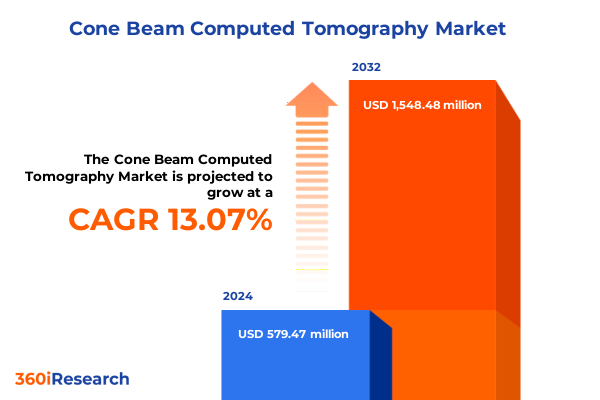

The Cone Beam Computed Tomography Market size was estimated at USD 647.88 million in 2025 and expected to reach USD 725.56 million in 2026, at a CAGR of 13.25% to reach USD 1,548.47 million by 2032.

Unveiling the Evolution and Strategic Importance of Cone Beam Computed Tomography in Modern Medical Imaging Environments

The realm of three-dimensional dental and craniofacial imaging has undergone a profound transformation with the advent of Cone Beam Computed Tomography technology. Initially conceived as an innovation to bridge the gap between conventional two-dimensional radiography and full-scale computed tomography, CBCT has matured into a versatile diagnostic modality that delivers high-resolution volumetric data with reduced radiation exposure. This breakthrough has empowered clinicians to visualize complex anatomical structures in intricate detail, enabling more precise diagnoses and treatment planning across a range of specialties, from endodontics to orthopedics. As a result, CBCT has carved out an indispensable role in modern healthcare workflows, redefining the standards for image quality, clinical efficiency, and patient safety.

In recent years, the convergence of hardware miniaturization and software sophistication has further accelerated CBCT adoption, fostering seamless integration into diverse clinical environments. Advanced image reconstruction algorithms now facilitate rapid three-dimensional rendering, while intuitive user interfaces streamline the scanning process for operators with varying levels of expertise. Meanwhile, integration with digital workflow ecosystems has enabled the fusion of CBCT data with intraoral scanning and surgical planning tools, supporting an end-to-end continuum of care that extends from diagnostic imaging to guided intervention. Such interoperability has not only enhanced clinical outcomes but also driven operational efficiencies, reducing chair time and optimizing resource utilization across dental clinics, hospitals, and specialized research facilities.

As healthcare providers strive to meet growing demands for minimally invasive and precision-guided therapies, CBCT continues to evolve in response to clinician and patient expectations. Innovations such as dynamic imaging modes and customizable field-of-view settings now allow practitioners to tailor exposure protocols to specific anatomical regions, further minimizing radiation dosage while preserving diagnostic detail. This adaptability underscores the strategic importance of CBCT in contemporary practice, where regulatory pressures and reimbursement considerations compel providers to balance cost, quality, and safety. Against this backdrop, understanding the pivotal role of CBCT within the broader imaging landscape is foundational to crafting strategies that harness its potential, anticipate emerging clinical needs, and navigate the shifting contours of the global medical imaging ecosystem.

Identifying the Key Technological and Clinical Shifts Redefining the Cone Beam Computed Tomography Ecosystem in Healthcare Delivery Systems

The landscape of Cone Beam Computed Tomography has been reshaped by a series of transformative advances that span technological innovation and clinical application. Among the most consequential shifts has been the integration of artificial intelligence and machine learning algorithms into image processing workflows, which have markedly improved segmentation accuracy, automated anomaly detection, and multi-modal data fusion. These capabilities have empowered clinicians to extract richer diagnostic insights from CBCT volumes, accelerating decision-making and reducing the likelihood of interpretive error. Consequently, the convergence of AI-driven analytics and three-dimensional imaging has begun to redefine not only the capabilities of CBCT systems but also the expectations for diagnostic confidence and workflow efficiency in imaging suites worldwide.

Concurrently, hardware developments have emphasized portability and ergonomics, leading to the proliferation of mobile CBCT units that can be deployed seamlessly across point-of-care settings. This shift towards modular, compact hardware configurations reflects a broader industry drive to decentralize imaging resources, enabling rural clinics, surgical centers, and field hospitals to access high-fidelity volumetric imaging without the infrastructure demands of fixed installations. Coupled with advancements in detector technology-most notably, the refinement of flat panel detectors offering improved signal-to-noise ratios and wider dynamic range-the enhanced design of modern CBCT scanners has facilitated greater flexibility in clinical deployment and patient positioning.

Moreover, the expansion of CBCT applications beyond traditional dental and maxillofacial diagnostics has prompted collaborations between imaging experts and surgical specialists in fields such as neurosurgery and orthopedics. These interdisciplinary partnerships have fueled research into dynamic intraoperative imaging and the development of specialized protocols for joint analysis, trauma assessment, and sinus examination. As a result, CBCT is emerging as a multi-purpose modality that not only supplements conventional CT in surgical planning but also underpins novel intraoperative guidance systems. Taken together, these developments underscore a pivotal industry evolution: CBCT systems are transitioning from standalone devices to integral components of integrated clinical ecosystems, heralding a new era of precision diagnostics and personalized patient care.

Assessing the Comprehensive Impact of the United States Tariff Adjustments in 2025 on the Supply Chain Dynamics of Cone Beam Computed Tomography Devices

The introduction of new tariff schedules by the United States in 2025 has exerted a significant recalibration of supply chain economics for Cone Beam Computed Tomography manufacturers and downstream providers. A baseline 10 percent import tax applied to most medical equipment created an immediate uptick in landed costs for critical components such as X-ray tubes and digital detectors, while targeted surcharges on high‐volume inputs from major trading partners further amplified price pressures. In particular, imports from certain jurisdictions now face levies as high as 54 percent on complex CT components-a measure that has reverberated across global manufacturing networks and prompted reexamination of sourcing strategies. These escalated duties have introduced new complexities into procurement planning, compelling stakeholders to balance cost mitigation against the imperative of maintaining access to precision-engineered CBCT modules.

Adding to the impact, the imposition of 25 percent tariffs on derivative products containing steel and aluminum has had a cascading effect on device assembly operations. Given that housing structures, gantry frames, and support fixtures rely heavily on metal assemblies, production lines have encountered material cost inflation that cannot be absorbed within existing capital expenditure frameworks. The consequence has been a twofold challenge: manufacturers face margin compression on legacy hardware models even as they allocate additional resources to qualifying new or existing products for possible exclusion under Section 301 exemption processes. This dynamic has temporarily slowed introduction of next-generation CBCT platforms in key markets, as device makers prioritize supply chain resilience over rapid innovation cycles.

In response to these disruptions, several leading providers have accelerated diversification of their manufacturing footprints, establishing regional assembly hubs in North America and select European jurisdictions to mitigate tariff exposure. Such strategic relocation efforts aim to optimize duty-free thresholds and qualify for preferential trade agreements, thereby safeguarding cost competitiveness without compromising on quality. Meanwhile, collaborative efforts with component suppliers have focused on identifying domestic or nearshored alternatives for critical subassemblies, fostering supplier partnerships that blend engineering expertise with localized production capabilities. Through these collective adjustments, the CBCT value chain is navigating the immediate ramifications of tariff realignments while laying the groundwork for a more agile and tariff-resilient operational model.

Deriving Actionable Segmentation Insights by Integrating Product Type Portability Technology Application and End User Perspectives for Strategic Decision

In examining the landscape through a segmentation lens, it becomes evident that product type differentiation between hardware platforms and software suites shapes both competitive positioning and customer engagement strategies. Providers with integrated software ecosystems are finding that robust analytical toolsets-ranging from volumetric measurement modules to virtual surgical planning interfaces-confer a distinct advantage in high-value clinical environments. Meanwhile, hardware specialists emphasize scanner durability, detector sensitivity, and ergonomic design to meet the demands of high-throughput imaging centers. Together, these complementary strengths underscore the importance of orchestrating hardware and software roadmaps in concert to deliver end-to-end solutions that resonate with diverse end-user requirements.

Portability emerges as another pivotal axis of differentiation, with fixed installations serving large hospital radiology departments and mobile units empowering remote care delivery. Fixed systems typically deliver maximal field of view and highest resolution, ideal for comprehensive craniofacial assessments, while mobile CBCT rigs furnish on-demand imaging in outpatient clinics or surgical theaters. The interplay between these modalities reveals a continuum of deployment scenarios: fixed scanners anchor centralized imaging services, whereas mobile platforms extend diagnostic capabilities to settings where infrastructure investments are constrained or where rapid patient turnover demands flexible imaging solutions.

Delving deeper into detector technology stratification, the contrast between flat panel detectors and image intensifiers illuminates evolving performance benchmarks. Flat panel architectures have become synonymous with high-fidelity capture, offering superior grayscale resolution, uniformity, and geometric distortion control. Conversely, image intensifier-based systems remain relevant in cost-sensitive markets and applications where legacy workflows persist, though their limitations in dynamic range and vignette artifacts are increasingly apparent. As clinical teams prioritize diagnostic clarity and quantitative accuracy, the migration toward flat panel-enabled scanners continues to accelerate, further raising the bar for image quality expectations across the board.

Application diversity further enriches the segmentation narrative. Within dentistry, practitioners leverage CBCT for both endodontic canal mapping and implantology planning, harnessing three-dimensional visualization to optimize access to root canals or to design patient-specific implant guides. In the ear, nose, and throat domain, CBCT protocols target sinus examination and temporal bone imaging, facilitating otologic assessments that demand sub-millimeter detail. Neurosurgical applications exploit the modality’s ability to render complex cranial landmarks for preoperative planning, while orthopedic teams employ CBCT-derived joint analysis and trauma assessment to inform interventions in weight-bearing extremities. This breadth of applications underscores the versatility of CBCT platforms, which adapt to specialty-driven protocols through modular software packages and tailored imaging presets.

Finally, alignment with end-user environments-spanning dental clinics, hospital systems, and research institutes-drives divergent purchasing rationales. Dental clinics emphasize workflow integration with practice management software, cost-effective per-scan economics, and compact form factors that suit office floorplans. Hospitals weigh throughput requirements, service contracts, and cross-departmental interoperability, seeking systems that support high scan volumes and multi-specialty utilization. Research institutions prioritize open-architecture platforms and advanced customization capabilities to facilitate novel imaging studies and technology validation. Together, these segmentation perspectives illuminate the strategic pathways through which CBCT innovators can tailor offerings to address the nuanced priorities of their target audiences.

This comprehensive research report categorizes the Cone Beam Computed Tomography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Portability

- Technology

- Application

- End User

Highlighting Regional Dynamics and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Markets in Cone Beam Computed Tomography

Across the Americas, Cone Beam Computed Tomography has achieved widespread acceptance, driven by robust healthcare infrastructure and high capital investment capacity. In the United States specifically, regulatory frameworks that emphasize radiation safety and image quality have set stringent performance criteria, fostering a competitive market where vendors vie to deliver advanced imaging features alongside comprehensive service support. Meanwhile, in Canada and Latin American markets, growing demand for specialized dental and craniofacial diagnostics is accelerating CBCT adoption in private practice settings, with mobile units playing an outsized role in outreach programs and rural healthcare initiatives.

Shifting to the Europe, Middle East & Africa region, a tapestry of regulatory regimes and reimbursement models informs CBCT deployment strategies. In Western Europe, established certification processes and value-based contracting have incentivized purchases of high-end flat panel detector systems, particularly in university hospitals and specialty clinics. Eastern European markets are gradually expanding their CBCT capacity, often through strategic partnerships that combine equipment financing with clinical training programs. The Middle East presents a climate of rapid infrastructure development, where major hospital projects and dental chains invest in flagship imaging centers. Meanwhile, in parts of Africa, CBCT penetration remains nascent, primarily driven by academic research institutions and emerging tele-imaging initiatives that seek to leverage mobile CBCT for outreach and diagnostic support in resource-limited environments.

In the Asia-Pacific arena, dynamic growth trajectories are underpinned by significant technological investments in healthcare modernization efforts. Japan and Australia exhibit mature CBCT ecosystems, characterized by strong collaboration between local manufacturers and global technology leaders. Southeast Asian nations are witnessing a surge in private dental clinics and imaging facilities, prompting demand for cost-effective, yet feature-rich CBCT solutions. At the same time, China’s large patient population and governmental support for domestic medical technology champions have catalyzed a market where both imported and locally produced CBCT devices compete vigorously. Across all markets, regional considerations around service networks, regulatory approvals, and import duties shape the strategic decisions of providers as they calibrate their market entry and expansion plans.

This comprehensive research report examines key regions that drive the evolution of the Cone Beam Computed Tomography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Participants and Their Innovations Shaping the Competitive Landscape of Cone Beam Computed Tomography Technology Evolution

Key players in the Cone Beam Computed Tomography arena are leveraging distinctive competitive strengths to differentiate their offerings and secure market leadership. Leading the charge, global imaging veterans are deepening their software portfolios to deliver cloud-based analytical services that enhance clinical collaboration across multi-site deployments. These technology architects are introducing subscription-based licensing models that lower upfront hardware costs while ensuring continuous access to software updates and regulatory compliance enhancements.

Emerging innovators, on the other hand, are focusing their R&D efforts on next-generation detector technologies and novel scanning protocols that promise to reduce radiation exposure without compromising image integrity. By collaborating with academic centers and engaging in clinical trials, these nimble challengers are accelerating time to market for features such as dynamic volume navigation and real-time reconstruction-a move that is resonating with forward-looking surgical teams seeking to integrate CBCT into minimally invasive workflows.

Strategic alliances have also become a hallmark of competitive differentiation, with several companies forming partnerships to deliver end-to-end solutions encompassing intraoral scanning, digital impression workflows, and surgical guide manufacturing. These alliances not only expand the ecosystem of compatible devices but also cultivate user loyalty by offering comprehensive training, service, and product integration under a unified support umbrella. Additionally, mergers and acquisitions activity has intensified as firms seek to consolidate their positions, acquire complementary technologies, and scale their operational footprints across key geographies.

Investment in service excellence remains a potent source of competitive advantage. Top-tier providers are establishing regional service centers and deploying remote diagnostics platforms to minimize downtime and optimize uptime for critical imaging systems. By offering predictive maintenance and performance analytics, these companies reinforce customer confidence and foster long-term partnerships. Collectively, these strategic moves illustrate a competitive landscape defined by technological differentiation, collaborative ecosystems, and a relentless focus on customer-centric service delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cone Beam Computed Tomography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASAHIROENTGEN IND. CO., LTD.

- Brainlab AG

- Carestream Health Inc.

- Cavendish Imaging Ltd. by DHC Group

- Cefla S.C.

- CurveBeam AI LLC

- Dentsply Sirona Inc.

- Hamamatsu Photonics K.K.

- Hefei Meyer Optoelectronic Technology Inc.

- iCRco Inc.

- J. Morita Corporation

- Jiangsu First-imaging Medical Equipment Co., LTD.

- Nanjing Perlove Medical Equipment Co., Ltd.

- Planmeca Oy

- PreXion, Inc.

- Rege Imaging & Cine Films Private Limited

- Renew Digital, LLC

- Tianjin Jinxi Medical Equipment Co.,Ltd

- VATECH CO., LTD.

- Xoran Technologies, LLC

- Zenoray Co., Ltd.

Developing Actionable Strategic Recommendations to Drive Innovation Market Penetration and Clinical Integration of Cone Beam Computed Tomography Modalities

Industry leaders are advised to pursue a multifaceted strategy that balances technological innovation with supply chain resilience and customer engagement. Prioritizing the integration of artificial intelligence modules within CBCT software suites can unlock new diagnostic capabilities, enabling earlier detection of pathologies and reducing reliance on manual interpretation. By cultivating partnerships with AI specialists, manufacturers can co-develop validated algorithms that enhance volumetric analysis, segmentation, and automated reporting functions.

Simultaneously, diversifying manufacturing footprints through establishment of assembly hubs in duty-exempt regions will mitigate exposure to escalating trade tensions. This tactical shift not only insulates organizations from abrupt tariff realignments but also strengthens relationships with local authorities and accelerates time to market. Coupling these efforts with proactive engagement in governmental exemption processes ensures that high-priority innovations can progress unimpeded.

Strengthening customer relationships through outcome-oriented service models will further differentiate market leaders. Introducing performance-based service agreements and outcome warranties instills confidence among end users and reinforces the perception of CBCT as a strategic investment rather than a commoditized purchase. Additionally, investing in remote service capabilities, including predictive analytics for maintenance and uptime optimization, will minimize operational disruptions and reinforce loyalty among high-volume imaging practices.

Finally, fostering an ecosystem approach by aligning with digital dental platforms and surgical planning suites will amplify the value proposition of CBCT systems. By ensuring seamless interoperability with complementary technologies, organizations can position their solutions as integral components of a broader digital workflow, driving stickiness and opening avenues for recurring revenue through software subscriptions and service offerings. Collectively, this holistic strategy will empower industry leaders to navigate market volatility, accelerate clinical adoption, and secure a sustainable competitive edge.

Outlining the Rigorous Multistage Research Methodology Underpinning the Development of Insights on Cone Beam Computed Tomography Market Dynamics

The research methodology underpinning this analysis involved a multistage approach that blended primary and secondary data gathering with rigorous analytical frameworks. Initially, a comprehensive review of academic publications, patent filings, and peer-reviewed clinical studies established a baseline understanding of technical progress and emerging application domains. Leveraging citation mapping techniques, the team identified thought leaders and innovation hotspots, ensuring that the investigative scope captured both established paradigms and nascent trends.

Building on this foundation, in-depth interviews were conducted with key opinion leaders across dentistry, otolaryngology, neurosurgery, orthopedics, and radiology. These interactions yielded qualitative insights into clinical workflows, decision-making criteria, and technology adoption barriers. Concurrently, discussions with procurement executives and supply chain managers illuminated the operational implications of evolving trade policies and manufacturing strategies. Through thematic analysis, the research team distilled common challenges and prioritized areas for strategic focus.

Quantitative data were sourced from publicly available regulatory filings, industry association reports, and financial disclosures of leading manufacturers. Advanced statistical techniques were applied to assess correlations between regulatory changes, tariff schedules, and supply chain adaptations. The triangulation of quantitative and qualitative findings facilitated a robust validation process, ensuring that conclusions drawn were both statistically significant and grounded in real-world practice.

Finally, iterative review sessions with cross-functional experts validated the study’s insights and refined the strategic recommendations. By synthesizing perspectives from engineering, clinical, commercial, and regulatory domains, the research framework delivered a cohesive narrative that reflects the multifaceted nature of the CBCT market. This structured methodology enables stakeholders to make informed decisions anchored in comprehensive evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cone Beam Computed Tomography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cone Beam Computed Tomography Market, by Product Type

- Cone Beam Computed Tomography Market, by Portability

- Cone Beam Computed Tomography Market, by Technology

- Cone Beam Computed Tomography Market, by Application

- Cone Beam Computed Tomography Market, by End User

- Cone Beam Computed Tomography Market, by Region

- Cone Beam Computed Tomography Market, by Group

- Cone Beam Computed Tomography Market, by Country

- United States Cone Beam Computed Tomography Market

- China Cone Beam Computed Tomography Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Strategic Implications and Future Trajectory of Cone Beam Computed Tomography Adoption in Clinical and Research Settings

The strategic exploration of Cone Beam Computed Tomography underscores its pivotal role in reshaping diagnostic imaging across multiple specialties. From the integration of AI-driven analytical tools to the optimization of hardware designs for mobile deployment, CBCT has transcended its original dental origins to become a versatile modality for complex surgical planning and intraoperative guidance. The interplay of technological advances, tariff-driven supply chain recalibrations, and nuanced segmentation insights has created a dynamic environment where providers must adapt swiftly to sustain growth and clinical relevance.

As regional narratives diverge, with mature markets emphasizing service excellence and emerging territories prioritizing accessibility, stakeholders must balance global best practices with localized strategies. Competitive differentiation will hinge on a provider’s ability to deliver comprehensive ecosystems that integrate hardware robustness, software sophistication, and outcome-oriented service models. Moreover, the imperative to future-proof operations against trade policy fluctuations underscores the importance of flexible manufacturing footprints and proactive engagement in regulatory processes.

Looking ahead, the trajectory of CBCT adoption will continue to be shaped by advances in detector technology, algorithmic innovation, and the convergence of imaging modalities. Sustained investment in R&D, coupled with strategic partnerships that bridge clinical and technological domains, will delineate the next chapter of growth for this transformative imaging platform. Ultimately, organizations that embrace a holistic view-one that encompasses clinical efficacy, operational agility, and market responsiveness-will be best positioned to harness the full potential of Cone Beam Computed Tomography.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Cone Beam Computed Tomography Market Research Report for Strategic Advantage

For organizations seeking to stay at the forefront of Cone Beam Computed Tomography research and implementation, now is the time to connect with Ketan Rohom, Associate Director of Sales & Marketing, to unlock unparalleled market insights. By engaging directly with Ketan Rohom, you gain the opportunity to explore tailored briefings that address the intricacies of evolving trade policies, segmentation dynamics, and emerging regional drivers that define the CBCT landscape today. This personalized discussion will equip your team with the nuanced perspectives necessary to refine capital allocation, optimize product development strategies, and enhance clinical adoption pathways. Reach out to secure your comprehensive market research report, which is designed to translate data-driven analysis into actionable tactics for sustained competitive advantage. Partner with Ketan Rohom to transform high-level intelligence into business-winning initiatives and secure your position in the rapidly advancing world of Cone Beam Computed Tomography.

- How big is the Cone Beam Computed Tomography Market?

- What is the Cone Beam Computed Tomography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?