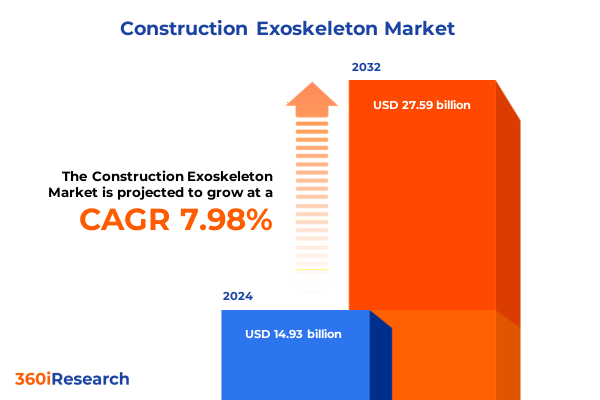

The Construction Exoskeleton Market size was estimated at USD 16.10 billion in 2025 and expected to reach USD 17.37 billion in 2026, at a CAGR of 7.99% to reach USD 27.59 billion by 2032.

Exploring the Foundations and Emerging Significance of Construction Exoskeletons in Revolutionizing Workforce Safety and Operational Efficiency

In construction, where manual labor and repetitive tasks are daily constants, the advent of exoskeleton technology is reshaping traditional notions of workforce capability. By providing wearable support systems that enhance human strength and reduce musculoskeletal strain, these mechanical frameworks are becoming indispensable tools on modern job sites. The intersection of ergonomic engineering and advanced robotics has given rise to solutions that harmonize human intent with mechanical assistance, yielding safer and more productive environments.

Recent developments in sensor integration and actuator responsiveness have accelerated the adoption of exoskeletons in heavy construction environments. Innovations in battery life and material science have made devices lighter and more enduring, facilitating extended use in demanding conditions. Furthermore, the shift toward modularity allows organizations to tailor supportive functions-whether for overhead installation or repetitive lifting-to specific task requirements, promoting a more adaptive workforce.

As stakeholders seek to modernize labor strategies, these systems not only mitigate injury risk but also demonstrate return on investment through enhanced throughput and reduced downtime. Consequently, construction exoskeletons are transitioning from niche applications to mainstream adoption, setting a new baseline for occupational health and productivity.

Highlighting the Convergence of Digitalization Workforce Demographics and Ecological Sustainability in Redefining Exoskeleton Adoption Dynamics

The construction sector is undergoing transformative shifts driven by digitalization, workforce dynamics, and sustainability imperatives, all of which are converging to redefine the role of exoskeletons. The integration of Internet of Things (IoT) connectivity enables real-time monitoring of biomechanical metrics, facilitating predictive maintenance of devices and proactive injury prevention for operators. Concurrently, artificial intelligence enhancements are allowing exoskeletons to learn and adapt to individual movement patterns, optimizing support for each user.

Demographic pressures, including an aging workforce coupled with labor shortages, have heightened the imperative for solutions that extend career longevity and attract new talent. Exoskeletons are answering this call by reducing physical barriers to entry, allowing less experienced workers to perform tasks safely while easing the burden on seasoned professionals. Simultaneously, an intensified focus on corporate responsibility has driven investment in ergonomically designed equipment, elevating safety standards and fostering a culture of wellness on worksites.

Environmental sustainability goals are also influencing material selection and power systems, spurring development of lighter composites and energy-efficient actuation methods. As a result, construction exoskeletons are evolving into sophisticated platforms that not only support human labor but also align with broader objectives of digital transformation and environmental stewardship.

Examining the Complex Consequences of 2025 United States Tariff Measures on Construction Exoskeleton Supply Chains and Innovation Paths

In 2025, the United States introduced a series of targeted tariffs affecting components critical to exoskeleton manufacturing, including high-strength alloys, precision actuators, and specialized sensor arrays. These measures have altered procurement strategies, prompting manufacturers to reassess supply chain resilience and seek alternative sourcing for imported materials. Consequently, some component costs have experienced upward pressure, which has influenced the pricing strategies of finished devices.

Domestic producers have responded by forging strategic partnerships with local suppliers, catalyzing growth in the North American supplier ecosystem. While this localization trend contributes to enhanced security of supply, it also demands investment in tooling and quality control measures to meet rigorous performance standards. Companies that had previously relied heavily on cost-competitive imports have adjusted their production timelines to accommodate new lead times, reinforcing the necessity for agile planning and inventory management.

Despite these challenges, the tariffs have stimulated innovation, as R&D teams explore composite alternatives and refined manufacturing processes to reduce dependency on tariff-impacted inputs. This shift underscores a broader industry commitment to supply chain diversification, ensuring that the evolution of exoskeleton technology remains uninterrupted by geopolitical fluctuations.

Uncovering the Full Spectrum of Market Segments Across Product Types Body Focus Applications Power Sources and Distribution Channels

A nuanced understanding of product and application segmentation is essential for identifying growth vectors within the construction exoskeleton market. Based on Product Type, the landscape is divided between Active Exoskeletons, which incorporate powered actuators, and Passive Exoskeletons, which rely on elastic elements. Within Active Exoskeletons, further distinctions exist between Full Body systems designed for all-encompassing support, Lower Body assemblies that target lifting and locomotion, and Upper Body frameworks that assist with overhead motions. These subdivisions are differentiated yet parallel, with each configuration engineered to address heavy lifting, material handling, overhead work, and repetitive motions. Passive Exoskeletons follow a similar structural taxonomy, offering full-body reinforcement or segmental support for lower and upper extremities, all optimized for ergonomic load distribution and fatigue reduction.

Based on Body Focus, the market is similarly dissected into Full Body, Lower Body, and Upper Body categories, each emphasizing core use cases such as heavy lifting, material handling, and overhead tasks. This classification ensures that end users can select devices calibrated to the precise biomechanical demands of their role, whether it involves extended static postures or dynamic load management. In the realm of Application, offerings are honed for task-specific challenges-heavy lifting solutions that maximize torque assistance, material handling systems available in electric-powered, hydraulic-powered, and spring-powered variants, overhead work exoskeletons crafted for extended reach, and repetitive motion supports that mitigate cumulative strain.

Power Source segmentation delineates Electric Powered units known for precision control, Hydraulic Powered devices valued for high-force output, and Spring Powered alternatives favored for their simplicity and maintenance ease. Notably, Spring Powered exoskeletons can be integrated into both active and passive formats, underscoring the versatility of mechanical assistance. Distribution Channel insights emphasize a multi-channel approach, with Direct Sales strategies fostering customized solution deployments for large enterprises, Distributor Sales ensuring broad geographic penetration, and Online Sales platforms facilitating rapid access for small to mid-sized operators. Direct Sales channels often include consultative services and training modules, particularly for both active and passive offerings, ensuring seamless technology adoption.

This comprehensive research report categorizes the Construction Exoskeleton market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Body Focus

- Power Source

- Application

- Distribution Channel

Analyzing Regional Drivers and Adoption Patterns Shaping Construction Exoskeleton Uptake in Major Global Markets

Regional dynamics play a pivotal role in shaping the trajectory of construction exoskeleton adoption, with distinct drivers emerging across the world’s major geographies. In the Americas, robust infrastructure programs and a focus on safety regulations have accelerated pilot deployments, particularly in regions with labor shortages and high regulatory scrutiny. North American construction firms are increasingly mandating ergonomic support systems to comply with evolving occupational health guidelines, driving demand for advanced exoskeleton solutions.

Across Europe, Middle East & Africa, stringent workplace safety directives and an emphasis on workforce sustainability are spurring widespread trials of assistive devices. European Union initiatives aimed at reducing workplace injuries have incentivized exoskeleton uptake, while Middle Eastern nations are leveraging these systems as part of broader smart city and advanced infrastructure projects. Africa’s nascent construction technology landscape is witnessing early-stage adoption, supported by partnership models that facilitate knowledge transfer and local assembly.

Within Asia-Pacific, rapid urbanization and large-scale infrastructure investments underpin a strong appetite for labor-augmenting technologies. Countries with aging demographics are placing particular emphasis on extending workforce participation, using exoskeletons to reduce physical strain and support long-term health. The Asia-Pacific market also benefits from a mature electronics manufacturing base, enabling local production of key components and fostering competitive device pricing. Across these regions, tailored market entry strategies and regulatory alignment continue to shape the pace and scale of exoskeleton deployment.

This comprehensive research report examines key regions that drive the evolution of the Construction Exoskeleton market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Competitive Landscape of Established Robotics Leaders and Agile Startups Powering Exoskeleton Innovation

The competitive landscape in construction exoskeletons is defined by a blend of established robotics pioneers and emerging specialized innovators. Leading names have leveraged deep expertise in wearable robotics to deliver solutions that seamlessly integrate with existing personal protective equipment and data analytics platforms. Their portfolios encompass full-scale systems for heavy duty construction tasks as well as task-specific modules optimized for distinct jobsite scenarios.

At the forefront, a cadre of companies has distinguished itself through continuous investment in R&D, strategic partnerships with industrial end users, and active engagement in standards development. These organizations have built ecosystems that encompass device maintenance services, performance monitoring software, and operator training programs. Meanwhile, agile startups are challenging incumbents by introducing lightweight materials, intuitive control interfaces, and competitive pricing models that cater to small and mid-tier contractors.

This competitive tension has catalyzed a faster innovation cycle, with companies frequently iterating on actuator efficiency, sensor fusion accuracy, and ergonomic customization. As a result, procurement teams must navigate a landscape where product differentiation is increasingly defined by modularity, integration capabilities, and after-sales support infrastructure rather than core mechanical performance alone.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Exoskeleton market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bioservo Technologies AB

- Chad Fisher Construction, LLC.

- Compariqo Limited

- Ekso Bionics Holdings, Inc.

- Exxovantage

- Fraco Products Ltd.

- GERMAN BIONIC SYSTEMS GMBH

- Hilti Inc.

- Hyundai Motor Company

- Levitate Technologies, Inc.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries Group

- noonee germany GmbH

- Ottobock SE & Co. KGaA by Näder Holding GmbH & Co. KG

- RB3D

- RLS d.o.o.

- Robo-Mate

- Sarcos Technology and Robotics Corporation

- Sarcos Technology and Robotics Corporation

- SUITX INDUSTRIAL EXOSKELETONS

Delivering Strategic Collaborations Training Frameworks and Flexible Procurement Models to Accelerate Market Penetration

In order to capitalize on the momentum building around construction exoskeletons, industry leaders must adopt a multifaceted approach. First, forging cross-sector collaborations with material science experts, ergonomists, and software developers will accelerate the creation of differentiated solutions that address evolving jobsite demands. Embedding data analytics capabilities within exoskeleton ecosystems can unlock new insights into user health and operational efficiency, paving the way for predictive maintenance and usage-based service models.

Equally important is the establishment of comprehensive training and certification programs in partnership with labor unions and vocational institutions. These programs should focus not only on device operation but also on maintenance protocols and data interpretation techniques, ensuring that end users derive maximum value. Proactive engagement with regulatory bodies to shape safety standards and compliance frameworks will further bolster market confidence and expedite adoption.

Finally, developing flexible procurement models-such as leasing options or performance-based contracts-can lower entry barriers for smaller contractors, driving volume growth and brand recognition. By aligning pricing structures with project outcomes, vendors can demonstrate clear value propositions and foster long-term customer relationships.

Detailing a Comprehensive Mixed-Methods Research Framework Integrating Stakeholder Interviews and Secondary Analysis to Ensure Rigor

The insights presented in this report are grounded in a robust research framework combining primary and secondary methodologies. Primary research involved in-depth interviews with construction safety managers, exoskeleton end users, and procurement specialists across North America, Europe, and Asia-Pacific. These conversations provided qualitative perspectives on deployment challenges, user experience metrics, and maintenance requirements, forming a foundation for actionable recommendations.

Secondary research encompassed a thorough review of industry white papers, regulatory filings, and patent databases to track technological breakthroughs and competitive activity. Market intelligence tools were employed to map supply chain relationships and identify emerging component suppliers. The research team also engaged with professional associations and standards committees to validate safety and interoperability benchmarks.

Data from these sources were triangulated through a rigorous validation process, ensuring consistency and reliability. Quantitative findings were cross-checked against industry reports and proprietary datasets, while thematic analysis of interview transcripts surfaced recurring patterns and pain points. This mixed-methods approach ensures that the conclusions and strategic guidance are both empirically grounded and reflective of real-world dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Exoskeleton market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Exoskeleton Market, by Product Type

- Construction Exoskeleton Market, by Body Focus

- Construction Exoskeleton Market, by Power Source

- Construction Exoskeleton Market, by Application

- Construction Exoskeleton Market, by Distribution Channel

- Construction Exoskeleton Market, by Region

- Construction Exoskeleton Market, by Group

- Construction Exoskeleton Market, by Country

- United States Construction Exoskeleton Market

- China Construction Exoskeleton Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Synthesizing Key Learnings on Technological Evolution Regional Dynamics and Strategic Imperatives for Future Growth

Construction exoskeletons stand at the intersection of human capability and mechanical augmentation, offering a path toward safer, more efficient worksites. The convergence of technological advancements, supply chain adaptation in response to tariffs, and evolving workforce dynamics has created a fertile environment for sustained innovation. Stakeholders who embrace collaborative development, user-centric design, and flexible deployment models will be best positioned to shape the next wave of adoption.

As regional adoption patterns diverge, companies must remain agile-adapting to regulatory landscapes in the Americas, navigating the safety-driven ethos of Europe, and capitalizing on infrastructure growth in Asia-Pacific. The competitive arena will increasingly reward entities capable of delivering end-to-end ecosystems that blend hardware, software, and services. In this context, a proactive stance on standardization and operator training will serve as critical differentiators.

Looking forward, construction exoskeletons are poised to move beyond pilot programs into mainstream acceptance, transforming not only how physical tasks are performed but also how labor strategies and project economics are articulated. The insights in this report underscore the imperative for strategic foresight and evidence-based decision-making as the industry traverses this transformative frontier.

Unlock the Competitive Advantage by Connecting with a Dedicated Associate Director to Acquire Cutting-Edge Insights on Construction Exoskeleton Market

Embarking on the next phase of competitive excellence requires timely insights and tailored guidance. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure a comprehensive market research report that illuminates the nuanced opportunities and challenges within the construction exoskeleton landscape. Ketan’s expertise enables a seamless experience from inquiry to delivery, ensuring the intelligence you receive is aligned with your strategic priorities and operational needs. Don’t navigate this transformative market alone-partner with a specialist who can translate complex data into actionable intelligence and propel your organization ahead of the curve.

Reach out today to initiate a conversation that will unlock the full potential of this emerging technology and position your business at the forefront of innovation.

- How big is the Construction Exoskeleton Market?

- What is the Construction Exoskeleton Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?