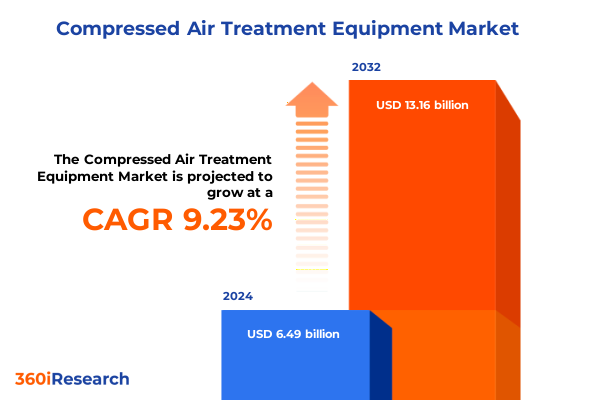

The Compressed Air Treatment Equipment Market size was estimated at USD 7.05 billion in 2025 and expected to reach USD 7.67 billion in 2026, at a CAGR of 9.30% to reach USD 13.16 billion by 2032.

Unearthing the Hidden Dynamics of the Compressed Air Treatment Equipment Market to Illuminate Strategic Decision-Making in a Rapidly Evolving Industrial Landscape

In a global industrial environment increasingly dependent on precision-process integrity and energy efficiency, the quality of compressed air systems has emerged as a critical competitive differentiator. This executive summary distills the most significant trends, challenges, and strategic imperatives shaping the compressed air treatment equipment landscape. It highlights how evolving regulatory measures, rapid technological advancements, and shifting trade dynamics are forcing stakeholders to reassess traditional supply chains and adopt more resilient, adaptive strategies.

As manufacturers and end users alike strive to balance cost pressures against demands for higher performance and reliability, compressed air treatment solutions have expanded far beyond conventional filtration and drying. Today’s market demands an integrated approach that weaves digital connectivity, predictive maintenance, and sustainability targets into core product offerings. In this context, understanding the interplay of equipment types, technology variants, and end-use applications is essential for decision-makers aiming to future-proof their operations.

This summary presents an analytically rich overview of transformative forces, tariff-driven disruptions, segmentation nuances, regional differentiators, and leading industry actors. It culminates in actionable recommendations designed to guide C-level executives and procurement specialists in optimizing portfolios and crafting growth-forward strategies that align with the latest industry imperatives.

Exploring the Transformational Forces Redefining Compressed Air Treatment Solutions Amid Technological Innovation and Sustainability Imperatives

Over the past decade, the compressed air treatment sector has undergone a profound metamorphosis driven by the convergence of Industry 4.0 frameworks, intensifying sustainability mandates, and an unrelenting focus on operational uptime. Digitalization initiatives have ushered in a new era of real-time performance monitoring, enabling predictive maintenance algorithms to detect early signs of contamination, pressure drops, or moisture ingress before they escalate into costly downtime.

Meanwhile, environmental directives and corporate net-zero commitments have placed energy efficiency at the forefront of technology development. Manufacturers are integrating variable speed drives and heat recovery systems to minimize energy waste, while advanced materials in desiccant and membrane modules deliver higher throughput with lower thermal footprints. These innovations are complemented by modular architectures that allow seamless retrofits and scalable deployments, aligning with end users’ shifting capacity requirements.

Moreover, regulatory pressures-especially around compressed air purity standards in critical sectors such as pharmaceuticals and food processing-have accelerated investment in high-performance filters and separators. As a result, stakeholder expectations have evolved; air treatment solutions are no longer viewed as ancillary components but rather as strategic assets instrumental to brand protection, product quality, and compliance assurance. Consequently, organizations are now prioritizing vendor partnerships that can deliver holistic, data-driven treatment ecosystems rather than standalone equipment.

Assessing the Cumulative Consequences of 2025 United States Tariffs on Compressed Air Treatment Equipment Supply Chains and Market Dynamics

The imposition of new United States tariffs in early 2025 has introduced significant reverberations throughout the compressed air treatment supply chain. Equipment imports subject to heightened duties have experienced upward price pressure, prompting end users to reassess vendor contracts and delivery timelines. This has catalyzed a recalibration of sourcing strategies, with several enterprises accelerating qualification processes for domestic manufacturers to mitigate exposure to unpredictable trade policies.

Simultaneously, original equipment manufacturers are reevaluating global production footprints to cultivate more geographically balanced supply networks. Some have repurposed existing facilities in North America to assemble critical components, while others have pursued joint ventures with local partners to navigate tariff uncertainties. This strategic shift has improved lead-time reliability but has also introduced capital expenditure demands in retooled manufacturing lines.

In parallel, cost pass-through to end users has stimulated more rigorous total cost of ownership analyses, compelling service providers to bolster maintenance and lifecycle support packages. As a transitional measure, hybrid procurement models combining tariff-exempt spare parts with fully assembled imports have emerged. Looking ahead, sustained dialogue with policymakers and active participation in industry associations will be pivotal, ensuring that future tariff structures account for the unique operational rhythms of the compressed air treatment ecosystem.

Unveiling Key Segmentation Insights into Equipment Type Technology and End Use Industry Roles Shaping Compressed Air Treatment Strategies

Diving into equipment type distinctions reveals that dryers-spanning desiccant, membrane, and refrigerated categories-form the backbone of moisture control strategies tailored to varying process sensitivities. Within desiccant dryers, the dichotomy between heatless and heated regeneration models surfaces trade-offs in energy consumption and dew point performance. Membrane dryers, particularly hollow fibre and spiral wound configurations, have gained traction for applications demanding compact footprint and on-site portability, whereas refrigerated dryers-available as compressor-mounted or standalone units-excel in general industrial settings where moderate moisture reduction suffices.

Complementarily, filter technologies span activated carbon, coalescing, and particulate media to address oil vapors, aerosolized droplets, and solid contaminants respectively, while separators focus on extracting oil-water mixtures or pure air-oil separations for lubricant recovery. These functional layers often integrate seamlessly, creating multi-stage treatment trains that adhere to the most stringent purity specifications.

Analyzing the interplay of technology-driven segmentation highlights how each end use industry-ranging from automotive assembly lines requiring ultra-fine particulate control to food and beverage operations prioritizing microbial-free air-leverages distinct treatment architectures. Healthcare and pharmaceutical environments necessitate near-sterile conditions, driving adoption of high-performance coalescing filters and desiccant units with sub-zero dew point capabilities. In contrast, oil and gas facilities depend heavily on robust oil-water separators to protect downstream instrumentation, while general manufacturing facilities seek balanced solutions that optimize energy efficiency, maintenance simplicity, and operational resilience.

This comprehensive research report categorizes the Compressed Air Treatment Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- End Use Industry

Illuminating Regional Nuances in Compressed Air Treatment Trends Across the Americas EMEA and Asia-Pacific Territories

Regional market dynamics underscore divergent priorities and investment trajectories across the Americas, Europe Middle East and Africa, and Asia-Pacific territories. In the Americas, energy cost volatility and robust industrial automation growth have elevated the importance of integrated treatment systems. Manufacturers in North America are increasingly embedding IoT-enabled sensors and analytics platforms into compressor packages, facilitating centralized monitoring and predictive maintenance across large-scale facilities.

Meanwhile, Europe’s aggressive regulatory landscape-encompassing stringent pressure equipment directives and airborne contaminant standards-has prompted rapid uptake of high-efficiency desiccant and refrigerated solutions. Suppliers in this region emphasize eco-design principles, leveraging recyclable materials and low-global-warming-potential refrigerants. The Middle East, buoyed by petrochemical expansion, shows growing demand for heavy-duty separators and filters capable of handling high oil carryover.

Conversely, the Asia-Pacific region remains a hotbed of growth driven by continued urbanization and manufacturing localization in China, India, and Southeast Asia. Market entrants here prioritize capital affordability and modular scalability, favoring membrane-based air dryers that balance performance with cost-effectiveness. Across these footprints, strategic alliances with local distributors and responsive aftermarket support networks are proving decisive for market leaders seeking to capture regional share and foster long-term loyalty among end users.

This comprehensive research report examines key regions that drive the evolution of the Compressed Air Treatment Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Pivotal Roles and Strategies of Leading Manufacturers Driving Innovation in Compressed Air Treatment Equipment

A closer examination of leading manufacturers reveals a competitive landscape characterized by continuous innovation and strategic portfolio expansion. Atlas Copco has positioned itself at the forefront by integrating multi-stage treatment modules directly into compressor housings, thereby simplifying installation and reducing overall system footprints. The company’s focus on seamless digital connectivity allows facility managers to aggregate performance metrics in unified dashboards, enhancing visibility into air quality and maintenance cycles.

Ingersoll Rand has responded with an emphasis on comprehensive service packages that bundle aftermarket support, remote diagnostics, and tailored training modules for maintenance personnel. This shift from transactional sales to outcome-based contracts reflects a broader industry movement toward lifetime value optimization. Parker Hannifin has concentrated on energy efficiency, unveiling new refrigerant-free dryer models that leverage advanced heat-exchange materials. These units cater specifically to customers facing stringent environmental regulations.

Smaller players, such as Kaeser and Sullair, are capitalizing on regional expertise and agile manufacturing strategies to penetrate emerging markets. By collaborating with local engineering firms, they achieve rapid customization cycles and responsive delivery timelines. Across the board, innovation pipelines are heavily weighted toward sensor-rich architectures, eco-friendly materials, and digital services, signaling that next-generation competitive advantage will hinge on melding hardware prowess with software-enabled intelligence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Compressed Air Treatment Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlas Copco AB

- Beko Technologies GmbH

- Boge Kompressoren GmbH & Co. KG

- Chicago Pneumatic Tool Company LLC

- CompAir Ltd.

- DEWALT Industrial Tool Company

- Donaldson Company, Inc.

- Elgi Equipments Limited

- FS-Curtis Compressors

- Fusheng Group Company

- Gardner Denver, Inc.

- Hitachi, Ltd.

- Howden Group Limited

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- Parker Hannifin Corporation

- Quincy Compressor LLC

- Sullair, LLC

Delivering Actionable Strategic Recommendations to Propel Growth and Operational Excellence in Compressed Air Treatment Solutions

To thrive in an increasingly complex environment, industry leaders must prioritize a series of strategic imperatives that balance innovation with operational rigor. First, accelerating investment in energy-efficient treatment technologies can deliver meaningful reductions in operating costs while aligning with tightening environmental regulations. By adopting advanced heatless desiccant systems and leveraging heat recovery from refrigerated dryers, organizations can generate quick wins in sustainability metrics.

Secondly, embedding predictive analytics and remote monitoring into treatment solutions is no longer optional. Companies that offer cloud-based performance dashboards and AI-driven maintenance alerts will earn greater trust from customers seeking to minimize unplanned downtime and extend equipment lifecycles. Collaborative partnerships with technology providers can expedite time-to-market for these capabilities.

Finally, supply chain resilience should be engineered through diversified sourcing strategies and flexible manufacturing footprints. By qualifying multiple suppliers for critical components and enhancing domestic assembly capacities, stakeholders can mitigate the impact of trade volatility. Simultaneously, fostering a culture of continuous operator training and structured service programs will ensure that treatment systems maintain peak performance throughout their lifespans. Taken together, these actions form a blueprint for sustainable growth and competitive differentiation in the compressed air treatment domain.

Explaining the Rigorous Research Methodology Underpinning Insights into Compressed Air Treatment Market Dynamics and Technology Trends

This analysis is grounded in a rigorous multi-phase research process combining both qualitative and quantitative methodologies. The study commenced with an extensive secondary research phase, drawing upon peer-reviewed journals, industry white papers, regulatory filings, and technical standards to establish foundational context around equipment categories, technology lifecycles, and compliance requirements.

Subsequently, primary research interviews were conducted with a cross-section of 25 subject matter experts, including engineering directors, procurement managers, and design engineers from key end-use segments. These dialogues provided real-world insights into application-specific priorities, procurement challenges, and emerging innovation pain points. Quantitative data points were then validated through a detailed regression analysis of import-export databases, tariff schedules, and corporate financial disclosures, ensuring robustness in trend identification.

Throughout the process, iterative workshops with senior analysts ensured that market segmentation frameworks, regional categorizations, and competitive landscapes accurately reflected the nuanced operational realities of compressed air treatment. A final review by an independent panel of industry veterans corroborated the conclusions and recommendations, affirming the reliability and strategic relevance of the insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Compressed Air Treatment Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Compressed Air Treatment Equipment Market, by Equipment Type

- Compressed Air Treatment Equipment Market, by Technology

- Compressed Air Treatment Equipment Market, by End Use Industry

- Compressed Air Treatment Equipment Market, by Region

- Compressed Air Treatment Equipment Market, by Group

- Compressed Air Treatment Equipment Market, by Country

- United States Compressed Air Treatment Equipment Market

- China Compressed Air Treatment Equipment Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Synthesizing Comprehensive Conclusions to Guide Future Decision-Making in the Compressed Air Treatment Equipment Landscape

In summation, the compressed air treatment equipment sector stands at a pivotal juncture where technological innovation, regulatory evolution, and geopolitical forces converge to reshape the competitive terrain. Stakeholders are compelled to adopt a more holistic view of treatment ecosystems, recognizing that equipment type, technological platform, and industry-specific demands must be orchestrated in unison to achieve optimal performance.

The 2025 tariff landscape has underscored the importance of supply chain agility, compelling manufacturers and end users to revisit sourcing strategies and bolster domestic capabilities. Meanwhile, the accelerated uptake of digital monitoring and predictive maintenance solutions reflects a broader shift toward outcome-based service models that enhance system reliability and lifecycle value.

Moving forward, success will hinge on the ability to deliver energy-efficient, modular, and sensor-integrated solutions tailored to the precise requirements of diverse end-use industries and regional markets. By internalizing the insights outlined in this summary and executing the recommended strategic initiatives, organizations can confidently navigate uncertainties and capitalize on emerging growth vectors within the compressed air treatment ecosystem.

Engaging Call-To-Action to Connect with Ketan Rohom for Access to the Definitive Compressed Air Treatment Market Intelligence Report

For professionals seeking ultra-detailed intelligence on compressed air treatment developments, connecting with Ketan Rohom (Associate Director, Sales & Marketing) unlocks immediate access to the definitive research resource. His expertise ensures tailored guidance in selecting the optimal package, whether your requirements are granular segmentation breakdowns, in-depth tariff impact analyses, or proprietary company strategy benchmarks. Engaging directly with him streamlines the procurement process, granting your team a competitive advantage by leveraging the most comprehensive and actionable market insights available.

Securing this report expedites informed decision-making, empowering executives to navigate supply chain complexities, capitalize on emerging technological trends, and align investments with regional growth hotspots. By conversing with Ketan Rohom, you benefit from a consultative process that clarifies your organization’s specific objectives, enabling a bespoke research solution that addresses your unique strategic imperatives. Reach out today to transform your understanding of compressed air treatment into a clear roadmap for operational excellence and sustainable profitability.

- How big is the Compressed Air Treatment Equipment Market?

- What is the Compressed Air Treatment Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?