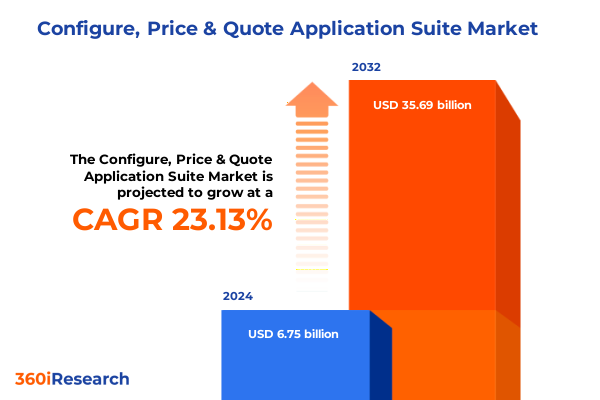

The Configure, Price & Quote Application Suite Market size was estimated at USD 8.25 billion in 2025 and expected to reach USD 10.08 billion in 2026, at a CAGR of 23.27% to reach USD 35.69 billion by 2032.

Revolutionizing Sales Processes through Integrated Configuration, Pricing, and Quote Solutions to Streamline Complex Deal Management and Accelerate Revenue Growth

In today’s hypercompetitive business environment, sales teams face unprecedented challenges-from managing complex product configurations to ensuring price accuracy across diverse customer segments. A robust Configuration, Pricing, and Quote application suite serves as the foundation for sales excellence, streamlining workflows and reinforcing cross-functional alignment. By automating the generation of accurate quotes, companies can minimize errors, accelerate deal cycles, and strengthen relationships with buyers who demand personalized solutions.

As organizations strive to differentiate through tailored offerings and dynamic pricing structures, CPQ solutions become a critical enabler of revenue growth. They bridge the gap between product engineering, finance, and sales operations, embedding governance mechanisms that safeguard margin integrity while empowering sales teams. Moreover, by embedding guided selling and visualization tools, CPQ platforms deliver an intuitive user experience that enhances adoption rates and reduces training time.

The integration of CPQ with CRM and ERP systems further amplifies its value, creating a unified data ecosystem that supports real-time decision-making. This seamless flow of configuration and pricing data enhances demand forecasting, inventory planning, and financial reconciliation processes. As a result, organizations equipped with advanced CPQ capabilities position themselves to capitalize on new market opportunities and maintain competitive agility.

How Digital Transformation and AI-driven Innovations Are Redefining Configuration, Pricing, and Quoting Workflows to Meet Evolving Customer and Market Demands

The configuration, pricing, and quoting landscape is undergoing a seismic shift driven by the adoption of digital technologies and evolving buyer expectations. Cloud-native architectures have supplanted on-premise deployments, enabling rapid feature rollouts and seamless scalability. Meanwhile, artificial intelligence and machine learning are transforming how pricing recommendations are generated, with predictive algorithms delivering more precise, context-aware offers.

Furthermore, the rise of subscription-based business models and usage-based pricing has compelled organizations to adopt flexible CPQ platforms capable of managing complex billing scenarios and renewals. Guided selling augmented with visualization capabilities helps sales teams navigate intricate product bundles and service attachments, creating compelling proposals that resonate with decision-makers.

As remote and hybrid selling models become the norm, mobile-enabled CPQ interfaces ensure that field representatives can configure and quote deals from any location. Low-code and no-code customization frameworks empower business analysts to adapt CPQ workflows without relying on IT cycles, accelerating time to value. These transformative trends underscore the necessity for enterprises to modernize their CPQ strategies to remain competitive.

Assessing the Cumulative Effects of United States 2025 Tariff Measures on Pricing Volatility and Supply Chain Cost Structures Impacting CPQ Strategies

United States tariff measures enacted in early 2025 have introduced new complexities for manufacturers and distributors, reverberating across supply chains and pricing strategies. Tariffs on key components and raw materials have increased landed costs, making it essential for CPQ platforms to support real-time cost updates. As a result, businesses are leveraging scenario modeling to assess the impact of multiple tariff scenarios on overall deal economics.

Moreover, dynamic pricing engines within CPQ suites are being configured to incorporate tariff escalators, ensuring that quotes accurately reflect additional duties without manual intervention. This level of automation reduces the risk of margin erosion and compliance lapses. From a strategic perspective, companies are reengineering product hierarchies and bill-of-material structures within CPQ systems to segregate tariff-exempt components or alternative sourcing options.

Consequently, the cumulative impact of these tariffs has accelerated the adoption of advanced CPQ capabilities, compelling organizations to prioritize flexibility and responsiveness. By embedding tax and duty configurations natively, CPQ vendors enable seamless end-to-end management, helping businesses adapt to regulatory changes while maintaining cost transparency for customers.

Uncovering Multifaceted Segmentation across Functionality, Component Type, Pricing Models, Deployment, Organization Size, and Industry Vertical Dynamics

The CPQ market’s nuanced segmentation reveals critical insights when analyzing functionality, component type, pricing model, deployment type, organization size, and industry verticals. Functionality is dissected across Configuration, Pricing, and Quoting modules, with Configuration featuring both Process and Product Configuration to address unique engineering and workflow requirements. Within Pricing, distinctions emerge among Discount Management, Dynamic Pricing, and Standard Pricing, each catering to different degrees of pricing sophistication, while Quoting spans Bid Management and Proposal Generation to streamline sales cycles.

In addition, the market can be understood by Component Type, where Service offerings such as Consulting, Implementation, and Managed Services complement Software deployments, delivering end-to-end support. The choice between Licensing and Subscription-Based models reflects customer preferences for CAPEX versus OPEX investment structures, influencing procurement strategies and vendor value propositions.

Deployment preferences split between Cloud-Based and On-Premise solutions, with each option appealing to varying IT governance and data security requirements. Organizational size further segments demand, as Large Enterprises demand extensive customization and scalability, whereas Small and Medium Enterprises prioritize ease of use and rapid deployment. Finally, industry verticals-from Energy, including Oil & Gas, Renewable Energy, and Utilities, to Financial Services with Banking, Insurance, and Investment Management, through Healthcare encompassing Medical Devices and Pharmaceuticals, and Manufacturing covering Discrete and Process Manufacturing, to Retail in both Brick-and-Mortar and E-commerce contexts-demonstrate diverse CPQ use cases driven by sector-specific workflows and regulations.

This comprehensive research report categorizes the Configure, Price & Quote Application Suite market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Functionality

- Component Type

- Pricing Model

- Deployment Type

- Organization Size

- Industry Vertical

Analyzing Regional Dynamics and Market Characteristics Shaping CPQ Adoption Growth Trajectories across Americas EMEA and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the adoption and customization of CPQ solutions, with each geographic market exhibiting distinct characteristics. In the Americas, North America leads with mature sales processes and a high propensity for cloud-based deployments, whereas Latin America is emerging, driven by digitalization initiatives and a growing appetite for flexible pricing mechanisms. As organizations navigate cross-border trade agreements and regional tax complexities, they require CPQ platforms that offer robust localization and compliance features.

Meanwhile, Europe, Middle East, and Africa present a tapestry of regulatory landscapes and market sophistication. European enterprises often prioritize data privacy and integration with SAP and other enterprise systems, while Middle Eastern organizations seek advanced configurators to support bespoke equipment and energy projects. African markets, though nascent, are rapidly digitalizing, demanding scalable, cost-effective CPQ deployments.

In the Asia-Pacific region, dynamic growth is fueled by manufacturing powerhouses and a thriving e-commerce ecosystem. Companies in China, Japan, and Southeast Asia are investing in AI-driven pricing analytics and guided selling tools to manage complex product portfolios. However, infrastructure variability and data sovereignty concerns influence deployment decisions, underscoring the need for flexible architectures that can adapt to local market regulations.

This comprehensive research report examines key regions that drive the evolution of the Configure, Price & Quote Application Suite market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading CPQ Vendors Strategic Innovations Partnerships and Competitive Advantages Fueling Market Leadership and Value Creation

Leading CPQ vendors continue to invest heavily in R&D, strategic partnerships, and ecosystem expansions to solidify their market positions. Salesforce extends its platform capabilities through AI-infused pricing recommendations and native integration with its CRM offerings, ensuring a unified customer engagement environment. Oracle focuses on deep ERP integration, leveraging its broad enterprise suite to enable end-to-end quote-to-cash orchestration. SAP CPQ distinguishes itself by embedding advanced constraint-based configuration within its S/4HANA ecosystem, appealing to organizations committed to a single-vendor strategy.

Specialist CPQ providers are also raising the bar. Apttus integrates blockchain-based contract management to enhance transparency in quote approvals, while PROS harnesses machine learning to optimize yield management in real time. Niche innovators such as Tacton deliver advanced visualization and product configuration for complex manufacturing scenarios, and Configure One addresses high-velocity manufacturing needs with a model-driven configurator. Joint ventures and strategic alliances among these players are expanding channel reach, with consulting partners embedding CPQ modules into larger digital transformation engagements.

Collectively, these companies are driving continuous innovation, with a strong emphasis on analytics, user experience, and low-code customization to meet evolving customer demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Configure, Price & Quote Application Suite market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apttus Corporation

- camos Software und Beratung GmbH

- Cincom System, Inc.

- ConnectWise, LLC

- EASA, Inc.

- Experlogix, Inc.

- Infor

- International Business Machine Corporation

- Model N, Inc.

- Oracle Corporation

- PandaDoc Inc.

- PROS Holdings Inc.

- Quootz

- Revalize, Inc

- Salesbricks, Inc.

- Salesforce.com Inc.

- SAP SE

- Subskribe, Inc.

- Workday, Inc.

- Xait AS

- Zuora Inc.

Strategic Recommendations Empowering Industry Leaders to Enhance CPQ Capabilities Drive Organizational Performance and Achieve Sustainable Growth Outcomes

To capitalize on emerging opportunities, industry leaders should prioritize the deployment of AI-driven pricing engines that leverage historical deal data and real-time market inputs to recommend optimal price structures. At the same time, integrating CPQ solutions seamlessly with ERP and CRM systems will ensure a single source of truth, reducing data silos and accelerating decision-making. Embracing low-code and no-code frameworks allows business analysts to tailor workflows and approval processes without lengthy IT cycles, increasing agility.

Moreover, organizations must invest in user-centric interface design to drive adoption among sales teams; intuitive guided selling and interactive product visualizers can reduce errors and training overhead. Establishing robust pricing governance frameworks-complete with role-based access controls and audit trails-will safeguard margin integrity and compliance. Additionally, building advanced analytics dashboards that monitor key performance indicators in real time enables continuous optimization of configuration rules and discounting strategies.

Finally, forging strategic partnerships with implementation specialists and fostering a center of excellence for CPQ best practices will ensure that deployments scale effectively across global teams and evolving business models. By adopting this holistic approach, companies can transform CPQ from a back-office enabler into a strategic growth driver.

Outlining a Rigorous Research Methodology Integrating Primary Interviews Secondary Analysis and Expert Validation to Ensure Insight Integrity

Our research methodology combined qualitative and quantitative approaches to deliver a comprehensive understanding of the CPQ landscape. Primary research involved in-depth interviews with senior executives, sales operations leaders, and IT architects across diverse industries, capturing firsthand perspectives on pain points, deployment hurdles, and feature priorities. These interviews were complemented by structured surveys designed to quantify adoption patterns, integration preferences, and ROI considerations.

Secondary research drew upon a wide array of public and proprietary sources, including vendor whitepapers, industry analyst commentaries, case studies, and regulatory filings. We analyzed ERP and CRM integration benchmarks, tariff databases, and technology adoption reports to contextualize emerging trends. Data triangulation ensured the validation of insights by cross-referencing findings from multiple sources, while expert validation workshops with domain specialists refined our interpretations and recommendations.

To maintain rigor, all data points underwent consistency checks, and thematic coding was applied to qualitative inputs to identify recurring patterns. This hybrid approach provides decision-makers with a roadmap grounded in empirical evidence and enriched by practical experience.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Configure, Price & Quote Application Suite market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Configure, Price & Quote Application Suite Market, by Functionality

- Configure, Price & Quote Application Suite Market, by Component Type

- Configure, Price & Quote Application Suite Market, by Pricing Model

- Configure, Price & Quote Application Suite Market, by Deployment Type

- Configure, Price & Quote Application Suite Market, by Organization Size

- Configure, Price & Quote Application Suite Market, by Industry Vertical

- Configure, Price & Quote Application Suite Market, by Region

- Configure, Price & Quote Application Suite Market, by Group

- Configure, Price & Quote Application Suite Market, by Country

- United States Configure, Price & Quote Application Suite Market

- China Configure, Price & Quote Application Suite Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Concluding Perspectives on the Strategic Imperatives of CPQ Solutions Shaping Modern Sales Ecosystems and Long-term Business Value Creation

Throughout this analysis, it is evident that modern sales ecosystems demand agile, data-driven CPQ solutions capable of addressing complexity at scale. Digital transformation, AI innovations, and subscription economy dynamics are reshaping how companies configure products, set prices, and generate quotes. Simultaneously, regulatory shifts such as United States tariffs introduce new variables that require responsive pricing frameworks and scenario modeling capabilities.

Our segmentation and regional insights reveal that no single approach fits all; rather, organizations must calibrate their CPQ strategies based on functionality requirements, component service mix, deployment preferences, and industry-specific workflows. The competitive landscape underscores the importance of choosing vendors that align with enterprise technology roadmaps and deliver continuous innovation.

By implementing our actionable recommendations and adhering to best-practice governance frameworks, businesses can unlock the full potential of CPQ as a strategic enabler of sales performance, operational efficiency, and customer satisfaction. The time to modernize quote-to-cash processes and embrace next-generation CPQ capabilities is now.

Take the Next Step to Elevate Your CPQ Strategy by Connecting with Our Associate Director of Sales and Marketing for Exclusive Market Research Report Access

If you’re prepared to harness the full potential of CPQ solutions and stay ahead of competitive pressures, now is the time to act. Our comprehensive market research report delivers in-depth insights tailored to your strategic priorities-from navigating evolving tariff landscapes to fine-tuning pricing governance frameworks. By reaching out to Ketan Rohom, Associate Director, Sales & Marketing, you’ll unlock access to exclusive data, expert analyses, and actionable recommendations designed to accelerate your CPQ initiatives.

By engaging directly with Ketan, you can schedule a personalized briefing that aligns with your organization’s objectives, gain clarity on how to integrate advanced configurators and dynamic pricing engines into your existing tech stack, and explore customized deployment strategies. This direct collaboration ensures you receive a targeted roadmap that addresses your unique operational challenges and growth ambitions. Don’t let complexity stall your transformation journey. Connect with Ketan Rohom today to secure your market research report and take the next step toward streamlined quote-to-cash excellence.

- How big is the Configure, Price & Quote Application Suite Market?

- What is the Configure, Price & Quote Application Suite Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?