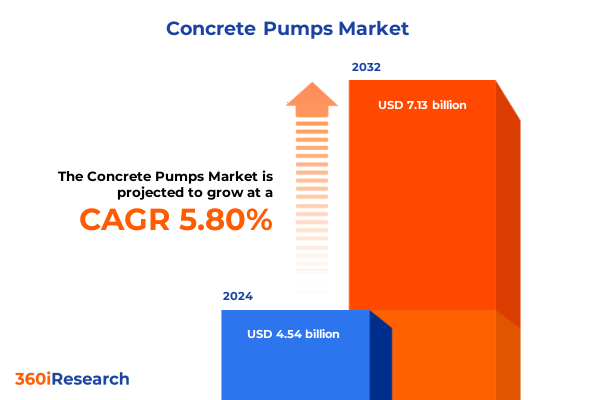

The Concrete Pumps Market size was estimated at USD 4.80 billion in 2025 and expected to reach USD 5.07 billion in 2026, at a CAGR of 5.82% to reach USD 7.13 billion by 2032.

Unveiling the Strategic Importance and Evolving Dynamics of Concrete Pumps in Supporting Modern Construction Efficiency and Productivity

In an era where construction timelines are increasingly compressed and quality standards continue to ascend, concrete pumps have emerged as vital enablers of precision, speed, and safety across building and infrastructure projects. From the sprawling urban skylines of North America to remote infrastructure developments in emerging markets, these specialized machines deliver fluid concrete accurately to hard-to-reach locations, circumventing traditional manual methods that are labor-intensive and prone to variability. The growing complexity of architectural designs, coupled with an emphasis on modular and precast techniques, underscores the essential role that boom and line concrete pumps play in contemporary construction workflows.

Transitioning beyond mere volumetric placement devices, modern concrete pumps also integrate advanced hydraulics and digital controls to optimize flow and reduce waste. As technological advancements converge with sustainability imperatives, manufacturers are accelerating development of electric and hybrid power solutions to minimize emissions and noise, thereby meeting stricter regulatory requirements and onsite operational constraints. This landscape demands that stakeholders-from contractors and rental companies to equipment lessors-understand both fundamental pump operations and emergent innovations that collectively redefine productivity and environmental performance in concrete construction.

Exploring the Transformative Technological and Operational Shifts Redefining Concrete Pump Solutions for Enhanced Performance and Sustainability

The concrete pump industry is witnessing a paradigm shift driven by innovations that extend well beyond incremental enhancements in discharge capacity. Automation of pump monitoring, incorporating Internet of Things connectivity and predictive maintenance algorithms, is reshaping how field service teams anticipate equipment downtime and plan interventions. This proactive approach reduces unplanned stoppages and lowers life-cycle costs, ensuring that projects adhere to stringent schedules in both urban high-rise sectors and large-scale infrastructure works.

Concurrently, material science breakthroughs have led to the development of advanced admixtures and high-performance concrete formulations that optimize rheology, enabling smoother pumping at higher pressures and with reduced wear on internal components. Such material compatibility testing is facilitating the deployment of high flow rate solutions, effectively balancing operational throughput with longevity of critical parts. Moreover, digital twins and simulation tools are offering virtual commissioning environments where pump configurations and hydraulic settings can be fine-tuned for site-specific conditions ahead of mobilization, thereby accelerating project kick-offs and minimizing risk under complex geotechnical scenarios.

Assessing the Comprehensive Ramifications of 2025 United States Tariffs on Concrete Pump Manufacturing Supply Chains and Market Economics

In 2025, elevated tariffs on imported steel, hydraulic components, and electric motor assemblies have exerted pronounced pressure on the cost structures of concrete pump manufacturers and end-users alike. As domestic steel prices rose in response to safeguard measures, producers faced a dual challenge: absorbing price increases or passing them through to contractors who were already navigating tight project budgets and labor constraints. Many OEMs responded by intensifying localization efforts, forging strategic partnerships with domestic suppliers to mitigate exposure to global supply chain volatility.

These tariff-induced dynamics also accelerated consolidation within the component manufacturing sector. Niche hydraulic pump and valve specialists explored mergers or long-term supply agreements with larger conglomerates to maintain scale efficiencies and R&D investment capacity. Concurrently, industry participants re-examined total cost of ownership analyses, factoring in tariff escalation scenarios and inventory financing strategies as core components of procurement planning. Contractors and rental firms, in turn, prioritized service agreements that offered fixed-rate maintenance contracts to hedge against further input cost variability, ensuring more predictable operational budgets amid a shifting trade policy environment.

Delivering In-Depth Segmentation Insights That Illuminate Pump Type Mobility Power Source Flow Rate Application and End-User Dynamics

A nuanced understanding of market segmentation illuminates how product differentiation and customer requirements coalesce to drive strategic positioning across concrete pump offerings. When evaluating by pump type, the distinct advantages of boom-mounted articulating equipment compared to line pumps must be considered, with boom configurations delivering reach and placement precision in high-rise applications while line pumps offer flexible hose deployment for narrow or subterranean work sites. Mobility further divides the landscape into stationary solutions that anchor for long-duration pours and mobile systems-whether trailer-mounted or truck-mounted-that facilitate rapid re-deployment across multiple job sites.

The shift toward electrification adds another layer of complexity, as diesel-driven units are now complemented by both grid-tied electric pumps for noise-sensitive urban environments and battery-electric models designed for off-grid projects and low-emission zones. Flow rate requirements create further segmentation, ranging from high-capacity pumps for large infrastructure pours to medium and low flow rate units optimized for tight tolerances in residential or decorative concrete applications. Finally, customer verticals span building construction through to industrial and commercial projects, infrastructure initiatives including bridges, roads, and tunnels, and even residential developments, with the end-user profile oscillating between contractor ownership models and rental-based strategies that prioritize flexibility and cost management.

This comprehensive research report categorizes the Concrete Pumps market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pump Type

- Mobility

- Power Source

- Flow Rate

- Application

- End-User

Dissecting Regional Dynamics Across Americas Europe Middle East Africa and Asia-Pacific to Highlight Diverse Market Drivers and Growth Patterns

Regional nuances in construction activity, regulatory environments, and infrastructure funding paradigms underpin differentiated growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, sustained public and private investment in sustainable urban transit and affordable housing has spurred demand for versatile boom pumps capable of operating in congested downtown cores and sprawling peripheral developments. Strong culture of equipment rental services further shapes purchasing decisions, with a preference for rental companies that can guarantee uptime through integrated service networks.

Meanwhile, Europe Middle East & Africa exhibits a bifurcated profile: Western European markets emphasize carbon reduction and noise abatement, incentivizing electric and hybrid pump adoption, whereas Middle Eastern infrastructure megaprojects-particularly in the Gulf Cooperation Council states-drive procurement of high flow rate units built to endure harsh environmental conditions. In contrast, the Asia-Pacific region demonstrates a broad spectrum of needs, from densely populated megacities in East Asia requiring high-efficiency boom pumps to developing economies in Southeast Asia and South Asia where cost-sensitive stationary line pumps remain predominant. Across all regions, end-users increasingly value digital service platforms that integrate telematics data for real-time equipment health monitoring and remote diagnostics.

This comprehensive research report examines key regions that drive the evolution of the Concrete Pumps market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Concrete Pump Manufacturers and Their Strategic Initiatives Shaping Competitive Landscapes and Innovation Trajectories

Market leadership in the concrete pump sector is defined by continuous innovation, global service footprint, and supply chain resilience. Key players have distinguished themselves through targeted R&D investments aimed at expanding electric powertrain portfolios and enhancing hydraulic efficiency. Several leading manufacturers have unveiled modular pump platforms that can be configured for boom or line applications, allowing for economies of scale in production and simplified aftermarket stocking. Meanwhile, select companies are forging alliances with component specialists to co-develop advanced valve technology and high-strength pump cylinders that deliver improved abrasion resistance.

Service excellence has emerged as a critical differentiator, with top-tier providers offering subscription-based telematics packages that supply customers with predictive maintenance alerts and performance benchmarking dashboards. Strategic acquisitions have also featured prominently, as larger conglomerates absorb niche regional players to bolster local assembly capabilities and accelerate time to market. Sustainability commitments, such as the introduction of carbon-neutral manufacturing plants and closed-loop hydraulic oil recycling programs, further position leading firms to meet evolving regulatory requirements and corporate responsibility goals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Concrete Pumps market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- "

- "Concord Concrete Pumps Inc

- Alliance Concrete Pumps Inc.

- Apollo Inffratech Pvt. Ltd.

- Aquarius Engineers Pvt Ltd

- Best Readymix Concrete

- Bobcat Company by Doosan Group

- Camfaud Concrete Pumps Ltd

- Fangyuan Group

- Flowcrete Group

- Hyundai Everdigm Corp.

- Junjin Construction & Robot Co., Ltd.

- KCP Concrete Pumps Ltd.

- Liebherr-International Deutschland GmbH

- Sermac Srl

- TEKSPED s.r.l.

- Zhejiang Xinrui Heavy Engineering Technology Co., Ltd.

- Zoomlion Heavy Industry Science&Technology Co., Ltd.

Charting Actionable Strategic Pathways for Industry Leaders to Navigate Challenges Capitalize on Opportunities and Accelerate Concrete Pump Market Growth

To thrive amid tightening regulatory frameworks and intensifying competition, industry leaders should prioritize a multi-pronged strategy focused on innovation, supply chain flexibility, and customer-centric service models. First, accelerating the development and commercialization of battery-electric and hybrid pump systems will not only address noise and emission regulations but also unlock new opportunities in permit-constrained urban zones. Concurrently, diversifying supplier networks through dual-source agreements for critical components such as hydraulic valves and electric motors will buffer against future tariff escalations and geopolitical disruptions.

Enhancing digital service offerings is equally imperative. By expanding telematics capabilities to include machine learning–driven diagnostics and dynamic performance optimization, OEMs and rental providers can offer customers tangible outcomes in reduced downtime and lowered operating expenses. Partnerships with software developers and cloud providers can further streamline data integration across fleet management platforms. Finally, cultivating a consultative sales approach-where technical specialists collaborate directly with contractors during project planning-will deepen client relationships and reinforce the value proposition of advanced pump technologies in delivering project efficiencies and sustainable outcomes.

Detailing Rigorous Research Methodology and Analytical Framework Employed to Deliver Robust Insights and Ensure Data Accuracy and Relevance

This analysis is grounded in a rigorous research methodology combining both primary and secondary information sources to ensure data veracity and comprehensive coverage. Primary research involved in-depth interviews with over 30 industry stakeholders, including equipment executives, rental fleet managers, and third-party service providers, to capture firsthand perspectives on emerging technology adoption, tariff impacts, and regional infrastructure priorities. Secondary research encompassed a systematic review of public filings, trade publications, and regulatory databases to triangulate findings and validate qualitative insights.

Supplementing these approaches, our analytical framework integrated comparative benchmarking of product specifications across leading manufacturers, alongside scenario-based modeling of input cost fluctuations under various tariff and raw material price trajectories. Quality assurance protocols, including peer reviews and cross-functional expert consultations, were applied at each stage of the research process to uphold objectivity and ensure that conclusions reflect the latest industry trends and operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Concrete Pumps market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Concrete Pumps Market, by Pump Type

- Concrete Pumps Market, by Mobility

- Concrete Pumps Market, by Power Source

- Concrete Pumps Market, by Flow Rate

- Concrete Pumps Market, by Application

- Concrete Pumps Market, by End-User

- Concrete Pumps Market, by Region

- Concrete Pumps Market, by Group

- Concrete Pumps Market, by Country

- United States Concrete Pumps Market

- China Concrete Pumps Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing Key Findings and Strategic Implications to Illuminate the Future Direction of the Concrete Pump Industry Amid Converging Market Forces

As the construction sector grapples with evolving environmental mandates, supply chain complexities, and a surge in digitalization, the concrete pump industry stands at the cusp of transformative growth. The convergence of electric and hybrid powertrain technologies, advanced materials research, and cloud-connected servicing models is redefining what customers expect from pumping solutions. At the same time, trade policy shifts and regional infrastructure investment patterns will continue to shape procurement strategies, underscoring the need for agility in both manufacturing and aftermarket operations.

Looking ahead, stakeholders who adopt an integrated approach-balancing product innovation with agile supply chain management and data-driven service offerings-will be best positioned to unlock new revenue streams and deliver sustainable value. By closely monitoring segmentation dynamics and regional nuances, companies can tailor their strategies to address specific customer needs, whether that entails high-capacity boom pumps for megaprojects or compact electric line pumps for urban retrofits. Ultimately, the industry’s success will hinge on its ability to anticipate regulatory shifts and harness technological advancements that enhance productivity, lower environmental impact, and drive competitive differentiation.

Engage with Ketan Rohom to Access Comprehensive Concrete Pump Market Intelligence and Empower Your Organization with Strategic Decision Support Solutions

To secure unparalleled insights and actionable data tailored to your strategic objectives, connect with Ketan Rohom, Associate Director of Sales & Marketing, who is dedicated to facilitating your organization’s access to comprehensive analysis that drives growth and competitive advantage. Through a consultative approach, Ketan will guide you in selecting the optimal research package, ensuring that your investment delivers clarity on critical trends, segmentation nuances, regulatory considerations, and emerging innovations within the concrete pump landscape.

By engaging with Ketan, you gain direct access to expert briefings, customized presentations, and priority delivery of in-depth reports that address your specific operational, technical, and commercial challenges. Whether you require detailed insights on supply chain resilience, tariff mitigation tactics, product development roadmaps, or regional opportunity assessments, Ketan’s expertise and commitment to client success will empower your team to make confident, data-driven decisions. Reach out today to elevate your strategic planning and unlock the full potential of the concrete pump industry’s evolving environment.

- How big is the Concrete Pumps Market?

- What is the Concrete Pumps Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?