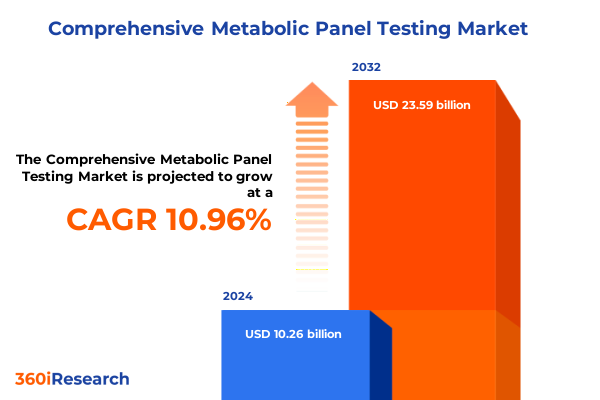

The Comprehensive Metabolic Panel Testing Market size was estimated at USD 11.38 billion in 2025 and expected to reach USD 12.62 billion in 2026, at a CAGR of 10.97% to reach USD 23.59 billion by 2032.

Unlocking the Critical Role and Unparalleled Diagnostic Value of Comprehensive Metabolic Panels in Modern Clinical Practice and Laboratory Workflows

The comprehensive metabolic panel (CMP) represents a foundational set of fourteen blood tests designed to evaluate core physiological functions, including kidney and liver health, electrolyte balance, and metabolic status. By measuring indicators such as glucose, calcium, sodium, and liver enzymes, the CMP provides clinicians with a holistic snapshot of a patient’s internal biochemical environment. This broad utility makes it indispensable in routine health checkups, chronic disease monitoring, and acute care settings, where early detection of anomalies can significantly influence patient outcomes.

As medical practice evolves toward preventive care and precision diagnostics, demand for reliable, high-throughput CMP testing has intensified. Healthcare providers rely on these panels not only to identify potential disorders such as diabetes, hypertension, and hepatic dysfunction but also to guide therapeutic decision-making and monitor treatment efficacy. In light of an aging population and rising incidence of lifestyle-related chronic conditions, laboratories and clinical sites are prioritizing investments in robust CMP capabilities to accommodate growing test volumes and stringent quality requirements.

This executive summary synthesizes key developments shaping the CMP testing landscape, from technological breakthroughs and market segmentation nuances to regulatory shifts and geopolitical trade impacts. By integrating insights from primary industry sources and authoritative secondary data, the report equips decision-makers with a clear understanding of critical drivers, emergent challenges, and actionable strategies essential for sustaining competitive advantage in the dynamic CMP testing market.

Embracing Disruptive Innovations Driven by Automation Data Integration and Point-of-Care Breakthroughs in Metabolic Panel Testing

Laboratories worldwide are undergoing a transformative shift driven by the integration of advanced automation and sophisticated data solutions. Traditional manual workflows are yielding to fully automated chemistry analyzers that streamline sample preparation, calibration, and result validation. These systems not only accelerate turnaround times but also minimize human error, ensuring consistent, reproducible data across high-volume testing environments. The emergence of cloud-based laboratory management platforms further enhances operational agility by enabling seamless collaboration among care teams and real-time access to patient results, marking a new era of interconnected diagnostic ecosystems.

Concurrently, point-of-care testing (POCT) solutions have evolved from basic glucometers and dipstick assays into handheld analyzers capable of delivering comprehensive metabolic panel results within minutes. Fueled by advances in microfluidics and biosensor technologies, these portable devices empower clinicians to make rapid, data-driven decisions at the bedside or in remote settings. High-quality POCT platforms integrated with telehealth services are particularly impactful in underserved regions, where centralized laboratory infrastructure may be limited, thereby democratizing access to critical metabolic health insights.

Assessing the Far-Reaching Operational and Financial Consequences of United States Trade Tariffs on Comprehensive Metabolic Panel Testing Ecosystem

The reinstatement and expansion of Section 301 tariffs on medical device imports have introduced significant cost pressures across the comprehensive metabolic panel testing value chain. Tariffs ranging up to 25 percent on select components and analyzers sourced from China and other regions have already driven up procurement costs for instruments and consumables, squeezing lab budgets and narrowing margins. Industry associations warn that prolonged trade tensions could exacerbate these effects, endangering timely patient access to essential diagnostics and potentially slowing the adoption of cutting-edge technologies.

Financial impacts are becoming evident as major diagnostic equipment manufacturers and reagent suppliers adjust pricing models to absorb tariff burdens. Wells Fargo analysts estimate that companies like Bausch & Lomb may experience earnings-per-share declines in the low double digits due to elevated costs, with downstream effects projected to influence hospital and lab purchasing decisions. In response, leading device makers are accelerating investments in domestic production facilities, notably in Georgia, Illinois, and Texas, to mitigate tariff exposure and meet growing demand for localized supply chain resilience.

Stakeholders across the medtech sector have mobilized to seek policy relief, with trade associations advocating for targeted tariff exemptions on essential diagnostics and lab equipment. AdvaMed has underscored that the U.S. medtech industry contributes up to 70 percent of domestic device manufacturing and that indiscriminate global duties threaten both innovation and affordability. As the USTR solicits industry commentary, there remains an urgent need for transparent implementation timelines and clear exemption criteria to stabilize procurement strategies and ensure continuity of patient care.

Decoding Strategic Market Dynamics Revealed Through Granular Product Service and End User Segmentation in Metabolic Panel Solutions

A detailed segmentation framework reveals that product offerings in the CMP testing arena span sophisticated instruments, precision reagents and kits, and comprehensive support services. Within the instruments category, demand is propelled by fully automated analyzers that optimize throughput and accuracy, while semi-automated and manual systems continue to serve specialized or low-volume settings. Reagents and kits, from calibrators and controls to consumables, are integral to assay performance and quality control, prompting suppliers to innovate around stability, shelf life, and lot-to-lot consistency. Concurrently, service portfolios encompassing preventive maintenance, technical support, user training, and validation consulting play a pivotal role in maximizing equipment uptime and ensuring compliance with evolving regulatory standards.

Testing modalities bifurcate into emergency and routine workflows, each requiring tailored instrument configurations and reagent formulations to meet distinct turnaround objectives. Emergency testing centers prioritize rapid throughput and streamlined interfaces, whereas routine testing laboratories emphasize cost efficiency and scalable processing capacities. Sample matrices extend beyond conventional serum and plasma to include whole blood and urine-based assays, broadening the clinical utility of CMP panels and facilitating point-of-care and home-based applications. Moreover, the analytical infrastructure supporting batch processing coexists alongside continuous flow and discrete analysis platforms, offering laboratories a choice between high-throughput batch runs and flexible, on-demand testing schedules.

End users range from academic research institutes and specialized diagnostic laboratories to hospital networks and standalone clinics, each segment presenting unique operational requirements and procurement cycles. Distribution channels straddle traditional offline networks-leveraging direct sales, distributorships, and on-site service contracts-and online platforms that streamline ordering, inventory management, and remote monitoring capabilities. Finally, applications of metabolic panel testing extend from routine clinical diagnosis and chronic disease monitoring to drug discovery pipelines and specialized research initiatives, positioning CMP assays as a versatile tool across both patient care and translational research domains.

This comprehensive research report categorizes the Comprehensive Metabolic Panel Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Testing Type

- Sample Type

- Test Mode

- End User

- Distribution Channel

- Application

Unraveling Distinct Regional Dynamics from the Americas Through Europe Middle East Africa to the Rapidly Growing Asia Pacific Diagnostic Markets

In the Americas, North America remains the epicenter of CMP testing adoption, driven by high healthcare expenditure, mature reimbursement frameworks, and integrated healthcare delivery systems. With over forty percent of the global in vitro diagnostics market concentrated in this region, laboratories prioritize state-of-the-art automated analyzers and comprehensive point-of-care solutions to manage rising volumes of chronic disease testing. Latin America, meanwhile, is witnessing gradual modernization of lab networks supported by government incentives and expanding private-sector partnerships, though challenges persist around infrastructure disparities and logistical complexities.

Europe, Middle East, and Africa exhibit a diverse landscape shaped by varying healthcare models and regulatory environments. Western European countries demonstrate robust uptake of advanced CMP platforms underpinned by stringent quality accreditations and favorable funding arrangements. In contrast, several Middle Eastern nations are embarking on ambitious healthcare infrastructure overhauls, incorporating digital laboratories and public-private collaborations to expand testing access. Across Africa, rising awareness of non-communicable disease management is catalyzing capacity-building efforts, with reference laboratory networks increasingly integrating high-performance analyzers and remote consultation services.

Asia-Pacific stands out as the fastest-growing regional market, propelled by rapid urbanization, expanding insurance penetration, and escalating investments in public health initiatives. Countries such as China and India are prioritizing diagnostic modernization through domestic manufacturing incentives and hub-and-spoke laboratory models. The Asia-Pacific region now accounts for nearly one-quarter of the global clinical laboratory services market and is poised to sustain double-digit growth as governments and private stakeholders bolster diagnostics infrastructure to address both communicable and non-communicable disease burdens.

This comprehensive research report examines key regions that drive the evolution of the Comprehensive Metabolic Panel Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Navigating the Competitive Terrain Through a Composed Analysis of Leading Industry Stakeholders Shaping Comprehensive Metabolic Panel Testing

The competitive arena of comprehensive metabolic panel testing is anchored by a cadre of global in vitro diagnostics specialists and integrated medtech conglomerates. Roche Diagnostics maintains leadership through its broad assay portfolio and high-throughput cobas platforms, leveraging AI-driven diagnostics and companion test offerings to enhance clinical decision support. Abbott Laboratories sustains momentum with its Alinity series and i-Stat systems, focusing on point-of-care capability and rapid result delivery in acute care settings. Siemens Healthineers complements these strengths with modular Atellica solutions, emphasizing flexible automation and digital connectivity to streamline laboratory operations.

Parallel contenders such as Danaher Corporation and Thermo Fisher Scientific have fortified their competitive positioning via strategic acquisitions and expanded reagent portfolios, targeting both centralized laboratories and decentralized testing environments. Bio-Rad Laboratories and Becton, Dickinson & Company play critical roles in supplying quality controls and consumable reagents, while speciality diagnostics firms like bioMérieux and QuidelOrtho distinguish themselves through molecular and rapid antigen testing innovations. Emerging participants, including Sysmex Corporation and QIAGEN, are increasingly leveraging NGS and liquid biopsy methods, signaling ongoing diversification of CMP testing applications beyond traditional blood chemistry assays.

This comprehensive research report delivers an in-depth overview of the principal market players in the Comprehensive Metabolic Panel Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abaxis by Zoetis Inc.

- Abbott Laboratories

- Accesa Labs

- ARUP Laboratories

- Baptist Health Medical Group

- CENTOGENE N.V.

- DirectLabs, LLC

- GRI Labs

- LabFinder, LLC

- Laboratory Corporation of America Holdings

- Metropolis Healthcare Limited

- NeoGenomics Laboratories, Inc.

- Picmed Wellness Corporation

- Private MD Labs

- Quest Diagnostics Incorporated

- Scion Lab Services, LLC

- Siemens Healthcare AG

- Sonic Healthcare Limited

- SYNLAB International GmbH

- Testing.com by OneCare Media, LLC

- Walk-In Lab, LLC

Implementing Proactive Strategies to Harness Emerging Technologies Diversify Supply Chains and Expand Market Reach Within Metabolic Panel Testing

Industry leaders should prioritize the expansion of localized manufacturing and supply chain resilience to offset trade-related cost volatility. Establishing agile sourcing frameworks, including dual-sourcing agreements and regional production hubs, can mitigate tariff impacts and reduce lead times for critical analyzers and consumables. Moreover, collaboration with policymakers to secure targeted tariff exemptions for life-saving diagnostic equipment will be essential to preserve affordability and access across diverse healthcare settings.

Investing in automation and digital integration remains a cornerstone recommendation. Deployment of advanced laboratory information management systems and AI-enabled analytics not only enhances workflow efficiency but also supports predictive maintenance and dynamic quality assurance. Simultaneously, scaling point-of-care testing platforms in both urban and remote environments will expand diagnostic reach, improve patient engagement, and alleviate centralized lab burdens. Strategic partnerships with telehealth providers and digital health platforms can further integrate CMP testing into holistic care pathways, strengthening overall healthcare delivery.

To capture growth in high-potential regions, companies should tailor market entry strategies to local regulatory and reimbursement landscapes. Forming alliances with regional distributors and leveraging hub-and-spoke laboratory networks in Asia-Pacific and emerging EMEA markets can accelerate adoption and foster long-term customer relationships. Finally, augmenting service offerings with value-added consulting, virtual training, and remote validation support will differentiate providers and promote enduring, performance-based partnerships.

Ensuring Rigor and Credibility Through a Robust Research Methodology Combining Primary Interviews Secondary Data and Comprehensive Triangulation Techniques

This market analysis is grounded in a dual-phase research methodology combining rigorous secondary research with targeted primary engagements. The secondary phase involved an exhaustive review of industry publications, regulatory filings, peer-reviewed journals, and credible media sources to identify prevailing trends and benchmark data. Authoritative sources, including government tariff notices, industry association reports, and leading business news outlets, were systematically analyzed to quantify market impacts and policy shifts.

In the primary phase, in-depth interviews were conducted with a cross-section of stakeholders encompassing laboratory directors, diagnostic equipment manufacturers, reagent suppliers, and policy experts. These structured discussions enriched the analysis with real-world perspectives on operational challenges, capital investment priorities, and regulatory compliance strategies. Data triangulation was employed to reconcile insights across multiple information streams, ensuring consistency, validity, and actionable relevance.

Finally, the research underwent thorough validation and peer review by subject matter experts in clinical diagnostics and medtech policy. Analytical frameworks were stress-tested through scenario modeling to assess sensitivity to key variables, including tariff adjustments, technology adoption rates, and regional policy evolutions. This robust methodological approach underpins the report’s credibility, delivering reliable intelligence for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Comprehensive Metabolic Panel Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Comprehensive Metabolic Panel Testing Market, by Product Type

- Comprehensive Metabolic Panel Testing Market, by Testing Type

- Comprehensive Metabolic Panel Testing Market, by Sample Type

- Comprehensive Metabolic Panel Testing Market, by Test Mode

- Comprehensive Metabolic Panel Testing Market, by End User

- Comprehensive Metabolic Panel Testing Market, by Distribution Channel

- Comprehensive Metabolic Panel Testing Market, by Application

- Comprehensive Metabolic Panel Testing Market, by Region

- Comprehensive Metabolic Panel Testing Market, by Group

- Comprehensive Metabolic Panel Testing Market, by Country

- United States Comprehensive Metabolic Panel Testing Market

- China Comprehensive Metabolic Panel Testing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Drawing Together Critical Insights to Illuminate Future Pathways and Strategic Imperatives in the Evolution of Comprehensive Metabolic Panel Testing

In summary, comprehensive metabolic panel testing occupies a critical intersection of patient care, laboratory innovation, and global trade dynamics. The advent of automation, advanced analytics, and decentralized testing models is reshaping diagnostic workflows, while policy-driven tariff pressures and evolving reimbursement frameworks demand strategic agility. Segmentation insights underscore the nuanced interplay between instruments, reagents, services, and end-user requirements, highlighting opportunities for tailored offerings and differentiated value propositions.

Regionally, North America leads in mature adoption and infrastructure sophistication, EMEA showcases varied growth trajectories with strong pockets of innovation, and Asia-Pacific emerges as the fastest-expanding frontier, driven by public health investments and private sector modernization. Competitive analysis reveals a balanced landscape of established industry giants and nimble innovators, all vying to deliver high-quality, cost-effective CMP solutions across diverse care settings.

Looking ahead, sustained success in the comprehensive metabolic panel testing market will hinge on proactive supply chain strategies, continuous technological investment, and regionally attuned commercialization plans. The convergence of precision diagnostics, digital health integration, and policy advocacy provides a fertile ground for transformative growth, positioning market participants to address the evolving needs of clinicians, laboratories, and patients worldwide.

Seize Opportunity Today to Deepen Your Market Intelligence and Propel Growth With Expert-Guided Comprehensive Metabolic Panel Testing Analysis

For an exclusive deep dive into the strategic insights and comprehensive data driving the future of metabolic panel testing, reach out directly to Associate Director of Sales & Marketing Ketan Rohom. Engage with an expert who can tailor this market research report to your specific requirements, ensuring you obtain the most relevant intelligence for your business priorities. Connect now to unlock detailed guidance, actionable recommendations, and bespoke solutions that will empower your organization to capitalize on emerging opportunities and mitigate key risks within the comprehensive metabolic panel testing arena.

- How big is the Comprehensive Metabolic Panel Testing Market?

- What is the Comprehensive Metabolic Panel Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?