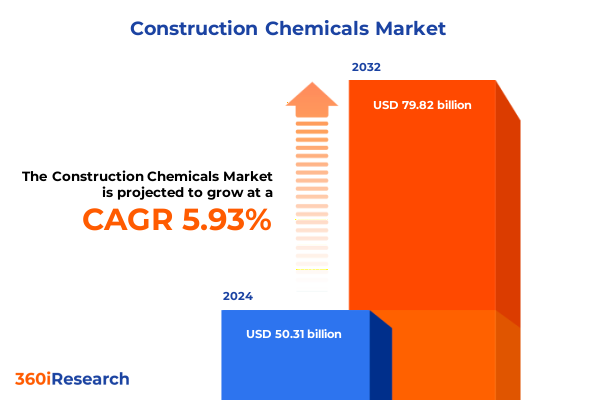

The Construction Chemicals Market size was estimated at USD 53.16 billion in 2025 and expected to reach USD 56.22 billion in 2026, at a CAGR of 5.97% to reach USD 79.82 billion by 2032.

Unlocking the Future of Construction Chemicals with an In-Depth Exploration of Market Dynamics, Technological Innovations, and Growth Drivers

Unlocking the potential of the construction chemicals sector requires a foundational overview that integrates market forces, technological advancements, and stakeholder dynamics. The introduction outlines the current macroeconomic context shaping demand for high-performance building materials, where infrastructure spending, urbanization trends, and sustainability imperatives converge to fuel innovation in chemical solutions. Rapid growth in emerging economies alongside renovation demands in mature markets underscores the dual momentum driving adoption of specialty admixtures, bonding agents, and protective coatings.

This section also frames the evolving regulatory environment, highlighting how stricter emissions standards and green building certifications are prompting manufacturers to formulate low-VOC and eco-friendly products. Meanwhile, competitive pressures are encouraging industry participants to pursue strategic partnerships and portfolio diversification. By tracing the nexus between global construction activity and chemical applications, the introduction establishes the strategic importance of performance, durability, and cost-efficiency in determining market trajectories, setting the stage for deeper analysis of transformative shifts and segmentation insights.

Navigating Transformative Shifts in Construction Chemicals Market Fueled by Sustainability, Digitalization, Supply Chain Resilience, and Regulatory Evolution

The construction chemicals landscape is undergoing transformative shifts driven by an intensified focus on sustainability, digitalization, and supply chain resilience. Manufacturers are investing in bio-based and recycled-material formulations to address regulatory mandates and meet corporate ESG objectives, fundamentally altering product portfolios. Concomitantly, digital tools such as AI-powered quality control and blockchain-enabled traceability are enhancing formulation precision and transparency, reducing waste and ensuring compliance across global operations.

Moreover, the industry is adapting to a heightened emphasis on resilience in procurement strategies. Lessons from recent disruptions have accelerated the diversification of raw-material sourcing and the adoption of nearshoring models, fostering greater stability. Regulatory evolution, particularly in regions implementing stricter environmental controls, is also reshaping R&D priorities, compelling companies to innovate in high-performance systems that balance functionality with ecological considerations. Together, these shifts underscore a market in dynamic flux, where agility and technological prowess will determine competitive advantage.

Assessing the Cumulative Impact of 2025 United States Tariffs on Construction Chemicals Supply Chains, Cost Structures, and Competitive Dynamics

The cumulative impact of United States tariffs enacted in 2025 has introduced new cost pressures and strategic considerations for participants in the construction chemicals sector. Tariffs on critical raw materials and additives have elevated input expenses, prompting manufacturers to reevaluate pricing models and renegotiate supply contracts. For many firms, the increased duty rates have underscored the necessity of optimizing production footprints within tariff-exempt zones or domestic facilities, accelerating capital investment decisions.

As a direct consequence, companies have intensified efforts to pass incremental costs to end users, influencing project budgets and procurement cycles downstream. Some organizations have sought supply chain diversification by expanding relationships with regional raw-material producers outside the tariff ambit, while others have prioritized process innovations to reduce reliance on affected imports. In this evolving environment, the ability to navigate tariff regimes and maintain cost competitiveness has emerged as a critical strategic competency, shaping near-term market outcomes and long-term growth trajectories.

Revealing Critical Segmentation Insights Offering Strategic Perspectives Across Product Types, Technologies, Applications, and End User Channels

A nuanced understanding of market segmentation reveals distinct performance drivers and customer preferences across multiple dimensions. Product type analysis highlights that concrete admixtures-ranging from accelerators and air-entraining agents to retarders and water reducers-remain foundational to structural applications, while construction bonding agents such as adhesives, primers, and sealants are increasingly prioritized for complex retrofit and restoration projects. Repair and rehabilitation chemicals, including epoxy injection resins, grouts, and repair mortars, are witnessing heightened demand due to infrastructure aging and safety mandates, whereas surface treatment chemicals like anti-corrosion coatings, concrete sealers, protective coatings, and waterproofing chemicals are recognized for their pivotal role in asset longevity.

Complementing these product insights, technological segmentation underscores the rise of acrylic-based systems that offer versatile adhesion, polymer-based formulations delivering enhanced flexibility, and silicone-based solutions prized for superior weather resistance. In terms of form, liquid products facilitate rapid application and uniform dispersion, paste formats support targeted adhesion tasks, and powder variants enable on-site customization. Construction type distinctions between new builds and renovation or repair work further clarify investment priorities, while application segmentation across commercial, infrastructure, and residential categories-spanning airports, hospitals, hotels, offices, bridges, tunnels, roads, and highways-reflects varied performance and compliance requirements. Finally, end-user segmentation among architects and engineers, builders and contractors, and industrial operators informs tailored marketing approaches, while distribution channel analysis differentiating offline traditional channels from online platforms highlights evolving procurement behaviors in a digitizing marketplace.

This comprehensive research report categorizes the Construction Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Form

- Construction Type

- Application

- End User

- Distribution Channel

Deciphering Key Regional Variations Influencing Construction Chemicals Demand and Growth Trajectories in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exhibit distinct patterns that shape demand and innovation across the construction chemicals industry. In the Americas, infrastructure renewal programs, residential construction growth, and a robust commercial pipeline are driving significant uptake of advanced admixtures and protective coatings that enhance structural resilience and aesthetic longevity. Market participants in North America are focusing on compliance with stringent environmental regulations, leading to the accelerated introduction of low-VOC and bio-based product lines.

Meanwhile, Europe, Middle East & Africa (EMEA) present a complex mosaic of mature and emerging markets. Western European nations emphasize sustainable construction standards and energy-efficient building envelopes, propelling demand for silicone-based sealants and polymer-enhanced surface treatments. In contrast, the Middle East and Africa prioritize rapid urbanization and infrastructure development, creating opportunities for repair and rehabilitation chemicals to support large-scale projects under challenging environmental conditions. Asia-Pacific remains the largest regional arena, where thriving urbanization in China and India and aggressive infrastructure investment strategies in Southeast Asia fuel high demand for cost-effective concrete admixtures and waterproofing solutions. Regional manufacturers are responding with localized production and tailored formulations to capture growth across these varied market landscapes.

This comprehensive research report examines key regions that drive the evolution of the Construction Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Leading Construction Chemicals Players Driving Innovation, Strategic Collaborations, and Market Positioning through Diverse Portfolios

Leading companies in the construction chemicals arena are leveraging proprietary technologies, strategic partnerships, and targeted acquisitions to strengthen their market positions. Global conglomerates with diversified portfolios focus on R&D to develop high-performance, eco-efficient formulations, while specialized players carve out niches by offering customized solutions for complex engineering challenges. Collaborative initiatives between chemical firms and construction contractors are becoming more prevalent, facilitating real-world validation and accelerating time to market for innovative products.

Furthermore, companies invest in digital platforms that enhance customer engagement and technical support, employing virtual application demos and data-driven advisory services. Alliances with raw-material suppliers and research institutions bolster innovation pipelines, particularly in green chemistry and nanotechnology. The competitive landscape is shaped by these strategic endeavors, where brand reputation, technical service excellence, and global distribution networks distinguish the foremost players from smaller regional competitors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Ashland Inc.

- BASF SE

- Cemex S.A.B. de C.V.

- Chembond Chemicals Limited

- CICO Group

- CLARIANT

- Evonik Industries AG

- Fairmate Chemicals (BD) Ltd.

- Fosroc International Limited

- Henkel AG & Co. KGaA

- Huntsman Corporation

- JSW Cement Limited

- LATICRETE International, Inc.

- Mapei S.p.A.

- Pidilite Industries Limited

- RPM International Inc.

- Saint-Gobain Group

- SCHOMBURG GmbH & Co. KG

- Sika AG

- The Dow Chemical Company

- Thermax Limited

- W. R. Grace & Co.

- Yuanwang Group

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Technological Advances, Sustainable Practices, and Market Disruptions

To capitalize on emerging market dynamics and mitigate tariff-induced challenges, industry leaders should prioritize supply chain agility and technological differentiation. Establishing localized production hubs near key construction markets can offset duty burdens and reduce lead times, while strategic alliances with raw-material producers ensure more stable input flows. Embracing circular economy principles through recycling and upcycling programs not only addresses sustainability mandates but also creates new revenue streams from recovered materials.

Investment in digital process controls and blockchain-based traceability systems will support quality assurance and regulatory compliance, enhancing customer confidence. Concurrently, R&D focus on multi-functional formulations-combining rapid setting, self-healing, and anti-corrosion properties-will meet the performance demands of modern infrastructure and green building standards. Finally, cultivating cross-functional teams that integrate technical service, marketing, and project management expertise can accelerate product adoption and strengthen brand loyalty among architects, contractors, and industrial clients.

Rigorous Research Methodology Combining Primary Expert Interviews, Comprehensive Secondary Data, and Robust Analytical Frameworks to Ensure Precision

This analysis rests on a rigorous research methodology combining primary and secondary data sources. Primary research involved structured interviews with industry stakeholders-including product development specialists, procurement managers, and regulatory experts-to validate emerging trends and competitive strategies. Complementary quantitative surveys captured end-user preferences across geographic regions and application segments.

Secondary research encompassed an extensive review of peer-reviewed journals, industry whitepapers, patent filings, and reputable trade publications to build a comprehensive data repository on material innovations, regulatory frameworks, and market drivers. Data triangulation techniques were employed to cross-verify findings, while statistical tools ensured consistency and reliability in segment-level interpretations. The integration of expert insights with robust analytical models underpins the credibility and precision of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Chemicals Market, by Product Type

- Construction Chemicals Market, by Technology

- Construction Chemicals Market, by Form

- Construction Chemicals Market, by Construction Type

- Construction Chemicals Market, by Application

- Construction Chemicals Market, by End User

- Construction Chemicals Market, by Distribution Channel

- Construction Chemicals Market, by Region

- Construction Chemicals Market, by Group

- Construction Chemicals Market, by Country

- United States Construction Chemicals Market

- China Construction Chemicals Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Strategic Conclusion Highlighting Core Insights and Forward-Looking Perspectives to Navigate Challenges and Opportunities in Construction Chemicals

Synthesizing the core findings reveals a construction chemicals market at the intersection of performance innovation and regulatory transformation. Sustainability mandates and digitalization imperatives are driving the development of eco-efficient, intelligent formulations, while tariff pressures necessitate agile supply chain architectures. Segmentation analysis underscores the diverse requirements across product categories, technologies, and end-user groups, and regional insights highlight distinctive growth patterns in the Americas, EMEA, and Asia-Pacific.

Strategic adoption of localized manufacturing, circular economy initiatives, and multi-functional product development will distinguish successful market participants. By aligning R&D priorities with customer demands and regulatory trajectories, stakeholders can navigate complexities and harness growth opportunities in both mature and emerging markets. This comprehensive perspective equips decision-makers with the clarity needed to formulate resilient strategies and achieve sustainable competitive advantage in the evolving construction chemicals landscape.

Connect with Ketan Rohom to Access the Full Construction Chemicals Market Report and Propel Strategic Decision-Making with Expert Analysis

For industry professionals seeking a comprehensive understanding of market dynamics and strategic guidance, the complete construction chemicals market research report is available for acquisition. This authoritative analysis offers an in-depth examination of evolving trends, regulatory shifts, and competitive benchmarks that will empower decision-makers to refine product portfolios, optimize supply chains, and innovate with confidence. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to unlock exclusive insights tailored to drive sustainable growth, mitigate tariff impacts, and position your organization at the forefront of technological advancements in the construction chemicals sector. Propel your strategic initiatives forward by engaging with expert assessment and data-driven recommendations designed to elevate your market performance and foster long-term resilience.

- How big is the Construction Chemicals Market?

- What is the Construction Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?