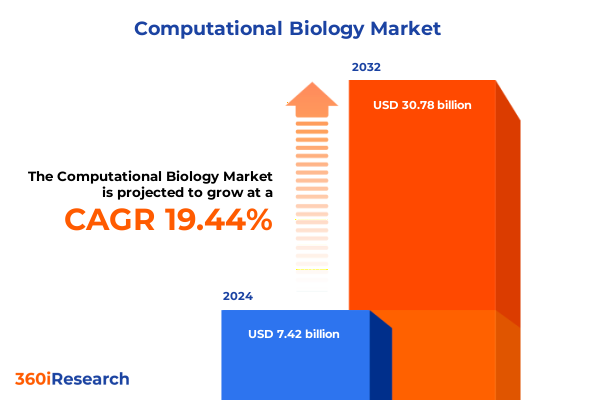

The Computational Biology Market size was estimated at USD 8.83 billion in 2025 and expected to reach USD 10.50 billion in 2026, at a CAGR of 19.52% to reach USD 30.78 billion by 2032.

Pioneering Insights into Computational Biology’s Dynamic Ecosystem and Its Role in Driving Breakthroughs across Research, Diagnostics, and Therapeutic Development

The field of computational biology has rapidly evolved into a cornerstone of modern life sciences by synergizing advanced computational power with biological inquiry to extract meaningful insights from complex datasets. This convergence of disciplines transcends traditional laboratory boundaries, enabling researchers to decode genetic architectures, model molecular interactions, and predict disease progression with unprecedented accuracy. In particular, the integration of big data analytics and high-throughput technologies has ushered in a new era of precision medicine, where therapeutic interventions can be tailored based on individual genomic profiles. As a result, computational biology not only accelerates foundational research but also drives translational applications across diagnostics, drug discovery, and synthetic biology.

Against this backdrop of relentless innovation, stakeholders across academia, industry, and healthcare systems must navigate an increasingly dynamic ecosystem. Emerging trends such as machine learning-driven biomarker discovery, cloud-based collaborative platforms, and multi-omics integration are redefining best practices. Moreover, the proliferation of open-source algorithms and standardized data formats has fostered a more inclusive and interoperable research environment, empowering both established players and disruptors.

This executive summary distills critical insights from extensive qualitative and quantitative research to guide decision-makers through the transformative shifts, segmentation nuances, regional dynamics, and competitive landscape shaping computational biology in 2025. It lays a strategic foundation for understanding market intricacies, synthesizing the cumulative impacts of policy changes, and equipping leaders with actionable recommendations to maximize the scientific and commercial potential of computational biology initiatives.

Unveiling the Transformative Technological and Analytical Shifts Reshaping Computational Biology Practices and Accelerating Scientific Discovery

Computational biology has reached an inflection point where traditional data analysis methods yield to the power of artificial intelligence and advanced analytics, fundamentally altering research paradigms. Machine learning algorithms now assist in predicting protein folding, identifying genomic variants, and elucidating cellular networks, thereby reducing reliance on time-consuming wet-lab experiments. Concurrently, the adoption of cloud computing and edge analytics has enabled distributed teams to collaborate seamlessly on massive datasets, unlocking real-time insights that were previously unattainable.

Furthermore, the advent of single-cell sequencing and spatial transcriptomics has expanded the granularity of biological understanding, allowing researchers to profile individual cells within heterogeneous tissues and map their spatial contexts. This high-resolution perspective is catalyzing breakthroughs in oncology, immunology, and regenerative medicine by uncovering cell-type-specific signatures and microenvironmental influences. Additionally, digital twin models are emerging as powerful tools for simulating biological processes in silico, offering a risk-free sandbox for hypothesis testing and therapeutic optimization.

As these transformative shifts converge, the boundaries between computational biology, systems biology, and synthetic biology are blurring, giving rise to hybrid multidisciplinary approaches. The democratization of data standards and modular software pipelines is further amplifying innovation, enabling smaller research groups to contribute meaningfully alongside global consortia. In this era of rapid change, organizations that embrace these technological and methodological advances will set the benchmarks for scientific excellence and market leadership.

Analyzing the Far-Reaching Effects of 2025 United States Tariff Policies on Computational Biology Supply Chains and Research Innovation

In 2025, the United States implemented a series of tariff adjustments targeting critical components of computational biology workflows, with significant ramifications for instrumentation, consumables, and software services. The imposition of higher duties on imported sequencing instruments and mass spectrometers has led to an uptick in capital expenditure costs for research institutions and biopharmaceutical companies. Consequently, procurement cycles have lengthened as stakeholders reevaluate supplier portfolios and explore alternative sourcing strategies to mitigate budgetary constraints.

On the consumables front, elevated tariffs on library prep reagents, proteomics reagents, and sequencing consumables have pressured margins for both vendors and end users, compelling companies to negotiate volume-based contracts and invest in localized manufacturing. This shift is driving alliances between reagent suppliers and domestic contract manufacturing organizations, fostering more resilient supply chains. Moreover, service-oriented segments such as instrument maintenance and data analysis have experienced downstream effects, with clients demanding flexible pricing structures to offset increased import costs.

Despite short-term disruptions, the cumulative impact of these tariff measures is catalyzing a strategic realignment toward domestic innovation hubs and collaborative research networks. Research organizations are forging partnerships with local technology providers to co-develop next-generation platforms that circumvent tariff barriers. As a result, the landscape is evolving from a reliance on global supply chains toward a more balanced ecosystem where agility and proximity foster sustained innovation.

In-Depth Exploration of Product, Technology, Application, and End User Segmentation Uncovering Niche Opportunities in Computational Biology Markets

Understanding the computational biology market requires an appreciation of how diverse segmentation dimensions intersect to shape demand dynamics and investment priorities. When examining the market by product type, it encompasses high-precision instruments such as imaging systems and mass spectrometry platforms alongside specialized microarray scanners, quantitative PCR instruments, and next-generation sequencing machines. The consumables segment extends into library preparation chemistries, PCR reagent kits, proteomics-grade reagents, and sequencing-specific consumables, while the software and services domain covers bioinformatics consulting, data visualization applications, and preventive instrument maintenance offerings.

From a technology perspective, key pillars include advanced imaging modalities ranging from confocal microscopy to electron microscopy and fluorescence-based systems, while mass spectrometry subtypes such as electrospray ionization mass spectrometry and MALDI-TOF continue to underpin proteomic and metabolomic investigations. Microarray approaches, including DNA and protein arrays, complement high-throughput screening, whereas next-generation sequencing technologies from major providers and pioneering platforms for long-read analysis are unlocking deeper genomic insights. Digital PCR and quantitative PCR methods further enhance target quantification for diagnostic and research applications.

Application segmentation highlights the pivotal roles of diagnostics in areas like oncology screening, genetic disorder testing, and infectious disease surveillance, as well as drug discovery workflows encompassing target identification, lead optimization, and toxicity assessment. Genomic analysis tasks span whole-genome sequencing, epigenomic profiling, and transcriptomic sequencing, while proteomic analysis involves protein identification, post-translational modification characterization, and quantitative mass spectrometry.

Investigating end-user categories reveals vibrant demand from academic and government research centers, large and niche contract research organizations, hospital laboratories and independent diagnostics providers, and a spectrum of biotechnology and pharmaceutical enterprises engaged in both early-stage innovation and commercial manufacturing.

This comprehensive research report categorizes the Computational Biology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Comprehensive Regional Perspectives Highlighting Unique Market Dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific Computational Biology Hubs

Regional market dynamics in computational biology reflect the interplay of funding landscapes, regulatory environments, and talent ecosystems across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, North American research institutions and biotechnology clusters benefit from substantial government grants and private sector investment, driving the development of precision diagnostics and AI-enabled platforms. Latin American nations are progressively enhancing clinical research infrastructure, creating new opportunities for partnerships and localized applications, particularly in infectious disease monitoring and agricultural genomics.

Across Europe Middle East & Africa, a mosaic of regulatory frameworks shapes market growth. The EU continues to harmonize data privacy and bioethics regulations, offering a fertile ground for pan-European consortia and cross-border trials. Meanwhile, Middle Eastern states are investing heavily in genomics centers and translational research facilities as part of national health strategies. African research hubs, though nascent, are garnering global attention for their contributions to tropical disease genomics and population-scale genetic studies, often supported by international collaborations.

Asia-Pacific stands out for its rapid infrastructure expansion and agile policy reforms. East Asian countries maintain leadership in sequencing services and high-throughput screening, while South Asian markets are leveraging cost efficiencies to scale clinical genomics. Southeast Asian nations are emerging as hotspots for biotech outsourcing, underpinned by government incentives and a growing skilled workforce. Collectively, these regional variations underscore the importance of nuanced strategies that align innovation objectives with local regulatory and funding realities.

This comprehensive research report examines key regions that drive the evolution of the Computational Biology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Innovators and Industry Leaders Shaping the Computational Biology Landscape with Strategic Investments and Cutting-Edge Technological Advances

The competitive landscape in computational biology is defined by a blend of established multinational corporations and nimble innovators whose strategic investments in research and development shape market trajectories. Leading life sciences instrument manufacturers have intensified their focus on integrated solutions that couple hardware with cloud-based analytics, aiming to deliver end-to-end platforms for genomic and proteomic workflows. These companies are expanding their service portfolios to include custom bioinformatics pipelines and predictive maintenance agreements, thereby enhancing customer loyalty and recurring revenue streams.

Meanwhile, specialized software firms are disrupting traditional models by offering modular, open architecture systems that enable seamless data integration across diverse technologies. These companies leverage artificial intelligence to provide predictive modeling, automated data annotation, and interactive visualization capabilities that simplify complex analyses. Their partnerships with hardware vendors and research institutions accelerate the adoption of next-generation instruments while democratizing access to advanced computational tools.

New entrants and academic spin-offs are also making significant inroads by focusing on niche applications such as single-cell multi-omics, spatial biology, and synthetic biology design. By securing venture capital backing and forging strategic alliances with pharmaceutical companies, these startups are rapidly translating proof-of-concept discoveries into commercial products. In parallel, contract research organizations are evolving their service offerings to include integrated computational biology services, positioning themselves as one-stop partners for end-to-end discovery and development initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Computational Biology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- BGI Group

- Biomax Informatics AG

- Chemical Computing Group Inc.

- Compugen Ltd.

- Dassault Systèmes SE

- DNAnexus, Inc.

- DNASTAR, Inc.

- Eurofins Scientific SE

- Genedata AG

- Illumina, Inc.

- Insilico Medicine

- Instem Group

- Nimbus Discovery Llc

- PerkinElmer, Inc.

- ProFound Therapeutics

- QIAGEN N.V.

- Rosa & Co. Llc

- Schrodinger, Inc.

- Simulation Plus Inc.

- SOPHiA GENETICS

- Thermo Fisher Scientific Inc.

- Waters Corporation

- WuXi NextCODE

Actionable Strategic Recommendations Empowering Industry Leaders to Navigate Evolving Computational Biology Trends and Maximize Research and Commercial Outcomes

To harness the transformative potential of computational biology, industry leaders should cultivate collaborative ecosystems that bridge academia, startups, and established enterprises. Establishing co-innovation centers and joint research initiatives will accelerate knowledge transfer and foster cross-disciplinary breakthroughs. Engaging in public-private partnerships can also unlock additional funding streams and regulatory support for high-impact projects.

Organizations must prioritize investments in scalable cloud infrastructure and robust cybersecurity frameworks to safeguard sensitive genomic and patient data. By leveraging elastic computing resources and containerized workflows, teams can ensure reproducibility and adapt quickly to evolving computational demands. Implementing automated quality control and data governance protocols will further enhance analytical rigor and regulatory compliance.

Talent development remains critical; therefore, companies should design immersive training programs and exchange fellowships to upskill researchers in advanced analytics, machine learning, and systems biology. Encouraging multidisciplinary career pathways and providing clear architectures for professional growth will help attract top talent and reduce turnover.

Strategic diversification of supply chains is equally important. Pursuing multi-sourcing agreements for critical reagents and instruments, as well as strengthening local manufacturing partnerships, will mitigate risks associated with policy changes and logistical disruptions. Furthermore, embracing flexible pricing and subscription models for software and services can lower barriers to adoption and foster long-term customer relationships.

Finally, decision-makers should monitor evolving regulatory landscapes and proactively engage with policymakers to shape standards that balance innovation with ethical considerations. Establishing advisory boards comprising industry experts, ethicists, and patient advocacy groups will facilitate transparent dialogue and ensure that computational biology solutions meet societal needs.

Rigorous Research Methodology Integrating Primary and Secondary Data Sources to Ensure Robust and Credible Computational Biology Market Insights

The research methodology underpinning this report integrates both primary and secondary data sources to ensure comprehensive and validated insights. Secondary research entailed a systematic review of peer-reviewed publications, patent filings, regulatory databases, and scientific conference proceedings to map current technological capabilities and emerging innovations. This groundwork provided a contextual framework for understanding historical trends and identifying knowledge gaps.

Primary research comprised in-depth interviews and surveys conducted with senior executives, research directors, and technical experts across academia, biotechnology, pharmaceutical companies, and contract research organizations. These consultations offered qualitative perspectives on strategic priorities, procurement strategies, and anticipated challenges. Quantitative analyses were performed using customs data, company financial disclosures, and publicly available instrumentation sales figures, which were triangulated with proprietary analytics to validate market patterns without disclosing sensitive proprietary values.

Data triangulation and iterative validation protocols were applied to reconcile discrepancies between sources, enhance reliability, and reduce bias. Analytical tools included advanced statistical modeling and scenario analysis to assess the potential impacts of policy changes, technological disruptions, and regional dynamics. The robust methodology ensures that the report’s findings accurately reflect the complex and rapidly evolving nature of computational biology markets.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Computational Biology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Computational Biology Market, by Product Type

- Computational Biology Market, by Technology

- Computational Biology Market, by Application

- Computational Biology Market, by End User

- Computational Biology Market, by Region

- Computational Biology Market, by Group

- Computational Biology Market, by Country

- United States Computational Biology Market

- China Computational Biology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesis of Key Insights and Strategic Takeaways Illuminating the Path Forward for Computational Biology Stakeholders Seeking Sustainable Growth

This executive summary synthesizes the critical insights emerging from an in-depth examination of computational biology, encapsulating transformative technological shifts, segmentation nuances, tariff-driven realignments, and regional variances. As the field advances, stakeholders must embrace AI-enabled analytics, single-cell and spatial technologies, and cloud-based collaborative platforms to unlock deeper biological understanding and drive innovation in diagnostics and therapeutics.

The cumulative effect of 2025 tariff policies underscores the importance of resilient supply chains, local manufacturing partnerships, and agile procurement strategies. Segmentation analysis reveals that diversified product types, spanning instruments to software and services, intersect with technology and application domains to create specialized niches. Regional insights highlight the unique funding landscapes and regulatory frameworks across the Americas, Europe Middle East & Africa, and Asia-Pacific, emphasizing the need for geographically tailored approaches.

Leading companies are investing in integrated solutions, open-architecture software, and specialized services to differentiate their offerings. Actionable recommendations urge industry leaders to cultivate collaborative ecosystems, invest in infrastructure and talent development, diversify supply chains, and engage proactively with policy stakeholders. The methodological rigor of this report guarantees that these insights are grounded in validated data and expert perspectives, positioning decision-makers to capitalize on the evolving computational biology landscape.

Empower Your Computational Biology Strategy Today by Partnering with Ketan Rohom to Access Comprehensive Market Intelligence and Drive Informed Decisions

To gain a deeper competitive edge in computational biology and secure the actionable insights needed to stay ahead of market shifts, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By reaching out today, you will unlock personalized guidance on tailoring the report’s comprehensive findings to your organizational objectives, ensuring swift integration of strategic imperatives into your roadmap. Ketan’s expert understanding of both market dynamics and client requirements will streamline your decision-making process, enabling you to capitalize on emerging opportunities with confidence. Don’t miss the opportunity to transform your computational biology initiatives with data-driven clarity-partner with Ketan now to access the full report and elevate your strategic planning with unparalleled market intelligence

- How big is the Computational Biology Market?

- What is the Computational Biology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?