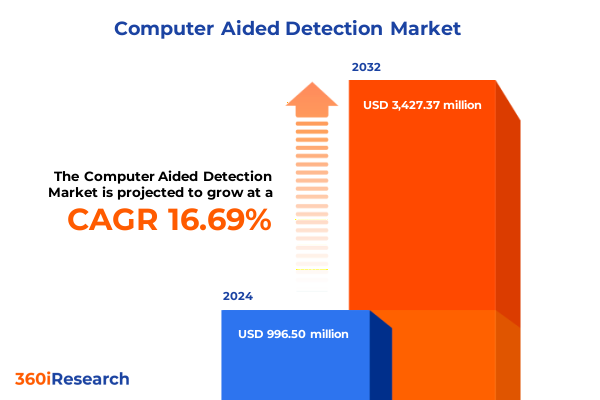

The Computer Aided Detection Market size was estimated at USD 976.45 million in 2025 and expected to reach USD 1,035.45 million in 2026, at a CAGR of 5.64% to reach USD 1,433.96 million by 2032.

Unveiling the Critical Landscape and Strategic Imperatives Driving Evolution in Computer Aided Detection Technologies Worldwide

Computer aided detection has emerged as a vital catalyst in modern healthcare by augmenting clinical decision-making and expediting diagnostic workflows. In recent years, advances in image analysis algorithms, powered by deep learning and enhanced computing infrastructure, have elevated the performance of computerized screening systems to unprecedented levels of accuracy and reliability. Consequently, clinicians and healthcare administrators are increasingly integrating these tools to streamline patient pathways, reduce diagnostic errors, and improve overall outcomes.

Amid this technological evolution, the broader healthcare ecosystem is experiencing a paradigm shift: data-driven insights are now central to both routine examinations and complex oncological assessments. Hospitals and specialized diagnostic centers have begun reallocating budgets to secure scalable software solutions and upgrade imaging modalities, recognizing that smarter detection platforms can lead to earlier interventions and cost efficiencies over time. Furthermore, as regulatory agencies worldwide refine guidelines around algorithmic validation and clinical usability, vendors are racing to align product roadmaps with evolving compliance frameworks to maintain market competitiveness.

As we introduce this executive summary, our aim is to crystallize the intersecting trends, regional nuances, and strategic imperatives that will define the next chapter of computer aided detection. We underscore the necessity for stakeholders across deployment models, component providers, and end users to synchronize innovation pipelines with shifting regulatory landscapes, ensuring that each advancement translates into tangible improvements in clinical effectiveness and patient care.

Identifying the Transformational Forces and Emerging Trends Reshaping the Computer Aided Detection Ecosystem at an Unprecedented Pace

The computer aided detection landscape has undergone seismic transformations driven by breakthroughs in artificial intelligence and cloud computing. Initially constrained by limited computational power and rudimentary image processing algorithms, the industry has transitioned into a phase where deep learning networks, supported by extensive training datasets, deliver robust pattern recognition across diverse imaging modalities. Moreover, the proliferation of platform-as-a-service and software-as-a-service offerings has democratized access to sophisticated analytic pipelines, empowering even smaller diagnostic centers to leverage high-end detection capabilities without heavy on-premise investments.

Simultaneously, end users are recalibrating their expectations: hospitals with dedicated oncology and radiology departments now demand seamless integration between detection software and hospital information systems, fostering real-time collaboration among multidisciplinary teams. Research laboratories, on the other hand, are expanding partnerships with algorithm developers to co-create domain-specific solutions, emphasizing customization and validation against local clinical workflows. In addition, component manufacturers are diversifying their portfolios to offer modular hardware, bespoke services, and advanced software bundles that cater to an array of clinical use cases.

Consequently, imaging modality providers have intensified efforts to embed intelligent analytics directly into modalities such as CT, MRI, PET, ultrasound, and X-ray platforms. This convergence of hardware and software heralds an era of pre-emptive detection, where AI-driven alerts and prognostic indicators can prefigure clinical diagnoses. As the industry continues to evolve at pace, strategic alliances and acquisitions will play a pivotal role in aligning technological capabilities with distinct end-user needs, shaping the next generation of detection ecosystems.

Analyzing the Compounded Repercussions of 2025 United States Tariffs on the Advancement and Deployment of Computer Aided Detection Solutions

In 2025, the United States implemented targeted tariff measures affecting a broad spectrum of high-technology imports, including certain imaging components and ancillary hardware critical to computer aided detection solutions. These tariffs have exerted upward pressure on procurement costs for diagnostic centers and hospitals, compelling software vendors and hardware manufacturers to reassess supply chains. As a result, many stakeholders are exploring localized production strategies or entering collaborative manufacturing agreements to mitigate the financial impact of increased duties.

Furthermore, the ripple effects of these trade barriers have spurred a recalibration of pricing models for services and licensing agreements, particularly within subscription-based on-premise deployments. Cloud-native providers offering platform and software-as-a-service solutions have adapted their contracting frameworks to shield end users from sudden cost fluctuations, often absorbing a portion of duty increases to maintain competitiveness. In parallel, perpetual licensing structures are being renegotiated to include flexible maintenance clauses, thereby enabling institutions to better manage capital allocations amid uncertain regulatory landscapes.

Consequently, the 2025 tariff environment has accelerated the diversification of component sourcing, pushing suppliers to seek alternative manufacturing hubs in Europe, Southeast Asia, and Latin America. This reorientation underscores the critical importance of dynamic supply chain resilience and agile commercial strategies, as industry leaders navigate the compounded economic and operational repercussions of evolving trade policies.

Unraveling Market Segmentation Frameworks to Illuminate Strategic Opportunities across Deployment, End User, Component, Modality, and Application Dimensions

A comprehensive understanding of market dynamics emerges by examining the interplay between deployment preferences, end-user requirements, component architectures, imaging modalities, and application domains. Deployment models bifurcate into cloud-native ecosystems and on-premise infrastructures, each offering distinct benefits: cloud environments leverage scalable platform- and software-as-a-service frameworks to facilitate rapid roll-out of algorithmic enhancements, while on-premise implementations, whether licensed perpetually or via subscription, provide institutions with greater control over data sovereignty and integration pathways.

End-user landscapes span from independent diagnostic centers to large hospital systems, including units specialized in oncology and radiology, as well as research laboratories pursuing cutting-edge validation studies. This diversity underscores the need for adaptive solutions that address both routine screening workflows and advanced investigational protocols. Component considerations further refine market segmentation by encompassing hardware platforms, professional services, and sophisticated software suites. Within software, algorithmic engines-powered by deep learning, conventional machine learning, and rule-based logic-serve as the analytical backbone, interpreting complex visual data across imaging modalities.

Imaging techniques such as computed tomography, magnetic resonance imaging, positron emission tomography, ultrasound, and digital radiography anchor the technological spectrum, with each modality presenting unique data characteristics and detection challenges. Application segments focus squarely on high-impact clinical areas, including breast cancer screening, colorectal lesion detection, lung nodule analysis, and prostate anomaly identification. Together, these interlocking segmentation dimensions shape a nuanced and actionable portrait of where innovations yield maximal clinical and economic value.

This comprehensive research report categorizes the Computer Aided Detection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Imaging Modality

- Deployment

- Application

- End User

Comparative Regional Dynamics Shaping Adoption Rates and Technological Advancements in Computer Aided Detection across Americas, EMEA, and Asia Pacific

Regional dynamics profoundly influence the adoption trajectory and maturity of computer aided detection systems, reflecting variations in healthcare infrastructure, reimbursement frameworks, and regulatory climates. In the Americas, particularly in North America, established reimbursement pathways for AI-enabled diagnostics and a strong emphasis on preventative care drive rapid uptake of cloud-based and on-premise solutions. Private payers and government programs alike incentivize early detection protocols, creating fertile ground for advanced imaging analytics to demonstrate both clinical efficacy and cost-savings over conventional modalities.

Across Europe, the Middle East, and Africa, divergent regulatory approaches and varying levels of digital health readiness produce a mosaic of market conditions. Western European nations, benefiting from centralized health systems and unified certification processes, often lead in integrated deployments of algorithmic detection tools, whereas emerging economies within the region may prioritize more modular and cost-effective service models. In the Gulf states and parts of Africa, public-private partnerships and infrastructure investments are catalyzing pilot programs that blend on-premise architectures with hybrid cloud overlays to manage sensitive patient data.

Moving to Asia-Pacific, the region presents a dual narrative of high-growth markets and established healthcare hubs. Countries with robust domestic manufacturing capacities are competitively reducing hardware costs, while large patient populations and government-led screening initiatives drive demand for scalable analytics. Governments in several Asia-Pacific nations are proactively formulating AI governance frameworks, which in turn shape procurement strategies and encourage local content development, fostering a dynamic ecosystem for computer aided detection innovation.

This comprehensive research report examines key regions that drive the evolution of the Computer Aided Detection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Competitive Intelligence on Leading Stakeholders Driving Innovation and Collaboration within the Computer Aided Detection Industry Value Chain

Leading stakeholders in the computer aided detection arena are actively reshaping the competitive landscape through strategic partnerships, targeted acquisitions, and continuous innovation. Established imaging conglomerates are enhancing their portfolios with algorithm developers and cloud service providers to offer integrated end-to-end solutions that span image acquisition, processing, and diagnostic reporting. Concurrently, pure-play software vendors are fortifying their market positions by securing certifications, expanding clinical validation studies, and establishing regional support centers to address localization needs.

Moreover, system integrators and value-added resellers play a pivotal role in tailoring turnkey packages for healthcare providers, merging advanced detection modules with existing hospital information systems and picture archiving and communication infrastructure. Services firms specializing in data annotation and algorithm training are emerging as critical enablers, bridging the gap between raw imaging datasets and clinically viable software. In parallel, partnerships between academic research institutions and industry players continue to accelerate proof-of-concept initiatives, translating laboratory breakthroughs into commercially deployable models.

In addition, cross-industry collaborations with telecommunications firms and cloud hyper-scalers are unlocking new modalities for real-time collaboration, remote diagnostics, and federated learning environments. This multifaceted competitive ecosystem underscores the need for agile go-to-market strategies that align technical roadmaps with evolving payer models and regulatory approvals, ensuring sustained leadership in a rapidly advancing field.

This comprehensive research report delivers an in-depth overview of the principal market players in the Computer Aided Detection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Fujifilm Holdings Corporation

- GE HealthCare Technologies, LLC

- Hologic, Inc.

- iCAD, Inc.

- International Business Machines Corporation

- Koninklijke Philips N.V.

- Lunit Inc.

- ScreenPoint Medical B.V.

- Siemens Healthineers AG

- Volpara Health Technologies Limited

Strategic Imperatives and Practical Roadmaps for Industry Leaders to Propel Market Expansion and Sustain Competitive Edge in Detection Systems

Industry leaders must adopt a forward-looking stance that balances technological innovation with pragmatic business considerations. First, organizations should prioritize the development of modular software architectures that allow for seamless integration of new algorithmic modules, thereby reducing time-to-market for feature enhancements. Investing in flexible licensing frameworks that accommodate both cloud subscriptions and on-premise perpetual models will enable vendors to address diverse customer procurement preferences.

Furthermore, collaboration with regulatory bodies to establish clear validation pathways can accelerate product approvals, fostering market confidence and expediting clinical adoption. Companies should also cultivate strategic alliances with hardware manufacturers, data annotation specialists, and local integrators to deliver comprehensive solutions that differentiate on service quality and system interoperability. In addition, focusing on region-specific use cases, such as targeted screening programs in emerging markets or specialized oncology workflows in developed regions, will unlock new revenue streams and reinforce value propositions.

Finally, embedding robust post-market surveillance mechanisms, including continuous performance monitoring and customer feedback loops, will not only ensure product efficacy but also inform iterative enhancements. By championing transparency, interoperability, and proactive stakeholder engagement, industry leaders can secure a sustainable competitive edge and steer the future trajectory of computer aided detection.

Detailing the Rigorous Research Methodology and Analytical Approach Underpinning Insights within this Comprehensive Study on Detection Technologies

This study is underpinned by a rigorous research methodology combining primary and secondary data sources, ensuring that the insights accurately reflect market realities and stakeholder perspectives. Extensive interviews with executives, radiologists, and IT specialists provided firsthand accounts of deployment challenges and solution performance. These qualitative engagements were complemented by an exhaustive review of regulatory filings, clinical trial databases, and industry publications to validate technological claims and compliance standards.

Analytical frameworks such as SWOT and supply chain mapping were employed to elucidate competitive pressures and identify potential partnerships. Segmentation analysis, based on deployment models, end-user categories, component typologies, imaging modalities, and application areas, enabled a granular assessment of growth drivers and adoption barriers. This multi-dimensional approach was reinforced by triangulation techniques that cross-verify findings against independent data points, enhancing reliability and reducing bias.

Data synthesis involved thematic clustering of technology trends, regional market nuances, and tariff impacts, yielding a cohesive narrative that informs strategic decision-making. Throughout the research process, best practices in data governance and ethical considerations guided the handling of sensitive information, ensuring confidentiality and compliance with relevant data protection regulations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Computer Aided Detection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Computer Aided Detection Market, by Component

- Computer Aided Detection Market, by Imaging Modality

- Computer Aided Detection Market, by Deployment

- Computer Aided Detection Market, by Application

- Computer Aided Detection Market, by End User

- Computer Aided Detection Market, by Region

- Computer Aided Detection Market, by Group

- Computer Aided Detection Market, by Country

- United States Computer Aided Detection Market

- China Computer Aided Detection Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Critical Findings and Strategic Narratives to Chart Future Directions in Computer Aided Detection Innovation and Market Penetration

The interplay of advanced artificial intelligence, shifting trade policies, and dynamic regional imperatives defines the current era of computer aided detection. As deployment models evolve, cloud-based solutions offer scalable intelligence, while on-premise implementations continue to serve institutions demanding tighter data control. End-user requirements, spanning diagnostic centers, hospital subspecialties, and research environments, underscore the necessity for adaptable solutions that cater to both routine and specialized workflows.

Simultaneously, supply chain realignments in response to tariffs have spotlighted the need for resilient manufacturing strategies and agile pricing mechanisms. Enabling technologies, from deep learning algorithms to hybrid cloud integrations, are unlocking new levels of diagnostic precision across a broad spectrum of imaging modalities and clinical applications. Regional disparities in regulatory frameworks and reimbursement policies further accentuate the importance of localized go-to-market approaches.

In synthesizing these critical findings, it becomes clear that the most successful market participants will be those who harmonize technological innovation with strategic partnerships and regulatory alignment. By leveraging robust segmentation frameworks and continuously refining product offerings in line with user feedback and clinical evidence, stakeholders can chart a future where computer aided detection plays an indispensable role in improving patient care and operational efficiency.

Engage Directly with Ketan Rohom for Personalized Insights and Seamless Acquisition of Premium Computer Aided Detection Market Research Report

For a bespoke discussion tailored to your organization’s objectives and to secure immediate access to our in-depth analysis, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise will guide you through the nuances of computer aided detection developments and provide streamlined pathways for acquiring the full market research report that equips you with critical insights and strategic priorities.

- How big is the Computer Aided Detection Market?

- What is the Computer Aided Detection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?