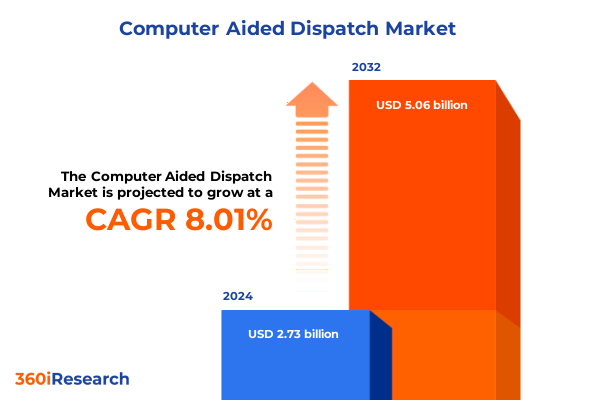

The Computer Aided Dispatch Market size was estimated at USD 2.90 billion in 2025 and expected to reach USD 3.09 billion in 2026, at a CAGR of 8.26% to reach USD 5.06 billion by 2032.

Unveiling the Future of Intelligent Emergency Response Through Advanced Computer Aided Dispatch Systems Fueling Operational Excellence

The landscape of public safety and emergency response has entered a pivotal era, marked by an unwavering demand for operational agility and real-time situational awareness. Computer Aided Dispatch (CAD) solutions, once limited to basic call routing and record keeping, now serve as the nerve center for integrated command and control. Leveraging advanced geospatial data, voice and data integration, and predictive analytics, modern CAD platforms empower first responders with critical, actionable intelligence at the moment of dispatch.

Against a backdrop of rising urbanization, complex threat environments, and an ever-expanding digital infrastructure, agencies and private entities alike seek solutions that transcend traditional workflows. This introduction delineates the core drivers propelling the CAD market’s evolution, outlines key technological inflection points, and sets the stage for an in-depth examination of strategic trends. By understanding these foundational elements, decision makers can better navigate vendor selection, prioritize investment areas, and align their operational objectives with emerging industry benchmarks.

Charting the Next Wave of Innovation Where AI Automation Cloud Connectivity and IoT Converge to Redefine Computer Aided Dispatch Operations

Any comprehensive review of Computer Aided Dispatch must account for the seismic shifts reshaping its technological foundation. Artificial intelligence and machine learning algorithms now anticipate incident patterns, enabling predictive dispatching that reduces response times and optimizes resource allocation. Concurrently, the widespread migration to cloud-native architectures has unlocked scalable deployments, seamless updates, and cross-jurisdictional data sharing without the constraints of legacy on-premise infrastructures.

Moreover, the proliferation of 5G networks and Internet of Things devices-ranging from connected traffic sensors to wearable biometric monitors-has enriched the data ecosystem supporting CAD platforms. These innovations facilitate a level of interoperability where video feeds, telematics, and environmental metrics converge within unified command dashboards. As a result, emergency operations centers can transition from reactive incident management to proactive risk mitigation, ultimately redefining public safety paradigms and elevating the expectations of stakeholders across defense, transportation, and utility sectors.

Assessing the Compounded Effects of 2025 US Tariff Policies on Hardware Supply Chain Costs Software Licensing and Service Delivery within CAD Ecosystems

The enactment of comprehensive tariff policies in early 2025 introduced a new variable into the cost structure of Computer Aided Dispatch ecosystems, primarily affecting hardware procurement and software licensing fees tied to imported components. A sustained 25 percent levy on semiconductor imports has been modeled to erode GDP growth by $1.4 trillion over a decade, translating to increased unit costs for critical CAD system boards and network infrastructure that underpin server farms and data centers. Consequently, technology budgets across public safety and transportation agencies face heightened pressure as procurement cycles adjust to absorb these elevated input prices.

In parallel, proposed levies on electronics containing foreign-manufactured chips threaten to extend cost pressures to end-user devices such as mobile dispatch terminals and in-vehicle tablets. Analysts warn that tariffs approaching 50 percent on copper and certain electronic assemblies could compel broader price adjustments across the supply chain, potentially impacting service-level agreements and maintenance contracts. In response, many organizations have initiated strategic sourcing reviews, weighing alternative domestic suppliers against the higher immediate costs of transition, while balancing long-term resilience against short-term financial impacts. Furthermore, industries most exposed to the tariff regime-ranging from machinery manufacturers to utilities-are proactively diversifying supply chains to mitigate volatility and secure uninterrupted access to essential CAD infrastructure.

Deciphering Market Dynamics through End User Component Deployment Application and Organizational Size to Reveal Targeted Opportunities in CAD Solutions

A granular segmentation framework reveals the nuanced requirements and adoption patterns that characterize the market for Computer Aided Dispatch solutions. When examining end-user verticals, demand signals vary significantly between Defense and Homeland Security entities, which prioritize classified communications and hardened networks, and Public Safety agencies that require granular incident categorization and interoperable dispatch capabilities across EMS, fire, and police operations. Meanwhile, transportation authorities focus on real-time fleet optimization, whereas utility providers integrate outage management and asset tracking.

In dissecting the component layer, pure software offerings differentiate themselves through modular feature sets, while service-led models emphasize managed deployments and professional consulting to address workflow customization and system integration. Deployment mode further stratifies the market: private cloud instances cater to agencies with stringent data sovereignty mandates, whereas public cloud options appeal to entities seeking rapid scalability. On-premise architectures remain prevalent among organizations that maintain legacy infrastructures but are steadily migrating workloads.

The application dimension spans greenfield rollouts, where agencies implement new installations to modernize emergency communications, and upgrade or maintenance engagements that focus on seamless transitions from incumbent platforms. Finally, organization size underscores divergent procurement processes and budgets, with large enterprises pursuing enterprise-wide standardization and small to medium enterprises prioritizing cost-effective, turnkey solutions that deliver essential dispatch functionalities without excessive overhead.

This comprehensive research report categorizes the Computer Aided Dispatch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- End User

Mapping Regional Growth Trajectories and Strategic Adoption Patterns across Americas Europe Middle East Africa and Asia Pacific in the CAD Landscape

Regional dynamics exert a profound influence on the adoption and evolution of Computer Aided Dispatch technologies. Across the Americas, North American agencies lead with early adoption of cloud-based dispatch solutions, driven by robust public safety funding and extensive interoperability mandates, while Latin American markets exhibit growth through targeted pilot programs and localized service partnerships. Investing in bilingual support and region-specific analytics has proven essential for vendors seeking to penetrate underserved municipalities and private security sectors.

In Europe, the Middle East, and Africa, CAD vendors navigate a mosaic of regulatory environments and language requirements. European Union directives on cross-border emergency communications and data privacy have accelerated the uptake of private cloud deployments bolstered by end-to-end encryption. Simultaneously, the Gulf Cooperation Council and North African countries prioritize integrated command centers that unify civilian and defense dispatch, enabling multi-agency coordination during large-scale events and critical infrastructure protection.

Asia Pacific markets present a blend of mature public safety frameworks in countries such as Japan and South Korea, where real-time geospatial analytics and drone integration are increasingly mainstream, and emerging economies in Southeast Asia that rely on managed services to bridge skills gaps and rapidly deploy scalable dispatch solutions. Vendors that tailor offerings to address local language diversity, network reliability constraints, and variable regulatory landscapes have secured significant wins across this dynamic region.

This comprehensive research report examines key regions that drive the evolution of the Computer Aided Dispatch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Positioning Innovation Roadmaps and Competitive Advantages of Leading Global Computer Aided Dispatch Providers Shaping the Market

Global Computer Aided Dispatch providers are intensifying their efforts to differentiate through innovation, strategic alliances, and expanded service portfolios. Established vendors with legacy customer bases have adopted subscription-based licensing to foster predictable revenue streams and fund continuous R&D investments. They are also integrating artificial intelligence modules that automate incident prioritization and resource scheduling, thereby reducing manual intervention and response latency.

Meanwhile, emerging players leverage open-architecture platforms to cultivate partner ecosystems, enabling third-party developers to create specialized modules for emerging use cases like disaster management and cross-border security. These partnerships often manifest as joint go-to-market arrangements with telecommunications providers, underscoring the criticality of network performance in real-time dispatch scenarios. In parallel, some vendors are securing defense contracts by enhancing compliance with government standards such as CJIS and NATO interoperability protocols, positioning themselves as dual-use solution providers.

Service innovation extends to professional consulting offerings that guide agencies through digital transformation roadmaps, emphasizing change management and end-user training to drive adoption. Crucially, vendors that excel in post-deployment support achieve higher renewal rates, as agencies depend on rapid incident response to software issues. This convergence of technology leadership, regulatory compliance, and customer-centric service delivery defines the competitive battleground among leading CAD suppliers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Computer Aided Dispatch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Caliber Public Safety

- Carbyne, Ltd.

- CentralSquare Technologies, Inc.

- CODY Systems

- Everbridge, Inc.

- Frequentis AG

- Hexagon AB

- Mark43, Inc.

- Motorola Solutions, Inc.

- NICE Ltd.

- RapidSOS, Inc.

- Southern Software, Inc.

- TriTech Software Systems

- Tyler Technologies, Inc.

- Versaterm Inc.

- Zetron, Inc.

Actionable Strategies for Industry Leaders to Enhance Scalability Resilience and Value Creation in an Evolving Computer Aided Dispatch Environment

To maintain a competitive edge and secure long-term resilience, industry leaders must embrace a multifaceted strategy that addresses both immediate operational imperatives and future-proofing considerations. First, prioritizing the adoption of cloud-native and microservices architectures will reduce technical debt, accelerate feature rollouts, and enable elastic scaling in response to fluctuating deployment demands. Additionally, integrating predictive analytics and machine learning workflows into core dispatch processes can yield substantial efficiency gains by automating routine tasks and highlighting critical incidents in real time.

Simultaneously, organizations should implement flexible procurement models that accommodate evolving budget cycles and mitigate the impact of external cost pressures, such as tariff fluctuations. Engaging in strategic partnerships with hardware suppliers and alternative sourcing channels can buffer supply chain disruptions while ensuring continuity of service. Furthermore, commitment to rigorous cybersecurity protocols-incorporating zero-trust principles and continuous vulnerability assessments-will safeguard mission-critical communications from emerging cyber threats.

Finally, investing in comprehensive change management and end-user training programs is essential to drive adoption and realize the full potential of advanced dispatch capabilities. By fostering a culture of continuous improvement and cross-functional collaboration-linking dispatch operators, IT personnel, and field responders-organizations can cultivate the agility necessary to adapt to evolving threat landscapes and regulatory demands.

Exploring Rigorous Research Methodologies Integrating Primary Expert Insights Secondary Data Analysis and Robust Validation for CAD Market Intelligence

This research leverages a robust methodology to ensure the validity and reliability of its insights. Primary data were collected through structured interviews with senior decision makers across defense, public safety, transportation, and utilities sectors, providing firsthand perspectives on procurement drivers, operational challenges, and technology roadmaps. Complementing these qualitative insights, a targeted survey of dispatch operators and IT managers captured user satisfaction metrics and feature prioritization trends.

Secondary data sources, including industry whitepapers, regulatory filings, and technology partnership announcements, were systematically analyzed to map vendor capabilities, partnership networks, and emerging use cases. This desk research was augmented by a comprehensive review of policy developments, such as interoperability mandates and data privacy regulations, to contextualize regional adoption patterns. Where appropriate, third-party economic and trade analyses were consulted to assess the implications of tariff regimes and supply chain dynamics.

Throughout the process, data triangulation techniques were applied to reconcile findings across sources, ensuring coherence and accuracy. Finally, draft insights underwent validation by an expert panel comprising former emergency management directors, network engineers, and academic researchers, whose feedback refined the conclusions and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Computer Aided Dispatch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Computer Aided Dispatch Market, by Component

- Computer Aided Dispatch Market, by Deployment Mode

- Computer Aided Dispatch Market, by Organization Size

- Computer Aided Dispatch Market, by End User

- Computer Aided Dispatch Market, by Region

- Computer Aided Dispatch Market, by Group

- Computer Aided Dispatch Market, by Country

- United States Computer Aided Dispatch Market

- China Computer Aided Dispatch Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings to Illuminate the Strategic Imperatives and Growth Pathways for Stakeholders in the Computer Aided Dispatch Sector

In synthesizing the key findings, it is evident that Computer Aided Dispatch systems are advancing from isolated call-routing platforms to dynamic, data-driven command hubs. The convergence of AI, cloud computing, and next-generation connectivity is unlocking transformative capabilities, while tariff-induced cost pressures and supply chain complexities underscore the need for strategic agility. Segmentation analysis reveals that tailored approaches-whether driven by end-user verticals, deployment preferences, or organizational scale-are paramount for vendors aiming to deliver differentiated value.

Regionally, early movers in North America and Western Europe set the innovation benchmark, but emerging markets present fertile ground for growth through managed services and modular deployments. Leading suppliers are distinguished by their ability to navigate complex regulatory landscapes, secure strategic partnerships, and invest in continuous product enhancement and customer support. For stakeholders, the imperatives are clear: adopt flexible architectures, fortify cybersecurity defenses, and cultivate cross-disciplinary collaboration to fully capitalize on advanced dispatch functionalities.

Ultimately, the sustained relevance of CAD solutions will hinge on their capacity to integrate emerging technologies, mitigate operational risks, and align seamlessly with evolving public safety mandates. Recognizing these imperatives equips decision makers with the strategic foresight necessary to harness the full potential of Computer Aided Dispatch in driving safer, more efficient communities.

Engage Directly with Associate Director Sales and Marketing to Secure In-Depth Computer Aided Dispatch Market Intelligence and Accelerate Decision Making

To embark on a deeper exploration of this comprehensive market intelligence, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, whose expertise bridges decision makers with actionable insights. Engaging with Ketan provides a tailored consultation to align the report’s rich findings with your strategic priorities, ensuring that investment decisions are grounded in robust data and nuanced industry knowledge. His guidance will help you navigate the complexities of procurement, identify the most relevant segments, and unlock opportunities that accelerate your organization’s competitive edge.

By connecting with Ketan, you gain a direct line to specialized support that streamlines the acquisition process, offers personalized briefings, and facilitates high-level executive dialogues. Seize this opportunity to transform data into decisive action and fortify your strategic roadmap in the rapidly evolving Computer Aided Dispatch market. Contact Ketan today to secure your access to this indispensable research and propel your organization toward sustained innovation and resilience

- How big is the Computer Aided Dispatch Market?

- What is the Computer Aided Dispatch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?