy methodologies and emerging repair paradigms. Traditional manual patching and wet-lay repair processes continue to play a vital role, particularly for small-scale cosmetic or structural corrections. However, the proliferation of automation-ranging from robotic milling and dispensing to drone-based inspection platforms-signals a shift toward scalable, precise, and repeatable practices. Regulatory compliance and performance validation add further layers of complexity, demanding that repair protocols align with stringent safety standards and environmental regulations. This report delves into these multifaceted dimensions, examining how technological, economic, and regulatory forces collectively shape the contemporary composite repair market.

At its core, this report dissects composite repair through a multidimensional lens. Based on resin type, it explores the dichotomy of thermoplastic versus thermoset chemistries, with thermoset systems further categorized into epoxy, polyester, and vinyl ester formulations. A comparative analysis of automated and manual repair techniques reveals distinct cost, quality, and scalability considerations. Application type receives careful attention, distinguishing between cosmetic repairs, leak remediation, and structural restoration. Finally, the end-use industry segmentation encompasses aerospace and defense-divided into commercial and military aviation-automotive and transportation with commercial and passenger vehicle subsegments, as well as construction, marine, oil and gas, and wind energy sectors, each with their respective subverticals. Together, these layers establish the analytical framework for understanding the composite repair market’s current state and future trajectory.

Revolutionary Material Science, Automation Advances, and Sustainability Imperatives Are Catalyzing a New Era in Composite Repair Practices Worldwide

Recent years have witnessed a wave of technological breakthroughs that are redefining composite repair methodologies. Nanocomposite-infused resins and fiber architectures now offer enhanced bonding strength and damage tolerance, enabling more durable and reliable restorations. Concurrently, self-healing polymer matrices that respond to microcrack formation are transitioning from laboratory concepts to field-deployable solutions. Automation is accelerating this trend: robotic surface preparation, precision patch application, and automated curing systems are reducing cycle times and human error while improving repeatability. Digital twins and advanced simulation tools further empower engineers to model repair scenarios in virtual environments, optimizing repair designs before execution in the field.

Alongside technology, regulatory and sustainability considerations are reshaping market expectations. Stricter environmental controls are driving suppliers toward low-VOC adhesives and recyclable composite systems, compelling repair service providers to adopt greener formulations that comply with evolving emission standards. At the same time, global safety authorities are tightening certification protocols for composite repairs in critical applications, such as commercial and military aircraft. These regulatory shifts are elevating quality assurance practices, mandating enhanced nondestructive inspection techniques and traceability mechanisms. As a result, the composite repair ecosystem is undergoing a fundamental transformation-where advanced materials, automated processes, and rigorous compliance coalesce into next-generation repair solutions.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Composite Repair Supply Chains, Cost Structures, and Competitive Positioning

The introduction of new United States tariff measures in 2025 has had a pronounced ripple effect across composite repair supply chains. Tariffs levied on imported high-performance resin systems and fiber reinforcements have elevated input costs for both thermoset and thermoplastic formulations. Repair service providers have been forced to reassess procurement strategies, with many pivoting toward domestic suppliers or sourcing from alternative low-tariff regions. This redirection has strengthened regional supply resilience but has also introduced logistical complexities, including lead-time variability and qualification processes for new resin certifications. Companies that proactively engaged in cross-border procurement realignment and scaled local manufacturing partnerships have mitigated cost escalation and preserved service continuity.

Beyond direct cost implications, the cumulative impact of these tariffs has reshaped competitive dynamics. Firms with in-house resin compounding capabilities or those that had previously invested in joint ventures with North American resin producers enjoyed a distinct advantage, securing preferential pricing and supply assurances. Conversely, repair specialists heavily reliant on imported consumables faced margin compression and, in some instances, had to renegotiate service contracts to accommodate pass-through costs. The tariff landscape has, therefore, underscored the strategic importance of vertical integration and flexible sourcing models, prompting industry players to explore joint R&D initiatives with resin manufacturers and to diversify material portfolios to include lower-tariff or tariff-exempt alternatives.

Unveiling Critical Segmentation Insights Across Resin Types, Repair Techniques, Application Scenarios, and End-Use Industries Shaping Market Dynamics

Dissecting the market through the lens of resin type reveals that thermoset polymers, particularly epoxy-based systems, continue to dominate structural repair applications due to their superior mechanical performance and fatigue resistance. However, the growing appeal of thermoplastic matrices-characterized by faster cure times and recyclability-signals a potential shift for certain noncritical or rapid-response repairs. The nuanced differences among polyester, vinyl ester, and epoxy systems underscore material selection strategies that balance cost, durability, and environmental compliance.

Technique-based segmentation uncovers a clear delineation between manual and automated repair processes. Manual repairs remain indispensable for localized cosmetic and leak remediation tasks, offering on-site adaptability and low capital investment. In contrast, automated approaches, which encompass robotic milling, automated dispensing, and precision placement, are increasingly adopted for large-scale or high-volume repairs where consistency and throughput are paramount. This bifurcation highlights a strategic opportunity for service providers to invest in hybrid repair facilities that can seamlessly integrate both methodologies, optimizing cost and performance across diverse application scenarios.

When evaluating application types, cosmetic repair activity has surged driven by heightened aesthetic standards and consumer expectations in automotive and maritime sectors. Leak repair demand remains stable, particularly in oil and gas infrastructure where downtime penalties are significant. Structural repair continues to represent the most technically complex segment, requiring rigorous engineering verification and certification. End-use industry segmentation reinforces aerospace and defense as the primary revenue driver, with commercial and military aircraft constituting the bulk of high-value structural repairs. Automotive and transportation applications, spanning commercial vehicles and passenger cars, present incremental growth fueled by lightweighting initiatives. Construction, marine, oil and gas, and wind energy each demonstrate distinct dynamics, influenced by regional infrastructure investments and sustainability mandates.

This comprehensive research report categorizes the Composite Repair market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Types

- Technique

- Repair Method

- Application Type

- End Use Industry

Decoding Regional Variations and Strategic Trends in Composite Repair Across the Americas, Europe, Middle East & Africa, and Asia-Pacific Territories

Regional analysis uncovers divergent growth trajectories shaped by regulatory frameworks, infrastructure priorities, and technological readiness. In the Americas, a mature regulatory environment and well-established repair networks support robust demand for both manual and automated services. Investments in domestic resin manufacturing and composite fabrication facilities have fortified supply chains, reducing reliance on imports. The commercial aerospace sector remains a pivotal driver, with U.S. operators and defense contractors heavily investing in life-cycle management programs to ensure fleet availability and safety compliance.

Europe, Middle East & Africa demonstrates a complex interplay of stringent European Union environmental regulations and burgeoning demand in Middle Eastern markets for marine and oil and gas repair services. European operators are increasingly embracing low-VOC resin alternatives and stringent nondestructive testing protocols to align with sustainability targets. Meanwhile, Gulf region infrastructure projects and naval vessel maintenance initiatives are boosting demand for both manual and automated repair capabilities. Africa, although nascent, shows early interest in wind energy repairs, driven by off-grid renewable projects and international funding programs.

Asia-Pacific stands out for its dynamic blend of manufacturing prowess and rapidly expanding repair service ecosystems. China’s large-scale composite manufacturing hubs and government-supported aviation maintenance programs have fostered a growing aftermarket for structural repairs. Japan and South Korea lead in advanced automation adoption, leveraging robotics and digital inspection to reduce downtime. Australia’s offshore wind farm developments have elevated the need for specialized repair solutions in remote environments. Across the region, the convergence of local production capacity with global technology partnerships is shaping a competitive and innovative composite repair landscape.

This comprehensive research report examines key regions that drive the evolution of the Composite Repair market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leadership Strategies and Innovation Portfolios of Key Global Stakeholders Driving Progress in the Composite Repair Industry

The composite repair space is characterized by a competitive landscape that includes materials suppliers, equipment manufacturers, and specialty service providers. Major chemical conglomerates with vertically integrated resin portfolios have intensified R&D spending to develop next-generation formulations that cater to both sustainability and performance criteria. Simultaneously, robotics and automation vendors are forging partnerships with composite repair firms to deliver turnkey solutions, combining hardware, software, and training services.

Service providers, ranging from global aerospace maintenance organizations to niche marine repair specialists, are differentiating through strategic alliances and digital offerings. Several leading players have launched cloud-based repair management platforms that integrate inspection data, material tracking, and regulatory documentation, streamlining workflows and enhancing traceability. Others are expanding geographically through acquisitions, entering adjacent end-use verticals such as wind energy and oil and gas to leverage existing technical expertise. This convergence of material innovation, digitalization, and strategic expansion is redefining competitive positioning and setting new benchmarks for service quality and operational efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composite Repair market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Air France KLM Group

- Airbus SE

- Armor Plate, Inc.

- BASF SE

- Boeing Company

- Composite Technology International Pte Ltd

- FGS Composites

- Fibrwrap Construction UK Ltd

- Furmanite Corporation

- Gougeon Brothers, Inc.

- Gurit Services AG

- HAECO

- Henkel AG & Co. KGaA

- Hexcel Corporation

- Huntsman Corporation

- ICR Group

- Lufthansa Technik AG

- Millennium Aero Dynamics Pvt. Ltd.

- Milliken Infrastructure Solutions LLC

- Owens Corning

- Patriot International

- Performance Composites Inc.

- Siemens AG

- Sika AG

- Solvay SA

- Stansted Aerospace LTD

- Team Inc.

- The IKM Group

- Total Wind Group A/S.

- Vestas Wind Systems A/S

- Wind Composite Service

Offering Actionable Strategic Guidance for Industry Leaders to Capitalize on Emerging Composite Repair Opportunities and Navigate Complex Market Challenges

To thrive in this rapidly evolving environment, industry leaders should adopt a multifaceted strategy that balances technological investment with supply chain resilience. Establishing collaborative R&D agreements with resin manufacturers can accelerate the development of eco-friendly repair compounds and reduce time-to-market. Concurrently, investing in automation platforms-such as robotic surface treatment and AI-driven inspection systems-can enhance throughput while reducing labor costs and variability.

Diversification of sourcing channels is equally critical. Firms should evaluate partnerships with regional resin producers to mitigate tariff risks and improve material availability. Building hybrid repair centers that seamlessly integrate manual and automated processes will enable providers to address a broader spectrum of repair scenarios more efficiently. Additionally, engaging proactively with regulatory bodies to shape evolving standards and participating in industry consortia can ensure early-adopter advantages and foster greater market acceptance of innovative repair methodologies.

Outlining Rigorous Research Methodologies and Data Validation Processes Employed to Uncover Actionable Insights in Composite Repair Market Analysis

This report’s conclusions are founded on a rigorous research methodology combining primary and secondary data sources. A comprehensive review of trade publications, regulatory filings, and technical standards provided the secondary foundation, while in-depth interviews with composite repair engineers, materials scientists, and supply chain managers enriched the analysis with real-world perspectives. Survey instruments deployed among service providers and end users yielded quantitative insights into current repair practices, material selection criteria, and equipment utilization patterns.

To ensure data integrity, findings were triangulated through cross-referencing of corporate press releases, patent filings, and conference proceedings. A panel of industry experts conducted validation workshops to refine assumptions and contextualize emerging trends. Geographic coverage was calibrated to reflect regional market dynamics, and segmentation frameworks were stress-tested against historical repair data and expert forecasts. The result is a robust, transparent research process that supports the credibility and actionable relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composite Repair market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composite Repair Market, by Material Types

- Composite Repair Market, by Technique

- Composite Repair Market, by Repair Method

- Composite Repair Market, by Application Type

- Composite Repair Market, by End Use Industry

- Composite Repair Market, by Region

- Composite Repair Market, by Group

- Composite Repair Market, by Country

- United States Composite Repair Market

- China Composite Repair Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives on Key Findings and Strategic Imperatives That Define the Future Trajectory of the Composite Repair Sector

In summary, composite repair is at a pivotal juncture where advancements in material science, automation, and regulatory compliance are redefining market expectations. The interplay of resin innovation, hybrid repair techniques, and evolving tariff landscapes underscores the necessity for strategic agility and ongoing investment in both R&D and supply chain flexibility. Differentiation will be driven by the ability to deliver high-quality, cost-effective repairs that meet stringent performance and environmental criteria.

As industry stakeholders navigate these complexities, those who embrace collaborative innovation, diversify procurement pathways, and align with emerging sustainability mandates will command a competitive edge. The insights highlighted herein provide a roadmap for decision-makers seeking to optimize repair operations, anticipate market shifts, and capture value in the dynamic composite repair ecosystem.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your composite repair market research report and expand your strategic vision

To explore the detailed findings and insights presented in this report and to translate them into actionable strategies for your organization, connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your composite repair market research report and expand your strategic vision. This engagement will provide you with tailored guidance, enabling you to make informed investment decisions, identify emerging opportunities, and strengthen your competitive positioning in an increasingly complex global landscape.

Reach out today to discuss customization options, volume licensing, and enterprise access models that align with your strategic objectives. By partnering directly with Ketan Rohom, you can ensure rapid access to proprietary data and expert analysis, empowering your team to drive growth, manage risk, and capitalize on the most compelling opportunities within the composite repair sector.

- How big is the Composite Repair Market?

- What is the Composite Repair Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?