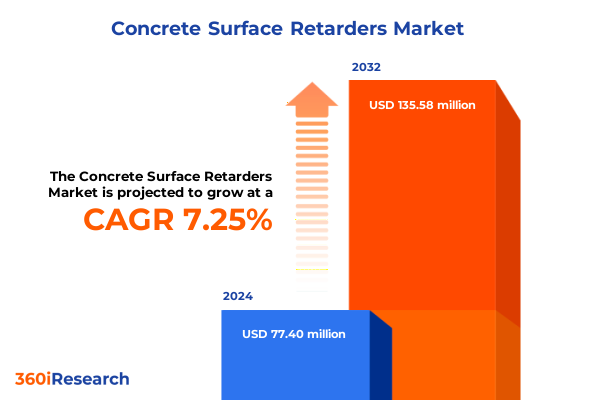

The Concrete Surface Retarders Market size was estimated at USD 83.08 million in 2025 and expected to reach USD 89.99 million in 2026, at a CAGR of 7.24% to reach USD 135.57 million by 2032.

Innovative surface retarder solutions are redefining concrete aesthetics and durability in modern construction trade environments worldwide

Concrete surface retarders play an essential role in advanced finishing practices, providing architects and contractors with tools to precisely control the exposure of aggregate in fresh concrete surfaces. By selectively delaying the hydration of cement paste at the surface, these chemical agents enable the creation of decorative textures that enhance slip resistance, durability, and aesthetic appeal without the need for mechanical surface treatment that can introduce microfractures. Initially adopted for specialized pedestrian applications, exposed aggregate finishes are now mainstream across commercial plazas, urban streetscapes, and high-end residential builds, underscoring the technology’s progression from niche decorative treatment to everyday construction staple.

The evolution of formulation technologies has broadened the capabilities of surface retarders. Early acid-based mixtures, such as phosphoric acid or sulfamic acid blends, remain popular for rapid and deep aggregate revelation. Meanwhile, environmentally conscious projects are increasingly turning to biodegradable enzyme-based and plant-derived chemistries, which offer comparable performance with reduced chemical residues and waste water treatment requirements. Caustic-based retarders employing potassium or sodium hydroxide are deployed selectively in repair contexts where controlled surface profiling is needed to match existing substrates. More recently, polymer-enhanced compositions have introduced advanced UV stability and extended working times, supporting application in variable climates. This dynamic interplay of formulation types, driven by performance demands and regulatory imperatives, positions surface retarders as a foundational technology in the pursuit of both visual and functional excellence in concrete construction.

Unprecedented shifts in regulatory frameworks supply dynamics and material innovation are revolutionizing the concrete surface retarder market

Recent years have witnessed a convergence of regulatory mandates, supply chain reconfigurations, and material science breakthroughs that are transforming how concrete surface retarders are designed, manufactured, and applied. Environmental regulations targeting volatile organic compounds and acid runoff have spurred a generational shift from conventional phosphoric acid preservatives toward greener, plant-derived alternatives. Concurrently, limitations on solvent usage and water discharge standards have incentivized the adoption of enzyme-based retarders, which break down naturally after fulfilling their functional role, thereby reducing the environmental footprint associated with wash-down processes.

Supply chain resilience has emerged as another focal point, driven by disruptions from global health events, energy price fluctuations, and geo-economic tensions. The reliance on imported raw materials such as sulfonated polymers and calcium salts has prompted leading manufacturers to establish regional production hubs and form strategic alliances with domestic chemical producers. These partnerships not only mitigate the risk of prolonged lead times but also enhance responsiveness to localized market demands, be it in North American highway expansion projects or European restoration initiatives.

Innovation in digital tools is further reshaping application methodologies. Mobile-enabled dosing units and IoT sensors mounted on finishing equipment now provide real-time monitoring of retarder concentration, dwell time, and ambient conditions. The resulting data streams feed into analytics platforms that recommend on-the-fly adjustments, enhancing consistency across large-scale pours and reducing material waste. As these transformative shifts gain momentum, a new generation of high-performance, low-impact retarders is emerging, ready to meet the dual imperatives of operational efficiency and sustainable construction practices.

Comprehensive evaluation of the cumulative effects of 2025 United States import levies on raw materials and finished chemical admixtures in construction

In line with broader trade policy objectives and industrial revitalization efforts, the U.S. administration in 2025 enacted a suite of import tariffs and countervailing duties affecting key raw materials and finished chemical admixtures integral to surface retarder production. Levies on primary acid precursors-chiefly phosphoric and sulfamic acids-rose by as much as fifteen percent, reflecting concerns over supply concentration and the desire to invigorate domestic acidulation capacities. In parallel, duties on acrylic polymer and synthetic latex intermediates climbed by approximately eight percent, aiming to shield the nascent polymer compounding industry from offshore competition.

The initial response in procurement circles was marked by increased price volatility, prompting concrete finisher associations to assess cost impacts on ongoing infrastructure and commercial projects. Acid-based retarders, which depend heavily on these imported feedstocks, saw the steepest import-driven cost upticks. Conversely, biopolymer and enzyme-based options demonstrated relative insulation, owing to their more diversified supplier networks and emerging domestic fermentation capabilities. Contractors and specifiers began to reconsider long-term supply contracts and explore alternative chemistries to hedge against future tariff escalations, while domestic manufacturers accelerated the commissioning of new processing lines designed to produce acid and polymer intermediates within U.S. borders.

Over the medium term, these policy shifts are expected to facilitate capital investment in local chemical infrastructure, fostering innovation clusters and technical skill development. The redistribution of global sourcing footprints, catalyzed by the 2025 tariff measures, is redefining competitive dynamics in the surface retarder segment. Market participants that adapt through collaborative R&D ventures and strategic capacity expansions stand to gain a first-mover advantage, capturing growth as the industry moves toward a more balanced and sustainable supply ecosystem.

In-depth analysis of type form application and end user industry segmentation reveals nuanced performance drivers in surface retarder adoption

A nuanced segmentation matrix reveals how chemical type, form, application setting, and end user industry intersect to influence the adoption and performance requirements of surface retarders. Within the domain of chemical type, acid-based formulations break down into phosphoric acid and sulfamic acid variants, each offering distinct etching profiles and reaction rates that align with heavy-traffic infrastructure projects and decorative pathways alike. In contrast, the biodegradable segment subdivides into enzyme-driven and plant-sourced chemistries, which appeal to green building certifications and projects with stringent wastewater discharge limits. Caustic-based retarders-leveraging potassium hydroxide or sodium hydroxide-are strategically deployed in repair and restoration contracts where precise surface profiling is essential to match adjacent pours, while polymer-based systems composed of acrylic or latex polymers provide superior film integrity and UV resilience in exposed architectural facades.

Form factor is equally critical in dictating on-site logistics and dosing precision. Liquid forms predominate in large-scale on-site applications such as expansive facades, airport runways, and urban sidewalks due to their pumpability and ease of integration into ready-mix systems. Powdered variants, on the other hand, are preferred in precast manufacturing plants producing blocks, hollow core panels, and wall panels, where exact weight-based dosing and storage stability are paramount.

Application-driven segmentation further clarifies usage trends: on-site pours in facades and floors reward rapid-acting acid and polymer blends, whereas pre-assembled precast elements leverage consistent, factory-controlled curing aided by powder retarders. In repair contexts-spanning crack remediation to full-depth restoration-the choice often tilts toward polymer-enhanced formulations that guarantee substrate compatibility and aesthetic uniformity with surrounding concrete. Overlaying this layer, end user industries impose their own criteria. Commercial developments in hospitality, office complexes, and retail centers emphasize decorative textures and safety features; industrial sites value durability and low maintenance; infrastructure projects demand proven performance under vehicular stress; and residential applications strike a balance between cost efficiency and aesthetic appeal. Together, these segmentation insights guide strategic formulation development and market positioning.

This comprehensive research report categorizes the Concrete Surface Retarders market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End User Industry

Comparative exploration of regional market dynamics innovation adoption and regulatory landscapes shaping surface retarder uptake globally

Differences in regional construction practices, regulatory oversight, and infrastructure spending priorities strongly influence the uptake of concrete surface retarders across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, sustained investment in highway modernization, municipal revitalization, and commercial redevelopment has bolstered demand for decorative and high-traction surfaces. The United States market, in particular, exhibits a growing appetite for integrated solutions that combine aggregate exposure with anti-slip enhancements, prompting contractors to favor both acid-based systems for rapid profiling and biodegradable enzyme-based variants for projects seeking LEED accreditation. In Latin America, climatic volatility and evolving environmental standards have accelerated interest in polymer-based retarders capable of withstanding high humidity and temperature fluctuations.

Within Europe Middle East and Africa, environmental compliance and circular economies drive market maturation. Western European nations are at the forefront of biodegradable technology adoption, fueled by local enzyme production and strict VOC restrictions. Middle Eastern markets, challenged by arid conditions and abrasive sandstorms, prioritize high-performance acid-polymer hybrids for critical infrastructure such as airport runways and desalination plant decks. In African regions where pan-continental infrastructure initiatives like transnational highways are underway, surface retarders are gradually integrated into tender specifications to extend the service life of pavements and bridges, although volume growth is tempered by budgetary constraints.

Asia Pacific showcases the widest spectrum of application and innovation. China’s precast juggernauts rely on both liquid and powder retarders for mega-scale residential and transport hubs, leveraging domestic chemical plant expansions to reduce reliance on imports. India is rapidly adopting polymer-enhanced and enzyme-based formulations for metro rail projects and green building mandates. Southeast Asian and Australasia markets are embracing eco-conscious chemistries in hospitality and residential builds as governments incentivize sustainable construction. Harmonization of technical standards and environmental testing protocols across the region is expected to further streamline product acceptance and stimulate cross-border technology transfer in the years ahead.

This comprehensive research report examines key regions that drive the evolution of the Concrete Surface Retarders market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic profiles of leading innovators and market disruptors driving research manufacturing and distribution excellence in surface retarders

Major chemical conglomerates and specialized admixture suppliers have strategically positioned themselves to capture growth in the surface retarder segment through innovation pipelines, manufacturing scale, and distribution reach. Established players have invested heavily in proprietary research facilities dedicated to customizing retarder formulations for specific climate zones and application types. This includes development of hybrid chemistries that combine polymer binders with biodegradable agents, delivering a balance of performance consistency, UV stability, and environmental compliance. Meanwhile, several firms have augmented their global manufacturing networks by adding or retrofitting polymer blending plants and enzyme fermentation lines in key end markets, reducing lead times and circumventing tariff-induced cost pressures.

Partnerships with equipment manufacturers have yielded specialized application systems that automate chemical blending, dosing, and timing, minimizing operator error and ensuring uniform surface finishes. Additionally, some companies have launched digital platforms offering remote monitoring and performance benchmarking, enabling clients to track retarder usage, optimize dosing schedules, and compare outcomes against benchmark projects.

Smaller innovators and start-ups have carved niches by pioneering bio-enzyme extraction processes and bio-based polymer matrices, often in collaboration with academic institutions. Their agility in developing next-generation chemistries has challenged market norms and inspired larger players to accelerate sustainable product development. Many of these emerging entrants are forging co-development agreements with lead contractors to field-test new formulations under stringent infrastructure project specifications. Collectively, these strategic moves underscore an industry-wide emphasis on integrating material science advances with operational efficiency and environmental responsibility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Concrete Surface Retarders market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adomast Manufacturing Limited

- BASF SE

- Chemmasters

- CHRYSO by Saint-Gobain

- Chryso Group

- CICO Technologies Limited

- Dayton Superior Corporation

- Fabrino Produktionsgesellschaft Mbh & Co. Kg

- Fosroc International Ltd.

- Fritz-Pak Corporation

- GCP Applied Technologies Inc.

- Interstar Materials, Inc.

- Larsen Building Products

- MAPEI S.p.A.

- MBCC Group by Sika AG

- Norsekem Limited

- Perma Colour Inc.

- Pidilite Industries Limited

- Premiere Concrete Admixtures

- RECKLI GmbH

- RPM International Inc.

- Russtech, Inc.

- Sika AG

- W. R. Grace & Co.

Proactive strategies for manufacturers suppliers and contractors to anticipate disruptions maximize performance and drive sustainable growth in surface retarders

To fortify market positioning and capitalize on emerging growth opportunities, manufacturers, suppliers, and contractors should implement a series of strategic initiatives that balance innovation with operational robustness. First, diversifying procurement channels for essential feedstocks such as phosphoric acid, potassium hydroxide, and polymer intermediates can mitigate exposure to tariff fluctuations and supply chain disruptions. Establishing long-term framework agreements with regional chemical partners enables predictable pricing and supply continuity, while exploring backward integration strategies may offer greater control over raw material quality and availability.

Second, fostering collaborative R&D ecosystems through partnerships with universities, government laboratories, and industry consortia can accelerate the development of next-generation bioderived and polymer-enhanced retarders. Pilot projects evaluating novel enzyme processes or advanced polymer blends under varied climate conditions provide critical performance validation, de-risking broader commercial rollouts. Concurrently, embedding digital process control systems on job sites-utilizing IoT-enabled dosing units and cloud analytics-will improve application accuracy, reduce chemical waste, and lower operational costs.

Third, investing in workforce development is essential for ensuring that applicators are trained in the latest best practices and safety protocols. Certification programs and virtual training modules can standardize quality across geographically dispersed projects, minimizing rework and enhancing client satisfaction. Finally, proactive engagement with policy makers and trade associations is recommended to shape conducive regulatory environments and access incentives for sustainable chemical adoption. By executing these actionable recommendations, industry leaders can strengthen resilience, drive market share, and foster a culture of continuous improvement across the surface retarder value chain.

Rigorous multi-tiered research methodology combining quantitative analysis expert interviews and field validation to ensure comprehensive market insights

The research underpinning this report followed a meticulously structured methodology to ensure comprehensive, accurate, and actionable insights. Initially, extensive secondary research was conducted, drawing on technical white papers, patent filings, environmental regulation databases, and industry association publications to assemble an overview of chemical formulations, application technologies, and evolving compliance requirements. Relevant trade and customs statistics on chemical imports and exports were analyzed to quantify the impact of tariff regimes and identify key supply chain nodes.

Primary research constituted the second phase, encompassing in-depth interviews with senior executives, R&D leaders, and technical service managers from chemical manufacturers, construction firms, and infrastructure developers. These interviews probed current retarder usage patterns, formulation preferences, and the operational challenges encountered in on-site and manufacturing settings. An online questionnaire distributed to field applicators captured quantitative data on application timelines, dwell time control practices, and satisfaction metrics with different retarder types.

To validate and enrich the findings, on-site field observations were conducted across representative projects in North America, Europe, and Asia Pacific, where performance metrics were recorded for diverse chemistries under actual environmental conditions. Regional expert workshops and roundtable discussions were convened to review preliminary conclusions, resolve data discrepancies, and prioritize emerging trends. A final triangulation process synthesized secondary data with qualitative and quantitative primary inputs, producing a robust set of insights and recommendations. This multi-tiered approach guarantees that the report reflects real-world market dynamics and supports confident decision-making for stakeholders seeking to optimize surface retarder strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Concrete Surface Retarders market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Concrete Surface Retarders Market, by Type

- Concrete Surface Retarders Market, by Form

- Concrete Surface Retarders Market, by Application

- Concrete Surface Retarders Market, by End User Industry

- Concrete Surface Retarders Market, by Region

- Concrete Surface Retarders Market, by Group

- Concrete Surface Retarders Market, by Country

- United States Concrete Surface Retarders Market

- China Concrete Surface Retarders Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Holistic synthesis of market evolution regulatory drivers and innovation imperatives shaping the future trajectory of concrete surface retarders

This executive summary consolidates the extensive exploration of chemical innovations, regulatory frameworks, trade policies, and market segmentation that define the contemporary surface retarder landscape. The analysis highlights how acid-based, biodegradable, caustic, and polymer chemistries each address distinct technical and environmental requirements, creating a rich portfolio of solutions tailored to specific project demands. The introduction of targeted U.S. tariffs in 2025 has underscored the strategic importance of supply chain agility and domestic production capacity, driving industry investment in regional manufacturing infrastructure and alternative sourcing models.

Segmentation by type, form, application, and end user industry has elucidated clear usage patterns and performance drivers, from large-scale infrastructure pours requiring aggressive aggregate exposure to precision repair projects demanding seamless aesthetic integration. Regional insights reveal disparate adoption trajectories, shaped by local regulatory pressures and construction cycles across the Americas, Europe Middle East and Africa, and Asia Pacific. Competitive analysis underscores a dynamic ecosystem of global chemical conglomerates and nimble innovators collaborating to deliver next-generation retarder systems that balance operational excellence with sustainability imperatives.

Looking ahead, success in this market will hinge on the integration of advanced formulation science, digital process controls, and strategic partnerships. Stakeholders who prioritize R&D in eco-conscious chemistries, invest in workforce upskilling, and engage proactively with policy makers will be best positioned to lead the next wave of innovation. Ultimately, the collective application of these insights will elevate concrete surface finishes, delivering safe, durable, and visually compelling results that meet the evolving needs of construction professionals and end users alike.

Empower your strategic decisions and secure your competitive edge in concrete finishing excellence with expert market insights from our latest report

Elevate your strategic planning and operational effectiveness by acquiring the complete market research report, which offers deep-dive analysis into the drivers, constraints, and opportunities shaping the global surface retarder sector. This comprehensive document delivers granular insights on regulatory shifts, tariff ramifications, segmentation trends, and competitive strategies across all major geographies. Detailed case studies and field data provide a practical framework for evaluating retarder performance under diverse environmental conditions, from urban infrastructure to bespoke architectural applications.

Purchasing the report grants exclusive access to proprietary forecasts, scenario modeling outputs, and expert commentary, empowering your organization to make data-driven decisions, optimize procurement and formulation strategies, and secure a competitive advantage. Whether you aim to refine product development roadmaps, streamline supply chains, or articulate value propositions that resonate with sustainability mandates, this research equips you with the knowledge required to succeed.

To arrange a personalized consultation, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan will guide you through the report’s key deliverables, discuss licensing options tailored to your needs, and coordinate a confidential briefing session to align insights with your strategic objectives. Don’t miss this opportunity to harness unparalleled market intelligence and drive transformative growth in your concrete finishing operations; contact Ketan today to access this essential resource.

- How big is the Concrete Surface Retarders Market?

- What is the Concrete Surface Retarders Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?