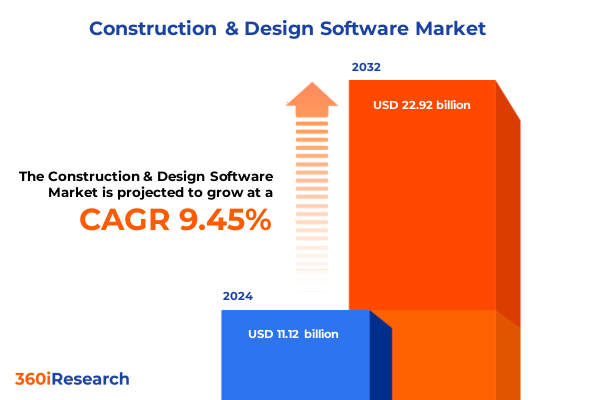

The Construction & Design Software Market size was estimated at USD 12.16 billion in 2025 and expected to reach USD 13.29 billion in 2026, at a CAGR of 9.47% to reach USD 22.92 billion by 2032.

Setting the Stage for Strategic Insights into the Evolving Construction and Design Software Ecosystem and Market Dynamics Shaping the Future

The global construction and design software landscape has evolved from isolated drafting tools to integrated platforms that drive end-to-end project lifecycles. In response to increasing complexity across the built environment, organizations now rely on digital solutions to enhance collaboration, streamline processes, and ensure compliance with stringent regulations. As stakeholders navigate tight timelines and budget constraints, software capabilities have expanded to encompass data-driven insights, predictive analytics, and cloud-enabled workflows.

Against this backdrop, today’s executive summary offers a concise yet comprehensive overview of the key forces shaping the industry. From technological breakthroughs such as AI-driven modeling to shifting regulatory frameworks and rising expectations for sustainability, the market demands solutions that can adapt in real time. The subsequent sections will guide decision-makers through transformative trends, segmentation insights, and actionable recommendations, equipping them to make informed investments. Ultimately, this introduction frames the strategic context for understanding how construction and design software is redefining project delivery and driving operational excellence in an increasingly digital era.

Examining the Pivotal Technological, Regulatory, and Market Disruptions Redefining Construction and Design Software for Accelerated Innovation

Over the past decade, the construction and design software arena has witnessed a series of transformative shifts that extend beyond mere digitization of blueprints. Building information modeling has matured into collaborative platforms that connect architects, engineers, and contractors in a unified data environment, fostering transparency and reducing rework. Concurrently, the integration of IoT sensors into job sites has enabled real-time monitoring of assets, enhancing safety protocols and maintenance schedules.

Moreover, regulatory bodies are tightening requirements around environmental impact and worker safety, compelling software providers to embed compliance checks and reporting functionalities directly into their offerings. In parallel, the rise of remote work, accelerated by global health concerns, has propelled cloud-based solutions to the forefront, ensuring uninterrupted collaboration across geographically dispersed teams. Furthermore, advancements in generative design, underpinned by artificial intelligence, are empowering stakeholders to explore multiple cost-efficient configurations in a fraction of traditional planning time.

These converging forces have not only redefined user expectations but have also opened new pathways for software vendors to differentiate through specialized modules and value-added services. As adoption grows, the competitive landscape has become more dynamic, with established players and emerging disruptors vying to deliver the next wave of innovation that will shape the built environment.

Analyzing the Comprehensive Effects of 2025 United States Tariff Policies on Construction and Design Software Supply Chains

In 2025, the United States implemented a series of tariffs targeting key hardware imports and specialized software components, creating ripple effects throughout the construction and design technology ecosystem. The increased costs of high-performance computing equipment and core licenses have pressured vendors to reassess supply chains, with many seeking to shift production to regions outside the tariff jurisdiction. Consequently, software providers are navigating elevated input costs while striving to maintain competitive pricing models for end users.

Additionally, the tariffs have prompted a reevaluation of localized development hubs, as some companies invest in domestic research and development facilities to mitigate long-term exposure to international trade uncertainties. This shift has catalyzed strategic alliances with regional hardware manufacturers and spurred negotiations for software porting to alternative platforms or open-source frameworks. At the same time, service providers have begun to offer flexible subscription tiers that reflect fluctuating cost structures, ensuring that contractors and design firms can manage their budgets more effectively.

Overall, the cumulative impact of these trade measures has accelerated the industry’s pivot toward supply chain resilience, strategic diversification of component sourcing, and expanded investment in domestic innovation. These adjustments not only safeguard continuity but also lay the groundwork for sustained competitiveness amid evolving geopolitical dynamics.

Uncovering Strategic Perspectives Through Multi-Dimensional Segmentation of Construction and Design Software Markets Across Diverse Criteria

Diving into the market through the prism of software specialization reveals that integrated construction management platforms continue to command attention, while cost accounting and modeling solutions are gaining momentum as firms seek greater financial transparency. Project design tools, once confined to initial schematic phases, have evolved to incorporate scheduling and rendering capabilities, blurring the lines between conceptualization and execution. From the standpoint of subscription frameworks, annual subscription models remain the backbone of most enterprise agreements, though monthly subscriptions and freemium offerings are capturing interest among small to midsize firms seeking lower entry barriers. Meanwhile, the availability of one-time purchase licenses persists for specialized applications and for organizations that prioritize capital expenditure over recurring costs.

When considering application domains, architectural practices leverage advanced parametric design, whereas building construction teams focus on safety and reporting modules to meet OSHA requirements. Interior design professionals increasingly turn to high-fidelity rendering engines to engage clients with photorealistic walkthroughs, and urban planners integrate geospatial data into modeling platforms to simulate infrastructure scenarios at city scale. From the vantage of user personnel, architects prioritize interoperability and BIM compliance, while contractors emphasize project management and scheduling synchronization. Designers seek intuitive interfaces that facilitate rapid iteration, and engineers demand robust analytics for structural validation. Lastly, deployment preferences reveal a strong migration toward cloud-based environments that enable remote collaboration, although on-premise solutions maintain traction among organizations with stringent data governance mandates.

This comprehensive research report categorizes the Construction & Design Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Software Type

- Subscription Model

- Application

- End User

- Deployment Mode

Deriving Actionable Insights from Regional Variations in Adoption and Growth Dynamics of Construction and Design Software Worldwide

Examining regional dynamics, the Americas region demonstrates robust adoption of end-to-end platforms that integrate cost accounting and project scheduling, driven by large-scale infrastructure investments in North America and Latin America’s urban expansion. In contrast, the Europe, Middle East & Africa corridor faces varied regulatory landscapes, which incentivize flexible deployment modes; cloud-based solutions are flourishing in Western Europe, while on-premise installations remain prevalent in markets where data sovereignty is critical. Furthermore, sustainability mandates in the European Union have sparked demand for modeling tools that assess life-cycle carbon impacts, positioning vendors with strong environmental analytics at an advantage.

Meanwhile, the Asia-Pacific domain is characterized by rapid digital transformation initiatives in major economies. Cloud-native ecosystems are becoming the standard in Australia, while emerging markets in Southeast Asia and India are adopting mobile-enabled project management applications to streamline on-site coordination. Additionally, joint ventures between global software providers and regional technology firms have accelerated the localization of user interfaces and compliance modules, bridging language barriers and regulatory requirements. Across all regions, interoperability standards and open APIs are increasingly seen as essential differentiators that enable cross-border project collaboration and data exchange.

This comprehensive research report examines key regions that drive the evolution of the Construction & Design Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Partnerships Driving Competitive Advantage in the Construction and Design Software Industry

In the competitive landscape, leading software houses distinguish themselves through continuous product innovation and ecosystem partnerships. One prominent vendor has expanded its solution suite by acquiring complementary analytics platforms, embedding predictive maintenance features directly into existing project design workflows. Another established player has forged alliances with hardware manufacturers to optimize software performance on proprietary devices, offering clients seamless integration from on-site sensors to centralized dashboards.

A rising specialist firm has gained traction by focusing exclusively on safety and reporting compliance, delivering mobile-first applications that streamline incident tracking and regulatory submissions. Meanwhile, full-spectrum providers are investing heavily in generative design algorithms, enabling users to explore a multitude of structural configurations in minutes and reducing engineering hours significantly. Across the board, companies are enhancing their value propositions through robust developer programs that empower third-party extensions, fostering vibrant marketplaces for specialized modules.

These strategic moves underscore an industry-wide commitment to creating interoperable, scalable platforms that address the complete project lifecycle. Vendors that successfully balance depth of functionality with open architecture principles are securing enhanced customer loyalty and carving out enduring competitive advantages.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction & Design Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Autodesk, Inc.

- Bentley Systems, Incorporated

- Buildr, LLC

- Cedreo

- Computer Methods International Corp.

- Constellation Software Inc.

- Contractor Foreman

- Corfix Inc.

- Dalux ApS

- Dassault Systèmes SE

- DATACAD LLC

- Deltek, Inc.

- eSUB, Inc.

- Fonn AS

- Gary Jonas Computing Ltd.

- Glaass Pty Ltd.

- Google LLC by Alphabet Inc.

- Hammer Technologies USA LLC

- Hexagon AB

- Hilti Corporation

- Houzz Inc.

- IMAGINiT Technologies by Rand Worldwide, Inc.

- JobNimbus, Inc.

- JobTread Software, LLC

- Knowify Inc.

- Leap, LLC

- LetsBuild Group

- Microsoft Corporation

- monday.com Ltd.

- Nemetschek SE

- Oracle Corporation

- Procore Technologies, Inc.

- Projul Inc.

- Raken, Inc.

- RedTeam Software, LLC

- Sage Group plc

- SAP SE

- Schneider Electric SE

- Siemens AG

- Sika AG

- Simpro

- Sitemate

- SiteMax Systems Inc.

- SOFiSTiK AG

- Topcon Positioning Systems, Inc.

- Touchplan by MOCA Systems Inc.

- Trimble Inc.

- VIATechnik LLC

- Wrench solutions (P) Ltd

Empowering Decision Makers with Tactical Recommendations to Navigate Disruption and Capitalize on Opportunities in Construction and Design Software

Industry leaders should prioritize the adoption of cloud-first architectures to maintain continuity across distributed teams and support real-time data exchange. Deploying modular subscription tiers that align with project scales and client budgets will enable software providers to capture new market segments without compromising enterprise revenue. Additionally, embedding AI-driven predictive analytics into core offerings can elevate value propositions by forecasting maintenance needs, optimizing resource allocation, and preempting potential project delays.

In parallel, forming strategic alliances with hardware manufacturers and IoT providers will enhance end-to-end solution bundles, ensuring seamless integration and data integrity. Investing in comprehensive training and certification programs for end users will foster deeper engagement and elevate platform proficiency, driving long-term retention. To fortify resilience against external shocks, organizations should diversify their component sourcing, explore localized development centers, and negotiate flexible licensing terms that reflect geopolitical uncertainties.

Finally, aligning product roadmaps with emerging regulatory standards-particularly around environmental impact and data security-will underscore a vendor’s commitment to compliance and sustainability. By executing this multi-pronged strategy, industry participants can navigate volatility effectively and unlock new avenues for growth.

Elucidating the Rigorous Research Approach and Data Collection Techniques Underpinning the Construction and Design Software Market Analysis

This analysis synthesized a comprehensive mix of primary and secondary research methodologies to ensure robust, data-driven conclusions. Primary research involved in-depth interviews with C-suite executives, project managers, and technical leads across architects, contractors, and engineering firms, supplemented by structured surveys that captured quantitative assessments of adoption patterns and feature priorities. Secondary sources included peer-reviewed journals, government publications, and industry white papers, which provided contextual benchmarks and validation points.

Data triangulation techniques were applied to reconcile insights from vendor disclosures, end-user feedback, and third-party integration case studies. The research team employed rigorous criteria for vendor selection, evaluating factors such as functionality breadth, integration capabilities, and customer satisfaction ratings. Geographic considerations were addressed through localized expert consultations, ensuring that regional regulatory and cultural nuances were accurately represented. To maintain objectivity, potential conflicts of interest were mitigated by anonymizing proprietary data and cross-verifying findings with independent advisors.

Throughout the process, iterative quality checks and peer reviews were conducted to enhance accuracy and reliability. While this methodology prioritizes depth and relevance, readers should consider that rapid technological evolution may introduce new developments beyond the report’s publication window. Nevertheless, the structured approach provides a solid foundation for strategic decision-making within the construction and design software domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction & Design Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction & Design Software Market, by Software Type

- Construction & Design Software Market, by Subscription Model

- Construction & Design Software Market, by Application

- Construction & Design Software Market, by End User

- Construction & Design Software Market, by Deployment Mode

- Construction & Design Software Market, by Region

- Construction & Design Software Market, by Group

- Construction & Design Software Market, by Country

- United States Construction & Design Software Market

- China Construction & Design Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings and Strategic Implications to Illuminate the Future Trajectory of Construction and Design Software Innovation

The confluence of advanced modeling capabilities, cloud-enabled collaboration, and regulatory compliance features signals a new era for construction and design software solutions. Stakeholders who embrace AI-driven workflows and resilient supply chain strategies will differentiate themselves in an increasingly competitive landscape. Segmentation analysis reveals that success hinges on serving specialized user needs-from architects demanding parametric flexibility to contractors prioritizing real-time scheduling synchronization-while offering flexible licensing and deployment options that accommodate diverse organizational mandates.

Moreover, regional insights underscore the importance of tailoring solutions to local regulatory frameworks and infrastructure priorities, whether it’s carbon footprint modeling in the European Union or mobile coordination tools across Asia-Pacific job sites. Leading vendors set the benchmark through strategic partnerships and open architectures that streamline integration with third-party modules and hardware ecosystems. As industry participants continue to navigate tariff-induced cost pressures and geopolitical volatility, those who align product innovation with emerging sustainability and security mandates will secure a competitive edge.

In summary, the construction and design software sector stands at a pivotal juncture. The decisions made today regarding technology adoption, partnership frameworks, and market segmentation will shape the built environment of tomorrow, driving efficiency, safety, and sustainability from project inception to completion.

Engage with Ketan Rohom to Secure an In-Depth Construction and Design Software Market Research Report that Fuels Strategic Decision Making

To explore the comprehensive insights and strategic intelligence detailed in this report, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who will guide you through the tailored solutions designed to empower your organization’s objectives. By engaging directly with him, you will gain immediate access to sample methodologies, thematic deep dives, and customized data packages that align with your unique business challenges. Ketan’s consultative approach ensures that you not only understand the implications of the research but also translate them into actionable strategies. Secure your copy of the construction and design software market report today, and position your organization to harness innovation, mitigate emerging risks, and capture new opportunities in a rapidly evolving landscape.

- How big is the Construction & Design Software Market?

- What is the Construction & Design Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?