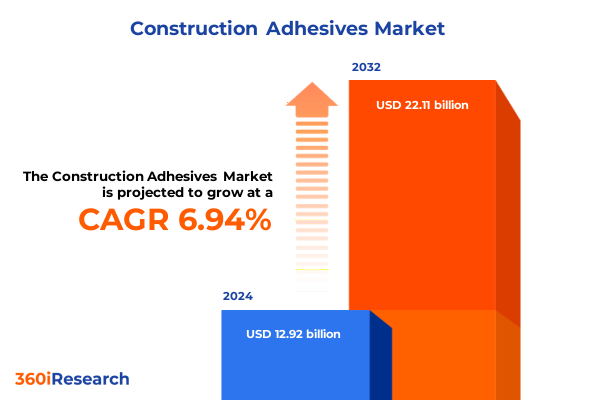

The Construction Adhesives Market size was estimated at USD 13.84 billion in 2025 and expected to reach USD 14.67 billion in 2026, at a CAGR of 6.92% to reach USD 22.11 billion by 2032.

Introduction to how advanced bonding solutions are reshaping building projects amid evolving sustainability demands

As the construction industry accelerates worldwide, adhesives have emerged as a foundational element for innovation, performance, and sustainability in building projects. Over the past decade, the shift toward lightweight materials, modular construction techniques, and eco-friendly building standards has dramatically elevated the role of advanced bonding solutions. This landscape demands adhesives that not only ensure structural integrity but also align with stringent environmental regulations and accelerate project timelines. Consequently, stakeholders from manufacturers and distributors to architects and contractors recognize adhesives as more than ancillary products-they are integral to value creation and cost optimization.

Against a backdrop of urban expansion, aging infrastructure renovations, and green building certifications, adhesive manufacturers are challenged to pioneer chemistries that deliver multi-substrate compatibility, rapid cure rates, and long-term durability. The interplay of volatile raw material pricing, evolving regulatory compliance, and digital tools for formulation design underscores the complexity of today’s environment. In this context, a clear understanding of macroeconomic drivers, supply chain dynamics, and end-use applications becomes essential for decision-makers seeking to maintain competitive advantage. By framing these trends within broader market developments, this analysis provides a strategic foundation for stakeholders aiming to capitalize on emerging opportunities and mitigate potential risks.

Emergence of specialized chemistries and digital tools driving high-performance adhesives toward sustainable and efficient building practices

Technological advancements and shifting industry priorities have catalyzed a series of transformative shifts reshaping the adhesives landscape. Initially driven by sustainable mandates and carbon footprint reduction, the development of water-based and low-VOC formulations has become a baseline expectation rather than a differentiator. Concurrently, digital formulation platforms leveraging artificial intelligence and machine learning now enable chemists to predict bonding performance across substrates, accelerating product development cycles and reducing trial-and-error costs.

Moreover, the rise of modular and prefabricated construction has placed a premium on rapid-curing reactive adhesives that facilitate off-site assembly without compromising structural integrity. This trend aligns with labor-scarce markets where contractors prioritize ease of handling and minimized on-site adjustments. Meanwhile, regional supply chain disruptions triggered by pandemic aftershocks and geopolitical tensions have driven manufacturers to localize raw material sourcing and adopt vertically integrated strategies. Collectively, these shifts underscore the industry’s pivot from commodity-driven production toward specialized, high-performance solutions tailored to specific applications.

Analysis of how new 2025 tariff measures on raw materials have reshaped supply chain strategies and cost structures in adhesives manufacturing

The imposition of new United States tariffs on certain adhesive raw materials and intermediate components in early 2025 has materially altered cost structures and procurement strategies across the value chain. Manufacturers dependent on imported polymers, solvents, and additives have encountered margin pressure as duties of up to 15% are applied, prompting a reevaluation of supplier relationships and input substitution. This measure aimed to bolster domestic production has instead introduced complexity for companies unprepared to transition quickly to alternative sourcing routes.

In response, several large-scale adhesive producers have accelerated qualification of locally manufactured feedstocks, investing in domestic polymerization capacity and strategic partnerships with petrochemical firms. While these efforts can mitigate long-term exposure to tariff volatility, short-term repercussions include disruptions to manufacturing schedules and inventory imbalances. Downstream, construction contractors and distributors have renegotiated purchase agreements to reflect pass-through costs, influencing project bid pricing and potentially delaying non-critical renovations. Overall, tariff conditions in 2025 underscore the necessity for agile supply chain frameworks and proactive risk management strategies in an era of heightened trade protectionism.

Deep dive into nuanced performance requirements across hot-melt, reactive, solvent-based, and water-based adhesive chemistries aligned with diverse end uses

Product type segmentation reveals that heat-activated hot-melt adhesives, encompassing EVA, polyamide, and polyolefin variants, continue to dominate applications requiring rapid set-up and high initial tack. In parallel, reactive chemistries such as epoxy, MS polymer, polyurethane, and silicone formulations have expanded into demanding structural bonding tasks where moisture and temperature resistance are critical. Solvent-based categories leveraging neoprene, styrene-butadiene, and vinyl acetate ethylene chemistries persist in specialized applications despite regulatory headwinds, while water-based acrylic, polyvinyl acetate, and styrene acrylic systems cater to projects prioritizing low emissions and ease of clean-up.

Simultaneously, application segmentation highlights the significance of adhesives in door and window assembly, where sealant performance under dynamic load conditions is imperative. Drywall bonding, supported by both paper-faced and vinyl-coated adhesives, addresses efficiency in interior finish workflows. Flooring solutions rely on high-strength adhesives that balance seam integrity with moisture vapor transmission, while panel bonding technologies facilitate the assembly of house-wrap, sub-floor, and prefabricated wall units. Tiling presents its own demands, with cement-based, dispersion, and epoxy-based adhesives each solving challenges related to substrate variance and curing environments. These layered segmentation insights illuminate the nuanced performance criteria driving product development and market adoption.

This comprehensive research report categorizes the Construction Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Sales Channel

Examination of regulatory, climatic, and economic variables shaping adhesives demand across Americas, EMEA, and Asia-Pacific landscapes

Regional dynamics play a pivotal role in shaping the trajectory of the construction adhesives sector. In the Americas, robust infrastructure investment and a strong remodeling market sustain demand, yet environmental regulations at federal and state levels drive a shift toward low-VOC adhesive solutions. Trade dynamics with Latin American neighbors further influence material flows, with cross-border free trade agreements and localized production hubs optimizing lead times.

Across Europe, Middle East and Africa, heterogeneity in building codes and certification programs creates divergent requirements for formulations, particularly regarding fire performance and indoor air quality standards. While Western European countries emphasize green building certifications, emerging markets in the Middle East prioritize rapid‐curing solutions for large‐scale commercial developments. In Africa, infrastructure growth fueled by urbanization and public–private partnerships presents opportunities for cost-effective adhesives tailored to hot climates.

The Asia-Pacific region remains the fastest evolving market segment, supported by rapid urban expansion in Southeast Asia, substantial government-backed housing programs in India, and advanced manufacturing clusters in East Asia. Manufacturers here blend international innovation with local production capabilities to meet diverse application demands and logistical constraints. Taken together, regional segment perspectives underscore the importance of adaptive strategies to address regulatory, climatic, and economic variables across global markets.

This comprehensive research report examines key regions that drive the evolution of the Construction Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insights into how strategic collaborations and targeted acquisitions are fueling innovation and geographic expansion among top adhesive manufacturers

Leading manufacturers continually differentiate through innovation in formulation, process technology, and strategic collaboration. Global chemical companies have introduced next-generation hybrid adhesives that combine the rapid set characteristics of hot-melt systems with the long-term strength of reactive chemistries. Partnerships between raw material suppliers and adhesive formulators drive co-development of proprietary polymers engineered for specific substrate interfaces, enabling performance optimizations that were previously unattainable.

At the same time, mergers and acquisitions remain a strategic lever for scaling product portfolios and geographic reach. Targeted acquisitions of regional specialist producers allow global players to integrate unique chemistries and local customer relationships, accelerating market penetration. Moreover, investment in continuous processing equipment and automation has granted leading firms enhanced throughput and quality consistency, while digital customer portals and application support services foster closer engagement with architects, engineers, and contractors. Collectively, these corporate strategies illuminate a competitive landscape where technological leadership and operational agility confer significant advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Avery Dennison Corporation

- BASF SE

- Benson Polymers Limited

- Dow Inc.

- DuPont de Nemours, Inc.

- Fosroc, Inc.

- Franklin International, Inc.

- General Sealants, Inc.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illinois Tool Works Inc.

- Jowat SE

- Lord Corporation

- Mapei S.p.A.

- Pidilite Industries Limited

- RPM International Inc.

- Saint-Gobain India Private Limited

- Sika AG

- Wacker Chemie AG

Actionable strategies for market leaders to harness predictive R&D, sustainable practices, and adaptive supply chains for competitive edge

To navigate evolving market conditions, industry leaders must adopt a multifaceted approach focused on innovation, resilience, and customer-centricity. Prioritizing investment in R&D platforms that leverage predictive analytics will accelerate the development of tailored adhesive formulations and reduce time-to-market for novel products. Equally important is the cultivation of flexible supply chain networks that blend local sourcing, strategic stock positions, and dual-sourcing agreements, thereby mitigating tariff exposures and logistical disruptions.

Simultaneously, expanding digital services such as interactive formulation configurators and virtual application training can enhance customer loyalty and support premium pricing strategies. Embracing sustainability as a core business pillar requires not only shifting toward low-emission chemistries but also integrating lifecycle assessment tools to quantify environmental impact and communicate value to green-focused stakeholders. Finally, establishing cross-functional innovation hubs brings together R&D, marketing, and customer insights to co-create solutions, ensuring that product roadmaps align with emerging end-use needs and regulatory trajectories.

Overview of research approach integrating primary expert interviews with secondary data validation and iterative stakeholder feedback loops

This report synthesizes qualitative insights from in-depth interviews with formulation scientists, procurement executives, and construction project managers, complemented by secondary data sourced from industry publications, regulatory databases, and trade association reports. Data triangulation ensures consistency between primary viewpoints and publicly available information on raw material flows, regulatory requirements, and application trends.

Analytical rigor is maintained through a structured framework encompassing supply chain mapping, value chain analysis, and comparative assessment of regional dynamics. Validation workshops with select industry stakeholders provided iterative feedback on preliminary findings, refining the narrative to reflect on-the-ground realities. While proprietary data sources underpin key supply chain observations, all insights have been cross-verified against multiple external references to safeguard accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Adhesives Market, by Product Type

- Construction Adhesives Market, by Application

- Construction Adhesives Market, by Sales Channel

- Construction Adhesives Market, by Region

- Construction Adhesives Market, by Group

- Construction Adhesives Market, by Country

- United States Construction Adhesives Market

- China Construction Adhesives Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Concluding synthesis of innovation drivers, regulatory nuances, and geopolitical factors that will define the next phase of adhesives market evolution

The construction adhesives market stands at an inflection point where technical innovation, regulatory shifts, and global trade dynamics converge to redefine competitive parameters. Manufacturers that align their product development with sustainability imperatives and leverage digital tools for formulation and customer engagement will lead future growth trajectories. At the same time, the ability to absorb trade policy shocks through diversified sourcing strategies will be critical to preserving margin performance in an uncertain macroeconomic environment.

Segmentation insights reveal that differentiated chemistries and application-specific innovations are no longer optional but mandatory to address the complexity of modern construction challenges. Regional nuances, from environmental compliance in the Americas to rapid urbanization in Asia-Pacific, necessitate adaptive go-to-market and operational strategies. By synthesizing these perspectives, stakeholders are equipped with a roadmap to navigate disruption, capitalize on emerging opportunities, and build resilient, future-ready portfolios.

Engage with our Associate Director of Sales & Marketing to secure the definitive construction adhesives market research report with personalized expert support

To gain unparalleled access to comprehensive market intelligence, detailed analysis, and strategic frameworks, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By reaching out to Ketan, you will unlock priority insights into the evolving construction adhesives landscape, including tailored recommendations and exclusive data visualizations. Whether your focus lies in navigating tariff impacts, refining product portfolios, or expanding into emerging regions, Ketan can guide you through our suite of customizable research offerings.

Engaging with Ketan Rohom ensures you receive personalized support, fast-track responses to your inquiries, and a seamless purchasing experience for the full report. Don’t miss the opportunity to equip your organization with an authoritative roadmap for success. Contact Ketan today to secure your copy of the complete construction adhesives market research report and propel your strategic initiatives with confidence.

- How big is the Construction Adhesives Market?

- What is the Construction Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?