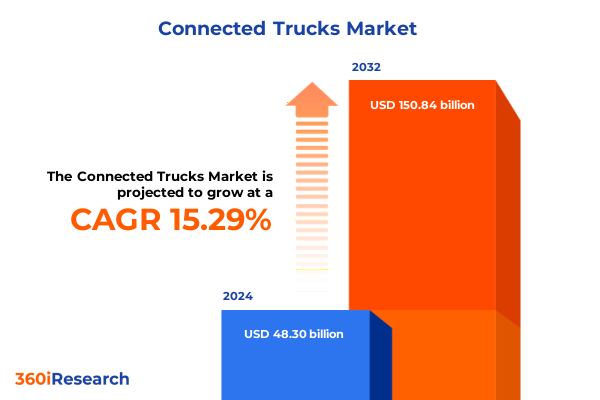

The Connected Trucks Market size was estimated at USD 55.78 billion in 2025 and expected to reach USD 64.43 billion in 2026, at a CAGR of 16.33% to reach USD 160.84 billion by 2032.

Discover how real-time connectivity and advanced analytics are revolutionizing fleet performance to drive unprecedented productivity gains

The transportation industry stands at the cusp of a profound technological transformation as traditional trucking fleets evolve into intelligent, data-driven networks. By embedding advanced connectivity solutions, trucks are no longer isolated vehicles but integrated nodes within a larger digital ecosystem. This shift brings enhanced visibility into fleet operations, real-time diagnostics, and predictive insights that elevate reliability and efficiency. As demand for expedited delivery grows, stakeholders are compelled to adopt connected solutions to maintain service levels, minimize downtime, and maximize asset utilization.

Moreover, the convergence of cloud computing, edge analytics, and next-generation communications is redefining operational paradigms. Insights that once arrived too late for actionable intervention can now trigger automated alerts, adaptive routing decisions, and proactive maintenance scheduling. Consequently, fleets of all sizes are reassessing legacy practices in favor of data-driven approaches. This introduction sets the stage for an executive summary that delves deep into the market’s structural shifts, emerging growth drivers, and strategic imperatives for industry participants.

Explore the disruptive convergence of 5G, satellite networks, and AI-driven applications reshaping the connected trucking ecosystem

The connected trucks landscape has undergone remarkable transformation as emerging technologies disrupt conventional models. Cellular networks transitioned beyond 4G, ushering in 5G deployments that deliver ultra-low latency communications and bandwidth sufficient for high-definition video streams and complex telemetry data. Complementing terrestrial networks, satellite communications operating in both Ka band and L band frequencies now bridge connectivity gaps in remote corridors and offshore operations, ensuring uninterrupted data flows across the entire logistics chain.

Simultaneously, applications have evolved from basic telematics to sophisticated solutions encompassing dynamic route optimization, predictive maintenance algorithms, remote diagnostics, and comprehensive safety and security platforms. By harnessing artificial intelligence and machine learning, these applications can predict component failures, optimize fuel consumption patterns, and detect anomalous behavior that signals potential security threats. As a result, fleet managers are empowered to make decisions with unprecedented precision, driving both cost efficiencies and service differentiation.

Understand the far-reaching impact of 2025 US component tariffs on supply chains, pricing models, and vendor strategies within the connected trucking sector

In 2025, a series of tariffs imposed by the United States government on key telecommunications and automotive components significantly altered the cost dynamics for connected truck technologies. Devices and modules relying on imported semiconductors saw price escalations, prompting manufacturers to reconsider supply chains and sourcing strategies. Components such as advanced modems and specialized sensors now carry embedded tariff premiums, compelling system integrators to absorb costs or pass them along to end users, thereby influencing adoption curves.

The cumulative effect of these tariffs goes beyond simple price increases. Companies have accelerated negotiations with domestic suppliers and regional partners to mitigate exposure while exploring redesigns that incorporate alternative materials or domestic fabrication. At the same time, service providers are offering flexible financing and turnkey installation packages to alleviate upfront investment hurdles. This complex interplay between regulation, supply-chain adaptation, and financial structuring continues to shape market entry strategies and competitive positioning throughout the connected trucks arena.

Uncover nuanced drivers and customized requirements across connectivity, application, vehicle type, and end-user segments shaping the market

Diving into market segmentation reveals a multi-dimensional landscape of connectivity and application needs. By connectivity type, industry participants are evaluating both cellular and satellite networks. Cellular connectivity spans established 4G infrastructures and the newer 5G framework, enabling higher data throughput and reduced latency for mission-critical operations. Meanwhile, satellite solutions leveraging Ka band deliver high-capacity links ideal for video-centric applications, whereas L band networks provide resilient coverage optimized for low-data-rate telemetry in remote regions.

Examining market segmentation through the lens of application uncovers differentiated value propositions. Fleet management platforms coordinate dispatch and asset tracking, while advanced navigation and route optimization systems adapt in real time to traffic and weather. Predictive maintenance algorithms analyze sensor data to forecast component wear, and remote diagnostics enable technical teams to troubleshoot issues without physical intervention. At the same time, safety and security solutions utilize AI and camera analytics to monitor driver behavior and secure cargo, reducing accident rates and theft.

Segmenting by vehicle type highlights divergent requirements across heavy, medium, and light trucks. Heavy trucks demand robust connectivity for long-haul routes, medium trucks balance payload efficiency with local delivery demands, and light trucks prioritize flexible deployments within urban environments. Finally, understanding end user segmentation-spanning construction, e-commerce, logistics, and retail-illuminates how vertical-specific workflows drive bespoke feature sets. Construction fleets often require ruggedized hardware and offline mapping, e-commerce operators focus on delivery speed and last-mile traceability, logistics providers emphasize real-time coordination across multimodal networks, and retail chains integrate connected trucks for inventory replenishment and on-shelf availability.

This comprehensive research report categorizes the Connected Trucks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Connectivity Type

- Vehicle Type

- Application

- End User

Analyze how differing network infrastructures, regulatory landscapes, and operational priorities across Americas, EMEA, and Asia-Pacific drive adoption patterns

Geographic dynamics are integral to understanding deployment patterns and technology preferences. In the Americas, widespread 5G rollouts coupled with dense highway networks facilitate comprehensive cellular coverage, supporting advanced fleet management and AI-driven route optimization. Conversely, Latin American corridors still rely heavily on satellite connectivity for critical data continuity, prompting innovative hybrid architectures that merge terrestrial and space-based networks.

Across Europe, the Middle East, and Africa, regulatory frameworks and cross-border operations influence network choices. The European Union’s stringent data privacy laws elevate the importance of secure, localized data storage, while Gulf countries invest heavily in satellite infrastructure to service vast desert regions. In Africa, telecommunication operators are forging partnerships with logistics firms to extend connectivity to rural areas, leveraging L band’s extended reach for essential telemetry.

In Asia-Pacific, explosive growth in manufacturing hubs and e-commerce has driven demand for high-throughput networks. Urban megacities are early adopters of 5G-enabled safety and security solutions, while remote supply routes in Southeast Asia and Oceania rely on Ka band satellite services to maintain operational visibility. These regional nuances underscore the necessity for tailored strategies that align technology portfolios with local infrastructure, regulatory environments, and sector-specific requirements.

This comprehensive research report examines key regions that drive the evolution of the Connected Trucks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine how collaborations between network operators, telematics innovators, satellite providers, and OEMs are fueling solution differentiation

Leading companies within the connected trucks domain are forging alliances, innovating solutions, and expanding service portfolios to capture value across the ecosystem. Network operators are partnering with telematics providers to offer integrated connectivity plans that bundle data services with hardware subscriptions, thereby simplifying vendor management for fleet operators. Meanwhile, telematics specialists are embedding AI modules and advanced sensor fusion capabilities into their platforms, delivering richer insights and predictive analytics.

At the same time, satellite communication providers are diversifying their offerings through Software as a Service models, allowing customers to scale capacity on demand. Original equipment manufacturers and Tier 1 suppliers are collaborating with chipset designers to develop modular, tariff-compliant connectivity units optimized for rugged roadway conditions. Additionally, system integrators are investing in cybersecurity frameworks to safeguard data integrity and comply with tightening regulatory requirements. Collectively, these strategic moves illustrate an industry in which collaboration and innovation fuel competitive differentiation and accelerate broader adoption of connected trucks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Connected Trucks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Volvo

- Aptiv Global Operations Limited

- Blue Energy Motors

- BorgWarner Inc.

- Continental AG

- Daimler Truck AG

- Denso Corporation

- Ford Motor Company

- General Motors Company

- Geotab Inc.

- HARMAN International

- Magna International Inc.

- Mercedes-Benz Group AG

- MiX Telematics International (Pty) Ltd.

- NXP Semiconductors N.V.

- PACCAR Inc.

- Robert Bosch GmbH

- Sierra Wireless, Inc.

- Tata Motors Ltd.

- Thales Group

- TomTom International BV

- Traton SE

- Trimble Inc.

- Verizon Communications Inc.

- ZF Friedrichshafen AG

Learn essential strategies to integrate resilient connectivity, AI-driven analytics, and domestic supply partnerships to outperform competitors

Industry leaders must adopt a strategic blueprint that harnesses technological advancements while mitigating external risks. First, prioritizing multimodal connectivity solutions that seamlessly switch between cellular and satellite networks will ensure uninterrupted data streams across diverse geographies. Next, investing in AI-powered analytics and edge computing will transform raw telematics into actionable insights, enabling proactive maintenance and dynamic route planning.

Furthermore, stakeholders should cultivate partnerships with domestic component suppliers to reduce exposure to tariff-induced cost fluctuations, thereby safeguarding project budgets. Embracing modular hardware designs and software-defined architectures will future-proof fleets against rapid technology shifts. Lastly, integrating robust cybersecurity protocols and compliance frameworks will protect sensitive operational data and maintain regulatory adherence. By implementing these measures, industry leaders can accelerate digital transformation, drive operational excellence, and secure a competitive edge in a rapidly evolving market landscape.

Dive into the rigorous multi-source, data-triangulation research methodology that underpins our comprehensive insights

This research employs a rigorous methodology combining primary and secondary data sources to ensure robust and reliable insights. Primary research includes in-depth interviews with supply-chain executives, fleet managers, and technology vendors, providing firsthand perspectives on technology adoption, operational challenges, and strategic priorities. Complementing this, secondary sources such as regulatory filings, industry whitepapers, and academic publications are analyzed to validate market dynamics and historical trends.

Data triangulation techniques reconcile disparate inputs, ensuring consistency across multiple viewpoints. Quantitative data is enriched through statistical analysis, while qualitative findings are distilled into thematic insights. Segmentation models are constructed based on connectivity type, application, vehicle type, and end-user verticals, enabling granular analysis of market drivers and use-case requirements. Additionally, regional assessments incorporate local infrastructure, regulatory frameworks, and economic indicators. This comprehensive approach ensures that conclusions and recommendations reflect the most accurate and up-to-date information available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Connected Trucks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Connected Trucks Market, by Connectivity Type

- Connected Trucks Market, by Vehicle Type

- Connected Trucks Market, by Application

- Connected Trucks Market, by End User

- Connected Trucks Market, by Region

- Connected Trucks Market, by Group

- Connected Trucks Market, by Country

- United States Connected Trucks Market

- China Connected Trucks Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesize key trends and strategic imperatives revealing how connectivity and analytics will redefine trucking operations and competitive advantage

The connected trucks market is at a pivotal moment, driven by technological breakthroughs, shifting regulatory landscapes, and evolving operational imperatives. As 5G networks expand and satellite providers enhance global coverage, fleets will benefit from seamless data connectivity that underlies advanced telematics, predictive maintenance, and safety applications. Nevertheless, external forces such as tariffs and supply-chain disruptions underscore the need for strategic resilience.

Moving forward, industry participants who embrace modular architectures, strategic partnerships, and AI-driven analytics will emerge as leaders in a landscape increasingly defined by data intelligence and real-time orchestration. By aligning technology investments with vertical-specific requirements and regional infrastructure realities, stakeholders can capture untapped efficiencies, minimize risk, and unlock new revenue streams. Ultimately, the convergence of connectivity and analytics will continue to reshape the trucking industry, delivering unprecedented levels of performance, security, and sustainability.

Unlock unparalleled competitive intelligence and secure your copy of the definitive connected trucks market report by engaging directly with Ketan Rohom

To acquire the full suite of in-depth analysis, proprietary data sets, and custom insights tailored to your strategic objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through exclusive package options and demonstrate how our comprehensive connected trucks research can empower your decision-making, reduce risk, and accelerate market entry. Engage now to secure your competitive advantage with the most exhaustive report on connected truck technologies, market dynamics, and regulatory developments available today.

- How big is the Connected Trucks Market?

- What is the Connected Trucks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?