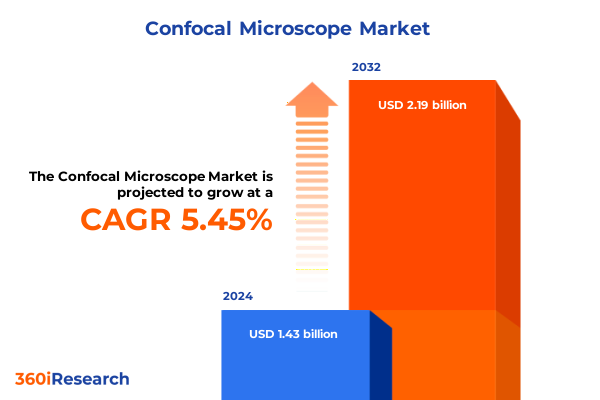

The Confocal Microscope Market size was estimated at USD 1.43 billion in 2024 and expected to reach USD 1.50 billion in 2025, at a CAGR of 5.45% to reach USD 2.19 billion by 2032.

Pioneering Advances in Confocal Microscopy Are Redefining Cellular Imaging Capabilities Across Scientific and Clinical Arenas Transforming Research and Diagnostics

Confocal microscopy, pioneered in the late twentieth century, revolutionized optical imaging by employing point illumination and spatial pinholes to eliminate out-of-focus light, thereby enabling optical sectioning and three-dimensional reconstruction of complex specimens. This technique has become indispensable in life sciences research, permitting detailed visualization of cellular structures, subcellular processes, and tissue architectures with unprecedented resolution. Beyond biological applications, confocal microscopy has also found roles in materials science, semiconductor inspection, and quality control, thanks to its ability to perform non-destructive, high-precision surface and subsurface imaging. As the demand for granular insights into intricate samples continues to rise, confocal microscope platforms are evolving to meet the stringent requirements of both academic and industrial laboratories.

In recent years, manufacturers have significantly ramped up research and development efforts to push the boundaries of confocal imaging. Companies have expanded their R&D budgets to incorporate next-generation optics, bespoke scanning modules, and enhanced detection systems. For instance, among pioneering initiatives is the release of advanced multiphoton microscopy solutions capable of deep tissue fluorescence imaging, alongside a 9.7 percent increase in R&D expenditure by leading instrument developers, reflecting the sector’s commitment to innovation and performance optimization. Strategic investments have fostered the creation of more robust imaging platforms, integrating custom software and hardware to streamline experimental workflows and accelerate discovery.

Moreover, the integration of artificial intelligence and machine learning algorithms has begun to transform data acquisition and analysis in confocal microscopy. AI-driven image reconstruction and deblurring techniques are enhancing image clarity, while predictive maintenance systems help preempt instrument malfunctions to reduce downtime. Concurrently, the emergence of compact, benchtop confocal units and modular designs is expanding accessibility, allowing smaller laboratories and field researchers to leverage high-resolution imaging capabilities without compromising on performance. This convergence of technological sophistication and user-centric design is laying the foundation for the next phase of breakthroughs in confocal microscopy.

Breakthrough Technological Integrations and Strategic Collaborations Are Catalyzing a New Era in Confocal Microscopy Applications and Accessibility

The confocal microscopy landscape is experiencing transformative momentum driven by groundbreaking integrations of super-resolution techniques and correlative imaging approaches. Researchers are now harnessing continuous advancements in STED and STORM methodologies to push the boundaries of optical resolution beyond diffraction limits, enabling visualization of molecular interactions at nanometer scales. Concurrently, the marriage of confocal platforms with electron microscopy through correlative workflows is offering multidimensional perspectives on biological and material samples, allowing investigators to transition seamlessly from macro to ultrastructural analysis. Crucially, these strides are bolstered by AI-powered image reconstruction algorithms that deblur and enhance raw datasets, delivering richer insights while expediting the interpretive process.

Complementing these technological breakthroughs, strategic collaborations and open-innovation partnerships are reshaping the ecosystem of confocal microscopy. Instrument developers are partnering with academic and clinical laboratories to co-develop tailored solutions, aligning hardware design with specific experimental use cases. Software providers are integrating cloud-based analytics and real-time remote operation capabilities, empowering geographically distributed teams to conduct high-throughput imaging campaigns. These collaborative models are accelerating time to market for next-generation systems, reducing entry barriers for emerging research institutions, and democratizing access to cutting-edge microscopy tools.

Escalating United States Trade Tariffs in 2025 Are Reshaping Supply Chains and Cost Structures Throughout the Confocal Microscopy Industry

In 2025, sweeping tariff policies enacted by the United States have exerted profound pressure on the confocal microscope supply chain. Tariffs of 25 percent on imports from Canada and Mexico and an increase from 10 to 20 percent on goods sourced from China have raised the cost basis for essential components, including precision objectives, high-sensitivity detectors, and laser assemblies. Meanwhile, proposals to impose duties of up to 50 percent on select European imports threaten to further disrupt global procurement strategies, compelling manufacturers to reassess sourcing frameworks and inventory commitments.

The medtech sector has already felt the repercussions of these measures, as evidenced by a notable decline in medical device stocks upon tariff announcements. Companies such as Bausch & Lomb, Boston Scientific, and Siemens Healthineers reported share price contractions, with analysts projecting up to a 13.8 percent reduction in annual earnings per share for certain firms, in part due to inflated production expenses and contractual price escalations. Industry stakeholders have criticized the broad application of tariffs on health-related goods, arguing that such policies undermine innovation incentives and impede patient access to critical diagnostic instruments.

For the confocal microscope market, the cumulative effect of these trade barriers is manifesting in delayed shipments, elevated component costs, and budgetary constraints within research and clinical procurement cycles. Laboratories are deferring capital investments, exploring alternative domestic suppliers, or absorbing higher expenses to maintain project timelines. In response, some manufacturers are exploring regional assembly hubs and dual-sourcing strategies to mitigate tariff exposure and safeguard supply continuity amid ongoing policy uncertainties.

Deep Dive into Confocal Microscope Segmentation Reveals How Product Types Technologies End Users and Applications Drive Market Dynamics

An analysis of product-type segmentation reveals that the market is distributed across components, software, and complete systems, each presenting unique dynamics. Within components, detectors, objectives, and scanners serve as the foundational blocks of imaging performance, with detector advancements driving sensitivity for low-light applications, objectives refining optical resolution, and scanner modules adapting scanning speeds to diverse research workflows. Software segmentation into analysis and control platforms underscores the growing importance of intuitive user interfaces and powerful post-acquisition algorithms capable of handling large volumetric datasets. Meanwhile, system-level solutions bifurcate into laser scanning and spinning disk architectures, addressing distinct requirements for resolution, penetration depth, and live-cell viability studies.

The technological segmentation further highlights the predominance of laser scanning confocal microscopy, favored for its versatility and compatibility with fluorescent markers, alongside multiphoton techniques that deliver superior deep tissue imaging capabilities. Spinning disk systems, known for their rapid image acquisition rates, are gaining traction in live cell applications where temporal resolution is paramount. These technology-driven distinctions inform purchasing decisions based on experimental objectives, driving differential growth rates across segments.

End-user segmentation spans academic research, clinical diagnostics, industrial research, and pharmaceutical and biotechnology sectors, reflecting the broad applicability of confocal microscopy. Academic institutions are at the forefront of fundamental discoveries, fueling demand for customizable platforms, while clinical diagnostic laboratories leverage the technology’s high-resolution imaging for precise histopathological assessments. Industrial research entities apply confocal microscopy to materials characterization and quality control under Industry 4.0 paradigms, and pharmaceutical and biotech companies integrate these systems into drug discovery pipelines, leveraging image-based screening assays to accelerate candidate validation.

Application segmentation encompasses three-dimensional structural imaging, fixed cell analysis, live cell dynamics, and tissue morphology studies. Three-dimensional imaging enables volumetric reconstructions of complex specimens, fixed cell imaging provides high-contrast snapshots of cellular architecture, live cell imaging captures dynamic biological events in real time, and tissue imaging translates microscopic insights to translational research models. These applications collectively drive the evolution of confocal microscopy toward more specialized, application-centric solutions that align closely with end-user requirements.

This comprehensive research report categorizes the Confocal Microscope market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Imaging Mode

- Detector Type

- Imaging Dimension

- Imaging Type

- Application

- End User

- Sales Channel

Regional Landscape Overview Highlights Distinct Growth Trajectories and Innovation Hubs Across Americas EMEA and Asia Pacific Markets

In the Americas, a robust research infrastructure and substantial public and private funding streams underpin sustained demand for confocal microscopy systems. North American institutions are leading adopters of multiphoton and super-resolution platforms, buoyed by government grants and large-scale genomics and proteomics initiatives. Canada’s well-funded life sciences sector and the United States’ pharmaceutical and biotechnology epicenters fuel ongoing investments in high-end microscopy, even amid cost pressures from tariff volatility.

Within Europe, the Middle East, and Africa, the market landscape is characterized by precision instrument manufacturing in Germany, Switzerland, and the United Kingdom, coupled with an expanding customer base in emerging economies across the Middle East and North Africa. European research consortia and Horizon Europe grants are instrumental in fostering collaborative microscopy projects, while stringent regulatory frameworks in clinical diagnostics reinforce the demand for validated imaging solutions. However, proposed tariff measures targeting EU imports could introduce new cost variables, prompting stakeholders to explore regional production and distribution alternatives.

Asia-Pacific represents a high-growth frontier, driven by domestic manufacturing capabilities in China, Japan, and South Korea. Government-led research initiatives and the rapid expansion of biotech hubs in Shanghai, Bangalore, and Seoul are generating significant demand for both entry-level and advanced confocal systems. Regional players are increasingly investing in localized R&D and assembly, aiming to offer cost-competitive alternatives to established OEMs. India’s burgeoning academic and clinical research programs, alongside Japan’s leadership in semiconductor and materials science applications, underscore the region’s strategic importance in the global confocal microscope ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Confocal Microscope market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Unveils Strategic Initiatives and R&D Investments of Leading Confocal Microscope Manufacturers and Specialists

The competitive landscape in confocal microscopy is dominated by a mix of established optics manufacturers and specialized imaging solution providers, each pursuing differentiated strategies to capture market share. Global incumbents such as Carl Zeiss, Leica Microsystems, Olympus, and Nikon maintain a commanding presence through extensive product portfolios that span basic research to clinical diagnostics. These organizations leverage decades of expertise in precision optics, bespoke software integration, and comprehensive service networks to deliver end-to-end imaging solutions that cater to diverse application requirements.

Innovative product launches and enhanced R&D investments are central to the strategic playbooks of leading players. Bruker’s introduction of the Ultima Investigator Plus multiphoton platform exemplifies the push toward deeper tissue imaging and higher throughput, while a 9.7 percent increase in research expenditures by major instrument developers underscores the sector’s emphasis on performance refinement and feature expansion. Oxford Instruments similarly allocates significant resources to next-generation confocal modules and user-friendly interfaces, aiming to lower barriers to adoption among emerging and resource-constrained laboratories.

Strategic partnerships and digital transformation initiatives are further redefining competitive dynamics. Companies are collaborating with software firms to integrate AI-driven analytics, developing cloud-based remote operation capabilities, and exploring modular hardware architectures that enable seamless upgrades. These alliances not only accelerate innovation cycles but also foster ecosystem development, empowering end users with flexible, scalable microscopy solutions tailored to evolving research demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Confocal Microscope market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- abberior Instruments GmbH

- Beijing BestScope Technology Co., Ltd.

- Bruker Corporation

- Carl Zeiss AG

- Confocal.nl B.V.

- CrestOptics S.p.A.

- Evident Corporation

- HORIBA Group

- ISS, Inc.

- Keyence Corporation

- Labtron Equipment Ltd.

- Lasertec Corporation

- Leica Microsystems by Danaher Corporation

- Nikon Corporation

- Oxford Instruments plc

- PicoQuant GmbH

- RADICAL SCIENTIFIC EQUIPMENTS PRIVATE LIMITED

- Revvity, Inc.

- Thermo Fisher Scientific, Inc.

- Thorlabs, Inc.

- VivaScope GmbH

Strategic Roadmap Recommendations Empower Industry Leaders to Harness Innovation Optimize Supply Chains and Enhance Global Market Penetration

Industry leaders seeking sustainable growth in the confocal microscopy market should prioritize the integration of artificial intelligence and machine learning across their product portfolios. By embedding AI-driven image recognition, predictive maintenance, and automated parameter optimization into their systems, manufacturers can significantly enhance user experience, reduce operational downtime, and generate value-added services that differentiate them from competitors.

To mitigate the risks posed by evolving tariff landscapes, organizations must diversify their supply chains and explore regional assembly or manufacturing partnerships. Identifying secondary suppliers for critical components in low-tariff jurisdictions and establishing dual-sourcing strategies will help stabilize procurement costs and ensure uninterrupted delivery of microscopy platforms to end users. Additionally, proactive engagement with policy stakeholders and participation in industry advocacy groups can help shape fair trade practices and protect the flow of scientific instruments across borders.

Expanding market reach into emerging regions and tailoring offerings to local needs presents another avenue for growth. Developing cost-effective, modular confocal units for entry-level research labs, alongside flexible financing models such as consumables-based leasing, can unlock new customer segments. Furthermore, co-development initiatives with academic centers and biotech startups will facilitate early adoption of novel imaging techniques and reinforce vendor credibility within specialized research communities.

Robust Multimodal Research Methodology Underpins Comprehensive Analysis Integrating Primary Interviews Secondary Data and Rigorous Validation

This analysis is founded on a robust, multimodal research methodology designed to deliver comprehensive and actionable insights. Primary data collection included in-depth interviews with key opinion leaders, end users across academic, clinical, industrial, and pharmaceutical sectors, and procurement specialists. These conversations provided firsthand perspectives on evolving requirements, operational challenges, and future priorities, allowing for nuanced understanding of user-driven innovation pathways.

Secondary research encompassed a thorough review of peer-reviewed journals, patent filings, corporate filings, conference proceedings, and reputable industry publications. Data triangulation techniques were applied to validate market trends, technological developments, and competitive strategies, ensuring high reliability and accuracy. Quantitative analyses utilized market segmentation frameworks, trend extrapolation, and ratio analyses to illuminate growth drivers and potential bottlenecks.

Analytical rigor was further enhanced through the application of strategic management tools, including SWOT and PESTEL analyses, to evaluate internal capabilities and external environmental factors. Geospatial mapping of regional hubs, supply chain networks, and tariff exposures provided a granular view of market vulnerabilities and opportunities. This systematic approach underpins the report’s strategic recommendations and ensures that conclusions are grounded in empirical evidence and stakeholder insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Confocal Microscope market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Confocal Microscope Market, by Product Type

- Confocal Microscope Market, by Imaging Mode

- Confocal Microscope Market, by Detector Type

- Confocal Microscope Market, by Imaging Dimension

- Confocal Microscope Market, by Imaging Type

- Confocal Microscope Market, by Application

- Confocal Microscope Market, by End User

- Confocal Microscope Market, by Sales Channel

- Confocal Microscope Market, by Region

- Confocal Microscope Market, by Group

- Confocal Microscope Market, by Country

- United States Confocal Microscope Market

- China Confocal Microscope Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Conclusive Perspectives Highlight the Critical Role of Innovation Collaboration and Strategic Adaptation in Shaping the Future of Confocal Microscopy

The evolution of confocal microscopy reflects the confluence of technological innovation, strategic collaboration, and adaptive market strategies. Advances in super-resolution techniques, artificial intelligence integration, and modular system design have broadened the scope of applications, enabling researchers to explore complex biological processes with exceptional clarity. At the same time, shifting trade policies and tariff pressures underscore the importance of resilient supply chain frameworks and proactive engagement with regulatory environments.

As the market continues to diversify across product types, technologies, end users, and applications, stakeholders must remain agile, prioritizing customer-centric development and strategic partnerships. Regional dynamics in the Americas, EMEA, and Asia-Pacific highlight the necessity of localized strategies, while competitive insights from leading manufacturers illustrate the critical role of R&D investment and digital transformation. By aligning innovation roadmaps with end-user demands and global trade realities, companies can capitalize on emerging opportunities and drive the next wave of breakthroughs in confocal microscopy.

Unlock InDepth Market Intelligence and Propel Strategic Growth by Securing Your Comprehensive Confocal Microscope Market Report Today

Are you ready to gain a competitive edge with unparalleled insights into the confocal microscope landscape? Engage directly with industry expertise by securing your comprehensive market research report from our Associate Director, Sales & Marketing, Ketan Rohom. This report offers a deep understanding of market dynamics, technological advancements, and strategic imperatives to position your organization for sustained growth.

Take the next step toward informed decision-making and strategic planning. Reach out to Ketan Rohom today to explore customized research packages, request a sample executive summary, or schedule a personalized briefing tailored to your specific needs. Unlock the data and analysis that will empower your team to navigate market complexities and capitalize on emerging opportunities.

- How big is the Confocal Microscope Market?

- What is the Confocal Microscope Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?