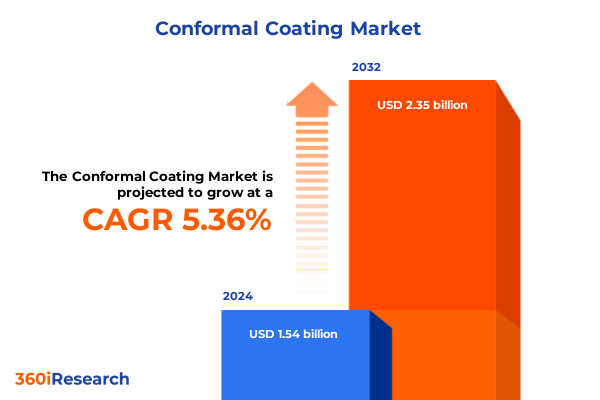

The Conformal Coating Market size was estimated at USD 1.62 billion in 2025 and expected to reach USD 1.71 billion in 2026, at a CAGR of 5.40% to reach USD 2.35 billion by 2032.

Setting the Scene for Advanced Protective Coatings in Electronics to Safeguard Innovation and Ensure Reliability Across Emerging Technologies

The evolution of electronic assemblies has heightened the demand for protective solutions that can maintain performance under increasingly stringent conditions. Conformal coatings have emerged as essential layers of defense, providing moisture resistance, contamination prevention, and electrical insulation for printed circuit boards and sensitive components. As electronics migrate into harsher environments such as electric vehicles, unmanned aerial systems, and medical wearables, the role of conformal coatings has expanded beyond basic protection to enable innovation in design and functionality.

Moreover, rapid advancements in miniaturization and integration of multifunctional components have created new challenges for coating application and performance. Thinner circuit geometries, complex surface topologies, and tighter component spacing require coating formulations and processes to adapt with precision. In tandem, environmental regulations and sustainability mandates are driving formulators to develop chemistries that balance performance with reduced volatile organic compound emissions and compliance with global standards.

As industry stakeholders navigate these dynamics, there is a critical need for a consolidated overview of prevailing trends, strategic drivers, and emerging opportunities within the conformal coating market. This executive summary synthesizes recent developments, highlights transformative shifts, and offers actionable recommendations to guide decision-makers. By articulating key insights across market segments, regions, and competitive landscapes, the summary aims to inform strategic planning and facilitate targeted investments in technologies that will define the next generation of electronic protection.

Exploring the Key Drivers and Disruptive Forces Reshaping Conformal Coating Markets in Response to Industry 4.0 Sustainability and Regulatory Imperatives

Conformal coating has undergone significant transformation in response to the convergence of Industry 4.0 technologies and heightened sustainability expectations. Smart manufacturing platforms now integrate real-time monitoring of coating thickness, cure state, and defect detection through machine vision systems. This level of process visibility has driven improvements in yield, repeatability, and quality assurance, laying the groundwork for predictive maintenance and adaptive process control.

In parallel, end users and formulators are pushing the frontier of sustainable chemistries. Water-based and UV-curable coatings are gaining traction as alternatives to traditional solvent-reliant formulations, thereby reducing environmental impact and enabling compliance with stricter emission regulations. As policymakers enforce tighter controls on volatile organic compound content, the shift toward greener coatings is becoming a strategic imperative for manufacturers aiming to future-proof their portfolios.

Furthermore, the proliferation of miniaturized sensors, 5G connectivity, and edge computing devices has spurred demand for coatings that deliver ultra-thin protective films without compromising dielectric strength. Developers are leveraging nanotechnology additives and advanced polymer blends to achieve exceptional performance at reduced thickness, thereby supporting the next wave of electronics design innovations. Collectively, these drivers and disruptive forces are reshaping the conformal coating landscape, creating new growth vectors and raising the bar for technical performance and environmental stewardship.

Unpacking the Ramifications of 2025 United States Tariff Measures on Supply Chains Material Costs and Strategic Sourcing Decisions for Conformal Coatings

The introduction of updated tariff measures by United States authorities in 2025 has created a ripple effect across global supply chains for conformal coating raw materials. Surcharges on key chemical precursors have directly increased procurement costs, prompting specifiers and manufacturers to reassess their sourcing strategies. As a result, end users are seeking to diversify suppliers, explore alternate chemistries, and evaluate nearshoring options to mitigate exposure to trade tensions.

Simultaneously, the tariff environment has catalyzed strategic alliances between formulators and domestic chemical producers, as well as investments in localized production capacity. These collaborations are designed to stabilize input costs and secure reliable access to critical materials. In many cases, organizations are entering joint development agreements to tailor resin systems that leverage regionally available feedstocks, thereby reducing dependency on imported intermediates.

Despite the cost pressures, the tariff scenario has also accelerated innovation as companies pursue high-efficiency coating processes and low-material-consumption application techniques. By optimizing application methods and refining curing protocols, manufacturers can offset material cost increases while maintaining performance standards. Moving forward, the interplay between trade policy and supply chain agility will remain a pivotal factor shaping the dynamics of the conformal coating sector.

Deriving Critical Insights from Material Types Curing Mechanisms Application Methods and End User Industries to Guide Conformal Coating Strategy

In examining the landscape through the lens of material types, acrylic formulations have sustained popularity due to their ease of application and rapid air-dry capabilities, while epoxy variants are preferred in applications demanding robust chemical resistance and mechanical durability. Parylene coatings, notable for their vapor deposition processes, provide uniform, pinhole-free coverage, making them indispensable for high-reliability electronics. Silicone-based systems offer superior flexibility and thermal stability, particularly in designs subject to thermal cycling, whereas urethane resins strike a balance between toughness and conformal adhesion, catering to a broad spectrum of operational conditions.

Curing mechanisms further delineate the application portfolio: evaporative cure systems facilitate ambient-drying workflows with minimal capital investment, whereas heat cure processes deliver accelerated throughput in high-volume production lines. Moisture cure coatings capitalize on atmospheric humidity to form crosslinked networks, which proves advantageous in field-service scenarios. UV-curable chemistries, leveraging photoinitiated polymerization, enable precise control over cure depth and rapid cycle times, aligning with the needs of high-mix electronic assembly operations.

When considering application methods, brushing remains prevalent for repair and rework, dipping is utilized for batch processing of smaller assemblies, spraying addresses large-area coverage with adjustable thickness, and vapor deposition is reserved for demanding microelectronics where conformality and uniformity are paramount. Across end user industries, aerospace and defense sectors mandate rigorous qualification protocols, automotive players emphasize thermal and vibration resilience, consumer electronics demand high-throughput, cost-effective coatings, healthcare applications prioritize biocompatibility and sterilization resistance, industrial markets value ease of maintenance and chemical resistance, and telecommunications equipment must adhere to strict reliability standards in varied operating environments.

This comprehensive research report categorizes the Conformal Coating market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Curing Mechanisms

- Functional Features

- Coating Thickness Range

- Distribution Channel

- Application Method

- End-Use Industry

Illuminating the Distinct Market Dynamics across the Americas Europe Middle East Africa and Asia Pacific Regions for Conformal Coatings

The Americas region demonstrates a mature market characterized by established supply chains, advanced manufacturing infrastructure, and a strong emphasis on regulatory compliance. North American electronics producers benefit from proximity to raw material sources and integrated value chains, supporting efficient procurement and rapid product iteration. In contrast, Latin American markets present emerging opportunities driven by investments in automotive electronics and renewable energy systems, though logistical complexities remain an area for strategic focus.

Within Europe, Middle East, and Africa, stringent environmental regulations and the push for circular economy practices have accelerated the adoption of low-VOC and sustainable coating solutions. Western European countries lead in certification standards and process automation, while economic diversification in the Gulf states is opening new avenues for electronics manufacturing hubs. In the African market, growth is slower but promising, particularly in telecommunications infrastructure and consumer device assembly, where cost-effective protective coatings are in high demand.

In the Asia-Pacific region, rapid industrialization, burgeoning consumer electronics demand, and government incentives for advanced manufacturing have propelled market expansion. East Asian economies showcase sophisticated research ecosystems driving cutting-edge coating technologies, while Southeast Asia is emerging as a high-volume production base for both domestic consumption and export. The confluence of cost-competitive labor, supportive trade agreements, and evolving quality standards positions the region as a critical battleground for global coating providers seeking scale and innovation partnerships.

This comprehensive research report examines key regions that drive the evolution of the Conformal Coating market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Conformal Coating Providers and Their Strategic Initiatives That Are Shaping Competitiveness and Innovation in the Market

Key players in the conformal coating domain have adopted multi-pronged strategies encompassing product innovation, strategic partnerships, and capacity expansion to strengthen their market positions. Leading formulators are launching next-generation chemistries that emphasize rapid curing, lower viscosity for intricate surface coverage, and enhanced environmental profiles, reflecting the convergence of performance and sustainability objectives.

Collaborative ventures between coating manufacturers and equipment suppliers have facilitated the integration of automated application platforms with proprietary material formulations, ensuring a seamless interface between process design and chemical performance. Such alliances enable end users to deploy turnkey solutions that minimize implementation risk and accelerate time to market. In parallel, select companies have invested in regional service centers and technical support networks to deliver localized troubleshooting, training programs, and custom testing services.

Beyond product and service enhancements, industry frontrunners are pursuing targeted acquisitions to broaden their geographic footprint and capture niche application segments. These moves not only diversify revenue streams but also provide access to specialized technologies and customer relationships. As the competitive environment intensifies, sustained emphasis on R&D investment and operational agility will determine which providers can consistently meet evolving customer requirements and regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Conformal Coating market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aalpha Conformal Coatings

- ACL, Inc.

- AI Technologies Inc.

- Chase Corporation

- Chemtronics

- CHT Group

- Dymax Corporation

- ELANTAS GmbH by Altana AG

- Element Solutions Inc.

- Elma Electronic AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- HZO, Inc.

- Industrialex Manufacturing

- KISCO Ltd.

- Master Bond Inc.

- Miller-Stephenson, Inc.

- Peters Group

- Plasmalex SAS

- Rapid Coatings Inc.

- Robnor ResinLab Ltd.

- Shin-Etsu Chemical Co. LTD.

- Simtal Nano-Coatings Ltd.

- The DOW Chemical Company

- Toagosei Group

- Wacker Chemie AG

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Conformal Coating Sector

To capitalize on burgeoning opportunities and mitigate emerging risks, industry leaders should deepen investments in R&D aimed at next-generation coating chemistries that align with both performance demands and environmental mandates. Prioritizing development of low-VOC, UV-curable, and moisture-activated systems can not only ensure compliance but also reduce total cost of ownership through streamlined application and faster cure cycles.

Simultaneously, diversifying supply chains through strategic partnerships with regional raw material producers will bolster resilience against trade disruptions and tariff volatility. Enterprises can achieve greater control over input costs by co-developing formulations optimized for locally accessible feedstocks and by securing long-term procurement agreements that incorporate volume-based incentives.

Moreover, integrating digital process monitoring and control solutions is essential to drive operational excellence. Deploying inline sensors, analytics dashboards, and machine learning algorithms to interpret coating performance data will unlock predictive maintenance capabilities, reduce defect rates, and enhance productivity. By combining material science innovation with process digitization, companies can differentiate their offerings, unlock new revenue streams, and position themselves as leaders in the evolving conformal coating landscape.

Detailing the Rigorous Research Methodology Employed to Ensure Robust Data Integrity and Comprehensive Analysis in the Conformal Coating Study

This study employs a multi-tiered research framework combining primary and secondary methodologies to ensure comprehensive coverage and data integrity. Primary research activities included structured interviews with formulators, equipment manufacturers, and end users across key industries, facilitating firsthand insights into application challenges, technology adoption barriers, and performance priorities.

Secondary research encompassed an exhaustive review of industry publications, technical journals, patent filings, and regulatory documents to map historical trends and identify emerging technological trajectories. Market intelligence databases were leveraged to track company developments, strategic moves, and partnership activities, providing an objective basis for competitive benchmarking.

Data triangulation and validation were achieved by cross-referencing primary feedback with secondary findings, ensuring consistency and reliability of conclusions. The research team also employed a quality assurance protocol involving peer review of key insights, verification of data sources, and scenario-based stress testing of strategic recommendations. This rigorous approach underpins the robustness of the analysis and supports confident decision-making by stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Conformal Coating market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Conformal Coating Market, by Material Type

- Conformal Coating Market, by Curing Mechanisms

- Conformal Coating Market, by Functional Features

- Conformal Coating Market, by Coating Thickness Range

- Conformal Coating Market, by Distribution Channel

- Conformal Coating Market, by Application Method

- Conformal Coating Market, by End-Use Industry

- Conformal Coating Market, by Region

- Conformal Coating Market, by Group

- Conformal Coating Market, by Country

- United States Conformal Coating Market

- China Conformal Coating Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Drawing Conclusions on Future Growth Drivers Sustainability Priorities and Strategic Directions for Conformal Coatings in a Dynamic Market Environment

Through this comprehensive assessment, it is evident that conformal coatings will continue to play a pivotal role in safeguarding the performance and longevity of electronic systems. Future growth will be driven by the dual imperatives of environmental sustainability and technological miniaturization, compelling formulators to innovate across chemical compositions and application processes.

Strategic partnerships and regional sourcing initiatives will shape the supply chain landscape as companies seek to balance cost pressures with supply reliability in an era of trade policy uncertainty. Concurrently, digital transformation in manufacturing will unlock new efficiencies, enabling real-time quality control and adaptive process optimization that can reduce waste and improve throughput.

Ultimately, organizations that successfully integrate advanced chemistries, sustainable practices, and smart manufacturing technologies will secure competitive advantage. By aligning product roadmaps with evolving regulatory requirements and end user expectations, industry stakeholders can steer the conformal coating sector toward a future characterized by enhanced performance, reduced environmental impact, and resilient supply networks.

Engage with Ketan Rohom to Unlock Comprehensive Conformal Coating Market Insights and Drive Strategic Decisions Through Research Purchase Opportunities

Engage directly with Associate Director of Sales & Marketing Ketan Rohom to secure an in-depth market research report that delivers actionable insights, strategic guidance, and expert analysis tailored to your organizational goals. Reach out to Ketan to discuss customized research packages, gain early access to proprietary data, and explore comprehensive support for decision-making in the conformal coating sector. Partner with our sales leadership to align report deliverables with your specific business challenges, ensuring you harness the full value of the research findings and position your organization for sustained growth.

The report purchase process is streamlined to prioritize your objectives, offering flexible engagement models that include one-on-one consultations, bespoke data extracts, and ongoing advisory support following acquisition. By collaborating with Ketan Rohom, you benefit from personalized service, rapid response times, and expert recommendations on leveraging insights to optimize product development roadmaps, supply chain strategies, and go-to-market execution. Initiate the conversation today to transform critical market intelligence into strategic advantage and drive measurable impact within your conformal coating initiatives.

- How big is the Conformal Coating Market?

- What is the Conformal Coating Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?