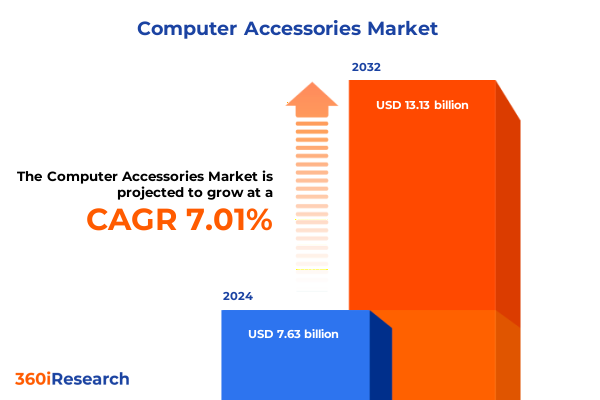

The Computer Accessories Market size was estimated at USD 8.17 billion in 2025 and expected to reach USD 8.63 billion in 2026, at a CAGR of 7.00% to reach USD 13.13 billion by 2032.

Setting the Stage for In-Depth Exploration of Evolving Trends and Driving Forces Shaping the Computer Accessories Industry Landscape

The computer accessories domain is witnessing an unprecedented convergence of consumer demand and technological innovation, driven in part by shifts in work habits and the rise of immersive entertainment experiences. Recent developments in remote work practices and hybrid office models have elevated the importance of ergonomic peripherals and high-fidelity audiovisual tools, underscoring the role that input and output devices play in everyday productivity. Simultaneously, the proliferation of competitive gaming, live streaming, and content creation has elevated standards for responsiveness, customization, and visual performance beyond what was conceivable just a few years ago.

Against this backdrop, manufacturers and channel partners are navigating a landscape marked by rapid product life cycles, heightened expectations for sustainability, and intensifying competition from both legacy brands and agile startups. Supply chain resilience has come to the fore as global logistics challenges and policy changes intersect, influencing component sourcing, lead times, and margin structures. In parallel, end users are gravitating toward wireless solutions to reduce desktop clutter, as well as RGB lighting and AI-powered software suites that enable deeper personalization. These combined forces establish a compelling foundation for understanding current market dynamics across mice, keyboards, monitors, headsets, webcams, and speakers.

This section establishes the framework for subsequent analysis by illustrating the key drivers and foundational trends shaping the computer accessories market. It highlights the strategic imperatives facing stakeholders, from innovating product differentiation to optimizing distribution channels, setting the scene for an in-depth exploration of transformative shifts, tariff impacts, segmentation intricacies, and region-specific nuances. By delineating the strategic context, readers gain clarity on the forces that will define success in this rapidly evolving arena.

Identifying the Transformational Dynamics and Technological Paradigm Shifts Redefining User Engagement and Product Development in Peripheral Devices

Innovation and shifting consumer behaviors have conspired to reshape the peripherals market in dramatic fashion. The advent of high-speed wireless standards, such as low-latency RF and advanced Bluetooth LE audio codecs, has propelled untethered devices into mainstream acceptance. Ergonomic design philosophies are being married with novel materials-ranging from recycled polymers to antimicrobial coatings-to address health, comfort, and sustainability concerns. In parallel, the integration of on-device AI accelerators and cloud-connected companion apps is enabling predictive input adjustments and context-aware lighting profiles, elevating the user experience to new heights.

Moreover, subscription-based software ecosystems and firmware-as-a-service models have emerged as key levers for manufacturers seeking recurring revenue streams. Cloud-based profile storage and cross-platform synchronization grant users seamless access to personalized settings across multiple setups. Layered on top of these digital offerings, lifestyle branding partnerships have proliferated, with peripheral makers collaborating with content creators, esports organizations, and entertainment franchises to deliver co-branded limited editions that resonate with targeted communities.

As these transformations unfold, channel strategies continue to evolve. Digital-native distribution channels are gaining ground, yet value-added resellers and specialty retailers retain relevance by offering in-person demos and technical support. Marketing efforts are increasingly driven by experiential activations and influencer partnerships, while data-driven demand forecasting tools are being leveraged to mitigate inventory imbalances. Collectively, these elemental shifts underscore the dynamic interplay between technology, branding, and commercialization that is propelling the accessories landscape into its next era.

Analyzing the Complex Effects of New United States Tariff Measures on Supply Chains Costs and Competitive Strategies in the Accessories Sector

In 2025, the introduction of elevated United States tariff rates on key electronic components has reverberated across the accessories supply chain. These measures, implemented to realign trade imbalances, have imposed additional duties on items sourced from major manufacturing hubs, most notably in East Asia. The immediate consequence has been a recalibration of landed costs for original equipment manufacturers, prompting supplier negotiations, renegotiations of contracts, and strategic inventory positioning.

Consequently, many market participants have accelerated plans to diversify manufacturing footprints, shifting production toward Southeast Asia and nearshore locations in Mexico to mitigate tariff exposure. While this reorientation offers long-term risk reduction, it has also introduced transitional challenges, including tooling transfer expenses, retraining of labor forces, and variable component quality calibrations. In the interim, price pass-through to end users has become a delicate balancing act, as brands weigh potential revenue erosion against the imperative of preserving market share.

Furthermore, retaliatory measures from certain trading partners have intensified volatility in raw material pricing, particularly for plastics and electronic subassemblies. These developments underscore the strategic importance of agile supply chain orchestration and underscore the need for robust scenario planning. Moving forward, the capacity to dynamically route orders, leverage multi-tiered procurement matchmaking, and deploy hedging strategies will distinguish the companies that thrive from those that merely endure in this heightened tariff environment.

Uncovering Segmentation-Driven Growth Opportunities through Detailed Analysis of Device Categories and Technology Differentiators in Peripheral Markets

A granular examination of device categories reveals divergent growth trajectories shaped by consumer preferences and technology adoption. Mice have experienced a pronounced migration toward wireless form factors, as users prioritize freedom of movement and clutter reduction; within this segment, low-latency RF solutions command a premium among competitive gamers, while mainstream audiences favor Bluetooth connectivity for its broad device interoperability. In parallel, the keyboard category has bifurcated into mechanical and membrane types, with mechanical switches defining the enthusiast and professional tiers; within that premium subset, RGB-enabled tactile and linear variants drive higher average selling prices compared to non-RGB models.

Monitor preferences continue to oscillate between LCD and LED backlighting technologies, where LED displays deliver superior contrast ratios and energy efficiency for multimedia applications, while traditional LCD screens maintain cost competitiveness for office-centric use cases. Headsets also mirror the wireless trend observed in mice, as Bluetooth-enabled and RF-based models offer cord-free convenience and spatial audio capabilities, contrasting with wired headsets that persist among budget-conscious consumers. Webcam adoption has surged in the Full HD tier, fueled by remote collaboration needs, even as entry-level HD webcams sustain basic video conferencing demand. Finally, audio speakers reflect a nuanced split between stereo systems for compact desktop setups and surround configurations tailored to immersive entertainment enthusiasts. These segmentation insights illuminate the nuanced preferences that underpin targeted product development and marketing strategies across multiple accessory categories.

This comprehensive research report categorizes the Computer Accessories market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity Technology

- Distribution Channel

Dissecting Regional Nuances and Demand Variations across the Americas Europe Middle East Africa and Asia-Pacific to Inform Market Strategies

Regional analysis underscores distinct demand drivers and competitive dynamics across the major geographies. In the Americas, robust work-from-home adoption in the United States and Canada has continued to fuel demand for ergonomic keyboards and high-precision mice, while Latin American markets exhibit growing interest in affordable HD webcams and entry-level audio solutions. Europe, the Middle East & Africa presents a tapestry of regulatory influences-such as digital accessibility standards-and diverse economic conditions, prompting vendors to adopt flexible pricing strategies and localize firmware to support multiple languages. Sustainability initiatives, including eco-label certifications, further shape purchasing decisions among environmentally conscious European enterprises.

Meanwhile, the Asia-Pacific region stands at the forefront of manufacturing innovation and early adoption trends. Established hubs in China and Taiwan continue to pioneer advanced LED monitor panel technologies and Bluetooth audio codecs, while emerging markets like India, Southeast Asia, and Oceania demonstrate increasing appetite for value-tier wireless peripherals. Government incentives aimed at boosting domestic electronics production are fostering a reshoring momentum, yet the imperative to maintain global export competitiveness keeps supply chains interwoven across borders. Collectively, these regional nuances call for tailored go-to-market strategies, whereby product positioning, channel selection, and after-sales support models are calibrated to resonate with local customer preferences and regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Computer Accessories market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading and Emerging Players Shaping Competitive Dynamics through Innovation Partnerships and Portfolio Expansion in Accessories Market

Leading corporations are deploying strategic initiatives to capture market share and advance technological frontiers. Key players with established portfolios have intensified R&D efforts in low-latency wireless communication and AI-enhanced device software, while selectively acquiring boutique brands to diversify their value propositions. Partnerships between major OEMs and semiconductor suppliers have enabled co-development of custom microcontrollers that optimize power consumption for battery-powered peripherals. Simultaneously, a wave of innovation from challenger brands has introduced modular and upgradable designs, catering to sustainability-minded consumers seeking longer device lifecycles.

Moreover, cross-industry alliances-spanning gaming, entertainment, and workplace wellness sectors-are creating differentiated offerings that blend functionality with lifestyle branding. Strategic expansion into subscription-based firmware update services is being pursued to establish recurring revenue streams and deepen customer engagement. These collective actions reveal an industry in which scale economies, agility, and brand resonance converge to determine competitive advantage. For stakeholders, understanding each company’s positioning in product breadth, technological differentiation, and channel reach is critical when evaluating partnership or procurement decisions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Computer Accessories market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A4Tech Co., Ltd.

- Acer Inc.

- Anker Innovations Limited

- Apple Inc.

- ASUSTeK Computer Inc.

- BenQ Corporation

- Cherry SE

- Cooler Master Technology Inc.

- Corsair Gaming Inc.

- Dell Technologies Inc.

- Elecom Co., Ltd.

- HP Inc.

- Kensington Computer Products Group

- Kingston Technology Corporation

- Lenovo Group Limited

- Logitech International S.A.

- Microsoft Corporation

- Rapoo Technology Co., Ltd.

- Razer Inc.

- Seagate Technology Holdings plc

- Sennheiser electronic GmbH and Co. KG

- Sony Group Corporation

- SteelSeries A/S

- Turtle Beach Corporation

- Western Digital Corporation

Delivering Actionable Strategic Recommendations to Guide Industry Leaders in Capitalizing on Emerging Trends and Mitigating Supply Chain Disruptions

Industry leaders should prioritize supply chain diversification by establishing multi-tiered sourcing networks that incorporate alternative manufacturing hubs alongside primary facilities. By contracting with co-manufacturers in Southeast Asia and Mexico, companies can reduce exposure to tariff fluctuations and improve resilience against geopolitical disruptions. Concurrently, investing in advanced inventory optimization systems and real-time logistics analytics will enable dynamic order routing and minimize stockouts or excesses.

In parallel, accelerating the development of wireless and AI-enabled peripherals will position brands to meet rising expectations for seamless user experiences and personalization. Companies are encouraged to expand software ecosystems that complement hardware offerings, driving stickiness and unlocking cross-sell opportunities. Environmental and ergonomic innovations should be integrated into new product roadmaps to align with evolving corporate procurement policies and consumer preferences.

Finally, cultivating strategic partnerships with enterprise IT providers, gaming communities, and streaming platforms can amplify market visibility and foster co-branded offerings. Tailoring marketing narratives to regional sensibilities-by highlighting sustainability credentials in Europe and affordability in emerging Asia-Pacific markets-will further enhance relevancy. By executing these recommendations, industry leaders can harness transformative trends, mitigate risk, and capture growth opportunities in the competitive peripherals landscape.

Outlining the Rigorous Research Framework Employed to Ensure Data Integrity Analytical Precision and Comprehensive Market Coverage

Our research methodology combines comprehensive secondary research with targeted primary engagements to ensure data integrity and analytical precision. The initial phase involved reviewing trade publications, corporate financial reports, and regulatory filings to map the competitive landscape and catalog recent tariff policy changes. This was supplemented by proprietary data feeds and customs records to quantify shifts in import volumes and average selling prices across device categories.

In the primary research phase, structured interviews were conducted with senior procurement officers, R&D executives, and distribution channel managers across major geographic regions. These conversations illuminated the operational challenges associated with tariff compliance, inventory management, and product localization. Additionally, an online survey of over one hundred IT decision-makers provided quantifiable insights into adoption drivers for wireless and AI-integrated peripherals.

Data triangulation techniques were then applied to reconcile quantitative datasets with qualitative insights, enabling the identification of key trends, market segments, and growth opportunities. All findings underwent rigorous validation through cross-referencing with industry benchmarks and third-party analytics platforms. This layered approach ensures that the final report delivers a robust, actionable set of strategic imperatives underpinned by empirical evidence and expert judgment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Computer Accessories market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Computer Accessories Market, by Product Type

- Computer Accessories Market, by Connectivity Technology

- Computer Accessories Market, by Distribution Channel

- Computer Accessories Market, by Region

- Computer Accessories Market, by Group

- Computer Accessories Market, by Country

- United States Computer Accessories Market

- China Computer Accessories Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 636 ]

Synthesizing Key Insights to Illuminate Future Trajectories and Empower Stakeholders with Clear Strategic Imperatives in the Accessories Sphere

Through a systematic analysis of technological shifts, tariff impacts, segmentation dynamics, and regional distinctions, this report distills the most pressing insights for stakeholders in the accessories domain. The evidence indicates that wireless peripherals, AI-enhanced software suites, and sustainable design initiatives will continue to drive differentiation and command premium valuations. Simultaneously, geopolitical forces and regulatory headwinds necessitate agile supply chain strategies to maintain competitive advantage.

The segmentation deep dive highlights the importance of tailoring product features to distinct user personas-from professional gamers demanding ultra-low latency RF mice and RGB mechanical keyboards to corporate end users prioritizing ergonomic, Bluetooth-enabled solutions. Regional intelligence underscores that no single go-to-market approach will suffice; instead, localized positioning and channel selection are essential to resonate with diverse buyer preferences.

Looking ahead, convergence across gaming, workplace productivity, and streaming entertainment will generate new form factors and convergence devices. Stakeholders who synthesize these trajectories with disciplined execution-balancing innovation investment against operational resilience-will be best positioned to capture the next wave of growth. This concluding synthesis underscores the strategic imperatives that will guide successful navigation of an increasingly complex and dynamic market.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Executive Summary Report Today Access Tailored Strategies to Boost Growth

For personalized guidance on leveraging these insights and for access to the full executive summary with detailed data and strategic analysis, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can provide a tailored consultation and demonstrate how this report’s findings will inform your specific organizational objectives. By engaging directly with him, you will secure a comprehensive resource designed to propel your decision-making and accelerate your growth strategies in the accessories market. Contact Ketan to arrange an in-depth briefing and take the first step toward actionable, data-driven market leadership.

- How big is the Computer Accessories Market?

- What is the Computer Accessories Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?