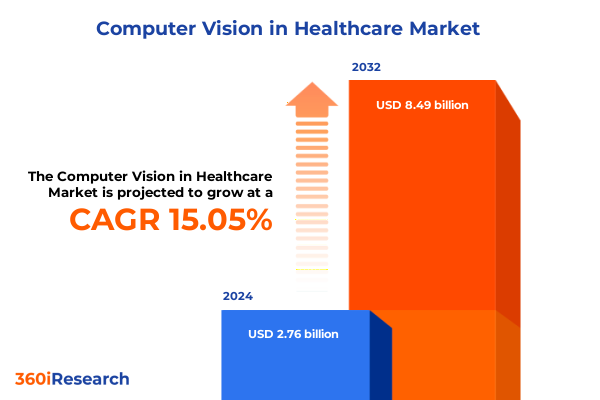

The Computer Vision in Healthcare Market size was estimated at USD 3.16 billion in 2025 and expected to reach USD 3.62 billion in 2026, at a CAGR of 15.17% to reach USD 8.49 billion by 2032.

Pioneering the Future of Healthcare: How Computer Vision Is Revolutionizing Diagnostics Treatment Personalization and Operational Efficiency

The rapid convergence of imaging technologies and artificial intelligence has ushered in a new era for healthcare delivery. Computer vision, the discipline that enables machines to interpret and act on visual data, now powers advanced diagnostic tools, surgical assistance, and patient monitoring systems. This fusion of technologies is reshaping clinical workflows; medical professionals are increasingly relying on automated image analysis to detect pathologies more accurately and at earlier stages. Simultaneously, machine learning algorithms are continuously refining their ability to recognize complex patterns in medical scans, driving greater precision in both diagnosis and treatment planning.

As organizations prioritize digital transformation, computer vision stands out as a pivotal enabler of efficiency and quality improvements. Hospitals, diagnostic centers, and research laboratories are embracing the technology to streamline processes, reduce manual workloads, and lower the incidence of human error. Moreover, integration of vision-based platforms with cloud and edge infrastructure is accelerating the deployment of real-time analytics across the care continuum. Consequently, stakeholders across the healthcare ecosystem-ranging from administrators to clinicians-are witnessing tangible benefits in operational performance, patient outcomes, and cost containment.

How Breakthroughs in AI Architectures Edge Computing and Regulatory Progress Are Redefining Healthcare Computer Vision Capabilities

Over the past few years, breakthroughs in neural network architectures and high-performance compute hardware have radically shifted the trajectory of healthcare computer vision. Deep convolutional networks, bolstered by access to vast annotated datasets, now deliver image analysis with human-level accuracy on tasks such as tumor segmentation and lesion detection. Concurrently, the maturation of edge computing solutions has empowered point-of-care devices to execute complex vision algorithms locally, reducing latency and enabling immediate clinical decision support in remote or resource-constrained settings.

In parallel, regulatory bodies are increasingly recognizing the clinical-grade potential of vision-based solutions, catalyzing faster approval cycles for software as a medical device. Interoperability standards have emerged to facilitate seamless data exchange between imaging modalities and electronic health record systems, fostering more cohesive care pathways. Altogether, these transformative developments are laying the foundation for a truly intelligent healthcare infrastructure in which visual analytics inform every stage of the patient journey.

Assessing the Ripple Effects of Newly Imposed United States Tariffs on Computer Vision Technologies Impacting Cost Structures and Supply Chain Resilience

In early 2025, new United States tariffs targeted key components integral to computer vision systems, including advanced camera modules, high-performance compute chips, and specialized sensor arrays. These measures were introduced as part of a broader trade policy aimed at achieving supply chain resilience for critical technologies. In particular, levies on imported hardware from several major manufacturing hubs have driven an uptick in landed costs for original equipment manufacturers and solution providers, thereby exerting upward pressure on procurement budgets across healthcare institutions.

Yet, the imposition of tariffs has also galvanized strategic responses among industry participants. A growing number of hardware vendors are relocating or expanding production footprints within North America to mitigate import duties. Likewise, distributors are diversifying their supplier networks to include domestic and regional options, thus reducing exposure to geopolitical risks. Over time, these adaptations are expected to foster deeper local ecosystems for camera systems, compute hardware, and sensors, enhancing long-term supply stability. In summary, while tariffs present short-term cost challenges, they are simultaneously accelerating the reshoring of vital manufacturing capabilities that underpin healthcare computer vision innovation.

Deep Dive into Market Segmentation Revealing How Component Types Technology Variants and Application Areas Shape the Trajectory of Computer Vision Adoption

The healthcare computer vision market unfolds across a multifaceted landscape of component categories, each contributing uniquely to solution efficacy. Hardware platforms encompass camera systems capable of capturing high-resolution imagery, compute hardware that accelerates algorithmic inference, and precision sensors that enhance data fidelity. Service offerings complement hardware by delivering professional integration, deployment support, and ongoing maintenance, ensuring that vision solutions remain robust and scalable. Meanwhile, a diverse array of software tools-from deep learning platforms that facilitate model development to specialized image analysis suites-enables data scientists and clinical researchers to build, validate, and refine AI-driven applications.

Technological differentiation further segments the market into artificial intelligence frameworks, deep learning algorithms optimized for intricate vision tasks, and broader machine learning platforms that support hybrid analytical workflows. Deployment modalities range from cloud-native architectures that offer elastic scalability to on-premise installations tailored for environments with stringent data privacy requirements. The intersection of these factors determines solution adaptability to applications such as diagnostic imaging, where high-throughput analysis is paramount, or intraoperative guidance systems that demand real-time responsiveness. Ultimately, end users-including diagnostic centers, hospital networks, and research laboratories-select configurations that align with their unique clinical objectives and operational constraints.

This comprehensive research report categorizes the Computer Vision in Healthcare market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Technology Types

- Deployment Modes

- Application

- End Users

Comparative Regional Dynamics Uncover How Americas Europe Middle East Africa and Asia Pacific Diverge in Driving Healthcare Computer Vision Advancements

Regional dynamics play a pivotal role in shaping the adoption and maturation of computer vision in healthcare. In the Americas, an abundance of venture funding and well-established healthcare infrastructures have spurred rapid integration of vision-based diagnostics and surgical assistance platforms. Stakeholders in Canada and Brazil, for instance, are leveraging pilot programs to validate value propositions before embarking on large-scale rollouts, while the United States continues to lead in regulatory clearances for AI-driven medical devices.

Conversely, Europe, the Middle East, and Africa exhibit a tapestry of regulatory and reimbursement environments that influence market penetration. The European Union’s Medical Device Regulation provides a unified framework yet requires rigorous clinical evidence, prompting vendors to collaborate closely with health systems on real-world validation studies. In the Middle East and Africa, governmental initiatives aimed at digital health transformation are catalyzing investments in telemedicine and remote monitoring, where computer vision augments care delivery across vast geographies.

Meanwhile, the Asia-Pacific region is characterized by aggressive local manufacturing incentives, strategic government funding, and growing research ecosystems. Countries like South Korea and Singapore are at the forefront of developing proprietary vision algorithms, and partnerships with multinational technology firms are accelerating knowledge transfer. Overall, these regional nuances warrant a tailored approach for market entry and expansion.

This comprehensive research report examines key regions that drive the evolution of the Computer Vision in Healthcare market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves by Leading Technology Innovators Shaping the Competitive Landscape and Collaborative Ecosystem in Healthcare Computer Vision Industry

Key industry players have embarked on ambitious strategies to fortify their positions within the healthcare computer vision arena. Leading semiconductor companies are engineering bespoke processors designed for low-power, high-throughput inferencing, while specialist camera manufacturers are integrating AI accelerators directly into imaging modules. Software vendors are pursuing partnerships with academic medical centers and clinical research organizations to co-develop domain-specific algorithms, ensuring that their platforms address real-world diagnostic and therapeutic challenges.

At the same time, marquee cloud providers are expanding their health technology portfolios by offering managed computer vision services compliant with healthcare data security standards. Strategic mergers and acquisitions are on the rise, as evidenced by deals that bring together deep learning startups and legacy medical device companies under unified leadership teams. Collaboration extends beyond corporate alliances; consortia of public and private institutions are pooling resources to create large-scale annotated image repositories, thereby accelerating algorithm training and validation. Together, these initiatives are shaping a competitive landscape defined by technological integration, cross-sector collaboration, and relentless innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Computer Vision in Healthcare market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AiCure, LLC

- Alteryx, Inc.

- Basler AG

- Butterfly Network, Inc.

- Caregility Corporation

- Descartes Labs Inc.

- Enlitic, Inc.

- Fujitsu Limited

- GE HealthCare Technologies Inc.

- Google LLC by Alphabet Inc.

- iCAD Inc.

- InData Labs Group Ltd.

- Innovacio Technologies

- Intel Corporation

- Intelligent Ultrasound Group

- Iterative Health, Inc.

- Keyence Corporation

- Medtronic Inc.

- Microsoft Corporation

- NVIDIA Corporation

- oxipit.ai

- Tempus AI, Inc.

- viso.ai AG

Proactive Strategies for Healthcare Technology Pioneers to Harness Computer Vision Capabilities and Sustain Competitive Advantage in a Dynamic Environment

To capitalize on the growing impact of computer vision, healthcare technology leaders should prioritize investments in modular, interoperable architectures that facilitate seamless upgrades and integration with existing digital health platforms. It is critical to establish partnerships with research institutions and clinical stakeholders early in the development cycle to refine algorithms against diverse patient cohorts, thereby enhancing generalizability and regulatory compliance. In tandem, organizations must allocate resources to workforce development, equipping radiologists, surgeons, and biomedical engineers with the skills required to interpret and trust AI-driven insights.

Furthermore, active engagement with policymakers and standards bodies will help shape balanced regulatory frameworks that encourage innovation while safeguarding patient safety. Leaders should adopt a phased go-to-market strategy that begins with focused pilot studies, gathering real-world evidence before scaling solutions across enterprise networks. Finally, embedding privacy-by-design principles and robust cybersecurity measures into every solution component will protect sensitive medical data and fortify trust among all stakeholders. By following this roadmap, technology providers and healthcare systems can unlock the full transformative potential of computer vision.

Comprehensive Research Framework Combining Qualitative Interviews Quantitative Data Collection and Industry Expert Validation to Ensure Robust Insights

This study leverages a rigorous mixed-methodology approach to deliver comprehensive insights into the healthcare computer vision landscape. The research framework commenced with an extensive secondary analysis of public filings, peer-reviewed journals, and industry white papers to establish foundational knowledge of technology trends and regulatory developments. Building upon this, primary research comprised in-depth interviews with senior executives, clinical specialists, and R&D leaders across geographies to capture nuanced perspectives on adoption barriers and success factors.

Quantitative data collection involved structured surveys administered to decision-makers at hospitals, diagnostic facilities, and research institutions, enabling a granular understanding of deployment preferences and technology performance metrics. Data triangulation was achieved by cross-referencing survey findings with proprietary database analytics and financial disclosures. Finally, iterative validation sessions with a panel of independent experts ensured that the insights are both accurate and actionable. This holistic methodology underpins the credibility of the analysis, offering stakeholders a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Computer Vision in Healthcare market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Computer Vision in Healthcare Market, by Component Type

- Computer Vision in Healthcare Market, by Technology Types

- Computer Vision in Healthcare Market, by Deployment Modes

- Computer Vision in Healthcare Market, by Application

- Computer Vision in Healthcare Market, by End Users

- Computer Vision in Healthcare Market, by Region

- Computer Vision in Healthcare Market, by Group

- Computer Vision in Healthcare Market, by Country

- United States Computer Vision in Healthcare Market

- China Computer Vision in Healthcare Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Underlining the Critical Role of Computer Vision Technologies in Transforming Healthcare Delivery and Outcomes

The collective findings underscore the pivotal role that advanced computer vision technologies now play in elevating healthcare quality and efficiency across the continuum of care. From early detection of complex pathologies to real-time surgical guidance, vision-based solutions are demonstrably reducing diagnostic errors and enabling more personalized treatment pathways. Supply chain realignments, driven in part by new tariff structures, are fostering resilient ecosystems for essential hardware components, while regional variations in regulation and funding continue to shape deployment strategies.

Looking ahead, the integration of computer vision with complementary modalities such as natural language processing and wearable sensor data promises to unlock even more holistic patient insights. Cross-industry collaborations and open innovation models will accelerate the diffusion of breakthroughs, ensuring that hospitals, clinics, and laboratories worldwide benefit from economies of scale. In this dynamic environment, stakeholders who remain agile, invest strategically, and engage proactively with regulatory and clinical communities will emerge as leaders in the next wave of healthcare transformation.

Take Action Today to Engage with Ketan Rohom for Exclusive Insights and Secure Your Comprehensive Healthcare Computer Vision Market Research Report Purchase

To gain unparalleled clarity into the market forces shaping computer vision in healthcare, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. By engaging with him, you will receive tailored guidance on selecting the right package of insights and data that aligns with your strategic objectives and investment horizons. Ketan’s deep understanding of emerging technologies and market dynamics ensures that you will secure the most relevant and actionable intelligence to drive decision-making.

Your next step involves a personalized consultation, during which you can explore premium features such as customized dashboards, expert interviews, and interactive scenario analyses. This guided approach guarantees that you extract maximum value from the research report, optimizing resource allocation and accelerating your go-to-market strategies. Don’t miss the opportunity to transform your strategic plans with authoritative research that has been rigorously validated by domain experts. Connect with Ketan today to secure your purchase and begin harnessing the full potential of computer vision innovations in healthcare.

- How big is the Computer Vision in Healthcare Market?

- What is the Computer Vision in Healthcare Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?