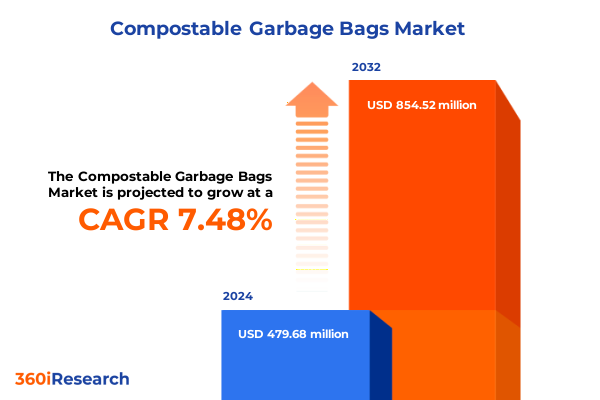

The Compostable Garbage Bags Market size was estimated at USD 516.02 million in 2025 and expected to reach USD 549.13 million in 2026, at a CAGR of 7.47% to reach USD 854.52 million by 2032.

Introducing the Emergence of Compostable Garbage Bags as a Sustainable Waste Management Solution for Modern Environmental and Consumer Needs

As global environmental concerns intensify, the imperative for responsible waste management solutions has never been more pronounced. Traditional plastic refuse containment has long contributed to landfill overflows and persistent pollution challenges, prompting municipalities, businesses, and households to seek alternatives that align with circular economy principles. Compostable garbage bags have emerged as a promising innovation, offering a biodegradable solution that can integrate seamlessly into organic waste processing systems and reduce the environmental burden of single-use plastics.

Against this backdrop, the compostable garbage bag market is witnessing accelerated interest from diverse segments, including municipal waste programs, commercial foodservice establishments, and eco-conscious consumers. Rapid advancements in biopolymer technology, coupled with stringent regulatory measures aimed at curbing plastic pollution, have catalyzed product enhancements and broader adoption. These factors underscore the importance of a consolidated executive overview that synthesizes key market drivers, stakeholder dynamics, and future trajectories.

This executive summary lays the groundwork for a deeper exploration of transformative trends, tariff impacts, segmentation nuances, regional variations, and competitive strategies. By presenting a cohesive analysis, it equips industry leaders and decision-makers with the insights necessary to navigate a complex landscape defined by sustainability mandates, cost pressures, and evolving consumer expectations.

Rapid Technological Advancements and Evolving Consumer Expectations Catalyzing a Paradigm Shift in Compostable Garbage Bag Production and Adoption

In recent years, shifting consumer values have redefined market expectations for waste management products. Increasing public awareness of plastic pollution and its ecological consequences has driven demand for Eco-certified solutions that guarantee compostability and reduced carbon footprints. Concurrently, regulatory bodies at federal, state, and municipal levels have instituted ambitious bans and fees on conventional plastic liners, creating an environment where compostable alternatives are rapidly transitioning from niche offerings to mainstream necessities.

Technological breakthroughs in biopolymer development have further reshaped the competitive landscape. Innovations in PBAT chemistry have improved film strength without compromising biodegradability, while next-generation PLA formulations now meet industrial composting standards more consistently. Starch-blend composites have also evolved, showcasing enhanced processability on existing manufacturing lines and delivering cost efficiencies that challenge incumbent plastic materials.

Supply chain innovations have paralleled material advancements. Manufacturers are forging strategic partnerships with raw material suppliers to secure feedstock for PBAT and PLA, while exploring localized production hubs to mitigate logistic complexities and reduce lead times. These collaborative models not only strengthen resilience against global disruptions but also align with corporate sustainability commitments through regional sourcing and reduced transportation emissions.

Meanwhile, distribution channels have undergone a fundamental transformation. Home improvement stores have expanded their eco-product assortments to cater to DIY consumers, whereas hypermarkets and supermarkets have elevated visibility for compostable bag brands through in-store sustainability initiatives. The rapid proliferation of online retail platforms has introduced dual pathways: brand websites serving as direct engagement portals for premium offerings, and marketplace ecosystems enabling consumers to compare multiple brands on convenience and pricing. These converging trends illustrate a redefined market where agility, transparency, and environmental performance dictate success.

Navigating the Implications of the United States 2025 Tariff Adjustments Shaping Cost Structures and Competitive Dynamics in the Compostable Bag Market

The introduction of new tariff measures by the United States in 2025 has introduced a layer of complexity to the compostable garbage bag ecosystem. Tariffs targeting imported biopolymer resins-specifically items sourced from major producers in Asia-have elevated raw material costs, prompting manufacturers to reassess procurement strategies. These duties, designed to encourage domestic manufacturing, have reshaped cost structures and influenced global trade patterns within the sector.

Manufacturers dependent on PLA and PBAT from established overseas facilities have encountered immediate margin pressures. To counterbalance duty-induced expense increases, many have renegotiated supply agreements or explored alternative feedstock channels, such as rice husk-derived starch blends and regionally produced PBAT. This reconfiguration of supply sources illustrates the market’s adaptive capacity, though it also underscores potential quality and consistency considerations during the transition.

In response to tariff shifts, several industry players have accelerated investments in domestic production capabilities. Joint ventures with local chemical producers have been announced, aimed at establishing PBAT compounding facilities and PLA polymerization units within the United States. Such strategic moves not only aim to circumvent import duties but also aspire to deliver shorter lead times, reduced carbon emissions, and enhanced oversight over polymer specifications critical for compostability certification.

Despite initial disruptions, the tariff adjustments have contributed to a more robust and diversified supply base. As companies integrate domestic production and alternative raw materials, the compostable garbage bag industry is poised to benefit from both competitive pricing in the long term and strengthened supply chain resilience. Stakeholders are encouraged to monitor tariff policy developments closely and to align material sourcing strategies with evolving trade landscapes.

Uncovering Strategic Market Opportunities Through Detailed Analysis of Product Types Materials Channels End Uses and Thickness Categories

An examination of the market by product type reveals that drawstring models have established themselves as the preferred choice for residential consumers seeking ease of closure and improved carrying convenience. Flap tie designs, on the other hand, have gained traction within the foodservice and hospitality sectors where secure sealing and leak resistance are paramount. Wicketed bags remain a staple in institutional procurement, particularly among waste management firms and large-scale composting facilities, due to their efficient dispensing and compatibility with automated packaging lines.

Material segmentation paints a vivid picture of the trade-offs between performance and cost. PBAT-based constructs deliver a balanced combination of tensile strength and accelerated biodegradation under industrial composting conditions, making them an attractive option for premium product tiers. PLA formulations, celebrated for their clarity and plant-derived origins, often command a price premium but benefit from widespread certification recognition. Meanwhile, starch blend composites have emerged as a cost-effective category, leveraging abundant agricultural byproducts to achieve acceptable compostability at more accessible price points.

When considering distribution channels, home improvement centers continue to serve as critical launchpads for consumer-focused compostable solutions, as their in-store expert guidance and sampling opportunities foster hands-on trial. Hypermarkets and supermarkets bolster mainstream visibility by integrating eco-certified options alongside traditional plastic bags, often under private labels. The online retail landscape has evolved into a bifurcated environment: brand websites facilitate direct engagement for high-margin specialty offerings, while broader marketplace platforms enable consumers to evaluate multiple brands based on price, certification, and peer reviews.

In end use considerations, commercial waste generators demand adherence to stringent compostability standards and volume efficiencies, whereas residential households prioritize user experience, bag integrity, and aesthetic design. Thickness differentiation further refines these applications: 12 to 15 micron films cater to light-duty residential uses, balancing thin profiles with sufficient strength for everyday organic refuse. The 16 to 20 micron range bridges mid-tier requirements, delivering enhanced durability for mixed household and small commercial operations. Above 20 micron grades are reserved for heavy-duty and high-volume waste streams, where maximum puncture resistance and load-bearing capacity are essential.

This comprehensive research report categorizes the Compostable Garbage Bags market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Thickness

- Distribution Channel

- End Use

Examining Distinct Regional Dynamics Across the Americas EMEA and Asia-Pacific That Influence Demand and Innovation in Compostable Waste Solutions

Across the Americas, regulatory momentum coupled with strong consumer advocacy has positioned the region as a leader in compostable bag adoption. Municipal composting programs and commercial food waste initiatives have proliferated, particularly in North America, where state-level bans on single-use plastic liners have fueled demand. Latin American markets, experiencing rapid urbanization and waste management infrastructure upgrades, are increasingly integrating compostable solutions to meet both environmental goals and emerging middle-class consumer preferences.

In Europe, Middle East & Africa, policy frameworks such as the European Union’s Single-Use Plastics Directive have been instrumental in driving market dynamics. Compostable bags certified under EN standards are becoming ubiquitous in Western European markets, supported by well-established industrial composting networks. In the Middle East, pilot programs in hospitality and municipal sectors are testing compostable liners as part of broader sustainability agendas. African markets present diverse landscapes, with leading economies adopting compostable technologies gradually as infrastructure for organic waste processing evolves.

The Asia-Pacific region presents a mosaic of opportunity and challenge. In developed economies such as Japan, South Korea, and Australia, consumer demand and municipal composting capabilities are aligning to support compostable bag growth. Emerging markets in Southeast Asia and South Asia reveal latent potential, albeit tempered by variability in waste collection systems and price sensitivity. Nevertheless, regional manufacturers are ramping up capacity, driven by both domestic demand and export opportunities, which collectively underscore the Asia-Pacific’s pivotal role in future market expansion.

This comprehensive research report examines key regions that drive the evolution of the Compostable Garbage Bags market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Partnerships Driving Growth and Technological Breakthroughs in the Compostable Garbage Bag Sector

Leading innovators have distinguished themselves through a combination of material science expertise and strategic alliances. Companies that have secured proprietary PBAT compounding technologies or developed next-generation biopolymer blends continue to fortify their market positions by offering enhanced performance assurances and broader certification coverage. These players often collaborate with academic institutions and waste management firms to validate composting behavior and to refine end-of-life pathways.

Strategic partnerships have also emerged as a key growth lever. Several manufacturers have aligned with composting operator networks to establish closed-loop programs, ensuring that post-consumer compostable bags are channeled into appropriate facilities and converted into usable compost. Such collaborations not only reinforce product credibility but also deliver tangible environmental benefits that resonate with corporate sustainability mandates and consumer expectations alike.

Supply chain integration represents another hallmark of leading firms. By securing long-term feedstock agreements and investing in in-house compounding capabilities, these organizations have bolstered cost predictability and product consistency. Vertical integration efforts, ranging from raw material sourcing to film extrusion, have enabled tighter quality control and faster innovation cycles, distinguishing top players from those reliant on fragmented supplier networks.

Furthermore, the intersection of branding and certification has gained prominence. Recognizable eco-labels and transparent compliance documentation have become integral to marketing strategies, helping companies articulate the environmental credentials of their compostable bags. Through targeted campaigns and educational initiatives, key industry participants are amplifying awareness of proper disposal practices, thereby enhancing both product adoption and end-market performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Compostable Garbage Bags market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbey Polytheme

- BASF SE

- Better Earth LLC

- BioBag International AS

- Biotec GmbH

- Bulldog Bag Ltd.

- Cosmos Bio

- Dart Container Corporation

- Eco-Products, Inc.

- Kruger Inc.

- NatureWorks LLC

- Novamont S.p.A.

- Pacovis AG

- Plastiroll Oy

- Polybags Ltd.

- RPC Group Ltd.

- Stora Enso Oyj

- The Biodegradable Bag Company Ltd.

- TotalEnergies Corbion

- Vegware Ltd.

- World Centric

Formulating Targeted Strategies to Enhance Operational Efficiency Foster Collaboration and Accelerate Sustainable Innovation Among Market Stakeholders

Industry leaders are encouraged to prioritize the development of resilient supply chains that can withstand policy shifts and global disruptions. By diversifying raw material sources and establishing domestic compounding facilities, companies can mitigate tariff impacts and ensure consistent resin availability. In parallel, investing in scalable production lines capable of handling multiple biopolymer blends will facilitate rapid market responsiveness and support emerging material innovations.

Collaboration with waste management infrastructures is essential to unlocking true environmental value. Manufacturers should engage with composting operators and municipal authorities to streamline collection and processing protocols, thereby maximizing the rate of successful compostable bag decomposition. Joint educational efforts that inform end users about proper separation and disposal methods will enhance recovery rates and fortify the circular integrity of organic waste systems.

Accelerating R&D initiatives focused on advanced polymer chemistries can yield next-generation products with reduced greenhouse gas footprints and faster composting cycles. Companies that allocate resources to pilot programs and third-party certification testing not only improve product performance but also cultivate credibility with key stakeholders, including regulatory agencies, institutional buyers, and sustainability-minded consumers.

Finally, transparent communication and strategic marketing are indispensable for driving widespread adoption. Embracing digital engagement channels, from brand websites to social media platforms, allows for focused storytelling around environmental impact and regulatory compliance. By articulating clear value propositions-such as reduced landfill contributions, compliance with emerging bans, and compatibility with existing composting infrastructure-industry participants can convert awareness into preference and foster enduring brand loyalty.

Revealing the Comprehensive Framework and Rigorous Methodological Approach Underpinning the Generation of Actionable Insights in Compostable Bag Market Analysis

The research methodology underpinning this analysis integrates a comprehensive framework of primary and secondary data collection techniques. Secondary research encompassed the review of publicly available regulatory documents, industry whitepapers, academic journals, and trade publications, ensuring a robust foundation of contextual knowledge. Additionally, a proprietary database of compostable certification standards provided critical benchmarks for assessing material compliance across global markets.

Primary research was conducted through in-depth interviews with key stakeholders, including biopolymer manufacturers, composting facility operators, waste management consultants, and major end-use customers. These qualitative insights were instrumental in validating market drivers, identifying emerging trends, and uncovering operational challenges and success factors. Quantitative surveys supplemented these findings by capturing end-user preferences, channel dynamics, and procurement criteria.

Data triangulation and iterative review processes were employed to reconcile findings and to enhance reliability. Forecasting models excluded from this report are built on scenario analysis and sensitivity testing, leveraging empirical data to project supply chain impacts under varying tariff and policy environments. While this executive summary focuses on core qualitative and trend insights, the full report provides extensive appendices detailing methodological limitations, data sources, and illustrative case studies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Compostable Garbage Bags market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Compostable Garbage Bags Market, by Type

- Compostable Garbage Bags Market, by Material

- Compostable Garbage Bags Market, by Thickness

- Compostable Garbage Bags Market, by Distribution Channel

- Compostable Garbage Bags Market, by End Use

- Compostable Garbage Bags Market, by Region

- Compostable Garbage Bags Market, by Group

- Compostable Garbage Bags Market, by Country

- United States Compostable Garbage Bags Market

- China Compostable Garbage Bags Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Consolidating Core Findings and Strategic Imperatives to Chart a Path Forward in Advancing Sustainable Practices Through Compostable Waste Management Solutions

In consolidating the core findings, it is evident that the compostable garbage bag market is entering a pivotal growth phase defined by regulatory impetus, technological refinement, and strategic collaborations. Stakeholders that align material innovation with supply chain resilience, and that proactively engage with waste management infrastructures, will be best positioned to capture emerging opportunities and to deliver tangible sustainability outcomes.

Moving forward, the imperative for industry participants is clear: harmonize performance attributes with environmental credentials, navigate tariff and policy landscapes with agility, and cultivate partnerships that reinforce the circular economy model. By embracing these strategic imperatives, companies can deliver differentiated value propositions, foster consumer trust, and contribute meaningfully to the global transition toward responsible waste stewardship.

Engaging Directly with Ketan Rohom to Secure Expert Guidance and Access Comprehensive Market Intelligence Report on Compostable Garbage Bags Today

For organizations poised to lead the transition toward more sustainable waste management, engaging Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, offers a direct avenue to obtain the comprehensive market intelligence report on compostable garbage bags. By connecting with Ketan, stakeholders can access granular insights tailored to their strategic objectives, while benefiting from expert guidance on leveraging emerging opportunities and navigating evolving market dynamics. This personalized engagement ensures that decision-makers receive the actionable analysis they need to drive growth, optimize operations, and align their sustainability ambitions with data-driven recommendations. Secure your competitive advantage today by collaborating with Ketan Rohom to acquire the definitive research resource for informed investment and innovation in compostable waste solutions

- How big is the Compostable Garbage Bags Market?

- What is the Compostable Garbage Bags Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?