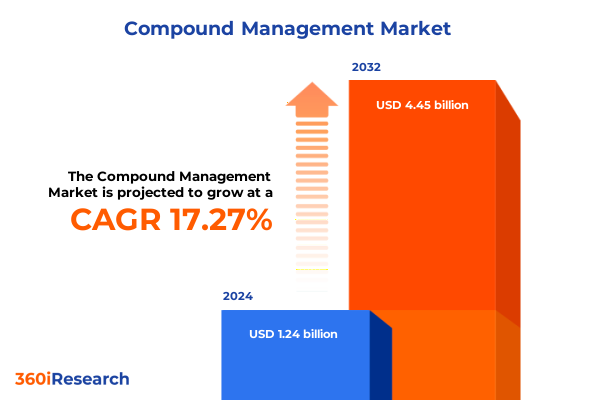

The Compound Management Market size was estimated at USD 575.83 million in 2025 and expected to reach USD 635.60 million in 2026, at a CAGR of 10.83% to reach USD 1,183.26 million by 2032.

Setting the Stage for the Compound Management Market with Comprehensive Contextual Overview Driving Strategic Imperatives

The global compound management ecosystem stands at a pivotal juncture, propelled by rapid technological advancements and evolving research demands. As organizations strive to streamline sample handling, storage, and retrieval, the necessity for robust, integrated solutions has never been clearer. Today, multidisciplinary teams across academia, biotechnology, pharmaceutical development, and regulatory bodies are collaborating more closely than ever before, placing compound management at the heart of innovation pipelines.

This report provides a comprehensive contextual foundation by examining the convergence of laboratory automation, digital transformation, and regulatory complexity. It underscores how modern compound management platforms not only enhance productivity but also strengthen data integrity, enabling researchers to derive actionable insights at unprecedented speed. Furthermore, by highlighting emerging best practices and operational imperatives, this introduction sets the tone for an in-depth exploration of the market landscape.

Through an evidence-based lens, readers will gain clarity on the factors driving adoption, the hurdles hindering seamless implementation, and the critical role of strategic partnerships. By establishing this groundwork, stakeholders can better understand the interplay between technological capabilities and organizational objectives, ultimately driving informed investment decisions and fostering long-term innovation in compound management.

Accelerating Technological Innovations and Operational Models Reshaping the Future of Automated Compound Management Ecosystems Worldwide

In recent years, the landscape of compound management has undergone seismic shifts, driven by the integration of advanced robotics, artificial intelligence, and cloud-native data platforms. Automation technologies have evolved from standalone sample handlers to fully integrated workflow orchestrators capable of optimizing every step, from compound accessioning to high-throughput screening. Concurrently, machine learning algorithms are enhancing predictive maintenance, sample tracking accuracy, and process optimization in ways previously unimaginable.

Moreover, digital connectivity is fostering seamless collaboration across geographically dispersed laboratories. Internet of Things (IoT) sensors embedded within storage systems now provide real-time environmental monitoring, ensuring that critical temperature and humidity conditions remain within specified tolerances. Meanwhile, cloud-based informatics solutions offer centralized databases and analytics dashboards, enabling decision-makers to identify bottlenecks, analyze throughput trends, and proactively manage inventory levels.

These transformative shifts are reinforcing the importance of interoperability, standardized protocols, and open architecture. As proprietary silos give way to harmonized ecosystems, laboratories can leverage modular upgrades without extensive downtime or capital reinvestment. Ultimately, these innovations are empowering organizations to accelerate drug discovery timelines, enhance regulatory compliance, and unlock new frontiers in material science and specialty chemistry applications.

Assessing the Multi-Dimensional Consequences of 2025 United States Tariffs on Supply Chains Operational Efficiencies and Cost Structures

The implementation of a new wave of tariffs announced by the United States in 2025 has introduced multifaceted challenges across supply chains, operational budgets, and procurement strategies. As import duties on laboratory instruments, consumables, and specialty reagents have increased, organizations are grappling with elevated cost structures that directly impact research budgets and project timelines. In many cases, procurement teams have had to reevaluate vendor agreements, negotiating new terms or seeking alternative suppliers to mitigate financial pressures.

Simultaneously, the ripple effects extend to inventory management practices. Faced with higher acquisition costs and potential delivery delays, laboratories are adjusting buffer stock levels and reevaluating just-in-time delivery models. This recalibration is further complicated by currency fluctuations and logistical constraints, which, when combined with tariff-induced price volatility, demand more agile sourcing strategies.

Despite these headwinds, some stakeholders are capitalizing on emerging domestic manufacturing initiatives. Investments in local production facilities for critical reagents and consumables are gaining traction, offering a buffer against international trade disruptions. While this transition requires upfront capital and process validation, it also presents opportunities to reduce lead times, strengthen quality assurance, and foster closer collaboration between vendors and end users. In aggregate, the cumulative impact of these tariffs underscores the urgency for strategic resilience and supply chain diversification within the compound management sector.

Unveiling Deep-Dive Insights across End Users Compound Types Applications and Automation Levels Highlighting Strategic Segmentation Imperatives

Understanding the compound management market through a segmentation lens reveals distinct priorities and operational dynamics that influence solution requirements. Among end users, academic and research institutions often prioritize flexibility and cost efficiency, supporting exploratory workflows and method development. In contrast, biotechnology companies demand scalable, high-throughput platforms capable of handling diverse compound libraries, while contract research organizations emphasize reproducibility and stringent quality controls to meet client expectations. Government and regulatory agencies focus intently on data integrity, traceability, and compliance with evolving standards, whereas pharmaceutical companies seek end-to-end automation that seamlessly interfaces with downstream discovery and development systems.

The spectrum of compound types further highlights specialized needs. Biologics, including cell therapy products, gene therapy vectors, monoclonal antibodies, recombinant proteins, and vaccines, necessitate tailored storage environments, validated handling procedures, and robust chain-of-custody protocols. Nucleotides and peptides require precise temperature regulation and contamination prevention measures, while small molecules benefit from high-density storage formats and rapid retrieval mechanisms.

Divergent application areas underscore the versatility of modern solutions. In agrochemicals, precise formulation management drives iterative testing, whereas in drug discovery, platforms are integral to hit identification, lead optimization, preclinical research, and target validation workflows. Material science initiatives leverage compound management for advanced functional materials, and specialty chemicals enterprises depend on consistent sample quality for process innovation. Finally, automation levels range from manual systems favored by smaller labs to semi-automated workstations balancing throughput and flexibility, and fully automated solutions delivering maximal efficiency in large-scale operations.

This comprehensive research report categorizes the Compound Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Compound Type

- Workflow Stage

- Application

- End User

Mapping Dynamic Growth Patterns and Emerging Opportunities across the Americas Europe Middle East Africa and Asia-Pacific Compound Management Hubs

Regional dynamics exert a profound influence on compound management strategies as organizations navigate varying regulatory frameworks, infrastructure capabilities, and growth trajectories. The Americas region, anchored by leading pharmaceutical hubs in North America, commands significant investment in cutting-edge automation and informatics platforms. Academic institutions and biotech clusters in the United States and Canada continue to pioneer collaborative research models, driving demand for flexible and integrated solutions.

In Europe, the Middle East, and Africa, distinct subregions present unique considerations. Western European nations enforce rigorous data protection and environmental regulations, prompting vendors to design systems that align with stringent compliance mandates. Meanwhile, emerging markets in the Middle East and Africa are prioritizing capacity building and technology transfer, seeking scalable platforms capable of supporting both academic research and nascent biotech ventures.

Asia-Pacific stands out as a high-growth arena, fueled by expanding pharmaceutical manufacturing capabilities and government-backed innovation initiatives in China, India, Japan, and Australia. This region demands tailored compound management solutions that accommodate local sourcing strategies, varying environmental conditions, and the integration of digital infrastructure. As competition intensifies, regional end users are leaning toward modular, scalable systems that can adapt to evolving research objectives across diverse geographic landscapes.

This comprehensive research report examines key regions that drive the evolution of the Compound Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators Driving Excellence in Compound Management Technologies through Strategic Partnerships and Advanced Solutions

The competitive arena for compound management technologies is shaped by established instrument manufacturers, emerging automation specialists, and software innovators. Leading players have deepened their market presence through strategic alliances, acquisitions, and the expansion of product portfolios. By integrating liquid handling modules, sample storage units, and informatics platforms, these companies deliver comprehensive solutions that address end-to-end workflows.

Several firms are gaining traction by emphasizing open architecture and interoperability. They offer application programming interfaces and modular hardware components that allow laboratories to tailor configurations to specific project needs. Others are focusing on end-user support services, including workflow consulting, onsite training, and preventative maintenance programs that reduce downtime and maximize return on investment.

In addition, new entrants are leveraging advances in microfluidics and nanotechnology to develop compact, high-throughput systems that minimize reagent consumption and enhance experimental throughput. Meanwhile, software providers are embedding artificial intelligence capabilities within their platforms, offering predictive analytics for sample stability, equipment health monitoring, and workflow optimization. Collectively, these developments are intensifying competition while raising the bar for innovation and customer-centricity in the compound management space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Compound Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Azenta Life Sciences

- Hamilton Company

- Tecan Group Ltd.

- WuXi AppTec Co., Ltd

- SPT Labtech Ltd.

- Evotec SE

- NOVALIX Group

- HighRes Biosolutions

- AXXAM S.p.A.

- LiCONiC AG

- Agilent Technologies, Inc.

- Beckman Coulter, Inc. by Danaher Corporation

- Benchling, Inc

- BioAscent Discovery Ltd.

- BioDuro LLC

- Biosero, Inc.

- Charles River Laboratories

- Chemaxon Ltd

- eMolecules, Inc.

- FORMULATRIX, Inc.

- IRBM S.p.A.

- Pharmaron Beijing Co., Ltd

- RG Discovery AB

- Sai Life Sciences Limited

- Selvita S.A

- Syngene International Ltd

- TCG Lifesciences Pvt. Ltd.

- Thermo Fisher Scientific Inc.

- Titian Service Limited

Delivering Targeted Strategic Roadmaps and Tactical Actions to Propel Sustainable Growth Resilience and Competitive Leadership in Compound Management

Industry leaders must adopt a proactive stance to navigate the evolving compound management landscape and secure sustainable competitive advantages. At the core of this approach lies strategic investment in scalable automation platforms that can accommodate fluctuating throughput demands without extensive system overhauls. Equally important is the deployment of digital twin models, enabling virtual validation of sample workflows and predictive maintenance simulations that reduce unplanned downtime.

To mitigate risks associated with tariff fluctuations and supply chain disruptions, organizations should cultivate diversified procurement networks. Establishing partnerships with regional manufacturers and qualified distributors can shorten lead times and fortify supply resilience. Concurrently, implementing advanced inventory management systems that utilize real-time analytics helps maintain optimal stock levels while minimizing carrying costs.

Cultivating a culture of continuous improvement is essential. Cross-functional teams should collaborate to standardize protocols, monitor key performance indicators, and drive iterative enhancements. Comprehensive training programs will empower laboratory personnel to leverage new technologies effectively, ensuring high adoption rates and operational consistency. Finally, forging strategic alliances with technology providers and research institutions fosters co-innovation, accelerating the deployment of next-generation solutions tailored to emerging application areas.

Elucidating Robust Research Frameworks and Analytical Methodologies Underpinning High-Integrity Insights and Rigorous Data Validation Processes

This analysis is grounded in a rigorous research framework designed to ensure high-integrity insights and comprehensive coverage of the compound management market. Primary research was conducted through structured interviews with senior stakeholders at leading pharmaceutical, biotech, and contract research organizations, capturing firsthand perspectives on automation strategies, procurement challenges, and technology adoption timelines. Supplementing these discussions, secondary research leveraged peer-reviewed journals, patent filings, regulatory guidance documents, and detailed vendor literature to contextualize market developments and technological innovations.

Quantitative data were triangulated across multiple sources, including proprietary databases of instrument shipments and consumable usage metrics. The synthesis of these datasets permitted the validation of qualitative insights and the identification of emerging usage patterns. Expert panel reviews provided an additional layer of scrutiny, ensuring that interpretations align with real-world operational experiences and best practices.

By combining methodological rigor with iterative stakeholder engagement, this research delivers an authoritative and nuanced understanding of the compound management ecosystem. The approach emphasizes transparency, reproducibility, and the continuous updating of findings to reflect the latest industry trends and regulatory changes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Compound Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Compound Management Market, by Offering

- Compound Management Market, by Compound Type

- Compound Management Market, by Workflow Stage

- Compound Management Market, by Application

- Compound Management Market, by End User

- Compound Management Market, by Region

- Compound Management Market, by Group

- Compound Management Market, by Country

- United States Compound Management Market

- China Compound Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Takeaways to Illuminate the Path Forward in Optimizing Compound Management Operations and Investments

The findings presented in this report converge to illuminate critical pathways for optimizing compound management operations across diverse organizational contexts. Emerging technologies, from fully integrated robotics to AI-driven informatics, are reshaping the possibilities for high-throughput screening and sample tracking, while shifting tariff regimes underscore the importance of supply chain resilience and strategic sourcing.

Segmentation analysis reveals that end users-from academic institutions to multinational pharmaceutical corporations-each face unique sets of priorities, whether it be cost-effective flexibility, regulatory compliance, or seamless integration with downstream processes. Regional dynamics further emphasize the need for tailored solutions that reflect local regulatory landscapes, infrastructure maturity, and investment climates.

Taken together, these insights provide a strategic blueprint for decision-makers seeking to harness the full potential of modern compound management. By aligning technology investments with organizational objectives, cultivating robust procurement networks, and fostering continuous improvement, stakeholders can unlock sustainable efficiencies and propel innovation. As the market continues to evolve, the capacity to adapt, collaborate, and anticipate emerging trends will define industry leadership in this critical domain.

Connect with Ketan Rohom for Exclusive Access to In-Depth Compound Management Market Intelligence Designed to Drive Strategic Decisions and Growth

Unlock unparalleled strategic clarity by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who will guide you through tailored solutions that align with your organization’s compound management objectives. By collaborating with Ketan, you gain exclusive access to the complete market research report, which offers in-depth analyses, actionable recommendations, and a holistic understanding of evolving technologies, regulatory landscapes, and competitive benchmarks.

Empower your decision-making with data-driven intelligence designed to optimize operational workflows, mitigate emerging risks from tariff fluctuations, and capitalize on regional growth dynamics. Ketan’s expertise and consultative approach ensure you receive customized insights that address your unique requirements, whether you’re expanding automation capabilities, refining supplier strategies, or exploring new application areas.

Take the next step toward transforming your compound management ecosystem. Connect with Ketan Rohom to secure your copy of the report and embark on a journey of strategic innovation and sustainable growth.

- How big is the Compound Management Market?

- What is the Compound Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?