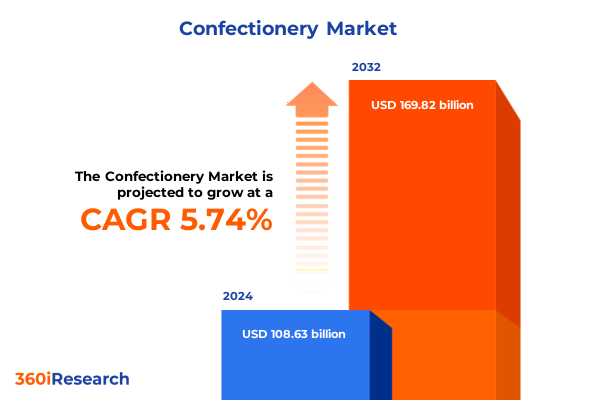

The Confectionery Market size was estimated at USD 114.77 billion in 2025 and expected to reach USD 121.25 billion in 2026, at a CAGR of 5.75% to reach USD 169.82 billion by 2032.

Setting the Stage for the Confectionery Industry’s Future Through Comprehensive Analysis of Consumer Trends and Market Dynamics

The confectionery sector stands at a pivotal moment where shifting consumer preferences and global supply dynamics converge to create both challenges and opportunities. In this environment, understanding the nuanced interplay between product innovation, ingredient sourcing, and distribution channels has never been more critical. This introduction outlines the overarching context of the confectionery landscape, highlighting the imperative for industry stakeholders to align strategic initiatives with emerging patterns in consumer behavior and regulatory developments.

Against a backdrop of heightened health consciousness and sustainability demands, market participants are recalibrating their approaches to product formulation and packaging design. Parallel to these trends, digital engagement and e-commerce penetration are reshaping how brands connect with consumers, underscoring the need for agile, omnichannel strategies. As traditional retail foot traffic evolves, companies must leverage data-driven insights to optimize assortment, pricing, and promotional tactics in real time. This section establishes the foundation for the subsequent deep dive into transformative shifts, tariff implications, and segmentation nuances.

By setting this stage, readers will appreciate the complex layers that define the modern confectionery industry. The insights presented herein aim to equip decision-makers with a holistic perspective, ensuring that strategic choices are informed by a rigorous understanding of market drivers and competitive forces. This introduction thus paves the way for a comprehensive exploration of how brands can seize momentum and thrive in an increasingly dynamic marketplace.

Exploring Pivotal Trends That Are Redefining Product Innovation, Digital Engagement, and Sustainability Across Confectionery

The confectionery landscape has undergone profound transformation as consumers increasingly demand products that harmonize taste with wellness. Health and wellness priorities have accelerated the development of formulations featuring lower sugar content, plant-based ingredients, and natural flavor extracts, challenging traditional product portfolios and prompting innovation in ingredient sourcing. Simultaneously, premiumization has emerged as a defining shift, with discerning shoppers gravitating toward artisanal and craft offerings that emphasize unique flavor profiles, single-origin cocoa, and bespoke packaging experiences.

Digital disruption has further reshaped the competitive environment, as brands invest in direct-to-consumer platforms and social commerce initiatives to cultivate deeper relationships with their audiences. These online channels are complemented by data-driven loyalty programs and immersive virtual experiences that amplify engagement and foster brand advocacy. In parallel, sustainability has ascended to a strategic priority, driving commitments around ethical sourcing, recyclable packaging, and transparent supply chain practices.

In navigating these transformative shifts, industry players must adopt an integrated approach that balances speed to market with robust risk management. Collaboration with ingredient innovators, co-brand partnerships, and targeted marketing campaigns that resonate with evolving consumer values will be critical. This section illuminates the key tectonic trends reshaping the confectionery sector and underscores the urgency for brands to reimagine their value propositions in light of changing preferences and technological advancements.

Assessing How 2025 Tariff Realignments on Confectionery Imports Are Reshaping Sourcing Strategies and Cost Structures

In 2025, the United States government implemented a series of tariff adjustments on imported confectionery ingredients and finished goods, significantly intensifying pressure on supply chains and pricing structures. These measures have reverberated through the industry, compelling manufacturers to reassess sourcing strategies and explore alternative markets for key inputs like cocoa, palm oil derivatives, and specialized packaging materials. The cumulative impact of these tariffs has manifested in tighter supplier contracts, extended lead times, and elevated transportation costs.

As raw material expenses climbed, brands encountered challenging decisions between absorbing costs to preserve shelf-price parity or passing increases to consumers. Many opted for reformulation initiatives to mitigate tariff impacts, incorporating a broader array of regional sweeteners and emulsifiers that offer cost efficiencies without compromising sensory appeal. Concurrently, businesses have intensified collaboration with domestic ingredient producers to bolster supply chain resilience and reduce exposure to cross-border trade volatility.

Despite these headwinds, agile players have leveraged the tariff landscape as an impetus for operational optimization. Investments in near-shoring, advanced demand planning tools, and strategic distribution center realignments have delivered incremental efficiencies. Looking ahead, ongoing dialogue with regulatory bodies and active participation in trade associations will remain pivotal for influencing policy evolution and ensuring that industry perspectives are represented in future tariff deliberations.

Deriving Multifaceted Insights from Product, Ingredient, and Distribution Channel Segmentation Within Confectionery

A nuanced understanding of consumer demand across product types reveals that chocolate continues to command significant attention, with dark, milk, and white variants each catering to distinct usage occasions and taste preferences. Dark chocolate’s perceived health benefits and premium connotations attract a discerning segment seeking antioxidant-rich indulgences, while milk chocolate remains the backbone of mainstream consumption owing to its familiar sweetness and versatile applications. White chocolate, with its creamy texture and novelty appeal, often gains traction through limited-edition flavor infusions and co-brand collaborations.

Ingredient type segmentation highlights an accelerating shift toward sugar-free offerings, underpinned by heightened scrutiny of caloric intake and glycemic impact. Aspartame, stevia, and sucralose each present unique taste profiles and functional attributes, enabling product developers to engineer indulgent experiences that align with wellness goals. Conventional sugar formulations maintain their market relevance, particularly in premium handcrafted confections where artisanal craftsmanship and traditional flavor authenticity command premium price points.

Distribution channels offer further granularity into consumer touchpoints, spanning convenience stores, drugstore pharmacies, online retail environments, and supermarket hypermarket complexes. The convenience channel thrives on on-the-go formats and impulse buys, whereas drugstore pharmacies benefit from pharmacy-driven wellness positioning for functional and sugar-free confections. Online retail has bifurcated into brand-owned e-commerce platforms and third-party marketplaces, driving personalization and subscription models. Supermarket hypermarket settings provide broad assortment and promotional scale, remaining a critical arena for volume-driven strategies.

This comprehensive research report categorizes the Confectionery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ingredient Type

- Distribution Channel

Uncovering Distinctive Regional Demand Patterns and Regulatory Drivers Across the Americas, EMEA, and Asia-Pacific Markets

Regional distinctions in the confectionery market are pronounced, with the Americas exhibiting a strong preference for rich, milk-based chocolates and bulk packaging designed for sharing. North American consumers demonstrate growing interest in functional and premium segments, driving brands to balance indulgence with clean-label claims. In Latin America, traditional confections infused with regional ingredients such as tropical fruit extracts and pecans continue to resonate, reflecting enduring cultural affinities.

The Europe, Middle East, and Africa landscape showcases a tapestry of regulatory frameworks and taste profiles. Western European markets lead in sustainability mandates and cocoa traceability, prompting investment in certification programs and farmer partnerships. In the Middle East, premium gifting traditions fuel demand for ornate confectionery packaging and luxury assortments, while parts of Africa are emerging as both production hubs and developing consumer markets, with urbanization catalyzing growth in branded offerings.

Asia-Pacific offers a dual narrative of mature markets with established premium chocolate consumption and rapidly expanding economies where sugar confectionery and gum categories are evolving. In developed East Asia, innovative flavors and health-oriented variants capture consumer interest, whereas in Southeast Asia, rising disposable incomes are lifting demand for both international brands and locally inspired treats. The interplay between modern retail expansion and e-commerce proliferation underscores the importance of channel strategy customization by region.

This comprehensive research report examines key regions that drive the evolution of the Confectionery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Market Leaders and Emerging Players Leverage Innovation, Partnerships, and Sustainability to Differentiate

Leading global confectionery companies continue to vie for competitive advantage through product innovation, strategic alliances, and targeted acquisitions. Enterprises at the forefront are those that marry robust R&D capabilities with agile go-to-market approaches, enabling rapid prototyping of novel flavor combinations and functional ingredients. Partnerships with flavor houses, ingredient specialists, and packaging innovators have accelerated time-to-shelf for specialty lines, further differentiating portfolios.

In response to sustainability imperatives, prominent players have bolstered commitments to ethical sourcing, aligning with third-party certification schemes and investing in long-term cocoa farmer development. Collaboration with non-governmental organizations and traceability platform providers has enhanced transparency, strengthening brand reputations among eco-conscious consumers. Additionally, the integration of digital marketing platforms and data analytics tools has empowered companies to tailor campaigns based on granular consumer insights, optimizing engagement and conversion metrics.

A number of mid-sized and emerging firms are carving niches through disruptive business models, including direct-to-consumer subscription services and limited-edition experiential drops. These organizations leverage social media communities and influencer partnerships to amplify buzz, tapping into younger demographics and fostering brand loyalty. Collectively, these strategic moves illustrate a competitive environment defined by both consolidation among established giants and invigorating innovation from agile challengers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Confectionery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arcor S.A.

- August Storck KG

- Cloetta AB

- Ezaki Glico Co., Ltd.

- Ferrero International S.p.A.

- Glico Group Co., Ltd.

- Godiva Chocolatier

- Haribo GmbH & Co. KG

- Lindt & Sprüngli AG

- Lotte Confectionery Co., Ltd.

- Mars, Incorporated

- Meiji Co., Ltd.

- Mondelēz International, Inc.

- Morinaga & Company, Ltd.

- Nestlé S.A.

- Orion Corporation

- Perfetti Van Melle S.p.A.

- Pladis Global Ltd.

- The Hershey Company

- Tootsie Roll Industries, Inc.

- Yıldız Holding A.Ş.

Implementing Integrated Strategies That Align Product Innovation, Distribution Optimization, and Sustainable Practices

Industry decision-makers should prioritize the development of multifunctional product lines that seamlessly blend indulgence with health-forward attributes. By harnessing advanced sweetener technologies and botanical infusions, confectionery manufacturers can resonate with wellness-oriented consumers without sacrificing sensory quality. Simultaneously, forging strategic alliances with health-tech startups and ingredient innovators will accelerate product development cycles and foster differentiation.

Next, brands must embrace a hybrid distribution strategy that unites the immediacy of convenience and drugstore channels with the personalization capabilities of online retail. Investing in data analytics for demand forecasting and dynamic pricing will enable more precise inventory allocation, reducing waste and enhancing profit margins. In tandem, experiential retail concepts and pop-up activations can invigorate brand presence and drive trial in competitive brick-and-mortar environments.

To address evolving regulatory landscapes and consumer expectations around sustainability, companies should implement end-to-end traceability solutions and adopt modular, recyclable packaging platforms. Collaborating with supply chain partners to integrate blockchain-enabled tracking can reinforce ethical claims and streamline compliance reporting. Finally, prioritizing continuous engagement with policy makers and industry associations will ensure that evolving trade regulations are navigated effectively, safeguarding operational continuity.

Detailing a Rigorous Research Framework Combining Multi-Source Secondary Review and Robust Primary Engagement

This research synthesizes insights drawn from a comprehensive blend of secondary and primary data collection methodologies. Secondary research involved rigorous review of trade publications, regulatory filings, and peer-reviewed journals to establish foundational understanding of industry trends, macroeconomic indicators, and regulatory developments. Concurrently, primary research encompassed in-depth interviews with senior executives across leading confectionery manufacturers, ingredient suppliers, and retail channel operators, providing firsthand perspectives on strategic priorities and operational challenges.

Quantitative analysis techniques were applied to anonymized shipment data and consumer survey results to validate thematic findings and detect emergent patterns. Data triangulation ensured the reliability of conclusions by cross-referencing multiple sources, including proprietary industry databases and third-party analytics. Qualitative insights were further enriched through moderated roundtable discussions with category experts, enabling nuanced interpretation of complex phenomena such as tariff impacts and sustainability deployment.

Throughout the study, rigorous quality assurance protocols were enforced, including standardized interview guides, statistical significance testing, and iterative peer reviews. This methodology guarantees that the report’s recommendations and insights rest upon a robust evidentiary foundation, empowering decision-makers to act with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Confectionery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Confectionery Market, by Product Type

- Confectionery Market, by Ingredient Type

- Confectionery Market, by Distribution Channel

- Confectionery Market, by Region

- Confectionery Market, by Group

- Confectionery Market, by Country

- United States Confectionery Market

- China Confectionery Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Summarizing Core Findings and Emphasizing Strategic Agility Required for Confectionery Market Leadership

In summary, the confectionery industry stands at an inflection point driven by health consciousness, premiumization, and sustainability imperatives. These forces, together with geopolitical dynamics such as tariff realignments, demand a multifaceted response from market participants. Companies that excel will be those that integrate agile product development with strategic distribution planning and transparent supply chain practices.

By leveraging segmentation insights across product types, ingredient formulations, and distribution channels, organizations can tailor offerings to diverse consumer cohorts and regional preferences. Simultaneously, monitoring competitive moves and regulatory shifts will inform proactive adjustments to sourcing strategies and operational footprints. The interplay between innovation, digital engagement, and sustainability is shaping the future of confectionery, and companies must adopt a holistic perspective to navigate these complexities successfully.

Ultimately, the path to market leadership lies in harmonizing consumer-centric product design with efficient, resilient supply chains and authentic sustainability commitments. This conclusion underscores the importance of foresight, collaboration, and strategic agility in capitalizing on the vast potential of the evolving confectionery landscape.

Unlock Customized Confectionery Intelligence by Connecting Directly with an Expert to Purchase Your Essential Industry Report

Elevate your strategic positioning and gain unparalleled clarity on evolving confectionery trends by securing this comprehensive market research report today. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discuss tailored insights that address your organization’s unique priorities. Embark on a data-driven journey to anticipate industry shifts, optimize product portfolios, and unlock growth opportunities ahead of your competitors. Connect with Ketan Rohom to obtain immediate access to in-depth analysis, executive-level recommendations, and custom consulting options designed for decision-makers seeking market leadership.

- How big is the Confectionery Market?

- What is the Confectionery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?