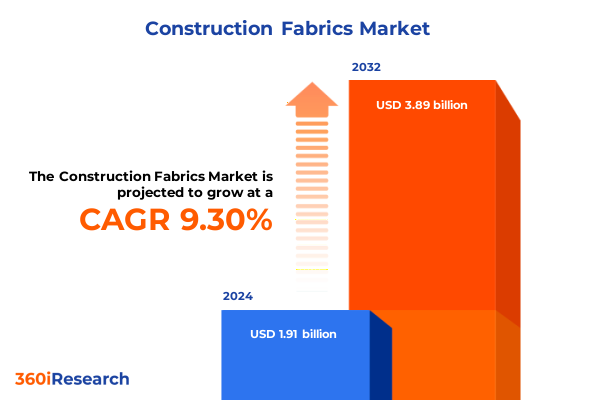

The Construction Fabrics Market size was estimated at USD 2.08 billion in 2025 and expected to reach USD 2.27 billion in 2026, at a CAGR of 9.32% to reach USD 3.89 billion by 2032.

Unveiling the Foundation of Modern Construction Fabrics: Pioneering Performance Innovations for Infrastructure Excellence

The global construction fabrics market has emerged as a critical enabler of modern infrastructure development, where performance, durability, and environmental stewardship intersect. Technological breakthroughs in fiber engineering and advanced manufacturing processes have propelled construction fabrics from simple membrane barriers into multifunctional components that safeguard assets and enhance structural longevity. As urbanization intensifies and regulatory frameworks shift towards sustainability, the demand for high-performance textiles is reshaping industry priorities, demanding robust solutions that balance cost, functionality, and ecological impact.

Against this backdrop, stakeholders across the value chain-from raw material suppliers to end-use contractors-are recalibrating their strategies to harness the transformative potential of innovative fabric solutions. The introduction of high-strength woven geotextiles has revolutionized soil stabilization, while non-woven membranes featuring novel polymer blends are elevating moisture management and insulation standards. Simultaneously, growing appetite for recyclable and bio-based fibers is driving cross-sector collaboration, forging alliances between chemical manufacturers, textile engineers, and construction firms in pursuit of next-generation materials.

Looking ahead, the construction fabrics landscape is poised for accelerated evolution as digitalization, automation, and circular economy principles gain momentum. Organizations that blend research-driven product development with agile supply chain models will lead the way, capturing value in an arena defined by rapid regulatory changes and escalating performance benchmarks. This introduction sets the stage for a comprehensive exploration of the market’s transformative shifts, tariff dynamics, and strategic imperatives that will shape competitive advantage in the years to come.

Exploring the Technological and Regulatory Catalysts Driving a New Era of Construction Fabric Innovation

In recent years, the construction fabrics sector has undergone seismic shifts driven by a confluence of technological breakthroughs and evolving regulatory mandates. Lightweight nanofiber coatings designed for enhanced water repellency and UV resistance have emerged from advanced polymer research, enabling protective membranes that extend asset lifespans while reducing maintenance cycles. Concurrently, the integration of digital weaving machines has enabled precise control of fabric architecture, shortening production lead times and fostering use-case-specific customization. These developments underscore a new era where performance optimization and production agility are no longer mutually exclusive.

Moreover, sustainability has become a paramount strategic driver, reshaping raw material selection and end-of-life considerations. Bio-based polymers such as polylactic acid (PLA) and recycled filament blends are progressively entering mainstream production, supported by tightening green building certifications and carbon reporting requirements. This regulatory landscape, complemented by incentive programs promoting circular supply chains, is incentivizing companies to design fabrics with cradle-to-cradle perspectives. As a result, lifecycle assessments and environmental product declarations are becoming standard due diligence tools for fabric manufacturers and procurement teams alike.

Furthermore, global supply networks are being reconfigured to mitigate geopolitical risks and ensure compliance with shifting trade policies. Strategic partnerships are forming between regional converters and technology providers to localize production, reduce transportation carbon footprints, and enhance responsiveness to market fluctuations. The cumulative effect of these transformative shifts is a construction fabrics ecosystem that is more resilient, adaptable, and aligned with the imperatives of sustainable infrastructure development.

Assessing the Far-Reaching Consequences of Recent Trade Measures on Construction Fabric Supply Chains and Operational Strategy

In 2025, a series of tariff adjustments implemented by the United States government have signaled a significant reordering of global trade relationships within the construction fabrics sphere. By imposing increased duties on select non-woven membranes and specialty coatings sourced from certain import origins, domestic producers found themselves presented with both challenges and opportunities. On one hand, the immediate effect was an uptick in raw material costs for converters reliant on imported polyester and polypropylene yarns; on the other, it catalyzed renewed investment in local manufacturing capabilities and supply chain resilience.

As companies grappled with higher landed costs, many accelerated the qualification of alternative suppliers in friendly trade zones and re-evaluated their inventory strategies to buffer against further policy shifts. This proactive stance fostered closer collaboration among fiber producers, fabric converters, and equipment manufacturers, resulting in coordinated R&D efforts aimed at domesticizing key production steps. Simultaneously, the pressures induced by new tariffs nudged builders and infrastructure developers to reassess specification requirements, occasionally substituting imported membrane layers with domestically sourced woven solutions that offered comparable performance at reduced total cost of ownership.

The broader implication of these trade measures transcends mere cost adjustments. By prompting systemic shifts toward nearshoring and strategic stockpiling, the tariff regime has reinforced the construction fabrics market’s pivot toward supply chain transparency and responsiveness. Looking ahead, organizations that blend tariff-aware procurement strategies with agile manufacturing capabilities will be best positioned to navigate future trade policy oscillations and capitalize on emerging domestic industry incentives.

Dissecting Core Market Segments by Material Composition, Fabric Architecture, and Distribution Dynamics to Reveal Hidden Advantages

The construction fabrics market’s complexity is reflected in its multi-tiered segmentation, each dimension revealing unique value pools and innovation pathways. Through the lens of product type, woven textiles deliver high tensile strength for geotechnical applications while knit variants, distinguished by warp and weft architectures, provide tailored elasticity and tear resistance for protective coverings. Non-woven offerings, spanning meltblown, needle punch, spunbond, and spunlace processes, excel in filtration, moisture management, and insulation roles, underscoring the sector’s capacity for function-specific engineering.

Material selection further diversifies performance outcomes, with polyester fibers prized for UV stability and tensile resilience, polyethylene favored for chemical inertness and cost efficiency, and polypropylene lauded for its balance of mechanical strength and thermal resistance. These material choices interweave with application demands-flooring underlays must prioritize impact absorption and noise reduction, while geotextiles necessitate soil reinforcement and erosion control properties. Insulation fabrics emphasize thermal conductivity modulation, protective textiles target abrasion and flame resistance, and roofing membranes require impermeability and weather durability.

End-use segmentation delineates commercial, industrial, infrastructure, and residential sectors, each driving unique specifications across product form and coating strategies. Roll forms predominate in large-scale geotechnical deployments, whereas sheet formats cater to precision architectural installations. Coated textiles, utilizing bitumen, polyurethane, or PVC layers, impart enhanced barrier functions, while uncoated substrates offer natural breathability and cost advantages. Finally, distribution channels ranging from direct partnerships to online platforms and wholesale networks influence lead times, customization levels, and aftermarket service models, creating a mosaic of engagement strategies that companies must navigate to capture market opportunities.

This comprehensive research report categorizes the Construction Fabrics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Product Form

- Coating

- Application

- End Use

- Distribution Channel

Mapping Regional Demand Variations and Growth Drivers Across Americas, EMEA, and Asia-Pacific in Construction Fabric Applications

Regional dynamics in the construction fabrics arena reveal distinct demand trajectories shaped by infrastructure imperatives and policy landscapes. In the Americas, accelerated investment in transportation corridors and urban renewal projects has spotlighted geotextiles for soil stabilization alongside high-performance roofing membranes designed to withstand severe weather conditions. Furthermore, North American sustainability benchmarks are fostering uptake of recycled and bio-based fabric solutions in commercial building envelopes, while Latin American infrastructure modernization initiatives are sparking growth in durable non-woven membranes for flood control and erosion mitigation.

Across Europe, Middle East & Africa, regulatory emphasis on carbon neutrality and green construction has driven adoption of energy-efficient insulation fabrics and coated textiles that meet stringent environmental product declaration criteria. European Union directives on circular economies are catalyzing closed-loop recycling systems, prompting manufacturers to develop materials compatible with end-of-life recovery processes. Simultaneously, rapid infrastructure expansions in the Gulf Cooperation Council states have triggered demand for robust woven and non-woven membranes in road and airport projects, where high mechanical strength and weather resistance are non-negotiable.

In Asia-Pacific, urbanization megatrends and industrial diversification are generating robust growth in both non-woven filtration fabrics and engineered woven solutions for infrastructure reinforcement. China’s emphasis on domestic innovation has led to proliferation of locally developed high-strength fibers, while Southeast Asian renewable energy installations are leveraging advanced membrane technologies for solar panel protection and wind turbine blade encapsulation. Across the region, evolving distribution ecosystems-spanning traditional wholesale networks to emerging e-commerce platforms-are reshaping market accessibility and competitive positioning for both global and regional suppliers.

This comprehensive research report examines key regions that drive the evolution of the Construction Fabrics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Pathways to Competitive Leadership in the Construction Fabric Market

A handful of leading companies have established commanding positions in the construction fabrics field by coupling technological prowess with strategic market engagement. Industry pioneers are leveraging proprietary polymer formulations and specialized coating processes to differentiate their geotextile, roofing membrane, and protective fabric portfolios. By forging alliances with construction conglomerates and engaging in targeted acquisitions, these firms are expanding their geographic footprints and accelerating time-to-market for innovative products that address precise project requirements.

Some market veterans have adopted platform-based approaches, integrating digital tracking and performance monitoring functionalities into their fabric solutions. These “smart” textiles, embedded with sensors and RFID tags, enable real-time data exchange on installation quality and long-term asset health, offering contractors and infrastructure owners a compelling value proposition. Meanwhile, other players are intensifying focus on sustainability credentials by investing in bio-based polymer research, scaling up recycled input utilization, and securing third-party eco-label certifications to meet escalating environmental procurement standards.

Competitive differentiation also hinges on distribution excellence. Companies that maintain robust direct sales channels while cultivating online offerings for niche applications can balance customized service levels with broader market reach. Wholesale partnerships remain vital for penetrating price-sensitive segments, particularly in emerging markets, whereas direct engagement models facilitate end-to-end collaboration on bespoke fabrication and installation protocols. Collectively, these strategic maneuvers underscore the multifaceted approaches successful firms employ to drive growth in an ever-evolving market landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Fabrics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashland Inc.

- Berry Global, Inc.

- Colbond BV

- DuPont de Nemours, Inc.

- DW USA CORP.

- ENDUTEX COATED TECHNICAL TEXTILES

- EREZ Thermoplastic Products

- Fibertex Nonwovens A/S

- Formosa Plastics Corporation

- Freudenberg SE

- GSE Environmental, Inc.

- HIRAOKA & Co.,Ltd

- HUESKER Synthetic GmbH

- Koninklijke Ten Cate BV

- NAUE GmbH & Co. KG

- Novum Membranes GmbH

- Propex Operating Company, LLC

- Saint-Gobain S.A.

- Sattler PRO-TEX GmbH

- Seaman Corporation

- Seele Group

- Sefar AG

- SERGE FERRARI

- Sioen Industries NV

- Solmax International ULC

- TAIYO KOGYO CORPORATION

- Tenax S.p.A.

- Verseidag-Indutex GmbH

Strategic Imperatives for Embracing Sustainability, Digitalization, and Supply Network Resilience to Outpace Competition

To thrive amidst intensifying competition and regulatory complexity, industry leaders should prioritize investment in sustainable material science and end-of-life circularity. Establishing partnerships with polymer innovators and recycling specialists can fast-track development of renewable fiber blends and closed-loop recovery systems, positioning companies at the forefront of green building supply chains. Concurrently, integrating digital transformation-encompassing smart fabric functionalities and advanced production analytics-will enhance product performance validation and predictive maintenance capabilities, unlocking new value streams for both manufacturers and end users.

Diversification of supply networks is equally critical. Organizations must diversify sourcing by qualifying alternative raw material suppliers in low-risk trade jurisdictions while simultaneously building strategic inventory buffers for key inputs. This dual approach mitigates exposure to policy-driven cost volatility and logistical disruptions, ensuring consistent output and customer satisfaction. Additionally, expanding digital distribution platforms will facilitate direct customer engagement, streamline order processing, and nurture data-driven demand forecasts, ultimately strengthening market responsiveness.

Finally, embedding agile project support models within sales and technical teams can differentiate service offerings. By providing turnkey consultation on product selection, installation optimization, and lifecycle management, companies can elevate their value propositions beyond commodity supply. This consultative approach fosters long-term client partnerships and generates recurring revenue opportunities, cementing leadership in a competitive landscape where expertise and responsiveness increasingly determine market success.

Illustrating the Rigorous Data Collection and Validation Process That Ensures Comprehensive Insights for Decision Makers

The research underpinning this analysis integrates comprehensive secondary and primary data collection methodologies to ensure both depth and credibility. Initially, a systematic review of industry publications, regulatory filings, and patent databases established foundational understanding of material advancements, technological breakthroughs, and trade policy evolution. This secondary phase was complemented by an extensive mapping of supply chain ecosystems, highlighting key raw material sources, converter networks, and end-use contractor segments across major global regions.

Primary validation was achieved through in-depth interviews with industry veterans, technical experts, and senior executives representing polymer manufacturers, fabric converters, and infrastructure developers. These dialogues provided nuanced insights into real-world implementation challenges, procurement dynamics, and strategic priorities. Triangulating these qualitative findings with quantitative trade data and customs records enabled robust cross-verification, fostering confidence in the analysis of tariff impacts and regional growth patterns.

To refine segmentation frameworks, a multi-criteria clustering approach was employed, grouping market activity by product architecture, material composition, application use cases, and distribution channels. Geographic demand modeling leveraged public infrastructure investment data alongside macroeconomic indicators to illuminate regional drivers. Throughout, rigorous quality control checks and iterative peer reviews ensured that conclusions remained objective, actionable, and reflective of the most recent industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Fabrics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Fabrics Market, by Product Type

- Construction Fabrics Market, by Material

- Construction Fabrics Market, by Product Form

- Construction Fabrics Market, by Coating

- Construction Fabrics Market, by Application

- Construction Fabrics Market, by End Use

- Construction Fabrics Market, by Distribution Channel

- Construction Fabrics Market, by Region

- Construction Fabrics Market, by Group

- Construction Fabrics Market, by Country

- United States Construction Fabrics Market

- China Construction Fabrics Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Core Discoveries and Forward-Looking Strategies to Guide Resilient Growth in Construction Fabric Markets

The global construction fabrics sector stands at a transformative crossroads, propelled by material innovations, sustainability imperatives, and shifting trade paradigms. Technological advancements in fabric engineering are unlocking performance thresholds previously unattainable, while emerging regulatory frameworks and incentive schemes are driving the adoption of eco-conscious materials. Simultaneously, policy-induced cost adjustments and supply chain realignments underscore the importance of agility and tariff-aware procurement strategies.

Through detailed segmentation and regional analysis, this report highlights the multifaceted nature of market opportunity, spanning high-strength woven solutions, specialized non-woven membranes, and smart fabric integrations across commercial, industrial, infrastructure, and residential projects. Leading companies are differentiating through platform-based digital services, circularity commitments, and targeted distribution frameworks that balance scale with customization. As the industry evolves, those who invest in sustainable R&D, diversify supply networks, and offer consultative project support will secure the competitive edge.

In conclusion, this landscape demands an integrated approach that marries advanced materials expertise with agile business models. By leveraging the insights and recommendations presented herein, stakeholders can navigate complexity, anticipate policy shifts, and capitalize on growth opportunities in one of the most dynamic corners of the built environment.

Empower Strategic Growth by Connecting Directly with Our Associate Director of Sales and Marketing for Customized Market Intelligence

To gain an unparalleled strategic advantage in the dynamic construction fabrics sector, reach out today to connect with Ketan Rohom, Associate Director of Sales & Marketing. His deep expertise and insight into emerging trends, regulatory shifts, and advanced material innovations will guide you to the precise research components that align with your organizational goals. With Ketan’s tailored consultation, you can uncover critical data, validated methodologies, and actionable intelligence designed to empower your decision-making. Engaging with him ensures expedited access to the full market research report, delivering the comprehensive analysis your team needs to excel.

- How big is the Construction Fabrics Market?

- What is the Construction Fabrics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?