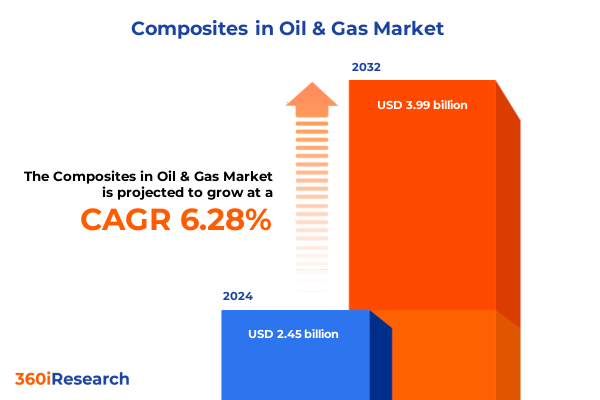

The Composites in Oil & Gas Market size was estimated at USD 2.59 billion in 2025 and expected to reach USD 2.74 billion in 2026, at a CAGR of 6.36% to reach USD 3.99 billion by 2032.

Revolutionizing Oil & Gas Through Advanced Composite Materials That Enhance Efficiency Safety and Sustainability in Modern Energy Infrastructure

The energy sector is undergoing a profound transformation as advanced composite materials emerge as critical enablers for modern oil and gas infrastructure. By offering superior strength-to-weight ratios and enhanced corrosion resistance compared to traditional metals, composites are redefining core equipment design and operational resilience. This introduction outlines how these materials are set to influence equipment lifecycles and maintenance paradigms, catalyzing a shift toward safer and more sustainable practices.

In practice, the market spans a diverse range of applications. Equipment segments encompass heat exchangers, separators, and valves, each benefiting from composites’ ability to withstand aggressive process conditions while reducing weight and installation complexity. Offshore structures-comprising jackets, platforms, and topsides-are also experiencing a transition as operators seek durable materials that can endure harsh marine environments and minimize lifecycle costs. Furthermore, the use of composites in pipes and tubing, pressure vessels, and storage tanks underscores the material’s versatility and potential for broad adoption throughout production, processing, and transport stages.

Finally, composite manufacturing processes such as filament winding, pultrusion, and resin transfer molding provide tailored solutions that align with specific performance requirements. These methods enable precise fiber orientation and resin distribution, resulting in components that optimize flow dynamics, structural integrity, and thermal stability. As a result, composites are poised to support the oil and gas industry’s pursuit of cost efficiencies, safety imperatives, and environmental stewardship, setting the stage for the detailed analysis that follows.

Shifting Paradigms in Oil & Gas Infrastructure Driven by Cutting Edge Composite Technologies and Evolving Operational Demands Across the Value Chain

Across the oil and gas value chain, recent innovations in composite technologies are driving a fundamental reordering of asset design and operational strategies. New fiber chemistries and resin systems are pushing performance boundaries, enabling components to withstand higher pressures, more extreme temperatures, and more corrosive environments than previously possible. Consequently, decision-makers are reevaluating traditional alloy-based solutions in favor of composites that deliver long-term operational stability and reduced maintenance burdens.

Simultaneously, digitalization and advanced manufacturing techniques are accelerating adoption. High-precision fabrication methods, including automated fiber placement and additive manufacturing, allow for rapid prototyping and complex geometries that were once impractical. Operators and fabricators are leveraging these capabilities to optimize supply chain efficiencies, reduce waste, and shorten lead times-an outcome that aligns with industry goals to improve project economics and risk management.

Moreover, collaborative partnerships between material suppliers, engineering firms, and service providers are fostering integrated solutions that address the full lifecycle of composite assets. Through these alliances, stakeholders can co-develop design guidelines, validation protocols, and maintenance frameworks. As a result, the landscape is shifting toward cohesive ecosystems that support scalable deployment of composite technologies, reinforcing their role as transformative agents across upstream, midstream, and downstream operations.

Assessing the Far Reaching Impact of 2025 United States Tariffs on Composite Material Supply Chains and Industry Competitiveness in Oil & Gas

In early 2025, the United States introduced revised tariffs on imported composite raw materials and finished components, a move aimed at bolstering domestic production while protecting critical supply chains. These measures have had ripple effects across the industry, prompting operators and fabricators to reassess sourcing strategies, negotiate longer-term agreements with domestic suppliers, and, in some cases, explore backward integration opportunities to secure feedstock stability.

Consequently, procurement teams are increasingly focused on developing local supplier networks and qualifying alternative resin suppliers that can meet stringent quality and performance requirements. This shift has accelerated investment in domestic manufacturing facilities equipped with state-of-the-art filament winding, pultrusion, and resin transfer molding capabilities. By localizing production, companies are not only mitigating tariff exposure but also reducing logistical complexity and lead times, thereby enhancing their responsiveness to project schedules and market fluctuations.

Looking ahead, the cumulative impact of these tariffs is encouraging the emergence of vertically integrated domestic ecosystems that encompass material R&D, component fabrication, and aftermarket services. While this transition presents near-term cost challenges, it also offers long-term benefits in terms of supply chain resilience, regulatory compliance, and strategic autonomy-key considerations for operators navigating an increasingly complex geopolitical and economic environment.

Uncovering Tailored Opportunities in Composites for Oil & Gas Through In Depth Analysis of Product and Process Based Market Segments

The composites market in oil and gas is inherently multifaceted, reflecting diverse application requirements across product categories and manufacturing processes. On the product front, heat exchangers, separators, and valves benefit from composites’ ability to maintain dimensional stability under thermal cycling, while offshore structures such as jackets, platforms, and topsides capitalize on the material’s resistance to marine corrosion and fatigue loading. Additionally, pipes and tubing leverage composites’ inherent low friction and chemical inertness to optimize fluid transfer, whereas pressure vessels and storage tanks harness enhanced barrier properties to safeguard integrity under high-pressure and corrosive conditions.

From a process perspective, filament winding stands out for its capacity to deliver high-strength cylindrical components through controlled fiber placement, making it ideal for pressure vessels and pipes. Pultrusion offers a cost-effective route to continuous, constant-cross-section profiles such as beams and strings for structural frames, including jackets and topsides. Meanwhile, resin transfer molding enables the production of complex geometries in separators and heat exchanger components by injecting resin into fiber preforms under pressure, ensuring thorough wet-out and minimal void content.

By synthesizing insights across these product and process dimensions, industry participants can identify tailored opportunities that align material properties with operational demands. This strategic alignment allows for targeted innovation, streamlined manufacturing workflows, and optimized lifecycle performance, thereby reinforcing composites’ growing prominence within the oil and gas sector.

This comprehensive research report categorizes the Composites in Oil & Gas market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Resin Matrix

- Fiber Type

- Application Area

Exploring Regional Dynamics Shaping Composite Adoption in Oil & Gas with Distinct Trends Emerging from Americas EMEA and Asia Pacific

Regional dynamics play a pivotal role in shaping both the supply and demand of composite materials within the oil and gas industry. In the Americas, robust exploration and production initiatives, particularly in shale gas and deepwater developments, are fueling demand for corrosion-resistant pipes and high-pressure vessels. Operators in this region are also benefiting from established manufacturing bases and logistics networks, enabling efficient deployment of filament wound components and pultruded structural profiles.

In Europe, the Middle East, and Africa, infrastructure modernization and offshore wind synergies have spurred interest in advanced composites for platforms, jackets, and topside modules. Regulatory emphasis on environmental performance and emission reduction is accelerating the adoption of lightweight materials that can deliver reduced transportation costs and lower carbon footprints. Local fabrication hubs in the North Sea, Gulf Cooperation Council states, and Mediterranean basin are collaborating to develop bespoke resin systems and fiber architectures that meet stringent industry standards.

Meanwhile, the Asia-Pacific region is witnessing rapid growth in downstream processing and petrochemical capacity, driving the need for durable storage tanks and separators engineered to withstand aggressive chemistries. Manufacturers in Southeast Asia, China, and Australia are increasingly investing in resin transfer molding and pultrusion plants to cater to both domestic and export markets. As these regional clusters mature, strategic partnerships between international material suppliers and local OEMs are enhancing technology transfer and building long-term capability in composite processing and design.

This comprehensive research report examines key regions that drive the evolution of the Composites in Oil & Gas market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Composite Manufacturers and Their Strategic Initiatives Transforming Oil & Gas Solutions with Advanced Material Innovations

The competitive landscape in composites for oil and gas is defined by a combination of global material innovators and regionally focused specialists. Leading fiber suppliers and resin formulators are driving R&D investments to develop high-temperature and chemically resistant systems tailored to upstream and midstream applications. Concurrently, component fabricators are differentiating through proprietary processes and design services that accelerate time to market and ensure compliance with industry-specific certifications.

In response to market demands, many companies are forming strategic alliances to integrate material science expertise with engineering and field service capabilities. These collaborations often result in co-developed prototypes that undergo rigorous validation, including full-scale testing in simulated offshore and onshore environments. Through these partnerships, organizations are able to align product roadmaps with operator requirements, thereby reducing project risk and facilitating smoother technology adoption.

Additionally, the emergence of digital twins and predictive maintenance platforms is enabling providers to offer value-added services beyond material supply. By leveraging sensor data and advanced analytics, these firms can optimize component lifecycles, forecast maintenance intervals, and suggest retrofit solutions that extend asset life. This holistic approach positions leading companies as strategic partners rather than mere suppliers, reinforcing their role in shaping the future of composite technologies in the oil and gas sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composites in Oil & Gas market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Gurit Holding AG

- Hexcel Corporation

- Huntsman International LLC

- Mitsubishi Chemical Corporation

- Owens Corning

- PPG Industries, Inc.

- SGL Carbon SE

- Solvay S.A.

- TechnipFMC plc

- Teijin Limited

- Toray Industries, Inc.

Action Oriented Strategies for Industry Leaders to Accelerate Composite Integration Enhance Performance and Mitigate Risk in Oil & Gas Operations

Industry leaders seeking to capitalize on composite material advantages should begin by embedding cross-functional collaboration within their organizations. By aligning procurement, engineering, and operations teams early in project planning, decision-makers can ensure material selection is guided by holistic performance, cost, and safety criteria. In parallel, investing in hands-on training and certification programs for fabrication and maintenance personnel will facilitate smoother technology integration and reduce the risk of installation errors.

Furthermore, it is critical to establish robust supplier qualification processes that assess not only technical capabilities but also supply chain resilience and innovation roadmaps. Engaging with a diversified network of resin and fiber producers-both domestic and international-can mitigate exposure to geopolitical and tariff-related disruptions. Organizations should also explore co-development initiatives with material suppliers to customize resin formulations and fiber architectures for specific operational environments.

Finally, leaders should leverage digital tools to create virtual prototypes and predictive maintenance schemes, integrating sensor data and analytics platforms to continuously monitor composite asset health. By adopting a data-driven approach, operators can shift from reactive maintenance to predictive interventions, optimizing uptime and extending service intervals. Implementing these strategies will enable companies to harness the full potential of composites, driving efficiency, safety, and sustainability across their oil and gas portfolios.

Rigorous Research Framework Combining Primary Insights Secondary Analysis and Expert Validation to Deliver Comprehensive Composite Market Intelligence

Our research methodology combines rigorous primary interviews with industry experts, including materials scientists, engineering consultants, and operations executives, to capture firsthand perspectives on composite adoption challenges and opportunities. These qualitative insights are complemented by secondary analysis of technical publications, regulatory guidelines, and case study reports to validate trends and corroborate emerging best practices.

Quantitative data collection focuses on mapping production capacities, technology deployment rates, and patent filings across major manufacturing hubs and end-user segments. Although specific market sizing and forecasting are not part of this summary, the underlying dataset has been curated to ensure comprehensive coverage of equipment, offshore structures, and processing applications. Furthermore, statistical correlations between manufacturing process parameters and performance outcomes have been examined to identify key drivers of material selection.

Finally, all findings have been subjected to a multi-stage validation process, with peer review from an external advisory panel comprising veteran engineers and composite specialists. This iterative approach ensures that recommendations and insights accurately reflect real-world operational constraints and opportunities, providing stakeholders with actionable intelligence to inform strategic decision-making in the dynamic oil and gas environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composites in Oil & Gas market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composites in Oil & Gas Market, by Product Form

- Composites in Oil & Gas Market, by Resin Matrix

- Composites in Oil & Gas Market, by Fiber Type

- Composites in Oil & Gas Market, by Application Area

- Composites in Oil & Gas Market, by Region

- Composites in Oil & Gas Market, by Group

- Composites in Oil & Gas Market, by Country

- United States Composites in Oil & Gas Market

- China Composites in Oil & Gas Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Key Insights on Composite Material Trends to Guide Strategic Decision Making and Foster Sustainable Growth in Oil & Gas Future

As the oil and gas industry adapts to shifting regulatory, environmental, and operational imperatives, composite materials are poised to play a transformative role in enhancing asset performance and lifecycle economics. The convergence of advanced manufacturing methods, material innovations, and regional investment trends underscores the strategic importance of integrating lightweight, corrosion-resistant components across upstream, midstream, and downstream segments.

Key thematic insights highlight the necessity for robust supply chain strategies in light of recent tariff changes, the value of cross-sector partnerships to accelerate technology adoption, and the promise of digital tools to optimize composite asset management. By aligning material selection with process requirements-whether through filament winding, pultrusion, or resin transfer molding-industry stakeholders can unlock new efficiencies while managing risk more effectively.

Ultimately, the synthesis of these trends points toward a future where composites are not merely alternatives to metals but foundational elements of resilient, sustainable energy infrastructure. Organizations that proactively embrace this transition will be well-positioned to achieve operational excellence, strengthen competitive positioning, and contribute to a safer, more environmentally conscious industry landscape.

Engage with Associate Director Ketan Rohom to Unlock Exclusive Market Research Insights and Drive Strategic Investment Decisions in Composite Materials

Engaging directly with our Associate Director of Sales & Marketing, Ketan Rohom, represents the most effective way to gain early access to comprehensive insights and tailored guidance on composite material strategies for oil and gas. By reaching out today, decision-makers can secure a customized executive briefing that aligns with organizational objectives and accelerates the integration of advanced composite solutions. Don’t miss the opportunity to leverage our depth of expertise to navigate regulatory challenges, optimize material selection, and position your projects for long-term success. Contact Ketan Rohom to schedule a one-on-one consultation, explore additional data sets, or receive a targeted proposal designed to address your unique operational priorities and investment criteria. Unlock the full potential of our market research to inform strategic decision-making and drive your organization’s competitive edge in the evolving oil and gas landscape.

- How big is the Composites in Oil & Gas Market?

- What is the Composites in Oil & Gas Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?