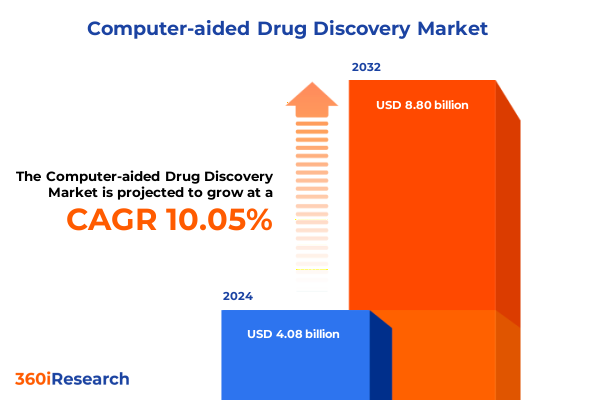

The Computer-aided Drug Discovery Market size was estimated at USD 4.49 billion in 2025 and expected to reach USD 4.90 billion in 2026, at a CAGR of 10.08% to reach USD 8.80 billion by 2032.

Unveiling the Era of Intelligent Molecule Design Powered by Advanced Computer Algorithms and Data-Driven Insights Revolutionizing Pharmaceutical Innovation

The convergence of computational power, advanced algorithms, and vast biochemical datasets has ushered in a new era of drug discovery where speed, precision, and cost-efficiency define success. As the industry navigates ever-increasing pressures to deliver novel therapies rapidly, computer-aided drug discovery stands out as a transformative approach that harnesses machine learning, molecular modeling, and cloud computing to identify promising candidates with unprecedented accuracy. In this evolving landscape, stakeholders across research institutes, biopharma companies, and technology providers are collaborating to overcome traditional bottlenecks and accelerate the timeline from target identification to candidate optimization.

Against this backdrop, our executive summary delves into the critical trends, regulatory influences, segmentation nuances, regional dynamics, and corporate innovations shaping the field today. By examining the interplay between emerging technologies and shifting trade policies, we highlight how organizations can strategically adapt to maintain momentum. This introduction establishes the foundation for understanding how the integration of artificial intelligence, high-performance computing, and multidisciplinary expertise is redefining the paradigms of molecular design. As you explore the subsequent sections, you will gain clarity on the forces driving progress and the choices that can unlock the full potential of computational drug discovery.

How Breakthrough Artificial Intelligence Models and Collaborative Platforms Are Redefining the Computer-Aided Drug Discovery Ecosystem

Over the past five years, leaps in artificial intelligence have catalyzed a profound transformation in how molecular properties are predicted and optimized. Deep learning architectures now enable virtual screening of billions of compounds in a fraction of the time that traditional high-throughput experimentation would require. Concurrently, the proliferation of collaborative platforms has broken down silos between chemists, biologists, data scientists, and clinicians, creating ecosystems where real-time feedback loops drive iterative design enhancements.

In addition, the adoption of cloud-native infrastructures has democratized access to scalable computing resources, allowing small- and mid-sized biotechs to compete alongside large pharmaceutical firms. This shift has been further amplified by open-source initiatives that share validated datasets and algorithmic benchmarks, fostering innovation through collective intelligence. Meanwhile, quantum computing prototypes are beginning to show promise for solving complex molecular interactions that remain intractable on classical machines. Taken together, these advancements signify a departure from one-dimensional computational methods toward a multi-modal, data-centric paradigm that optimizes every stage of the drug discovery continuum.

Analyzing the Ripple Effects of 2025 United States Trade Policies on Global Computational Chemistry and Biopharma Research Supply Chains

In 2025, new trade policies introduced by the United States triggered a chain reaction affecting the global supply chains that underpin computational chemistry workflows. Increased tariffs on specialty reagents, high-performance computing hardware, and software licenses have led to recalibrated sourcing strategies and cost pass-throughs that reverberate across both academic and commercial research entities. Organizations reliant on imported biochemical libraries and custom synthesis services have responded by forging closer partnerships with local vendors and investing in regional capacity building to mitigate exposure to geopolitical shifts.

Furthermore, software providers have begun adjusting their pricing structures and support models to accommodate customers facing escalated import duties, introducing flexible licensing options and modular service bundles. These measures have eased short-term operational pressures, yet have also spurred longer-term considerations around supply chain resilience and portfolio diversification. As a result, many stakeholders are reassessing their deployment footprints, evaluating the balance between on-premises clusters and cloud-based alternatives to ensure continuity and control over critical research assets in the face of evolving trade landscapes.

Decoding Diverse Market Segments Through Molecule Types, Deployment Models, Pricing Structures, and Application Horizons

An in-depth look at key segmentation reveals that the dichotomy between biologics and small molecules continues to influence platform requirements, with biologics discovery workflows placing higher demands on structural modeling and protein-ligand interaction simulations, while small molecule design often prioritizes high-throughput virtual screening and quantitative structure-activity relationship modeling. Meanwhile, enterprises face critical decisions regarding deployment, weighing the agility and lower upfront costs of cloud-based solutions against the security and customization afforded by on-premises installations.

From a pricing perspective, stakeholders must choose between pay-per-use models that scale with compute consumption, perpetual licenses that provide fixed access, and subscription options that bundle updates and support. End users span academic institutions and government labs pursuing fundamental research, biotechnology firms pushing novel therapeutic modalities, contract research organizations delivering turnkey services, and large pharmaceutical companies integrating in silico tools into multi-year development programs. In terms of offerings, some providers focus on consulting, implementation, research outsourcing, and maintenance, while others deliver analytics, de novo design engines, molecular modeling suites, QSAR tools, and virtual screening platforms. Furthermore, underlying technologies such as ADMET prediction, bioinformatics modules for functional genomics, chemoinformatics workflows for library design, and structure-based design algorithms intersect across clinical trials support, lead discovery, lead optimization, preclinical development, and target identification initiatives.

This comprehensive research report categorizes the Computer-aided Drug Discovery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Molecule Type

- Deployment Model

- Pricing Model

- Type

- Technology

- Application

- End User

Unearthing Regional Dynamics Across Americas, EMEA and Asia-Pacific in Computer-Aided Drug Discovery Advancements and Innovation Adoption Patterns

Regional dynamics play a pivotal role in shaping adoption curves for computational drug discovery technologies. In the Americas, robust research infrastructure, supportive funding ecosystems, and proximity to leading contract research organizations have cemented the region as a hotbed for early technology validation and commercialization. This environment encourages the development of hybrid models combining academic excellence with private sector agility.

Across Europe, the Middle East and Africa, collaborative networks driven by public-private partnerships and regulatory harmonization initiatives are accelerating the establishment of pan-regional standards for data sharing and intellectual property protection. These efforts facilitate cross-border consortia that can collectively absorb policy risks and distribute development costs. Conversely, the Asia-Pacific region is experiencing rapid deployment of next-generation platforms fueled by aggressive government investments in biotech hubs, low labor costs, and burgeoning talent pools in artificial intelligence and data science. As a result, innovation adoption patterns vary significantly, with established markets focusing on incremental platform enhancements while emerging markets leapfrog classic workflows in favor of fully integrated digital discovery environments.

This comprehensive research report examines key regions that drive the evolution of the Computer-aided Drug Discovery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Innovators Driving Precision and Scalability in Computational Drug Design and Lifecycle Management

Leading technology providers and research organizations are driving the evolution of computational drug discovery through continuous investment in algorithm refinement and platform interoperability. Some entities specialize in deep learning frameworks that predict molecular properties directly from chemical graphs, while others concentrate on enhancing de novo design algorithms to propose novel scaffolds that meet stringent kinetic and thermodynamic criteria. Partnerships between software vendors and contract research organizations have matured into co-development agreements, ensuring that real-world dataset feedback loops inform product roadmaps.

In parallel, pharmaceutical giants are establishing in-house centers of excellence to integrate computational tools seamlessly with experimental high-throughput screening and medicinal chemistry teams. These centers focus on creating federated data lakes that preserve data privacy while enabling cross-functional analytics. Emerging startups are carving out niches by offering specialized services in ADMET modeling and bioinformatics pipelines for multi-omics integration. Collectively, these corporate strategies underscore a commitment to scaling discovery efforts and reducing the time and resources required to advance candidates through the preclinical pipeline.

This comprehensive research report delivers an in-depth overview of the principal market players in the Computer-aided Drug Discovery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Accelrys, Inc.

- AstraZeneca PLC

- Bayer AG

- Bio-Rad Laboratories, Inc.

- Boehringer Ingelheim International GmbH

- Chemical Computing Group Inc.

- Dassault Systèmes SE

- Eli Lilly and Company

- Gilead Sciences, Inc.

- GlaxoSmithKline PLC

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc.

Strategic Roadmap for Decision Makers to Harness Next-Generation Computational Platforms and Optimize Drug Discovery Pipelines

To capitalize on the accelerating pace of innovation, industry leaders should prioritize investments in hybrid computing infrastructures that blend on-premises security with cloud-native scalability. Adopting open standards for data formats and APIs will enhance interoperability between disparate platforms and accelerate cross-organizational collaboration. In addition, developing in-house talent through targeted training programs in machine learning, cheminformatics, and structural biology will ensure that teams can fully leverage the capabilities of advanced software suites.

Furthermore, forging strategic alliances with regional computational centers and specialty reagent suppliers can mitigate supply chain risks posed by fluctuating trade policies. Leaders should also evaluate flexible pricing agreements that align cost structures with research intensity, enabling them to scale usage as project needs evolve. Finally, integrating feedback mechanisms that capture experimental outcomes into algorithmic training pipelines will create continuous improvement cycles, driving higher confidence in in silico predictions and more efficient progression from lead identification to preclinical validation.

Rigorous Multimodal Research Framework Integrating Quantitative Analysis, Expert Interviews and Technology Benchmarking

Our research methodology blended rigorous secondary research with expert consultations and technology benchmarking exercises. The elicitation of qualitative insights began with a comprehensive review of published literature, patent filings, regulatory filings and academic conference proceedings to identify emerging technology trends and adoption challenges. Subsequently, in-depth interviews were conducted with key stakeholders, including computational chemists, data scientists and R&D executives, to validate hypotheses and uncover latent requirements.

To assess platform capabilities, we executed comparative analyses of leading software suites and service offerings, testing performance across standardized virtual screening tasks, de novo design challenges and ADMET prediction subprojects. Data integrity was ensured through triangulation, cross-referencing primary customer feedback with secondary data points derived from public financial disclosures and scientific publications. Finally, findings were synthesized into strategic frameworks that align technological capabilities with business objectives, ensuring that our recommendations address both current needs and future opportunities within the computer-aided drug discovery landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Computer-aided Drug Discovery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Computer-aided Drug Discovery Market, by Molecule Type

- Computer-aided Drug Discovery Market, by Deployment Model

- Computer-aided Drug Discovery Market, by Pricing Model

- Computer-aided Drug Discovery Market, by Type

- Computer-aided Drug Discovery Market, by Technology

- Computer-aided Drug Discovery Market, by Application

- Computer-aided Drug Discovery Market, by End User

- Computer-aided Drug Discovery Market, by Region

- Computer-aided Drug Discovery Market, by Group

- Computer-aided Drug Discovery Market, by Country

- United States Computer-aided Drug Discovery Market

- China Computer-aided Drug Discovery Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Converging Technologies and Strategic Imperatives Shaping the Future Trajectory of Computer-Aided Drug Discovery

In conclusion, the intersection of advanced computational methodologies, evolving trade landscapes and diversified market segments has created a complex yet opportunity-rich environment for drug discovery organizations. Technological breakthroughs in artificial intelligence, quantum simulations and cloud-driven architectures are dismantling historical barriers, allowing for faster, more accurate prediction of molecular behavior. Meanwhile, stakeholders must navigate regulatory, economic and infrastructural variables that influence platform selection and deployment strategies.

Looking ahead, success will hinge on the ability to integrate cross-disciplinary expertise, maintain supply chain resilience, and continuously refine algorithms with high-quality experimental data. Organizations that adopt modular, interoperable systems and cultivate adaptive partnerships will be best positioned to translate computational insights into clinically viable therapies. As the field advances, the most effective players will be those who balance technological innovation with strategic foresight, ensuring that every computational investment drives measurable progress toward improving patient outcomes.

Contact Ketan Rohom Associate Director Sales & Marketing to Secure Exclusive Insights and Elevate Your Drug Discovery Strategy

To explore how these comprehensive insights can inform your strategic decisions and propel your organization ahead in the competitive landscape of computational drug discovery, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with our team will grant you exclusive access to in-depth analysis, proprietary data interpretations, and personalized advisory tailored to your research objectives. Don’t miss this opportunity to translate cutting-edge intelligence into actionable strategies and secure a competitive edge in your discovery pipeline. Contact Ketan today to secure your copy of the full report and elevate your approach to next-generation drug development.

- How big is the Computer-aided Drug Discovery Market?

- What is the Computer-aided Drug Discovery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?