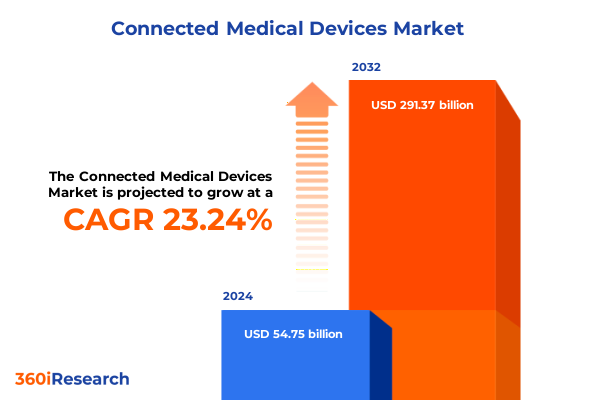

The Connected Medical Devices Market size was estimated at USD 67.26 billion in 2025 and expected to reach USD 82.23 billion in 2026, at a CAGR of 23.29% to reach USD 291.37 billion by 2032.

Revolutionizing Patient Care and Operational Excellence with Connected Medical Devices Transforming Accessibility, Efficiency, and Innovation

The connected medical devices sector has rapidly evolved into a cornerstone of modern healthcare delivery, redefining how clinicians interact with patients and interpret critical health data. Telehealth platforms and virtual care ecosystems now depend on intelligent medical devices, from remote monitoring sensors to advanced imaging tools, to enable real-time diagnostics and treatment adjustments. This convergence of connectivity and clinical insight not only enhances patient outcomes but also drives operational efficiencies across care settings. Concurrently, artificial intelligence and machine learning algorithms are embedded within device software, improving diagnostic accuracy and predictive analytics, with the FDA reporting a significant uptick in AI-enabled device submissions in recent years.

As this ecosystem expands, it brings into focus critical challenges such as cybersecurity vulnerabilities and interoperability hurdles. The proliferation of interconnected devices heightens exposure to cyber risks, compelling manufacturers and providers to adopt robust encryption, continuous monitoring, and zero-trust security frameworks to protect sensitive patient data. Moreover, standardization initiatives aim to break down data silos and facilitate seamless integration between devices and electronic health record systems, which is essential for care coordination and longitudinal patient monitoring.

This executive summary offers a concise yet comprehensive overview of the forces shaping the connected medical devices market. Subsequent sections will examine transformative technological and regulatory shifts, evaluate the impact of recent U.S. tariffs, uncover key segmentation and regional dynamics, profile leading industry players, and deliver actionable recommendations for industry leaders. By synthesizing these insights, decision-makers will gain the clarity required to navigate this dynamic landscape effectively.

Unprecedented Technological and Regulatory Milestones Driving the Connected Medical Device Landscape Into a New Era of Patient-Centric Care

The connected medical devices landscape is undergoing transformative shifts driven by the integration of edge computing, artificial intelligence, and advanced sensor technologies. Edge AI, which processes data directly on devices rather than in centralized cloud environments, has emerged as a game-changer by reducing latency, optimizing bandwidth usage, and facilitating immediate clinical decision-making at the point of care. As a result, clinicians can respond more swiftly to critical events, patient engagement improves through timely feedback loops, and operational costs decline due to reduced data transfer expenses.

Meanwhile, personalized and predictive healthcare models are gaining traction, leveraging continuous data streams from wearable devices and remote monitoring sensors to anticipate clinical deterioration and preempt hospital readmissions. This proactive paradigm shift is supported by regulatory initiatives promoting interoperability, where standardized protocols and data formats allow disparate devices and health IT systems to communicate seamlessly. Collaborative consortia and industry frameworks now prioritize harmonization across platforms, marking a significant departure from siloed device ecosystems.

The growing emphasis on cybersecurity and privacy has further shaped this landscape. With connected devices transmitting sensitive health information, manufacturers must adhere to stringent security guidelines, conduct comprehensive risk assessments, and implement lifecycle management plans for software updates. As the market accelerates toward more sophisticated, integrated solutions, these concurrent technological and regulatory advancements are setting the stage for a new era of patient-centric, data-driven care delivery.

Assessing the Far-Reaching Consequences of 2025 U.S. Trade Tariffs on Medical Device Innovation, Costs, and Global Supply Chain Resilience

In 2025, U.S. trade policy introduced new tariffs that have reverberated throughout the medical device industry, creating complex cost and supply chain challenges. Major announcements of tariffs on European imports, including a proposed 15% duty with specific exemptions for critical goods like medical devices, followed negotiations with trading partners and have stirred significant market uncertainty. High-tech innovators such as Siemens Healthineers, whose Naeotom Alpha photon-counting CT scanner is manufactured in Germany, have warned that interim and proposed duties of up to 50% could inflate acquisition costs, delay hospital procurement plans, and disrupt the rollout of advanced imaging systems in U.S. healthcare facilities.

Surveys of manufacturer and provider stakeholders underscore the broader operational impact. A majority of equipment producers anticipate longer lead times and potential component shortages as higher duties on imported semiconductors and raw materials drive up production expenses, compelling many to consider alternative sourcing strategies. Hospitals have flagged the need to pass increased device costs to insurers or patients, intensifying financial pressures on healthcare systems already managing tight budgets.

To mitigate these disruptions, leading medtech firms are accelerating reshoring and near-shoring efforts. Companies such as Boston Scientific and Abbott have announced expansions of domestic manufacturing footprints, investing in new U.S. facilities to absorb tariff-related cost burdens and ensure supply continuity. While these strategic moves bolster long-term resilience, they require significant capital outlays and time to scale production capabilities, underscoring the profound cumulative impact of 2025 U.S. tariffs on innovation, cost structures, and global supply chain stability.

Deep Dive Into Market Segmentation Revealing Diverse Product, Application, End User, Connectivity, and Distribution Patterns Shaping Industry Dynamics

A nuanced understanding of market segmentation reveals the breadth of opportunities and the specificity of user needs across the connected medical devices ecosystem. Product-type differentiation underscores that diagnostic platforms, including advanced imaging systems, point-of-care test kits, and ultrasound scanners, are leveraging connectivity to integrate AI-driven analytics and remote interpretation capabilities. Concurrently, patient monitoring solutions-from continuous ECG and glucose sensors to vital signs monitors-are evolving into platform-agnostic networks capable of streaming real-time health data to providers, triggering automated alerts for out-of-range metrics.

Within the surgical sphere, connectivity enhances precision tools such as electrosurgical units, endoscopic cameras, and robotic surgery platforms by supplying live feedback and augmented reality overlays during procedures. Therapeutic device categories, including dialysis systems, infusion pumps, and mechanical ventilators, now feature integrated telemetry for remote parameter adjustment and predictive maintenance scheduling. Wearable devices, notably fitness trackers and smartwatches, have matured into medical-grade instruments, capturing granular biometric signals that support chronic disease management and wellness initiatives.

Application-based segmentation further delineates the landscape. Intelligent drug delivery solutions span infusion, inhalation, and injection modalities with closed-loop control and digital adherence monitoring. Imaging workflows encapsulate CT, MRI, ultrasound, and X-ray modalities enriched by cloud-based image sharing and AI-led diagnostic assistance. Patient monitoring extends beyond hospital walls into ambulatory, critical care, and remote environments, while rehabilitation, surgical assistance, and telehealth services interweave digital connectivity to amplify clinician effectiveness and patient engagement. Finally, end-user considerations range from ambulatory care centers and diagnostic facilities to home-based elderly and post-operative care settings, all supported by diverse connectivity technologies-Bluetooth (Classic and BLE), cellular networks (2G through 5G), Wi-Fi standards, and Zigbee-with distribution channels spanning traditional offline channels and burgeoning online platforms. This layered segmentation insight illuminates the market’s complexity and the tailored innovation pathways essential for success.

This comprehensive research report categorizes the Connected Medical Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Connectivity Technology

- End User

- Application

- Distribution Channel

Illuminating Regional Dynamics Highlighting Growth Drivers and Challenges Across Americas, Europe Middle East & Africa, and Asia Pacific Markets

Regional dynamics in the connected medical devices sector reflect a mosaic of regulatory frameworks, infrastructure maturity, and market adoption rates across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the United States leads with its well-established digital health initiatives, comprehensive FDA guidances on cybersecurity, and AI-enabled device lifecycle management, providing a structured pathway for developers and fostering rapid adoption across care settings. Canada follows with supportive reimbursement policies for remote patient monitoring, while Latin American markets are advancing connectivity through public-private partnerships aimed at bridging rural-urban healthcare gaps.

Across Europe Middle East & Africa, the EU has deployed substantial public funding-over €403 million-to spur innovation in medical device design and AI integration, driving private investments and job creation within the sector. Harmonization efforts under the Health Technology Assessment Regulation and ongoing MDR and IVDR compliance initiatives are gradually streamlining market entry, although regional fragmentation persists, particularly in North Africa and parts of the Middle East where regulatory ecosystems continue to mature.

Asia-Pacific represents the fastest-growing regional market, propelled by robust economic expansion, smartphone and 5G network penetration, and strategic national programs such as China’s Healthy China 2030 and India’s digital health mission. Investments in telemedicine infrastructure and the proliferation of wearable health devices have catalyzed the adoption of connected diagnostics and monitoring solutions, positioning the region as a pivotal growth frontier for medical technology innovators.

This comprehensive research report examines key regions that drive the evolution of the Connected Medical Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Connected Medical Device Sector’s Competitive Landscape

Leading industry players are doubling down on strategic collaborations and manufacturing realignments to secure competitive advantages within the connected medical devices landscape. Medtronic’s partnership with Amazon Web Services exemplifies how cloud infrastructure and advanced analytics can be harnessed to scale telehealth solutions, streamline data management, and support clinical decision-making across distributed care networks. Similarly, Philips Healthcare’s expanded collaboration with AWS underscores the convergence of diagnostic imaging, digital pathology, and cardiology platforms into unified, AI-powered ecosystems.

Established medtech giants have also responded to tariff-induced pressures with targeted investments. Siemens Healthineers revealed significant capital allocations aimed at shifting critical production lines to the U.S., seeking to mitigate the impact of proposed EU-US duties on advanced imaging systems. Boston Scientific and Abbott have each announced substantial expansions of domestic manufacturing capabilities, from Georgia and Illinois to Texas, absorbing millions of dollars in potential tariff exposures while bolstering supply chain resilience and reducing lead times.

Emerging disruptors and digital health integrators continue to innovate at the intersection of software and medical hardware. Startups are accelerating platform-agnostic sensor development, interoperable middleware solutions, and subscription-based care models that blend remote monitoring with patient engagement tools. As competition intensifies, strategic mergers, acquisitions, and ecosystem partnerships will be key determinants of leadership positions in this rapidly evolving domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Connected Medical Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Apple Inc.

- Baxter International Inc.

- Becton Dickinson and Company

- Boston Scientific Corporation

- Dexcom Inc.

- Fitbit Inc.

- Fresenius Medical Care AG & Co. KGaA

- Garmin Ltd.

- GE Healthcare

- Honeywell International Inc.

- iHealth Labs Inc.

- Insulet Corporation

- Johnson & Johnson Services Inc.

- Masimo Corporation

- Medtronic plc

- Omron Healthcare Inc.

- Philips Healthcare

- ResMed Inc.

- Roche Diagnostics

- Samsung Electronics Co. Ltd.

- Siemens Healthineers AG

- Smiths Medical

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

Actionable Strategic Imperatives to Strengthen Security, Enhance Interoperability, Diversify Supply Chains, and Accelerate Regulatory Compliance

To navigate the complexities of the connected medical devices market, industry leaders should adopt proactive strategies that reinforce security, streamline compliance, and fortify supply chains. First, embedding cybersecurity by design across all stages of product development is imperative. By implementing zero-trust architectures, continuous vulnerability assessment processes, and structured postmarket surveillance, manufacturers can protect patient safety and maintain regulatory alignment.

Second, strengthening supply-chain resilience through diversified sourcing and strategic reshoring initiatives will mitigate the operational disruptions triggered by trade tariffs. Establishing relationships with alternative component suppliers, stockpiling critical materials where feasible, and leveraging group purchasing alliances can help buffer cost fluctuations and lead-time volatility.

Third, accelerating interoperability efforts by adopting open-standard protocols and participating in industry consortiums will enable seamless data exchange and drive clinical workflow efficiencies. Engaging early with electronic health record vendors and health information exchanges ensures that device data streams integrate smoothly, maximizing the utility of connected platforms. Finally, forging public-private partnerships and investing in regional innovation hubs can unlock new markets, stimulate collaborative R&D, and reinforce institutional trust, laying the groundwork for sustainable, patient-centric growth.

Robust Multi-Source Research Methodology Combining Primary Interviews, Secondary Literature Analysis, and Data Triangulation to Ensure Rigorous Insights

This analysis synthesizes insights acquired through a robust, multi-phased research methodology designed to balance depth, accuracy, and relevance. Secondary research involved extensive reviews of regulatory guidance documents, peer-reviewed literature, industry white papers, and credible news sources to establish a comprehensive baseline of technological, economic, and policy drivers. Key data points and trends were corroborated through targeted consultations with subject-matter experts, including clinical engineers, regulatory affairs specialists, and cybersecurity professionals.

Primary research entailed in-depth interviews with senior executives from leading medtech firms, healthcare providers, and technology partners to capture nuanced perspectives on adoption barriers, innovation priorities, and competitive strategies. These qualitative insights were triangulated against quantitative datasets derived from public filings, trade–association reports, and subscription-based industry analytics to validate patterns and forecast implications without disclosing proprietary market estimates.

Data triangulation underpinned each section of this report, ensuring that conclusions rest on convergent evidence rather than isolated observations. The methodology prioritized transparency, replicability, and rigor, aligning with best practices in market intelligence to provide stakeholders with actionable, evidence-based guidance for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Connected Medical Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Connected Medical Devices Market, by Product Type

- Connected Medical Devices Market, by Connectivity Technology

- Connected Medical Devices Market, by End User

- Connected Medical Devices Market, by Application

- Connected Medical Devices Market, by Distribution Channel

- Connected Medical Devices Market, by Region

- Connected Medical Devices Market, by Group

- Connected Medical Devices Market, by Country

- United States Connected Medical Devices Market

- China Connected Medical Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesis of Critical Insights Underscoring the Transformative Impact and Strategic Opportunities Within the Connected Medical Device Ecosystem

The convergence of connectivity technologies, advanced analytics, and regulatory evolution is reshaping the medical device industry into a dynamic, patient-centric ecosystem. As edge AI and immersive sensor platforms gain traction, clinicians are empowered with near-real-time insights and predictive alerts that enhance clinical outcomes and reduce operational burdens. Meanwhile, cybersecurity and interoperability frameworks are maturing, reinforcing trust and interoperability across diverse care settings.

However, the policy environment-highlighted by recent U.S. tariffs-introduces cost pressures that necessitate strategic supply-chain adaptations and capital investments in domestic manufacturing. At the same time, global regulatory realignments in the EU and Asia-Pacific present opportunities for market expansion and collaborative innovation. The segmentation and regional analyses underscore that success requires nuanced strategies tailored to product lines, end-user settings, and connectivity modalities.

Leading industry players have demonstrated adaptability through strategic partnerships, production realignments, and digital platform integrations. Nonetheless, the pace of technological change and shifting policy landscapes demands that industry leaders remain agile, prioritize security, and continuously engage with regulatory stakeholders. By synthesizing these critical insights, organizations can formulate informed roadmaps to navigate market complexities, capture emerging growth avenues, and deliver transformative healthcare solutions.

Empower Your Strategic Decisions with Exclusive Connected Medical Devices Market Intelligence—Connect Directly with Ketan Rohom to Secure Your Comprehensive Report

If you’re ready to deepen your understanding of the connected medical devices landscape and equip your organization with strategic intelligence, we invite you to reach out directly to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the comprehensive market research report and help tailor insights to your unique strategic priorities, ensuring you stay ahead of competitive and regulatory shifts. By engaging early, you’ll gain privileged access to in-depth analyses, actionable recommendations, and expert guidance to drive innovation and growth within your organization. Contact Ketan today to secure your copy and unlock the full value of this essential industry resource.

- How big is the Connected Medical Devices Market?

- What is the Connected Medical Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?