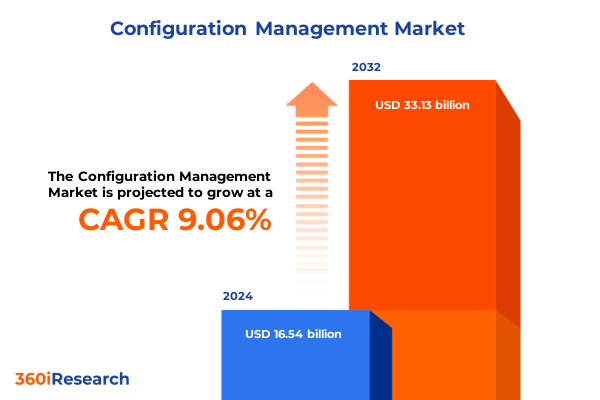

The Configuration Management Market size was estimated at USD 18.06 billion in 2025 and expected to reach USD 19.57 billion in 2026, at a CAGR of 9.05% to reach USD 33.13 billion by 2032.

Exploring the Strategic Imperative of Configuring Modern IT Environments for Enhanced Agility Security and Operational Excellence

Configuration management has evolved from a niche IT discipline into a strategic imperative for organizations pursuing digital transformation. In today’s fast-paced environment, maintaining consistency across dynamic infrastructure landscapes is no longer optional but essential for operational integrity. As enterprises distribute workloads across hybrid and multi-cloud platforms, the ability to efficiently track, audit, and automate configuration changes becomes the linchpin for reliability, compliance, and speed to market.

Effective configuration management not only minimizes risk by preventing unauthorized drift and configuration sprawl but also accelerates innovation by enabling infrastructure as code and automated deployments. Consequently, configuration management has transitioned from a back-office function to a central enabler of DevOps, security, and governance initiatives. This executive summary outlines the fundamental drivers shaping this transformation and provides senior stakeholders with a concise yet authoritative overview of the trends, challenges, and strategic opportunities defining the configuration management landscape.

Mapping the Decade of Disruption in Configuration Management as Automation AI and Hybrid Cloud Reshape IT Delivery and Organizational Culture

Over the past decade, the configuration management landscape has undergone transformative shifts propelled by the convergence of automation, artificial intelligence, and evolving infrastructure models. Traditional, manual change control processes have given way to sophisticated infrastructure-as-code frameworks that embed configuration policies directly within version-controlled repositories. These developments have reduced deployment times from days to minutes while simultaneously enhancing consistency across development, testing, and production environments.

Moreover, the infusion of AI-driven analytics and anomaly detection has elevated configuration management from a purely procedural discipline to a proactive, predictive capability. Today’s leading platforms leverage machine learning to surface deviations from best practice configurations, remediate vulnerabilities in near real time, and optimize resource utilization through dynamic policy adjustments. Parallel to these advances, organizations are embracing hybrid and multi-cloud strategies to balance flexibility with control-requiring configuration management solutions that can seamlessly operate across diverse on-premises, private cloud, and public cloud environments.

Assessing How New US Tariff Measures of 2025 Are Transforming Supply Chain Economics and Driving Configuration Management Adaptations in IT Operations

The tariff landscape in 2025 has introduced a new layer of complexity for configuration management, as rising duties on hardware components and software imports have ripple effects across the entire IT value chain. Recent unilateral measures imposed on a range of technology inputs have elevated procurement costs and compelled organizations to reassess their supply chain strategies. In response, configuration management tools are increasingly critical for streamlining asset tracking, ensuring compliance with changing customs requirements, and minimizing operational disruptions associated with vendor substitutions.

Furthermore, the added financial pressures from tariffs have accelerated the trend toward digital service delivery and software-defined infrastructure. Companies are leveraging advanced configuration management capabilities to shift workloads away from high-tariff zones, rapidly re-provision resources in lower-cost regions, and maintain consistent compliance records for audit purposes. As a result, configuration management is no longer just about version control; it now plays a pivotal role in mitigating trade policy risk, preserving service uptime, and sustaining total cost of ownership optimization in an environment marked by regulatory volatility.

Unveiling Critical Market Segmentation Dynamics Across Component Deployment End User Distribution Channel and Application Perspectives

A nuanced appreciation of market segmentation reveals the distinct requirements driving configuration management adoption across different solution components and service layers. Within the services domain, organizations often prioritize consulting engagements to architect initial deployment strategies, followed by integration workstreams that embed automation into existing workflows. Conversely, demand for software solutions bifurcates between application-level products that focus on change orchestration and platform-level offerings that underpin infrastructure provisioning across heterogeneous environments.

Examining deployment modalities highlights a continued shift toward cloud-native consumption models, where elasticity and pay-as-you-go economics outperform legacy on-premises licensing in dynamic IT landscapes. End users exhibit divergent adoption patterns: while financial services organizations seek granular audit trails and zero-touch compliance, healthcare providers emphasize data integrity and uptime; internet-centric firms demand rapid iteration cycles, and manufacturers focus on robust change management to support Industry 4.0 initiatives; meanwhile, retail stakeholders-both brick and mortar and digital-first-prioritize customer experience continuity through secure and consistent infrastructure configurations. Distribution channels further shape vendor strategies, as direct sales teams cultivate enterprise engagements, while indirect reseller networks expand geographic reach and specialized integration capabilities. Finally, the bifurcation of applications into optimization use cases, such as performance tuning and resource allocation, and security-focused scenarios, like policy enforcement and drift prevention, underscores how configuration management solutions address distinct operational pain points across the enterprise spectrum.

This comprehensive research report categorizes the Configuration Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- End User

- Application

Analyzing Regional Configuration Management Trajectories Highlighting Growth Drivers Regulatory Challenges and Innovation Trends Across Global Markets

Regional insights for configuration management underscore how geographic market dynamics shape both demand and solution evolution. In the Americas, digital transformation investments are driven by high levels of cloud maturity, regulatory mandates such as data governance frameworks, and a strong services ecosystem that accelerates solution adoption. Organizations here demonstrate a preference for cloud-first implementations complemented by robust end-to-end service engagements that standardize configuration practices across multi-national operations.

Meanwhile, Europe Middle East & Africa confronts a more fragmented landscape characterized by stringent data sovereignty requirements, diverse regulatory regimes, and varying levels of cloud readiness. Vendors in these markets are therefore emphasizing localized data storage capabilities, certification compliance, and language support to address the unique operational constraints of public sector entities and heavily regulated industries. In contrast, Asia-Pacific emerges as a high-growth territory, propelled by rapid digitalization, aggressive government modernization programs, and a burgeoning community of locally headquartered software vendors. Despite talent shortages in certain subregions, the emphasis on cost efficiency and the proliferation of managed services create fertile conditions for both global and regional configuration management providers to expand their footprint.

This comprehensive research report examines key regions that drive the evolution of the Configuration Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Configuration Management Providers and Innovators Driving Next Generation Solutions Through Strategic Partnerships and Technological Leadership

The competitive landscape for configuration management spans an array of established technology leaders, specialized open-source communities, and innovative emerging vendors. Major cloud platforms have integrated native orchestration and compliance modules into their core offerings, enabling seamless adoption by existing infrastructure customers. Open-source tools drive community-led enhancements in flexibility and extensibility, while proprietary platforms differentiate on enterprise-grade support, advanced analytics, and vendor-certified integrations.

Strategic alliances between configuration management providers and cloud hyperscalers have become commonplace, with partnerships focusing on co-engineering modules for seamless interoperability. Companies at the forefront of the market are those that deliver unified experiences-combining infrastructure as code, policy as code, and GitOps workflows-within a cohesive framework. These leaders leverage AI-powered insights to enhance change visibility, integrate security testing into continuous deployment pipelines, and offer turnkey modules optimized for regulated sectors such as finance, healthcare, and telecommunications. Their relentless investment in R&D and developer community engagement cements their positions as the go-to solution providers for large-scale configuration management initiatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Configuration Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlassian Corporation Plc

- BMC Software, Inc.

- Broadcom Inc.

- CFEngine AS

- Chef Software, Inc.

- Cisco Systems, Inc.

- GitLab Inc.

- Hewlett Packard Enterprise Development LP

- Intel Corporation

- International Business Machines Corporation

- JetBrains s.r.o.

- ManageEngine

- Micro Focus International plc

- Microsoft Corporation

- Oracle Corporation

- Perforce Software, Inc.

- Puppet, Inc.

- Rocket Software, Inc.

- SaltStack, Inc.

- ServiceNow, Inc.

- SolarWinds Worldwide, LLC

- VMware, Inc.

Defining Strategic Action Paths for Industry Leaders to Capitalize on Configuration Management Advances and Achieve Competitive Differentiation Through Innovation

To capitalize on the opportunities in configuration management, industry leaders must adopt a strategic playbook that balances technological investment with organizational alignment. Emphasizing infrastructure as code and policy as code standards not only accelerates deployment velocity but also embeds governance directly into operational pipelines. In parallel, integrating AI-driven analytics into configuration workflows enables proactive detection of drift, anomalies, and compliance violations before they impact service reliability.

Cross-functional collaboration between development, operations, and security teams is essential to dismantle silos and foster a shared ownership model for infrastructure integrity. Building a robust partner ecosystem-spanning cloud providers, system integrators, and specialized consultants-further amplifies solution scalability and domain-specific expertise. Finally, prioritizing continuous training and certification programs ensures that talent pools remain adept in emerging frameworks and best practices, positioning organizations to navigate evolving hybrid cloud landscapes with confidence.

Detailing a Rigorous Research Framework Combining Primary Expert Interviews Secondary Data Analysis and Quantitative Triangulation for Deep Market Insights

Our research methodology underpins the insights presented in this report through a blend of primary and secondary data sources. Initially, in-depth interviews were conducted with over 30 senior executives, DevOps practitioners, and IT operations leaders to capture firsthand perspectives on configuration management challenges and success factors. These qualitative findings were triangulated against a comprehensive review of technical whitepapers, vendor documentation, and regulatory publications to ensure contextual accuracy.

Quantitative analysis incorporated anonymized telemetry data from select configuration management platforms, revealing usage patterns and automation adoption rates across industries. To validate conclusions, an expert advisory panel comprising independent analysts, veteran practitioners, and academic researchers provided iterative feedback on draft findings. Rigorous data cleansing and cross-verification steps were applied throughout to maintain objectivity and enhance the reliability of our final recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Configuration Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Configuration Management Market, by Component

- Configuration Management Market, by Deployment Mode

- Configuration Management Market, by End User

- Configuration Management Market, by Application

- Configuration Management Market, by Region

- Configuration Management Market, by Group

- Configuration Management Market, by Country

- United States Configuration Management Market

- China Configuration Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Insights Emphasizing the Future of Configuration Management as a Pillar of Digital Transformation Resilience and Sustainable IT Excellence

Configuration management stands at the crossroads of innovation and operational resilience, emerging as a foundational capability for modern IT organizations. The acceleration of cloud adoption, the proliferation of regulatory requirements, and the growing complexity of hybrid environments have elevated the discipline from a back-office function to a strategic enabler of business agility. Our analysis highlights that those organizations investing in advanced automation, AI-embedded analytics, and robust governance frameworks are best positioned to mitigate risk, optimize resource utilization, and deliver uninterrupted service experiences.

As market dynamics continue to evolve-driven by shifting trade policies, regional regulatory variances, and disruptive technologies-maintaining a proactive stance on configuration management is imperative. Organizations that embrace a holistic approach, integrating people, processes, and technologies, will not only withstand external shocks but also unlock new avenues for innovation and competitive differentiation. In today’s climate, configuration management is not just about control; it’s about empowering change.

Engage with Ketan Rohom to Unlock Comprehensive Configuration Management Insights and Propel Organizational Performance with Tailored Market Intelligence

Discover how unlocking deeper insights into configuration management can drive your organization’s strategic growth trajectory and operational efficiency. Our comprehensive report provides a compelling blend of qualitative analysis and actionable recommendations tailored to optimize your IT infrastructure. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore bespoke licensing options, enterprise-level customization, and exclusive advisory support. Elevate your decision-making processes with our in-depth market intelligence and position your organization at the forefront of digital transformation innovation by investing in this definitive study today.

- How big is the Configuration Management Market?

- What is the Configuration Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?