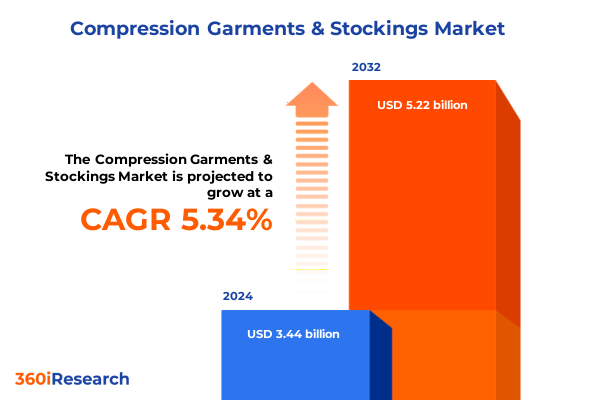

The Compression Garments & Stockings Market size was estimated at USD 3.60 billion in 2025 and expected to reach USD 3.78 billion in 2026, at a CAGR of 5.42% to reach USD 5.22 billion by 2032.

Forging the Path Ahead with Comprehensive Perspective on the Evolution and Current State of the Compression Garments and Stockings Sector

In today’s rapidly evolving healthcare and wellness landscape, compression garments and stockings have emerged as pivotal solutions across multiple domains-from clinical rehabilitation to athletic performance enhancement. These specialized products, engineered to deliver graduated pressure, play a vital role in addressing circulatory disorders and in supporting muscle recovery. Over the past decade, technological advancements in materials science have enabled manufacturers to enhance breathability, durability, and ergonomic fit, redefining consumer expectations for comfort and efficacy. Concurrently, a surge in preventive health measures and heightened awareness of venous disorders has elevated market demand among both patients and general wellness enthusiasts.

Moreover, the integration of data-driven monitoring devices, along with rising digital health platforms, has started to blur the lines between traditional compression wear and smart medical devices. This convergence not only amplifies the utility of compression solutions in remote patient management but also fuels expanded applications in sports science and everyday wellness regimes. As regulatory pathways evolve, the distinction between over-the-counter and prescription-grade products continues to shape market access and distribution strategies. These intertwined developments set the stage for a nuanced exploration of transformative shifts, trade dynamics, segmentation intricacies, and regional subtleties that define the compression garments and stockings sector today.

Unraveling the Wave of Transformative Shifts Driven by Technology, Sustainability, and Consumer Expectations in the Compression Wear Market

In recent years, the compression garments and stockings market has witnessed transformative shifts that extend beyond material innovation to encompass digital integration and eco-conscious production. One of the most significant changes stems from the infusion of smart textiles and sensor-embedded fabrics, enabling real-time monitoring of pressure metrics and wearer compliance. This advancement not only enhances clinical outcomes by ensuring optimal therapeutic regimens but also creates new opportunities for remote patient engagement.

Simultaneously, sustainability has become a critical differentiator, prompting manufacturers to adopt recyclable polymers and low-impact dyeing methods. As a result, eco-certifications and transparent supply-chain audits increasingly influence procurement decisions among hospitals, specialty stores, and direct-to-consumer channels. At the same time, the rise of personalized compression wear-driven by 3D knitting technology and advanced body-scanning tools-allows for bespoke fits that cater to individual anatomical variations. This customization trend dovetails with growth in sports performance applications, where athletes demand products that offer both functional compression benefits and enhanced comfort during intensive training sessions.

Taken together, these developments illustrate a market in flux, defined by cross-disciplinary innovations and shifting stakeholder priorities. As patient expectations evolve, manufacturers and distributors must adapt to stay ahead of both regulatory requirements and consumer demands, setting the stage for a new era of tailor-made, tech-enabled compression solutions.

Examining the Ripple Effects of 2025 Tariff Measures on Supply Chains, Pricing Structures, and Strategic Realignments in the United States Market

The implementation of new tariffs in the United States during 2025 has imparted a complex set of effects on the compression garments and stockings market, reshaping sourcing strategies and cost structures. Import duties on textile inputs and finished products have prompted manufacturers to reevaluate global supply chains, leading several key players to explore near-shoring alternatives and regional production hubs. Consequently, procurement teams are now balancing the higher fixed costs of domestic manufacturing against the variable savings from reduced shipping and tariff-induced levies.

Furthermore, the tariff regime has exerted pricing pressures across multiple distribution channels. While some large hospital systems and specialty retailers have successfully negotiated long-term contracts to cushion end users from abrupt cost increases, smaller pharmacies and online retailers face margin compression that may limit promotional flexibility. To mitigate these challenges, many companies are optimizing their product portfolios, phasing out lower-margin items in favor of high-performance lines with differentiated materials and proprietary designs.

Looking ahead, the cumulative impact of these trade measures is likely to accelerate vertical integration and partnerships between textile manufacturers and compression brands. By investing in domestic capacity and forging strategic collaborations, industry stakeholders aim to safeguard supply continuity while preserving competitive pricing. As tariff policies remain subject to political negotiation, agility in strategic sourcing will remain paramount for sustaining profitability and market share.

Delving into Critical Segmentation Dimensions to Unlock Nuanced Insights from Product Types to Materials and Consumer Applications

A nuanced understanding of market segmentation reveals how each category influences both product development and go-to-market strategies. When analyzing by product type, compression gloves, sleeves, socks, stockings, and tights each command distinct design priorities and regulatory considerations; for instance, sleeve innovations focus on joint mobility while stockings emphasize graduated pressure gradients along the leg. In terms of end use, the industrial segment demands durability for occupational applications, the medical arena prioritizes certified therapeutic efficacy, and sports enthusiasts seek lightweight, breathable options that facilitate rapid moisture evacuation.

Equally critical is the distribution landscape, spanning hospitals and clinics; online retail platforms; pharmacies and drug stores; specialty stores; and sports outlets, each channel requires tailored marketing approaches and logistics frameworks. From an application standpoint, solutions targeting deep vein thrombosis prevention, lymphedema management, postoperative recovery, pregnancy support, sports performance, and varicose vein treatment call for varying compression levels and fabric constructions. Gender differentiation further complicates segmentation, as female, male, and unisex product lines must align with morphological differences without compromising on aesthetic or functional attributes.

Finally, material choice serves as a foundational determinant of performance and user experience. Natural fibers like cotton and rubber deliver comfort and elasticity for select applications, whereas synthetic options such as nylon and spandex provide superior tensile strength, resilience, and form-retention. By cross-referencing these segmentation criteria, stakeholders can unveil growth pockets and optimize resource allocation for R&D, marketing, and distribution.

This comprehensive research report categorizes the Compression Garments & Stockings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Gender

- Distribution Channel

- Application

- End Use

Mapping Regional Dynamics by Comparing Market Drivers, Adoption Patterns, and Growth Opportunities Across Americas, EMEA, and Asia-Pacific

Regional dynamics play an indispensable role in shaping competitive landscapes and investment strategies across the compression garments and stockings market. In the Americas, robust healthcare infrastructure and rising awareness of venous disorders drive sustained demand for medical-grade compression solutions. Meanwhile, sports performance applications gain momentum, fueled by active lifestyle trends and endorsements by high-profile athletes. Economic incentives and favorable reimbursement policies in select markets further bolster uptake through hospital procurement programs and specialized clinics.

Turning to Europe, the Middle East, and Africa, aging populations in Western Europe amplify the need for postoperative recovery and lymphedema management solutions, while stringent regulatory frameworks ensure product quality and safety. Gulf Cooperation Council nations are emerging as growth hotspots, with rising disposable incomes enabling greater adoption across online and specialty-store channels. Across Africa, however, market penetration remains varied, constrained by limited distribution networks and price sensitivity.

In the Asia-Pacific region, rapid urbanization and expanding middle-class demographics underpin a surge in demand for both medical and sports applications. Markets such as Japan and South Korea prioritize technologically advanced, smart compression wear, whereas Southeast Asian economies present growth potential through cost-effective, mass-market products. Government initiatives supporting manufacturing and export hubs in China and India further contribute to regional supply-chain diversification and competitive pricing.

This comprehensive research report examines key regions that drive the evolution of the Compression Garments & Stockings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Shaping Innovation, Collaboration, and Market Leadership Trajectories

A survey of leading companies reveals a competitive ecosystem characterized by targeted innovation, strategic collaborations, and value-added services. Key manufacturers are investing heavily in R&D partnerships with textile institutes and biomechanics centers to pioneer next-generation fabrics that combine adaptive compression profiles with moisture-wicking performance. In parallel, alliances with technology vendors are accelerating the integration of sensor networks within garment structures, opening avenues for subscription-based monitoring platforms and digital therapeutics.

Moreover, forward-looking companies are realigning their distribution models to capture omnichannel synergies. By leveraging direct-to-consumer e-commerce capabilities alongside traditional hospital and retail frameworks, these organizations optimize market coverage while deepening customer engagement through personalized digital touchpoints. Strategic acquisitions and joint ventures are also prevalent, enabling rapid entry into adjacent segments such as custom orthotics and connected wellness solutions.

Further illustrating the competitive spirit, several brands have launched sustainability initiatives that encompass cradle-to-grave product stewardship, including take-back programs and biodegradable packaging. Such commitments not only comply with evolving regulatory standards but also resonate with increasingly eco-conscious buyers, securing brand loyalty and enhancing corporate reputation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Compression Garments & Stockings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AMERX Health Care Corp. by Procyon Corporation

- Bio Compression Systems, Inc.

- Bodyment

- Calze G.T. S.r.l.

- Cardinal Health, Inc.

- ContourMD

- Dermawear by CPS Shapers Limited

- DirectDermaCare

- Essity AB

- FeelWell

- Julius Zorn GmbH

- Kinex Medical Company, LLC

- Lipoelastic

- Lohmann & Rauscher GmbH & Co. KG

- LYCRA Company

- Lymphedema Products, LLC

- MACOM Enterprises Ltd.

- medi GmbH & Co. KG

- Nouvelle Inc.

- Paul Hartmann AG

- Rainey Recovery Wear

- Rehan International Co., Ltd.

- Sanyleg SRL

- SIGVARIS Group

- The Marena Group, LLC

- Tommie Copper, Inc.

- Wear Ease

Actionable Strategic Recommendations for Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Opportunities Successfully

To navigate the ever-shifting landscape of compression garments and stockings, industry leaders must adopt a multi-pronged strategy that balances innovation with operational resilience. First, investing in modular manufacturing capabilities will enable rapid pivots between product types, ensuring responsiveness to sudden shifts in regulatory requirements or tariff structures. Concurrently, fostering deep partnerships with technology firms can accelerate the development of sensor-embedded textiles, positioning companies at the forefront of digital health convergence.

In parallel, adopting a regionally diversified supply-chain strategy can mitigate the impact of trade policy fluctuations. Establishing secondary production sites in tariff-friendly jurisdictions and exploring contract manufacturing agreements will provide greater flexibility and cost predictability. Similarly, embrace of circular economy principles-through material recycling programs and extended producer responsibility initiatives-will strengthen sustainability credentials and preempt environmental compliance risks.

Finally, industry stakeholders should prioritize customer-centric research by leveraging advanced analytics to track usage patterns and compliance rates. These insights can inform iterative product enhancements and personalized marketing campaigns that resonate with end users across clinical, industrial, and sports applications. Executed in concert, these recommendations will empower market participants to chart a resilient growth trajectory amid intensifying competition and evolving consumer expectations.

Detailing a Rigorous Research Methodology Integrating Primary Interviews, Secondary Data, and Analytical Frameworks for Robust Market Insights

This research report employs a rigorous methodology designed to deliver reliable and actionable insights. Initially, comprehensive secondary research was conducted by analyzing peer-reviewed journals, industry white papers, regulatory filings, and company disclosures to establish a foundational understanding of market drivers and technological advances. Subsequently, expert interviews were carried out with C-level executives, R&D directors, and clinical specialists to validate secondary findings and surface emerging trends that have yet to enter the public domain.

Data triangulation formed the cornerstone of the analytical framework, integrating quantitative data points-such as production volumes, import-export statistics, and patent filings-with qualitative assessments garnered from stakeholder consultations. Advanced statistical tools were utilized to identify correlation patterns and forecast adoption trajectories without disclosing proprietary market estimates. Furthermore, a competitive landscape analysis was performed to benchmark key players across innovation metrics, sustainability initiatives, and distribution reach.

Throughout the process, stringent data governance protocols were upheld to ensure the integrity and confidentiality of primary inputs. This methodological approach underpins the report’s credibility, equipping decision makers with a transparent, reproducible framework for interpreting insights and formulating strategic plans.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Compression Garments & Stockings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Compression Garments & Stockings Market, by Product Type

- Compression Garments & Stockings Market, by Material

- Compression Garments & Stockings Market, by Gender

- Compression Garments & Stockings Market, by Distribution Channel

- Compression Garments & Stockings Market, by Application

- Compression Garments & Stockings Market, by End Use

- Compression Garments & Stockings Market, by Region

- Compression Garments & Stockings Market, by Group

- Compression Garments & Stockings Market, by Country

- United States Compression Garments & Stockings Market

- China Compression Garments & Stockings Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Reflections on the Evolutionary Trajectory and Future Outlook of the Compression Garments and Stockings Industry Landscape

In summary, the compression garments and stockings industry stands at the intersection of medical necessity and consumer-driven performance enhancement, propelled by continuous innovation in materials, digital integration, and sustainable practices. As trade policies and regional dynamics evolve, stakeholders must maintain strategic agility to capitalize on shifting supply-chain paradigms and emerging growth pockets. Simultaneously, a deep segmentation lens-encompassing product variations, end-use contexts, and distribution channels-enables targeted deployment of resources and personalized value propositions.

Looking forward, the confluence of sensor-enabled wearables and adaptive compression technologies promises to redefine therapeutic outcomes and user experiences, while collaborative ecosystems among manufacturers, technology providers, and clinical institutions will accelerate time-to-market for breakthrough solutions. Ultimately, the ability to harness advanced analytics and agile operational models will determine which organizations secure leadership positions in this dynamic landscape.

With a panoramic view of both near-term disruptions and long-term transformations, industry participants are well-positioned to drive sustainable growth and deliver differentiated value to patients, athletes, and wellness consumers alike. The time to translate insight into action is now.

Engage with Ketan Rohom to Unlock Comprehensive Market Intelligence and Propel Strategic Decision Making with Our Detailed Market Research Report

For organizations assessing strategic investments in the compression garments and stockings space, there is no substitute for a comprehensive market research report tailored to your ambitions. To explore actionable intelligence, competitive benchmarking, and in-depth analysis of market dynamics, reach out to Ketan Rohom, Associate Director of Sales & Marketing, for personalized guidance. He will assist in crafting a solution that aligns with your objectives and timelines, ensuring you obtain a clear roadmap to maximize ROI and secure a competitive edge. Connect now to secure your copy of this indispensable resource and transform data into decisive action.

- How big is the Compression Garments & Stockings Market?

- What is the Compression Garments & Stockings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?