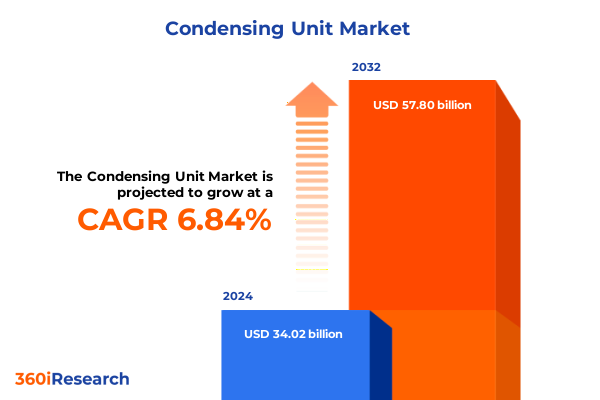

The Condensing Unit Market size was estimated at USD 36.20 billion in 2025 and expected to reach USD 38.57 billion in 2026, at a CAGR of 6.91% to reach USD 57.80 billion by 2032.

Revolutionizing Cooling Solutions: Unveiling Critical Drivers and Emerging Opportunities Shaping the Condensing Unit Market Landscape

Condensing units form the backbone of modern cooling and refrigeration systems, translating engineering innovation into real-world performance. From supermarket walk-ins to sprawling data centers, these assemblies compress refrigerant and release heat, enabling precise temperature control under diverse operating conditions. As stakeholders across residential, commercial, and industrial sectors seek ever-greater energy efficiency, reliability, and environmental compliance, condensing unit technology has become a critical differentiator.

Against a backdrop of urbanization, intensified infrastructure development, and heightened regulatory scrutiny, manufacturers and end users alike face mounting pressure to optimize lifecycle costs while minimizing carbon footprints. The evolution of condensing units now encompasses not only raw performance metrics but also seamless integration with building management systems, next-generation refrigerants, and modular design principles. This convergence of mechanical, electrical, and digital innovation heralds a new era of capability, where equipment agility and data-driven maintenance coalesce to deliver superior uptime and reduced total cost of ownership.

This executive summary distills key market dynamics, transformative shifts, and actionable insights to equip decision-makers with a comprehensive understanding of the condensing unit landscape. By exploring technological advancements, tariff-driven supply chain ramifications, segmentation nuances, regional growth catalysts, and competitive strategies, readers will emerge with a holistic perspective on opportunities and challenges shaping the industry’s trajectory.

From Sustainability Mandates to IoT Integration: How Technological, Regulatory, and Operational Shifts Are Redefining the Condensing Unit Market

The condensing unit market is undergoing a profound transformation fueled by stringent energy efficiency mandates and sustainability objectives. Regulatory bodies such as the U.S. Department of Energy have established performance standards targeting a 30% reduction in energy consumption for commercial condensing units by 2027, catalyzing widespread adoption of inverter-equipped and variable‐speed compressors that dynamically match cooling output to real‐time demand. Moreover, the European Union’s Eco-design Directive has mandated the phase-in of low-GWP refrigerants, compelling manufacturers to innovate around natural alternatives such as CO₂ and ammonia to comply with environmental regulations while maintaining operational performance.

In parallel, the integration of IoT and smart monitoring systems by leading producers is revolutionizing equipment management. Real-time data exchange with building management platforms enables predictive maintenance, allowing service teams to address emerging faults before they disrupt operations. A notable case study in New York revealed that smart condensing unit installations delivered a 25% reduction in energy costs within the first year, underscoring the tangible ROI of connected technologies.

Furthermore, the shift toward modular, scalable unit architectures is granting end users unprecedented flexibility. By deploying standardized skids that can be easily expanded or reconfigured, facility managers can right-size capacity to evolving cooling requirements without resorting to full system overhauls. This modularity not only streamlines installation but also reduces waste by isolating upgrades to discrete subsystems, aligning cost management with sustainability goals.

Assessing the Broad Economic and Supply Chain Consequences of Recent U.S. Tariffs on Steel and Aluminum Affecting Condensing Unit Production

In early 2025, the U.S. government raised Section 232 tariffs on imported steel and aluminum from 25% to 50%, directly targeting the metal content of products to bolster domestic manufacturing capacity. Previously, a 25% levy introduced on March 12, 2025, had already disrupted supply chains by sharply increasing the cost of raw steel and aluminum used in condensing unit shells, heat exchangers, and structural frames.

The immediate effect has been a pronounced surge in production costs for HVAC and refrigeration equipment manufacturers. After the tariff hike, reports indicated that domestic steel prices experienced double-digit percentage increases, compelling firms to either absorb margin pressure or pass higher costs to downstream buyers. Consequently, component fabricators and original equipment manufacturers (OEMs) have begun renegotiating long-term supplier agreements and exploring alternative alloys or localized material sources to mitigate cost volatility.

Beyond material expenses, the sudden tariff escalation has triggered supply chain disruptions. Heightened customs inspections at U.S.–Canada and U.S.–Mexico border crossings have introduced delays in returning containers, while companies heavily reliant on Chinese components-many now subject to an additional 20% tariff-have scrambled to secure inventory or qualify new vendors. Such bottlenecks have, at times, led to unit assembly backlogs and extended lead times for both commercial and residential installations.

As manufacturers and contractors face these mounting pressures, equipment prices are increasingly being transferred to end users. Observers note that basic condensing units, once price-competitive, now carry premiums reflecting the cumulative tariff burden. Moreover, regional disparities have emerged: the U.S. market contends with immediate cost hikes, while Canadian and Mexican producers weigh potential reciprocal measures, complicating cross-border trade dynamics and requiring strategic sourcing adjustments.

Deep Dive into Market Segmentation Reveals How Type, Refrigerant, Mounting, Compressor, Operation Location, and End Use Determine the Condensing Unit Industry

The condensing unit market is structured around multiple dimensions of differentiation that influence product design, application, and performance. First, the primary classification by type encompasses air-cooled units ideal for standard indoor and outdoor installations, evaporative models that leverage water spray for enhanced heat rejection, and water-cooled systems suited to centralized plant environments requiring higher thermal efficiency. Each type addresses distinct temperature control challenges, with the choice heavily dependent on site conditions, water availability, and maintenance considerations.

Refrigerant chemistry further refines market segmentation, spanning legacy HCFC compounds alongside HFC variants-most notably R-134a, R-404A, and R-410A-and a growing portfolio of natural refrigerants such as ammonia and CO₂. The industry’s pivot toward lower-GWP alternatives is reshaping equipment architectures, as material compatibility, pressure ratings, and safety protocols must all align with the selected refrigerant profile.

Mounting configurations present another axis for customization, with horizontal units providing compact footprints for confined mechanical rooms, whereas vertical orientations enable gravity-fed oil return and improved airflow in rooftop or outdoor settings. Similarly, compressor technologies-ranging from reciprocating and rotary designs to screw and scroll variants-are chosen to match capacity requirements, noise constraints, and part-load efficiency targets.

Operational context also plays a vital role. Indoor units must balance acoustic and space considerations, while outdoor units require weather-hardened enclosures and extended heat rejection capabilities. Finally, end-use applications bifurcate into four major categories: air conditioning for residential and commercial buildings; commercial refrigeration serving cold storage warehouses, food service, and retail display cases; heat pumps for both heating and cooling; and industrial refrigeration processes in chemical and pharmaceutical manufacturing. Across these dimensions, product roadmaps are being driven by regulatory compliance, application-specific performance demands, and the overarching imperative to deliver energy savings.

This comprehensive research report categorizes the Condensing Unit market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Refrigerant Type

- Mounting Type

- Compressor Type

- Location Of Operation

- End Use

Unveiling Regional Dynamics and Growth Drivers across Americas, Europe Middle East & Africa, and Asia-Pacific Markets Shaping Condensing Unit Demand

In the Americas, the United States remains a cornerstone of demand, driven by ongoing facility retrofits and expansion of data center and cold chain infrastructures. Enhanced building codes in key states and incentives for energy efficiency have accelerated upgrades to high-performance condensing units, while Canada and Mexico contribute through USMCA-compliant manufacturing that softens tariff impacts and supports North American supply networks. As stakeholders prioritize resilient logistics and near-shoring strategies, the region’s integrated marketplace continues to adapt to both policy shifts and evolving end-user requirements.

Europe, the Middle East, and Africa present a diverse tapestry of growth drivers. In Europe, stringent Eco-design mandates and the F-Gas Regulation compel the adoption of low-GWP refrigerants and advanced energy-saving features, fostering early uptake of natural refrigerant-based condensing units. Simultaneously, the Middle East’s booming hospitality and logistics sectors demand robust outdoor units capable of sustained performance in high-ambient environments, spurring manufacturers to offer bespoke solutions tailored to desert climates and large-scale cold storage complexes.

Asia-Pacific continues to lead on volume, fueled by rapid industrialization, urban expansion, and government investments in electrified cold chains to minimize post-harvest losses. Initiatives such as India’s PMFME scheme underscore public commitment to enhancing food security through modern refrigeration, while Southeast Asian markets leverage cost-effective manufacturing and local assembly to serve both domestic and export customers. Across the region, affordability and scalability remain paramount, prompting the proliferation of modular designs that align with diverse infrastructure capacities.

This comprehensive research report examines key regions that drive the evolution of the Condensing Unit market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Initiatives and Competitive Strategies of Leading Global Manufacturers Driving Innovation and Growth in the Condensing Unit Sector

The competitive landscape of the condensing unit market is dominated by a consortium of established global manufacturers, each leveraging strategic R&D investments and targeted partnerships to fortify their market position. Key players such as Emerson Electric Co., Carrier Global Corporation, Daikin Industries, Danfoss A/S, GEA Group AG, Mitsubishi Electric, BITZER Kühlmaschinenbau, Johnson Controls, Heatcraft Refrigeration Products, and Tecumseh Products Company collectively represent the frontier of product innovation and geographic reach. These firms continuously refine their portfolios to integrate low-GWP refrigerants and smart connectivity features demanded by today’s environmentally and digitally driven marketplaces.

A closer look at recent strategic initiatives reveals a pronounced emphasis on natural refrigerant solutions and digital service ecosystems. Danfoss’s Optyma™ iCO₂ condensing unit exemplifies this trajectory, offering high-pressure CO₂ operation in a plug-and-play format suited for food retail environments. Emerson has simultaneously rolled out variable-speed models equipped with scroll compressors and predictive analytics platforms, enabling remote diagnostics and energy optimization. Carrier’s Infinity® Variable-Speed Cold Climate Heat Pump further underscores the drive for cold-weather resilience, delivering high SEER2 ratings and full-capacity operation at subzero temperatures. These advancements reflect an overarching industry commitment to balancing efficiency, sustainability, and lifecycle cost management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Condensing Unit market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Baltimore Aircoil Company

- BITZER Kühlmaschinenbau GmbH

- Blue Star Limited

- Carrier Global Corporation

- Chigo Air Conditioning Co., Ltd.

- Copeland LP

- Cruise Appliances

- Daikin Industries Ltd.

- Daikin Industries, Ltd.

- Danfoss AS

- Electrolux AB

- Emerson Electric Co.

- EVAPCO, Inc.

- FRASCOLD SPA

- Fujitsu General Limited

- GEA Group AG

- Godrej & Boyce Manufacturing Company Limited

- Gree Electric Appliances Inc.

- Haier Inc.

- Havells India Limited

- Heat Transfer Products Group

- Hitachi Ltd.

- Honeywell International Inc.

- Intersonic s.r.o.

- Johnson Controls International plc

- Lennox International Inc.

- LG Electronics Inc.

- Mayekawa Mfg. Co.

- Midea Group Co., Ltd.

- Midea Group Co., Ltd.

- Mitsubishi Electric Corporation

- Nidec Corporation

- Panasonic Holdings Corporation

- Rheem Manufacturing Company

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd

- Schutte & Koerting Company

- Secop GmbH

- Tecumseh Products Company LLC

- Toshiba Corporation

- Trane Technologies plc

- Voltas by Tata Group

- Whirlpool Corporation

Proactive Strategies and Practical Recommendations for Industry Leaders to Capitalize on Emerging Trends and Overcome Challenges in the Condensing Unit Market

Industry leaders must proactively embrace a portfolio of strategic initiatives to navigate evolving market challenges and capitalize on emergent opportunities. First, investing in R&D for low-GWP and natural refrigerant solutions will not only ensure regulatory compliance but also position companies as sustainability frontrunners. By advancing oil-free compressor technologies and higher-efficiency heat exchangers, manufacturers can achieve reduced carbon footprints while preserving system reliability.

Second, developing comprehensive digital platforms that integrate remote monitoring, predictive maintenance algorithms, and data analytics will extend equipment lifecycles and enhance service revenue streams. Companies should collaborate with controls specialists and software providers to create end-to-end solutions that facilitate real-time performance optimization and firmware upgrades without site visits.

Third, strengthening regional manufacturing footprints-particularly in North America, Europe, and Southeast Asia-will help mitigate tariff exposure and supply chain vulnerabilities. Establishing modular assembly centers near key demand hubs will reduce lead times and support local content requirements, while strategic partnerships under free trade frameworks can preserve margin stability.

Finally, cultivating deep customer engagement through training programs, technical support portals, and outcome-based service contracts will foster loyalty and differentiate offerings in commoditized segments. By aligning commercial models with lifecycle value delivery, manufacturers can shift from transactional sales to consultative partnerships, driving long-term profitability.

Comprehensive Research Methodology and Data Collection Approaches Ensuring Accurate and Actionable Insights for the Condensing Unit Industry Analysis

This analysis synthesizes quantitative and qualitative data collected through a rigorous multi-stage methodology. Initially, secondary research leveraged industry publications, regulatory databases, and corporate disclosures to map the market landscape and identify key regulatory drivers. Government fact sheets, trade association reports, and news outlets provided the foundation for understanding tariff developments and policy shifts.

Subsequently, primary research was conducted via structured interviews with senior executives from OEMs, component suppliers, and end users across major regions. These discussions yielded insights into strategic priorities, technology adoption timelines, and operational constraints that underpin segmentation dynamics. All findings were then triangulated against publicly available financial filings, patent databases, and technical standards documentation to ensure consistency and accuracy.

The segmentation framework was validated through cross-referencing multiple data sources, including equipment registration statistics and installation surveys. Regional analyses incorporated macroeconomic indicators and infrastructure investment trends, while competitive profiles were bolstered by patent activity and merger and acquisition records.

Finally, data inputs were modeled using scenario-based sensitivity analyses to assess the impact of tariff escalations and regulatory changes on cost structures. The resultant insights were peer-reviewed by independent market analysts to guarantee objective interpretation and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Condensing Unit market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Condensing Unit Market, by Type

- Condensing Unit Market, by Refrigerant Type

- Condensing Unit Market, by Mounting Type

- Condensing Unit Market, by Compressor Type

- Condensing Unit Market, by Location Of Operation

- Condensing Unit Market, by End Use

- Condensing Unit Market, by Region

- Condensing Unit Market, by Group

- Condensing Unit Market, by Country

- United States Condensing Unit Market

- China Condensing Unit Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Strategic Implications to Equip Decision-Makers with a Holistic Understanding of the Condensing Unit Market Evolution

This executive summary has traversed the complex terrain of the condensing unit market, illuminating how advancements in energy efficiency, digitalization, and modular design converge with shifting regulatory and tariff landscapes to reshape competitive dynamics. Through detailed segmentation and regional assessments, we have identified critical growth vectors-from the adoption of natural refrigerants to the strategic imperatives of near-shoring-to guide decision-makers in calibrating their product roadmaps and operational models.

In an era defined by sustainability targets and supply chain uncertainties, manufacturers must balance innovation with resilience. The integration of IoT-enabled controls, coupled with robust support services, will be indispensable in delivering lifecycle value and differentiating in commoditized markets. Moreover, proactive engagement with regulatory developments and trade policy shifts will help organizations anticipate cost pressures and adapt sourcing strategies accordingly.

Ultimately, the path forward demands a blend of technological foresight, regional agility, and customer-centric commercial models. By anchoring strategic initiatives in rigorous market intelligence and fostering collaborative ecosystems, industry participants can not only weather near-term disruptions but also unlock long-term growth in a dynamic, decarbonizing world.

Unlock In-Depth Intelligence and Propel Your Strategic Decisions—Contact Ketan Rohom Today to Secure Your Comprehensive Condensing Unit Market Research Report

Seize the opportunity to gain a competitive edge with unparalleled insights into the condensing unit market. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report and unlock detailed analysis, strategic recommendations, and data-driven intelligence tailored to your organization’s needs. Act now to empower your business decisions with expert guidance and proprietary research that will drive sustainable growth in a rapidly evolving industry.

- How big is the Condensing Unit Market?

- What is the Condensing Unit Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?