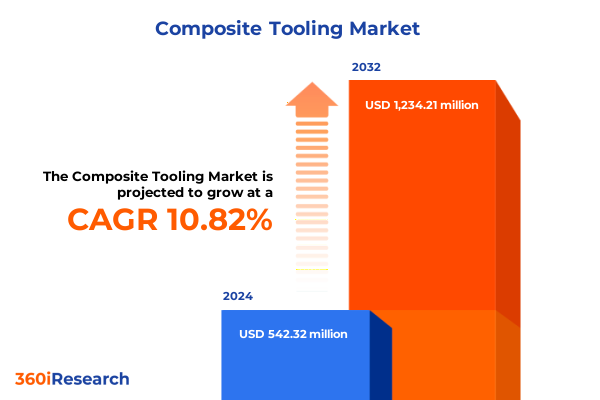

The Composite Tooling Market size was estimated at USD 594.32 million in 2025 and expected to reach USD 657.12 million in 2026, at a CAGR of 11.00% to reach USD 1,234.21 million by 2032.

Unveiling the Crucial Role of Composite Tooling in Accelerating Innovative Manufacturing Across Aerospace, Automotive, Marine, and Wind Energy Sectors

Composite tooling represents the backbone of modern manufacturing innovation, enabling the production of lightweight, high-strength components across multiple high-value industries. By leveraging specialized molds, dies, and inspection systems, organizations can significantly enhance process efficiency, reduce cycle times, and improve part quality. As the demand for advanced composites continues to accelerate, the tooling landscape is evolving to address increasingly complex geometries, tighter tolerances, and rigorous performance requirements. Consequently, understanding the strategic importance of composite tooling is foundational for stakeholders seeking to capitalize on the transformative potential of these materials.

This executive summary provides a concise yet comprehensive introduction to the composite tooling market, examining the key drivers, technological breakthroughs, and emerging challenges that shape its trajectory. It outlines the purpose and scope of the full research report, detailing the analytical frameworks and segmentation approaches used to illuminate critical trends. By setting the stage with clear context and defining the core themes, this introduction equips decision-makers with the necessary perspective to navigate the deeper insights that follow in subsequent sections.

Exploring Key Technological Advancements and Industry Dynamics Rewriting the Playbook for Composite Tooling Effectiveness and Efficiency

The composite tooling landscape is undergoing a period of rapid transformation driven by a convergence of digitalization, advanced materials science, and process automation. Digital twins and simulation tools are enabling precise virtual testing of tool designs prior to physical fabrication, significantly reducing development cycles and minimizing costly rework. Concurrently, integrated machine learning algorithms are optimizing mold parameters in real time, elevating quality control standards and enhancing consistency across high-volume production runs.

Material innovation has also redefined tooling capabilities, with hybrid carbon-aramid composites and thermally stable polymers expanding operating envelopes and improving durability under extreme conditions. These breakthroughs are complemented by the rise of additive manufacturing techniques, which now support rapid prototyping and even end-use tool production for intricate geometries that were once infeasible through traditional methods. In parallel, robotics and automated material handling have streamlined dress-out operations and expedited cure cycles in autoclave environments.

Together, these transformative shifts are reshaping cost structures, reducing time-to-market, and unlocking new design possibilities. The fusion of digital workflows, sustainable materials, and automated processes is not only enhancing performance metrics but also setting new benchmarks for agility and resilience in composite tooling operations.

Assessing the Comprehensive Consequences of 2025 United States Tariffs on Composite Tooling Supply Chains, Cost Structures, and Competitive Dynamics

In 2025, a suite of tariffs imposed by the United States on composite tooling components, raw materials, and finished assemblies has reverberated across global supply chains. These measures, targeting a broad array of carbon fiber, resin systems, and precision tooling imports, have introduced cost pressure that ripples through tier-one manufacturers and OEMs alike. Elevated import duties have compelled many organizations to reassess sourcing strategies, with near-shoring and domestic production emerging as viable alternatives to mitigate exposure to unpredictable tariff regimes.

The immediate effect has been an uptick in procurement costs, driving end-users to seek efficiency gains elsewhere in the value chain. Several firms have accelerated investments in local tooling workshops to regain price stability and foster closer collaboration with material suppliers. Meanwhile, international competitors have seized the opportunity to reinforce their foothold in markets less impacted by U.S. policy, deepening the competitive landscape. Supply chain leaders are now navigating a delicate balance between preserving cost competitiveness and maintaining access to specialized technologies that traditionally originated from established overseas hubs.

Mitigation strategies have coalesced around diversifying supplier bases, renegotiating long-term contracts to include tariff-contingent clauses, and exploring tariff engineering techniques. As stakeholders adapt to these elevated trade barriers, the composite tooling ecosystem is poised to evolve toward greater geographic dispersion and enhanced supply chain resilience.

Decoding Market Divisions Through Application, Process, Material, and Tool Type Lenses to Illuminate Strategic Opportunities in Composite Tooling

A nuanced understanding of the composite tooling market emerges through the lens of its core segmentation dimensions, each offering unique insights into growth drivers and innovation hotspots. When examining applications, aerospace stands out due to its rigorous performance demands across commercial aircraft platforms, bespoke general aviation builds, and defense-grade military programs. The automotive domain similarly reveals distinct trajectories, as commercial trucking applications seek rugged tooling solutions, electric vehicle manufacturers pursue lightweight die designs for battery enclosures, and passenger vehicle OEMs focus on high-precision mold systems for complex interior components.

Process segmentation further clarifies competitive positioning, with additive manufacturing techniques-spanning fused deposition modeling, selective laser sintering, and stereolithography-injecting agility into low-volume prototyping and custom tool production. Established methods like autoclave molding continue to underpin high-strength part fabrication, while CNC machining operations cover drilling, milling, and turning tasks essential for tight-tolerance fixtures. Simultaneously, compression molding, resin transfer molding, and vacuum bag molding maintain their relevance in high-volume scenarios, each aligned with specific material and design requirements.

Material considerations, encompassing aramid fiber’s impact resistance, carbon fiber’s stiffness, glass fiber’s cost efficiency, and natural fiber’s sustainability appeal, inform tool design choices and end-use performance expectations. Finally, tool type segmentation-ranging from cutting tools to forming tools such as dies and molds, and inspection systems including coordinate measuring machines and nondestructive testing equipment-completes the picture of an ecosystem characterized by specialized components and modular tool assemblies. Altogether, these segmentation insights frame a holistic perspective on where innovation is concentrated and where future growth corridors lie.

This comprehensive research report categorizes the Composite Tooling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process

- Material

- Tool Type

- Application

Unraveling Regional Market Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Highlight Regional Drivers and Challenges

Regional considerations play a pivotal role in shaping composite tooling dynamics, as each geography presents distinct regulatory landscapes, infrastructure capabilities, and customer demands. In the Americas, the emphasis on near-shoring and domestic capacity building has spurred investment in local tooling centers, particularly in automotive hubs of the United States and Canada. This focus on regional supply chain security has been bolstered by government incentives aimed at revitalizing manufacturing and reducing reliance on overseas inputs.

Over in Europe, the Middle East, and Africa, stringent environmental regulations and carbon neutrality targets have accelerated the adoption of sustainable tooling materials and processes. Leading European aerospace and wind energy clusters are increasingly collaborating with technology providers to pioneer low-emission cure methods and recyclable composite systems. Meanwhile, Middle Eastern and African markets are emerging as key growth corridors for marine and power generation applications, with localized service networks under development to support aftermarket tooling and repair operations.

Asia-Pacific continues to dominate in production scale, driven by robust demand from the rapidly expanding aircraft maintenance, repair, and overhaul sector, alongside burgeoning electric vehicle manufacturing in key markets such as China, Japan, and India. Investments in automation, combined with a vast skilled-labor pool, have positioned APAC as a competitive stronghold for cost-effective large-scale tooling, while government-led innovation initiatives are fostering next-generation process technologies across the region.

This comprehensive research report examines key regions that drive the evolution of the Composite Tooling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Composite Tooling Innovators and Strategic Collaborators Driving Market Evolution in Materials and Manufacturing Technologies

Market leaders in composite tooling have distinguished themselves through strategic investments in advanced materials and end-to-end process integration. Several prominent tooling providers have forged partnerships with resin and fiber suppliers to co-develop custom formulations optimized for specific curing profiles and environmental conditions. Such collaborations have yielded modular tool architectures that enhance reusability and reduce time-consuming setup phases.

At the same time, tool manufacturers with deep automation expertise are expanding their service portfolios to include predictive maintenance solutions, leveraging sensor-based monitoring to preemptively address tooling wear and ensure consistent part quality. This convergence of mechanical engineering and digital analytics is redefining the service model, enabling customers to transition from reactive repair schedules to proactive lifecycle management.

Innovation ecosystems led by specialized firms have also given rise to consortiums focused on next-generation additive tooling materials and hybrid manufacturing processes. These ventures underscore a collective commitment to sustainable practices, with research agendas targeting reduced energy consumption during autoclave cycles and the incorporation of bio-derived fibers to lower carbon footprints. Through strategic alliances, leading companies are shaping the competitive landscape, setting benchmarks for tool performance, and driving widespread adoption of cutting-edge manufacturing methodologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composite Tooling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Covestro AG

- Gurit Holding AG

- Hexcel Corporation

- IDI Composites International

- Magnum Venus Products, Inc.

- Mitsubishi Chemical Holdings Corporation

- Owens Corning

- Royal TenCate N.V.

- SGL Carbon SE

- Solvay SA

- Teijin Limited

- Toray Industries, Inc.

Strategic Imperatives and Best Practices for Industry Leaders to Harness Composite Tooling Innovations and Secure Competitive Advantage

To thrive in a market marked by rapid technological advances and evolving trade policies, industry leaders must embrace a series of strategic imperatives. First, integrating digital twins and simulation platforms into the tooling development cycle will accelerate design validation and unlock opportunities for virtual troubleshooting, ultimately compressing lead times. Concurrently, firms should invest in modular tool architectures that facilitate quick changeovers between applications, reducing downtime and enhancing operational flexibility.

Diversifying supply chains is another critical priority. By establishing multiple sourcing channels and exploring near-shore partnerships, companies can mitigate the impact of tariff fluctuations and geopolitical disruptions. Aligning procurement strategies with tiered contract structures that include contingency clauses for tariff adjustments will further strengthen resilience. In parallel, cultivating close collaborations with material providers will ensure early access to novel fiber and resin systems, enabling first-mover advantages in emerging application segments.

Finally, embedding sustainability criteria into tooling program roadmaps will not only address regulatory imperatives but also resonate with environmentally conscious end-users. This entails evaluating bio-based materials, optimizing energy efficiency in cure processes, and implementing closed-loop recycling initiatives for worn tool components. Through these combined measures, industry leaders can secure a differentiated competitive edge while paving the way for a more robust, adaptive composite tooling ecosystem.

Detailing a Robust and Transparent Research Framework Combining Qualitative and Quantitative Approaches for Composite Tooling Market Analysis

The research underpinning this executive summary is grounded in a rigorous, multi-phased methodology designed to ensure both depth and reliability. Secondary research formed the foundation of the analysis, drawing on industry white papers, technical journals, and patent filings to map the technological landscape and identify emerging material innovations. Concurrently, an extensive database of company profiles, regulatory filings, and trade data was synthesized to provide context on supply chain structures and competitive positioning.

Primary validation was achieved through structured interviews and workshops with executives, process engineers, and R&D specialists across a cross-section of sectors including aerospace, automotive, marine, and energy. These interactions were complemented by an expert panel comprising tooling machine builders, materials scientists, and market analysts, who provided critical insights on current pain points, investment trends, and future technology adoption timelines.

Data triangulation techniques were applied throughout the process to reconcile quantitative metrics with qualitative feedback. Rigorous cross-validation protocols, including consistency checks against independently sourced data sets, safeguarded accuracy. Together, these steps culminated in a coherent analytical framework that balances empirical data with expert perspectives, delivering a trustworthy lens into the composite tooling market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composite Tooling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composite Tooling Market, by Process

- Composite Tooling Market, by Material

- Composite Tooling Market, by Tool Type

- Composite Tooling Market, by Application

- Composite Tooling Market, by Region

- Composite Tooling Market, by Group

- Composite Tooling Market, by Country

- United States Composite Tooling Market

- China Composite Tooling Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Critical Insights to Chart the Future Trajectory of Composite Tooling Adoption and Sustainable Manufacturing Practices

The composite tooling sector stands at a pivotal crossroads, shaped by converging technological innovations, shifting trade landscapes, and evolving regional dynamics. Digital transformation initiatives and material breakthroughs are unlocking unprecedented design freedom and operational agility, while tariff pressures are prompting strategic realignments in supply chain networks. The segmentation analysis highlights the varied needs across aerospace, automotive, marine, and energy applications, underscoring the importance of targeted approaches that align tool type and material selection with end-use performance criteria.

Regional insights further emphasize that adaptability and proximity to end markets are now as critical as technical excellence, and that leaders must tailor their strategies to local regulatory and infrastructural parameters. The success stories of companies blending advanced analytics with collaborative research initiatives point to a future in which integrated service offerings and sustainability credentials will determine market leadership.

As manufacturers and OEMs navigate this complex landscape, the insights presented here serve as a compass for strategic decision-making. By synthesizing the collective implications of transformative shifts, tariff impacts, segmentation nuances, regional drivers, and leading practices, this executive summary charts the course for informed investments and operational enhancements that will shape the next chapter of composite tooling innovation.

Engage with Ketan Rohom to Unlock In-Depth Market Intelligence and Drive Composite Tooling Success Through Tailored Research Solutions

To take the next step toward harnessing cutting-edge insights in composite tooling, engage directly with Ketan Rohom, Associate Director of Sales & Marketing, for a personalized consultation tailored to your strategic objectives. You can explore how deep market intelligence will empower your team to navigate complex supply chain dynamics, capitalize on emerging process technologies, and refine your segmentation strategies for maximum impact. This one-on-one discussion will outline the bespoke research solutions available, provide clarity on report components aligned with your unique priorities, and ensure swift access to the data you need to make confident, forward-looking decisions.

By connecting with Ketan Rohom, you gain a dedicated partner committed to delivering actionable recommendations and supporting your growth roadmap in composite tooling. Don’t leave critical opportunities untapped-reach out today to secure your comprehensive market research package and unlock the competitive edge that leading manufacturers rely on to drive innovation and sustainable success.

- How big is the Composite Tooling Market?

- What is the Composite Tooling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?