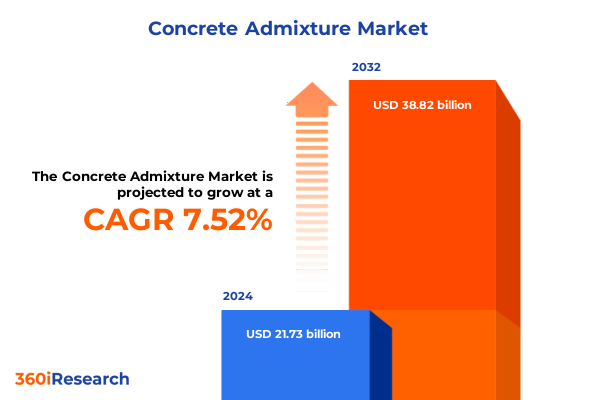

The Concrete Admixture Market size was estimated at USD 23.31 billion in 2025 and expected to reach USD 25.00 billion in 2026, at a CAGR of 7.56% to reach USD 38.82 billion by 2032.

Exploring How Concrete Admixtures Have Transformed Construction Performance Durability and Sustainability While Enabling Innovation in Infrastructure

In recent years the concrete construction industry has witnessed a revolution driven by the strategic use of admixtures designed to enhance performance durability and sustainability. What began as simple chemical additives has evolved into a sophisticated toolkit enabling concrete producers and end users to tailor mix designs to exacting specifications. This shift reflects a broader transformation in construction practices where precision control over setting times strength development and resistance properties has become paramount.

Against this backdrop admixtures have emerged as critical enablers of high-performance concrete solutions. From accelerating agents that facilitate rapid strength gain to superplasticizers that improve workability at low water contents these products are now integral to large-scale infrastructure projects high-rise developments and specialized repair applications. Consequently decision makers across the value chain are investing in new formulations and application protocols to optimize cost efficiency and meet more stringent durability requirements.

Furthermore environmental pressures and sustainability mandates have propelled the development of bio-based and carbon-reducing admixtures that limit cement usage and curb carbon emissions. Combined with digital quality control systems and real-time mix monitoring this trend underscores a new era in which performance reliability and environmental responsibility coexist. As a result stakeholders are rethinking procurement strategies supply chain partnerships and design standards to fully harness the potential of concrete admixtures moving forward.

Identifying the Transformative Shifts in Admixture Technologies Market Dynamics and Regulatory Drivers Shaping the Concrete Industry Landscape

The landscape of concrete admixtures is undergoing transformative shifts driven by technological breakthroughs evolving regulatory demands and changing end-user expectations. Advanced chemistries now integrate nanotechnology and polymer science to deliver multifunctional solutions that not only accelerate or retard set times but also impart self-healing antimicrobial and corrosion-resistant properties. This wave of innovation is redefining competitive differentiation as suppliers race to introduce next-generation additives that address complex project requirements.

Alongside product innovation new regulatory frameworks focused on sustainability and structural safety are reshaping market dynamics. Stricter limits on greenhouse gas emissions and lifecycle environmental impacts have incentivized the adoption of admixtures that facilitate cement reduction and enable the use of alternative binders. Consequently producers are incorporating low-carbon admixture formulations to comply with building codes and green certification standards while maintaining or improving performance metrics.

Moreover the integration of digital tools is accelerating these shifts by providing unprecedented visibility into mix design consistency and on-site quality assurance. Cloud-enabled platforms and IoT-connected sensors allow real-time adjustments and predictive maintenance for admixture dispensing systems. In turn this digital transformation fosters greater operational agility and risk mitigation throughout the supply chain, enabling contractors and material suppliers to navigate an increasingly complex regulatory and market environment with confidence.

Analyzing the Cumulative Impact of New Tariff Measures and Trade Policies on the United States Concrete Admixture Market in 2025

The implementation of new tariff measures by the United States in 2025 has generated ripple effects across the global supply chain for concrete admixtures. Import duties on key chemical precursors have led manufacturers to reexamine sourcing strategies and consider reshoring certain production processes. As tariffs have elevated input costs imported admixtures have become more expensive for domestic users prompting a shift toward local suppliers and alternative raw materials that fall outside the scope of these trade measures.

In response to rising price pressures many companies have entered strategic partnerships with domestic chemical producers to secure consistent supply and mitigate volatility. Additionally end users have accelerated the adoption of admixtures formulated from regionally available materials in order to maintain project budgets and timelines. These adjustments have been further reinforced by value-engineering initiatives where engineers optimize mix designs to reduce reliance on higher-cost additive types without compromising performance.

Consequently the tariff-driven realignment has cultivated a more resilient North American admixture ecosystem characterized by expanded in-country capacity and diversified supplier bases. Although cost increases persist in the near term this reconfiguration is expected to foster long-term efficiency gains, reduce exposure to external trade risks and reinforce the strategic importance of supply chain agility within the concrete admixture sector.

Unveiling Key Segmentation Insights Across Product Types Materials Forms Applications and End Users to Guide Strategic Decision Making

Insights into concrete admixture performance and adoption trends can be drawn from an in-depth segmentation based on the types of additives used within mix designs. By type accelerating admixtures are driving early strength development in cold-weather and fast-track construction projects while air-entraining agents enhance freeze-thaw resilience in harsh climates. Bonding admixtures improve adherence in restoration applications whereas corrosion inhibitors extend the service life of reinforced concrete structures. Meanwhile retarding admixtures facilitate long transit times and complex formwork schedules, shrinkage-reducing agents limit crack formation in large slabs, superplasticizers allow for high workability at low water-cement ratios, and water-reducing admixtures help minimize overall cement consumption and environmental impact.

Another pivotal dimension lies in material type where natural admixtures sourced from minerals or plant extracts coexist with synthetic polymer-based alternatives. Natural options appeal to projects prioritizing green credentials yet may exhibit variability in performance, whereas synthetic admixtures offer consistent quality and customization potential for demanding engineering requirements. In tandem form-based segmentation distinguishes between liquid admixtures that enable precise metering and rapid dispersion and solid formulations in granulated or powder form that support on-site blending flexibility and extended shelf life under variable storage conditions.

Applications further refine the narrative by separating building and construction projects from infrastructure and specialized repair structures. Within building and construction commercial high-rise developments, industrial facilities and residential housing each present unique admixture demands related to workability aesthetic finish or load-bearing criteria. Infrastructure projects such as bridges tunnels and roads require additives optimized for durability and long-term performance. Repair structures rely on bonding and corrosion-inhibiting admixtures to restore structural integrity. Finally end users including architects civil engineers contractors and project owners each influence the selection and specification process, balancing technical performance with project timelines and budget constraints.

This comprehensive research report categorizes the Concrete Admixture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Type

- Form

- Application

- End User

Examining Regional Variations in Concrete Admixture Demand and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific

Regional demand patterns for concrete admixtures reveal distinct priorities and growth drivers across the Americas Europe Middle East Africa and Asia Pacific. In the Americas infrastructure modernization programs coupled with robust residential and commercial construction pipelines have accelerated adoption of performance-enhancing additives. As a result suppliers with strong local manufacturing footprints have gained an edge by reducing lead times and transportation costs, thereby appealing to cost-conscious contractors and developers.

Across Europe the Middle East and Africa sustainability regulations and stringent building codes have spurred the uptake of low-carbon and multifunctional admixtures. Moreover public-private partnerships in large infrastructure undertakings have created opportunities for admixture formulations that deliver extreme durability and reduce life-cycle maintenance requirements. In parallel high-growth markets in the Middle East are investing in advanced admixtures to support ambitious urban development and transportation networks under harsh environmental conditions.

Asia Pacific remains a leading region in terms of raw admixture consumption driven by rapid urbanization industrial expansion and government investment in smart city initiatives. In many markets the emphasis on high-rise construction, resilient infrastructure and resource efficiency has elevated the importance of superplasticizers and corrosion inhibitors. Furthermore regional manufacturers are innovating cost-effective formulations tailored to local climatic and logistical challenges, reinforcing the competitive landscape by offering value-added technical support and field services.

This comprehensive research report examines key regions that drive the evolution of the Concrete Admixture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Companies Innovative Collaborations and Strategic Initiatives Driving Competitive Advantage in the Concrete Admixtures Market

Leading players in the concrete admixture market have distinguished themselves through a combination of robust research and development investments strategic collaborations and targeted geographic expansion. By forging alliances with cement producers and construction technology firms these companies have enhanced their product portfolios and extended their service offerings to include digital quality control systems and on-site support programs. Consequently they have solidified relationships with key contractors and engineering firms looking for end-to-end solutions rather than standalone products.

Furthermore top contenders have pursued selective acquisitions and joint ventures to access new markets and leverage specialized chemistries. This inorganic growth strategy has enabled rapid entry into regions with complex regulatory requirements and unique raw material profiles, thereby strengthening the resilience of their global supply chains. In addition these firms have launched pilot projects incorporating innovative admixture blends designed to meet strict low-carbon building standards and circular economy objectives.

At the same time emerging companies are challenging incumbents by focusing on niche applications and bespoke formulations. By prioritizing responsiveness and localized technical expertise these agile organizations are gaining traction in repair and restoration segments where adaptability and rapid turnaround are critical. Collectively such competitive maneuvers are raising the bar for customer expectations and accelerating the pace of innovation across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Concrete Admixture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACC Limited

- Alumichem A/S

- Aura Polymer Australia

- BASF SE

- Bostik SA

- Cementaid International Group of Companies

- CEMEX S.A.B. de C.V.

- CICO Group

- Compagnie de Saint-Gobain

- Concrete Additives and Chemicals Private Limited

- Cormix International Limited

- Cortec Corporation

- Fosroc Group

- Fritz-Pak Corporation

- Ha-Be Betonchemie GmbH

- MAPEI S.p.A.

- MUHU (China) Construction Materials Co., Ltd.

- MYK Arment Private Limited

- Normet Group

- RAZON ENGINEERING CO. PVT. LTD.

- Rhein-Chemotechnik GmbH

- Riteks Inc.

- RPM International Inc.

- Sika AG

- The Dow Chemical Company

- Thermax Limited

- WEIFANG BEACON CHEMICAL BUILDING MATERIALS CO., LTD

- Xuzhou Giant Building Materials Co., Ltd.

- Yara International ASA

Identifying Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Position in Concrete Admixtures

Industry leaders seeking to maintain or expand their market share should prioritize continuous innovation by allocating resources to advanced admixture research and development initiatives. By fostering partnerships with academic institutions and technology startups they can accelerate the introduction of next-generation formulations that address emerging performance and sustainability requirements. This collaborative approach will also help in staying ahead of evolving regulatory landscapes and green building certifications.

In addition strengthening supply chain resilience is paramount in light of shifting trade policies and raw material uncertainties. Companies can achieve this by diversifying supplier networks establishing regional production hubs and investing in inventory management technologies that provide real-time visibility across operations. By doing so they will minimize disruptions and enhance responsiveness to dynamic market conditions.

Finally focusing on end-user education and technical services can unlock new revenue streams and deepen customer loyalty. Offering customized training programs field support and digital mix-optimization tools will empower architects contractors and project owners to maximize the benefits of advanced admixtures. This value-added strategy reinforces market positioning and creates a competitive moat in an increasingly commoditized environment.

Outlining a Rigorous Research Methodology Emphasizing Data Collection Analysis and Validation Processes for Comprehensive Insights

The research methodology underpinning this analysis combines rigorous primary and secondary data collection techniques to ensure comprehensive and reliable insights. Primary research involved structured interviews with material suppliers admixture manufacturers contractors and engineering consultants to validate product performance trends and adoption barriers. These one-on-one discussions provided qualitative context and real-world perspectives that informed key findings.

Secondary research encompassed a thorough review of industry publications technical white papers and regulatory documents to map historical developments and emerging market drivers. Statistical data from government agencies trade associations and material science journals were triangulated to establish a robust understanding of production and consumption patterns. Throughout the process all information was cross-verified against multiple credible sources to minimize bias and enhance analytical accuracy.

Quantitative analysis utilized data normalization and trend modeling techniques to detect growth patterns and assess the impact of external factors such as tariffs and environmental regulations. Qualitative insights were synthesized through thematic analysis to uncover nuanced stakeholder priorities and strategic imperatives. This mixed-methods approach ensures that conclusions are both data-driven and grounded in operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Concrete Admixture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Concrete Admixture Market, by Type

- Concrete Admixture Market, by Material Type

- Concrete Admixture Market, by Form

- Concrete Admixture Market, by Application

- Concrete Admixture Market, by End User

- Concrete Admixture Market, by Region

- Concrete Admixture Market, by Group

- Concrete Admixture Market, by Country

- United States Concrete Admixture Market

- China Concrete Admixture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Core Findings and Their Implications for Stakeholders Navigating the Evolving Concrete Admixture Industry Landscape

This executive summary has highlighted the pivotal role of concrete admixtures in advancing construction performance durability and sustainability across diverse applications. By examining transformative technological shifts regulatory developments and the repercussions of new tariff measures we have illuminated the strategic imperatives facing industry participants. Furthermore segmentation and regional analyses have underscored the multifaceted nature of demand drivers and the importance of tailored solutions for different markets and end-user groups.

Key competitive insights reveal that innovation alliances regional expansion and end-user engagement are foundational to securing long-term advantage. Meanwhile the evolving trade environment and sustainability mandates require agile supply chain strategies and proactive product development roadmaps. Taken together these findings signal a dynamic landscape in which stakeholders must continuously adapt to seize emerging opportunities and mitigate potential risks.

Ultimately this report serves as a strategic compass for architects engineers contractors and material suppliers navigating the intricacies of the concrete admixture market. By leveraging the insights presented here stakeholders can make informed decisions that propel project success align with environmental objectives and sustain competitive differentiation.

Connect with Ketan Rohom Associate Director Sales and Marketing to Secure Your Customized Concrete Admixture Market Research Report Today

For a personalized walkthrough of detailed insights and strategic guidance tailored to your organization’s needs reach out to Ketan Rohom Associate Director Sales and Marketing at 360iResearch today to secure your comprehensive concrete admixture market research report and position your team to capitalize on the latest industry developments

- How big is the Concrete Admixture Market?

- What is the Concrete Admixture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?