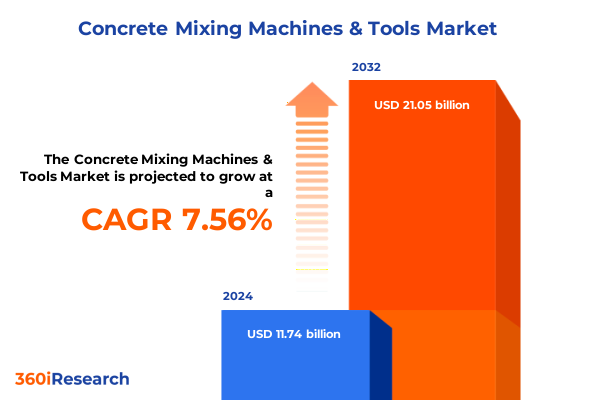

The Concrete Mixing Machines & Tools Market size was estimated at USD 12.55 billion in 2025 and expected to reach USD 13.42 billion in 2026, at a CAGR of 7.66% to reach USD 21.05 billion by 2032.

Setting the Stage for Understanding the Evolving Concrete Mixing Equipment Ecosystem and Its Pivotal Influence on Modern Construction Projects Worldwide

The concrete mixing machinery sector stands at the heart of modern infrastructure development, underpinning projects that range from towering skyscrapers to expansive road networks. Anchored by continuous innovation and evolving construction demands, this market has witnessed a remarkable transformation over recent years. Stakeholders across the value chain, including equipment manufacturers, contractors, and investors, increasingly recognize the critical importance of selecting the right mixing solutions to achieve efficiency, cost-effectiveness, and sustainability goals.

As urbanization accelerates and public infrastructure spending intensifies, the demand for reliable and high-performance concrete mixers has surged. Technological advancements in automation and power efficiency are driving a shift away from traditional manual processes, enabling faster cycle times and consistent quality. At the same time, environmental considerations and regulatory pressures are prompting manufacturers to explore cleaner power sources and optimized machine designs. Against this backdrop, it becomes imperative for decision-makers to gain a holistic understanding of market dynamics, technology trends, and regulatory landscapes to chart a successful growth trajectory in the competitive arena of concrete mixing equipment.

Identifying the Key Transformative Forces Reshaping the Concrete Mixing Machinery Landscape in Recent Years

Over the past decade, the landscape of concrete mixing machinery has undergone profound shifts driven by converging technological, economic, and regulatory forces. Automation technologies, such as automated batch control systems and remote monitoring capabilities, have redefined operational norms, enabling contractors to achieve unprecedented precision while reducing labor intensity. As digitalization permeates construction sites, data-driven maintenance and performance analytics have emerged as critical enablers of uptime optimization and lifecycle cost reduction.

Economic factors have also played a transformative role. Variations in raw material prices and supply chain disruptions have incentivized end users to seek machines that offer flexibility in handling diverse mix formulations and rapid adaptability to changing project requirements. Furthermore, stricter emissions standards and sustainability goals have propelled the adoption of electric and hybrid power sources, marking a departure from traditional diesel-driven models. These dynamics collectively underscore a market environment in which agility, technological prowess, and regulatory compliance converge to determine competitive advantage.

Assessing the Comprehensive Impact of New United States Tariffs Introduced in 2025 on Concrete Mixing Equipment Dynamics

In 2025, the introduction of revised United States tariffs on imported construction machinery has introduced new variables into the strategic calculus for equipment manufacturers and end users alike. By increasing the cost of certain foreign-made concrete mixers and related components, these measures have driven a re-evaluation of global sourcing strategies. Some manufacturers have accelerated localization efforts to insulate their supply chains from tariff volatility, expanding production capacities within North America and forging partnerships with regional suppliers to ensure consistency in component availability.

Conversely, contractors and distributors have adjusted procurement plans, factoring in longer lead times and potential cost escalations. In response, several OEMs have introduced value-engineered models designed to deliver core performance metrics at more accessible price points, effectively mitigating tariff-driven inflation. This recalibration of pricing structures and manufacturing footprints has significant implications for competitive dynamics, compelling stakeholders to balance compliance, cost management, and product differentiation in an increasingly protectionist trade environment.

Uncovering Profound Insights Derived from Segmentation by Capacity, Power Source, Operation Technology, and End Use in Concrete Mixing

The diverse configurations of concrete mixing machinery cater to a wide spectrum of operational requirements, and a nuanced segmentation analysis reveals clear preferences emerging across different market segments. Equipment handling volumes between one and three cubic meters has gained traction for mid-scale commercial and light industrial applications, balancing throughput with maneuverability. Machines above three cubic meters continue to dominate large infrastructure and heavy commercial projects, where high-capacity batching dictates the need for robust, high-throughput configurations. Conversely, compact models below one cubic meter retain relevance for residential and small contractor operations, offering affordability and ease of use in constrained job sites.

Power source preferences further demarcate equipment choices. Diesel-driven mixers have historically represented the backbone of remote and large-scale operations due to fuel availability and torque characteristics. However, electric motor–powered alternatives are rapidly penetrating urban and enclosed environments where emissions controls are stringent and noise reduction is a priority. Petrol-engine units remain a niche but valuable option for small-scale contractors seeking low initial investment and simple maintenance. Technological segmentation underscores the ascendancy of automatic machines, which leverage programmable logic controllers to deliver precise mix formulations and reduced human error, while manual and semi-automatic variants persist in markets where cost sensitivity and operator familiarity predominate. Finally, end-use considerations split demand streams among commercial construction, infrastructure projects, and residential construction, each driving distinct machine specifications, service requirements, and aftermarket expectations.

This comprehensive research report categorizes the Concrete Mixing Machines & Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mixing Capacity

- Power Source

- Technology

- End Use

Analyzing Regional Divergence and Convergence Trends Across Americas Europe Middle East Africa and Asia Pacific in Concrete Mixing

Regional dynamics in the concrete mixing machinery market exhibit a complex mosaic characterized by varying growth trajectories and competitive landscapes. In the Americas, robust infrastructure investment and residential development continue to buoy demand for high-capacity and hybrid-power mixers. North American contractors increasingly prioritize machines that integrate telematics and sustainability features, while Latin American markets maintain strong interest in cost-effective diesel-engine–driven models adapted to diverse climatic conditions.

Across Europe, the Middle East, and Africa, stringent emissions regulations and ambitious urban redevelopment projects drive demand for electric and semi-automatic mixers tailored to metropolitan environments. European manufacturers lead the charge with advanced automation and green technology integration, whereas Middle Eastern infrastructure expansions spotlight large-capacity units optimized for arid, high-temperature conditions. African markets, by contrast, remain price-sensitive, with a pronounced preference for diesel-powered, manually operated machines that facilitate straightforward maintenance and local repair.

In the Asia-Pacific region, rapid urbanization and mega-infrastructure ventures under initiatives like the Belt and Road drive a heterogeneous demand profile. China and India dominate consumption, with a balanced mix of automatic and heavy-duty capacity machines, while Southeast Asian economies show growing enthusiasm for portable, electric-powered models that address environmental concerns and grid reliability. These divergent regional patterns underscore the need for manufacturers to tailor product portfolios and go-to-market strategies to localized needs and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Concrete Mixing Machines & Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Competitive Movements and Profiles of Leading Concrete Mixing Equipment Manufacturers Worldwide

The competitive landscape of concrete mixing machinery is shaped by a blend of long-established industrial players and innovative challengers. Leading manufacturers have solidified positions through strategic acquisitions, collaborative ventures, and continual product innovation. Several global OEMs have leveraged their broad distribution networks and service capabilities to introduce advanced automatic and hybrid power solutions, reinforcing brand loyalty among large contractors and government agencies.

Emerging companies, meanwhile, are carving out niches by focusing on specialized applications such as mobile mixers for remote sites or electric compact units for urban refurbishment. These entrants often employ agile development cycles to pilot novel features like real-time mix quality diagnostics and modular component designs. Partnerships between machinery makers and software providers are also proliferating, resulting in integrated hardware–software ecosystems that enhance predictive maintenance and resource optimization.

Amid these dynamics, aftermarket service models have become a key battleground. Manufacturers offering comprehensive service contracts, remote monitoring packages, and flexible upgrade paths have gained traction, especially among operators seeking to maximize equipment uptime and total cost of ownership predictability. The interplay between product innovation, service excellence, and strategic alliances continues to redefine competitive hierarchies in the concrete mixing machinery market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Concrete Mixing Machines & Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajax Engineering Ltd.

- Ammann Group Holding AG

- Apollo Inffratech Pvt Ltd.

- Atlas Equipments Pvt Ltd.

- CIFA S.p.A.

- Conmat Machinery India Pvt Ltd.

- Dewan Equipment Industries India Ltd.

- Elkomix Makina Sanayi Ve Ticaret A.Ş.

- Fiori Group S.p.A.

- Gamzen Plast Pvt Ltd.

- Indabar – Concrete Equipment Pvt Ltd.

- John Infra Equipment Pvt Ltd.

- Liebherr‑International AG

- MEKA Crushing & Screening and Concrete Batching Technologies

- Sany Heavy Industry Co., Ltd.

- Schwing Stetter GmbH

- Schwing Stetter India Pvt Ltd.

- Shandong Yuanyou Heavy Industry Science & Technology Co., Ltd.

- Teka Maschinenbau GmbH

- Terex Corporation

- VMP Concrete Equipment Pvt Ltd.

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

- Zoomlion India Infrastructure Co., Ltd.

Delivering Actionable Strategic Recommendations to Strengthen Market Positioning and Drive Growth in Concrete Mixing Machinery

Industry leaders seeking sustainable competitive advantages should prioritize a multi-faceted strategy that combines technological leadership, operational resilience, and customer-centric service offerings. Investing in advanced automation and digital platforms will not only enhance machine performance but also foster deeper customer engagement through data-driven insights. Strengthening local manufacturing footprints, particularly in regions affected by tariff fluctuations, can mitigate supply chain risks and reduce time to market.

Simultaneously, diversifying power source portfolios to include electric and hybrid models will address tightening emissions regulations and evolving end-user preferences. Establishing partnerships with energy providers or infrastructure developers can facilitate innovative financing and leasing models that lower the barrier to adoption. Equally important is the development of modular, upgradable platforms that enable incremental enhancements, preserving the relevance of installed bases and unlocking recurring revenue streams through aftermarket upgrades and service contracts.

Detailing the Rigorous Research Methodology Underpinning the Comprehensive Market Analysis of Concrete Mixing Machinery

The findings presented in this report are grounded in a robust research framework that integrates multiple sources and analytical techniques. Primary research included in-depth interviews with key stakeholders such as equipment manufacturers, distributors, contractors, and industry associations. These conversations provided nuanced perspectives on technological advancements, procurement considerations, and regulatory impacts across key markets.

Secondary research encompassed a thorough review of industry publications, government tariff notifications, patent filings, and corporate financial disclosures. Quantitative analysis incorporated data triangulation to reconcile insights from company reports, trade data, and site observations. Segmentation analyses leveraged institutional databases and expert consultations to refine categorizations by mixing capacity, power source, technology, and end use. Regional dynamics were synthesized through comparative assessments of infrastructure spend projections, construction activity indices, and policy frameworks. This multi-pronged methodology ensures the reliability and comprehensiveness of the insights delivered.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Concrete Mixing Machines & Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Concrete Mixing Machines & Tools Market, by Mixing Capacity

- Concrete Mixing Machines & Tools Market, by Power Source

- Concrete Mixing Machines & Tools Market, by Technology

- Concrete Mixing Machines & Tools Market, by End Use

- Concrete Mixing Machines & Tools Market, by Region

- Concrete Mixing Machines & Tools Market, by Group

- Concrete Mixing Machines & Tools Market, by Country

- United States Concrete Mixing Machines & Tools Market

- China Concrete Mixing Machines & Tools Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Perspectives Emphasizing Critical Takeaways and Future Outlook for Concrete Mixing Equipment Stakeholders

In conclusion, the concrete mixing machinery market is characterized by dynamic interplay among technological innovation, regulatory pressures, and shifting customer demands. Automation and electrification represent twin pillars of future growth, driven by the dual imperatives of operational efficiency and environmental stewardship. Tariff-induced realignments in production and sourcing underscore the importance of flexible strategic planning and local engagement. Meanwhile, segmentation insights highlight diverse requirements across capacity, power, technology, and end-use segments, mandating tailored product and service offerings.

Regional analysis reveals that no single market dominates in isolation; rather, success will accrue to manufacturers capable of adapting to local regulations, infrastructure priorities, and customer expectations. Competitive leadership rests on the ability to integrate product innovation with comprehensive service models, fostering long-term partnerships and stable revenue streams. As the sector moves forward, stakeholders who leverage data-driven decision-making and collaborative ecosystems will be best positioned to capitalize on emerging opportunities and navigate the challenges of an evolving construction landscape.

Immediate Engagement Opportunity Shared by Ketan Rohom to Secure the Definitive Concrete Mixing Machinery Market Research Report

Are you ready to gain an unparalleled strategic advantage in the concrete mixing machinery market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, and take the next step toward unlocking in-depth market insights tailored to your organization’s needs. This comprehensive report offers the critical intelligence required to make informed decisions, navigate regulatory complexities, and capitalize on emerging trends across capacity, power source, technology, end use, and regional dynamics. Engage directly with Ketan to discuss how this research can be customized to address your unique objectives, ensuring you stay ahead in a rapidly evolving industry. Seize this opportunity today to transform your growth strategy, strengthen your competitive positioning, and drive lasting success in the concrete mixing equipment sector.

- How big is the Concrete Mixing Machines & Tools Market?

- What is the Concrete Mixing Machines & Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?