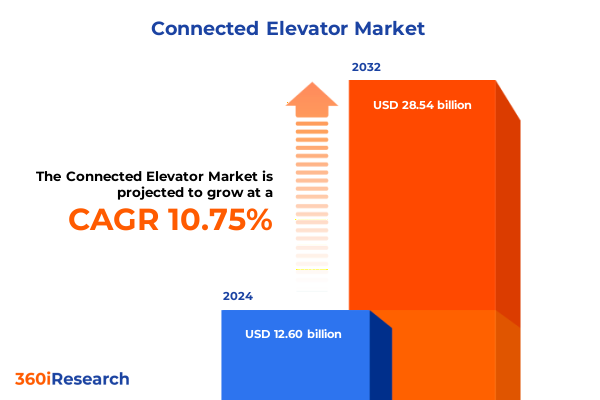

The Connected Elevator Market size was estimated at USD 13.93 billion in 2025 and expected to reach USD 15.27 billion in 2026, at a CAGR of 10.78% to reach USD 28.54 billion by 2032.

Reimagining Vertical Transportation by Integrating IoT and Smart Technologies to Drive Next-Generation Elevator Solutions for Urban Environments

The landscape of vertical transportation is undergoing a seismic shift as buildings become smarter, more connected, and increasingly data driven. Traditional elevator systems-once designed primarily for simple conveyance-are now being retrofitted and reimagined as integral components of intelligent building ecosystems. By embedding sensors, networking modules, and advanced analytics platforms, industry stakeholders can unlock real-time performance metrics, predictive maintenance capabilities, and occupant experience enhancements that were inconceivable a decade ago. This evolution is propelled by the convergence of Internet of Things (IoT) technologies, cloud computing, and rising demand for safety, reliability, and energy efficiency in urban centers.

In parallel, urbanization trends and stringent regulatory mandates around accessibility and green building certifications are accelerating the adoption of smart elevator solutions. Developers and facility managers are prioritizing systems that offer remote diagnostics, fault prediction, and seamless integration with building management platforms. Moreover, end users-from commercial office towers to residential high-rises and industrial sites-are recognizing the intrinsic value of reduced downtime and enhanced operational transparency. These factors collectively position the connected elevator domain as a critical enabler of next-generation infrastructure, reshaping how vertical mobility is delivered in densely populated environments.

Harnessing Data Analytics, Artificial Intelligence, and Digital Twin Technologies to Transform Traditional Elevator Ecosystems into Proactive Maintenance Platforms

The transformative wave within the elevator industry is defined by the integration of artificial intelligence, machine learning, and digital twin frameworks that convert passive hardware into proactive service platforms. Modern connected elevators leverage embedded sensors to continuously transmit vibration, temperature, and usage data to centralized cloud repositories, where advanced algorithms analyze patterns for signs of emerging wear or component anomalies. As a result, maintenance routines can shift from calendar-based schedules to condition-driven interventions, minimizing both service disruptions and lifecycle costs.

Furthermore, the emergence of wireless connectivity technologies-ranging from low-power wide-area networks (LPWAN) to 5G modules-has liberated digital elevator architectures from the constraints of cabling and simplified upgrades in legacy installations. Coupled with edge computing capabilities, processing can occur closer to the device, enabling ultra-low-latency responses for safety-critical functions. Over time, these innovative approaches coalesce into comprehensive digital twins of elevator ecosystems that simulate operational scenarios, forecast energy consumption, and support rapid development of customized mobility services. Collectively, these shifts are redefining maintenance paradigms, enhancing passenger experience, and unlocking new value streams throughout the building lifecycle.

Deciphering the Ripple Effects of United States 2025 Import Tariffs on Elevator Component Supply Chains, Cost Structures, and Operational Modernization Strategies

In 2025, a new suite of United States import tariffs targeted raw materials and electronic components crucial to elevator manufacturing and aftermarket service modules. These measures-initially implemented to address trade imbalances-have reverberated across the entire value chain. For OEMs, increased duties on steel, aluminum, and circuit boards have driven up procurement costs, compelling many suppliers to scramble for alternative sources. As a consequence, several integrated device manufacturers began passing input cost increases onto end users, influencing the economics of modernization projects and new installations.

Beyond immediate price effects, the tariffs catalyzed accelerated diversification of supply chains, with procurement teams evaluating near-shoring options in Mexico and Eastern Europe to mitigate future policy risks. Some service providers increased inventory buffers to avoid project delays, while others turned to localized manufacturing partnerships to secure duty-exempt status. In spite of short-term budgetary pressures, these strategic adjustments may yield long-term resilience, positioning stakeholders to navigate volatile trade environments without sacrificing network reliability or service quality.

Unveiling Critical Market Segment Dynamics Spanning Diverse Elevator Types, Comprehensive Service Models, Varied Connectivity Solutions, and End User Verticals

A deep dive into elevator segment dynamics reveals a tapestry of market demands and service imperatives. When considering elevator types, freight systems must balance high-load requirements with robust safety protocols, while observation elevators demand panoramic designs and bespoke aesthetics to enhance visitor experiences. Passenger elevators dominate high-rise environments, requiring uninterrupted uptime and speed optimization, whereas service elevators prioritize flexibility for maintenance crews and material transport within commercial or industrial facilities.

Disaggregating by service type uncovers clear distinctions in revenue drivers: maintenance remains the backbone of recurring contracts, modernization projects inject digital capabilities into aging fleets, and new installations capture growth in emerging urban developments. Maintenance contracts hinge on sensor-driven fault detection and remote diagnostics, enabling service teams to preemptively address component wear. Modernization efforts focus on upgrading control systems, traction motors, and human-machine interfaces, delivering immediate performance enhancements without full replacement. Meanwhile, new installations emphasize turnkey integration with smart building frameworks and sustainability certifications.

Examining connectivity technology layers further sharpens the competitive landscape. Wired connectivity continues to offer proven reliability in mission-critical environments, delivering high-speed data channels for continuous monitoring. Conversely, wireless connectivity opens up retrofit opportunities, reducing both installation time and capital outlay for cabling. Hybrid architectures that blend wired backbone networks with wireless edge nodes can provide an optimal balance between reliability and flexibility.

Finally, end-user considerations shape system specifications and service models. Commercial occupancies prioritize aesthetics, ride comfort, and tenant satisfaction metrics. Industrial clients emphasize ruggedization, throughput capacity, and compliance with safety regulations. Residential applications call for low noise levels, intuitive controls, and energy-efficient standby modes. By understanding these nuanced requirements, solution providers can tailor their value propositions to meet the expectations of diverse customer cohorts.

This comprehensive research report categorizes the Connected Elevator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Elevator Type

- Service Type

- Connectivity Technology

- End User

Exploring Regional Divergence in Connected Elevator Adoption Trends across the Americas, Europe Middle East and Africa, and Asia-Pacific Infrastructure Landscapes

Regional analysis highlights stark contrasts in technology adoption, regulatory frameworks, and infrastructure priorities across major geographies. In the Americas, advanced building codes, frequent seismic considerations, and robust data-privacy regulations are driving early uptake of condition-monitoring platforms and encrypted connectivity solutions. Urban centers such as New York City and São Paulo are spearheading pilot programs that integrate elevator telemetry with building management systems, enabling dynamic energy-use optimization and occupant flow analytics.

Within Europe, the Middle East, and Africa, a combination of historical building stock and ambitious development initiatives fuels a dual focus on modernization and new-build connectivity. In Western Europe, stringent sustainability targets are accelerating investments in regenerative drives and smart dispatch algorithms to reduce carbon footprints. Meanwhile, Middle Eastern megaprojects in Dubai and Riyadh are showcasing glass-walled observation elevators and passenger experience apps as marquee attractions. Across Africa, rapidly growing metropolitan areas are prioritizing cost-effective wireless retrofits to expand connectivity without extensive structural work.

Asia-Pacific stands out as the most dynamic region, with China’s smart city programs and India’s urban transformation agenda at the forefront. High-density metropolises are deploying wireless-enabled elevator networks that interface with mobile apps for remote summon, predictive fault alerts, and usage analytics. Japan continues to push the envelope on energy-efficient drive technologies and AI-facilitated crowd management in hyper-busy transit hubs. In Southeast Asia, resilient designs for coastal climates and renewable energy integration are emerging as key differentiators.

This comprehensive research report examines key regions that drive the evolution of the Connected Elevator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Elevator Manufacturers and Technology Providers Pioneering Connected Solutions through Strategic Partnerships and Innovative Offerings

Leading global elevator manufacturers and technology providers are staking competitive positions through differentiated digital portfolios and strategic partnerships. One industry stalwart has introduced a next-generation IoT gateway that aggregates multi-sensor data streams into a unified analytics dashboard, enabling facility teams to troubleshoot remotely with virtual reality overlays. Another major supplier has inked alliances with cloud infrastructure leaders to deliver scalable, cybersecurity-hardened elevator-as-a-service offerings that shift from capital-intensive models to subscription-based revenue streams.

Meanwhile, niche technology startups are carving out spaces by offering plug-and-play wireless modules that retrofit legacy control systems in under a day, drastically reducing implementation complexity. These innovators often collaborate with established OEMs to integrate their modules into broader service ecosystems, combining agility with deep domain expertise. Additionally, service networks are consolidating through mergers and acquisitions, enabling regional providers to leverage centralized analytics hubs and standardized training programs. Collectively, these corporate maneuvers are accelerating the transition from reactive maintenance contracts to holistic lifecycle partnerships centered on continuous performance improvement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Connected Elevator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bucher Municipal AG

- Fujitec Co. Ltd.

- GAL Manufacturing Corp.

- Hitachi Ltd.

- Hyundai Elevator Co. Ltd.

- Kleemann Hellas SA

- KONE Oyj

- Mitsubishi Electric Corporation

- Orona S.C.

- Otis Worldwide Corporation

- Schindler Holding AG

- Sicher Elevator Co. Ltd.

- Sigma Elevator Company

- Stannah Lifts Holdings Ltd.

- Thyssenkrupp AG

- TK Elevator GmbH

- Toshiba Corporation

Implementing Strategic Roadmaps for Industry Stakeholders to Capitalize on Connected Elevator Trends through Technology Investment and Collaborative Initiatives

To capitalize on emerging opportunities, industry leaders must embrace a multifaceted strategic roadmap. First, investing in advanced wireless connectivity modules and edge-computing infrastructure will unlock rapid retrofit pathways for aging elevators, while ensuring data sovereignty through localized processing nodes. Second, integrating machine learning algorithms into service platforms can augment human expertise, enabling predictive insights that optimize parts inventory and field technician deployment.

In parallel, diversifying supply chains through near-shoring initiatives and regional manufacturing partnerships will mitigate exposure to fluctuating trade policies and logistical disruptions. Collaborating with technology incubators and academic research centers can catalyze the development of next-generation sensors, smart dispatch logic, and energy-recovery systems. Finally, embedding sustainability metrics into product design-such as regenerative drive efficiency and eco-friendly lubrication-will resonate with both regulatory bodies and corporate social responsibility goals. By aligning these elements within a cohesive execution plan, elevator providers and building owners alike can transform vertical mobility into a strategic competitive advantage.

Detailing Robust Research Framework Incorporating Primary Interviews, Secondary Industry Data, and Quantitative Analysis for Comprehensive Market Insights

The research framework underpinning this analysis combined both secondary and primary sources to ensure depth and rigor. Initially, a comprehensive review of industry journals, regulatory filings, and company technical documentation established a foundational understanding of connected elevator architectures and service propositions. This was complemented by in-depth analysis of patent portfolios and technology benchmarks to map innovation trajectories.

To validate and enrich these insights, structured interviews were conducted with senior executives at OEMs, service providers, and select facility management firms across North America, Europe, and Asia-Pacific. Supplemental surveys targeted elevator technicians and building managers to capture operational pain points and user experience priorities. Quantitative data-covering deployment metrics, failure rates, and maintenance response times-were triangulated with qualitative feedback to highlight key performance differentiators. Finally, all findings underwent peer review by industry analysts specializing in smart building technologies and trade policy to ensure accuracy and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Connected Elevator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Connected Elevator Market, by Elevator Type

- Connected Elevator Market, by Service Type

- Connected Elevator Market, by Connectivity Technology

- Connected Elevator Market, by End User

- Connected Elevator Market, by Region

- Connected Elevator Market, by Group

- Connected Elevator Market, by Country

- United States Connected Elevator Market

- China Connected Elevator Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Key Findings and Emerging Opportunities in the Connected Elevator Sector to Inform Informed Decision Making and Strategic Planning Efforts

This executive summary underscores the profound shift underway as elevators evolve from mechanical conveyance devices into intelligent, connected assets. The interplay of IoT sensors, data analytics, and AI-driven services is reshaping stakeholder expectations, demanding closer collaboration between manufacturers, service providers, and building operators. Segmentation trends reveal that performance requirements and adoption drivers vary widely across elevator types, service models, connectivity technologies, and end-user verticals, necessitating tailored strategies for each cohort.

The impact of U.S. tariffs has injected both challenges and opportunities into the supply chain, accelerating diversification efforts that may yield lasting resilience. Regional insights highlight divergent pathways to adoption: the Americas prioritize regulatory compliance and system integration, EMEA balances modernization with new-build ambitions, and Asia-Pacific leads in scale and innovation pilots. Leading companies are responding through digital product enhancements, strategic alliances, and novel business models that align incentives around uptime, safety, and sustainability.

Moving forward, industry participants that proactively invest in advanced connectivity, predictive maintenance intelligence, and sustainable design will secure a competitive edge. The insights presented here lay a clear path for decision makers to harness technological disruption, regulatory shifts, and global expansion into tangible growth outcomes. As the vertical transportation sector accelerates toward a fully connected future, stakeholders equipped with rigorous data and actionable recommendations will be best positioned to navigate complexity and capture emerging value pools.

Empowering Decision Makers to Drive Growth and Innovation by Securing In-Depth Connected Elevator Market Intelligence from Our Expert Sales and Marketing Lead

To explore the comprehensive data, strategic analysis, and future outlook for the Connected Elevator sector-and to equip your organization with the critical intelligence needed to stay ahead in a rapidly evolving market-reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in translating in-depth research into actionable strategies will guide you through customized advisory services, licensing options, and extended consultancy engagements tailored to your unique business priorities. Engage with this authoritative resource today to gain unparalleled insights, benchmark against industry leaders, and accelerate your growth trajectory in the smart vertical transportation landscape.

- How big is the Connected Elevator Market?

- What is the Connected Elevator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?