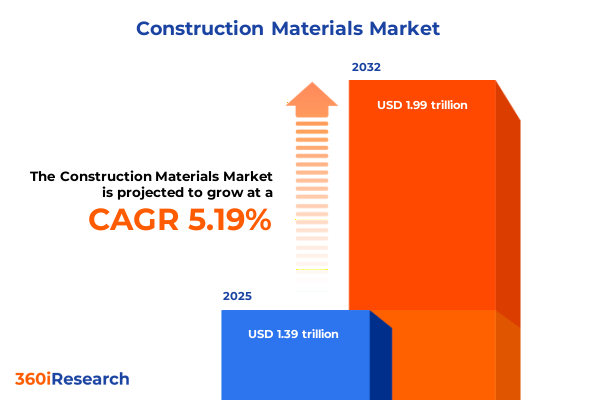

The Construction Materials Market size was estimated at USD 1.39 trillion in 2025 and expected to reach USD 1.46 trillion in 2026, at a CAGR of 5.19% to reach USD 1.99 trillion by 2032.

Framing the Transformation of Construction Materials Markets Amid Supply Chain Disruptions, Sustainability Imperatives, and Technological Innovations Shaping the Industry

Construction materials markets are currently navigating an era defined by pronounced volatility, where the interplay of supply chain disruptions, inflationary pressures and geopolitical dynamics has reshaped traditional procurement and production models. Over the past eighteen months, widespread raw material shortages and transportation bottlenecks have stressed the resilience of long-established supply chains, compelling manufacturers to reevaluate sourcing strategies and emphasize near-shoring and regional partnerships. As a result, many firms have accelerated digital tracking of materials and invested in agile inventory management to absorb shocks from fluctuating freight rates and intermittent port closures. Against this backdrop, stakeholders across the value chain-from cement producers to downstream fabricators-are adjusting operational priorities to safeguard continuity and preserve project timelines in the face of persistent uncertainty.

Simultaneously, the growing imperative for decarbonization has elevated sustainability from a reputational consideration to a central pillar of corporate strategy in the construction sector. Materials such as concrete, which accounts for roughly eight percent of global CO₂ emissions, are under intensifying scrutiny, prompting a surge in demand for low-carbon alternatives and eco-innovations. Glass, metals and plastics manufacturers are pursuing novel formulations and energy-efficient production methods, while insulation suppliers are advancing foam and mineral wool composites with enhanced thermal performance and recycled content. The integration of Environmental Product Declarations (EPDs) and Life Cycle Assessments (LCAs) into procurement criteria has become increasingly prevalent, enabling clients to quantify and compare embodied carbon across material options. This shift reflects a broader realization that environmental stewardship and regulatory compliance are inextricably linked to market competitiveness.

At the same time, technological innovation is reshaping how materials are designed, specified and deployed. The adoption of Building Information Modeling (BIM), augmented reality visualization tools and IoT-enabled tracking has introduced unprecedented levels of transparency into project workflows. Contractors and suppliers are leveraging automated data analytics to optimize logistics, predict maintenance requirements and reduce waste, thereby unlocking efficiency gains and bolstering margins. In many regions, digital platforms now facilitate real-time coordination among architects, engineers and materials providers, accelerating decision-making and driving convergence toward integrated solutions. As the industry embraces these digital enablers, future material procurement strategies will likely be defined as much by software compatibility and data interoperability as by physical performance attributes.

Unpacking the Major Transformative Shifts in Construction Material Landscapes Driven by Sustainability Priorities Digitalization and Circular Economy Practices

The trajectory of construction materials markets has been profoundly influenced by a collective drive toward sustainability, as regulatory bodies and end-users alike impose stricter environmental standards that extend beyond mere energy efficiency. Innovations in low-embodied-carbon solutions, such as cross-laminated timber and rammed earth, are now being championed in major projects to reduce lifecycle emissions and enhance circularity. Concurrently, adaptive reuse and deconstruction practices are gaining traction, preserving existing structures and diverting significant volumes of material from landfills. These trends underscore a paradigm shift in which the selection of materials is governed not only by performance but also by long-term ecological impacts and resource stewardship.

Digitalization continues to redefine the material landscape, fostering a new generation of smart products and sensor-integrated components that enable active monitoring of structural health and energy consumption. Phase-change materials embedded in facades regulate indoor temperatures, while self-healing concretes with bacteria-infused capsules automatically seal cracks, extending service life and reducing maintenance requirements. The convergence of advanced robotics, 3D printing and modular construction techniques further accelerates delivery, allowing for precise onsite fabrication and minimized waste. As these technologies mature, they are set to transform procurement frameworks, requiring stakeholders to evaluate compatibility and total cost of ownership over extended lifecycles.

Finally, circular economy principles have taken root as a strategic objective across the sector, with major players and policymakers collaborating to establish standardized pathways for material recovery, recycling and repurposing. Construction and demolition waste recycling initiatives are expanding, and digital material passports are emerging to track composition and reuse potential. By embedding circular design criteria into early project stages, stakeholders can optimize resource flows and unlock new revenue streams through reclaimed aggregates, recycled steel and reclaimed wood products. This integration of circularity not only enhances environmental performance but also mitigates exposure to raw material price volatility and supply chain constraints.

Analyzing the Cumulative Effects of U.S. Section 232 and Related Tariff Measures on Construction Material Costs Supply Chains and Industry Economics in 2025

In early 2025, the U.S. government reinstated comprehensive Section 232 tariffs on steel and aluminum imports, restoring a uniform 25 percent duty on steel and raising aluminum tariffs from 10 percent to 25 percent. This action closed longstanding exemptions for key trading partners and applied stringent “melted and poured” standards, expanding tariff coverage to include downstream derivative products. President Trump’s proclamation of February 11, 2025, effectively removed product exclusion processes and codified these higher rates to fortify domestic capacity and national security interests.

Subsequent proclamations in March and June of 2025 escalated these measures further. On March 12, the White House expanded the tariffs to all countries, eliminating all exemptions and phasing out approved exclusion lists under Section 232, thereby standardizing the 25 percent steel and aluminum duties across global imports. By June 4, tariffs were increased to a full 50 percent ad valorem on all steel and aluminum imports, with the exception of certain non-metallic contents of composite products. These escalating levies have reshaped cost structures for steel- and aluminum-intensive materials and put upward pressure on project budgets nationwide.

The amplified duty environment has reverberated through the construction sector, contributing to material cost increases of up to ten percent for steel- and aluminum-based components, depending on regional supply dynamics and the specific material grade. U.S. homebuilders have reported that the heightened levies are a primary driver of rising costs, exacerbating an already challenging landscape characterized by high interest rates and constrained housing starts. Contractors utilizing extruded aluminum and structural steel have been compelled to pass through surcharges, dipping into contingency budgets and renegotiating contract terms to absorb the burden of elevated import duties.

Beyond direct cost inflation, the cumulative tariffs have lengthened lead times for structural beams, roofing panels and decorative metal finishes. Fabricators in key manufacturing hubs now face extended production schedules-often stretching to sixteen or more weeks-due to a combination of reduced import volumes, surcharges of up to 25 percent on raw inputs and higher downstream fabrication costs. As a result, project timelines have been disrupted, compelling many developers to prioritize domestic steel mills and forge long-term supply agreements to secure priority allocations. This recalibration of supply chains underscores the far-reaching implications of tariff policy on procurement strategies and project delivery in 2025.

Deriving Critical Insights from Material Type Form Application and Distribution Channel Segmentation to Illuminate Market Dynamics and Growth Drivers

Insights derived from material type segmentation reveal a nuanced landscape in which high-volume commodities and specialty inputs each follow distinct trajectories. Traditional aggregates, cement and concrete continue to anchor foundational construction work, benefiting from large-scale infrastructure investments, while accelerating demand for glass and plastics is tied to the expansion of façade engineering and lightweight building assembly. Insulation, bifurcated into foam and mineral wool, has witnessed differentiated growth, with foam variants such as EPS and XPS capturing share in energy-efficient retrofit projects, and mineral wool holding a critical position in fire-resistant assemblies. Metals, subdivided into aluminum copper and steel, exhibit variable pricing and supply patterns, reflecting both global commodity cycles and the U.S. tariff environment. Adhesives and sealants, though a smaller segment by volume, are increasingly strategic due to their role in modular systems and engineered panel construction.

Application-based segmentation underscores the divergent needs across end markets, with residential construction responding to renovation and retrofit imperatives driven by affordability challenges, industrial facilities prioritizing durability and corrosion resistance, and commercial development focusing on flexibility and interior finish quality. Infrastructure projects, buoyed by federal funding, emphasize high-performance concrete and corrosion-resistant metals to extend service life under demanding conditions. Each application category engages unique material specifications and certification requirements, shaping supplier portfolios and channel strategies accordingly.

Form segmentation highlights the influence of handling and onsite integration on procurement decisions. Boards and sheets are predominant in façade systems, interior wall assemblies and insulating applications, where dimensional stability and ease of installation are paramount. Liquid formulations, encompassing concrete admixtures and sealants, require precise dosage control and compatibility validation, driving supplier investment in metered delivery systems. Granular and powder formats dominate cementitious blends, offering long shelf life and transport efficiency, while specialized liquids and emulsions enable innovative spray-applied insulations and coatings.

Distribution channel segmentation reflects evolving preferences for procurement convenience and value-added services. Wholesale channels remain central to bulk commodity transactions, leveraging logistics scale and credit facilities to support large-volume infrastructure programs. Retail channels, including hard-goods outlets, serve the decentralized needs of smaller contractors and do-it-yourself consumers, prioritizing accessible SKU assortments and localized inventory. Online platforms are emerging as a strategic growth vector, enabling digital specification tools, next-day delivery options and virtual technical support, which are increasingly valued by architects and contractors seeking rapid price comparisons and detailed product data.

This comprehensive research report categorizes the Construction Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Form

- Distribution Channel

Exploring Distinct Regional Market Dynamics Across the Americas, Europe Middle East & Africa and Asia Pacific to Identify Growth Opportunities and Challenges

In the Americas, the construction materials landscape is substantially influenced by domestic policy levers and consumer demand patterns. Federal infrastructure programs continue to underpin large-scale transportation and public works projects, while residential renovation markets are buoyed by homeowners extending product lifecycles in response to high financing costs. This region also grapples with tariff pass-through on steel, aluminum and copper, which has elevated material pricing and incentivized partnerships with domestic mills to secure preferential supply allocations. The interplay of public spending and private sector investment drives a dynamic environment where logistics resilience and regulatory alignment are critical success factors.

Europe Middle East & Africa (EMEA) presents a mosaic of regulatory frameworks and economic cycles, in which stringent emissions directives, such as the EU’s Energy Performance of Buildings Directive, are accelerating the uptake of low-carbon cements, green mineral components and advanced insulation solutions. In the Middle East, rapid urbanization and megaprojects are stimulating demand for specialized glass, high-performance concrete and modular systems, while Africa’s infrastructure expansion requires durable aggregates and cost-effective cement blends. Regional circular economy initiatives and producer responsibility regulations further shape material sourcing, prompting manufacturers to integrate recycled content and end-of-life recovery mechanisms into their offerings.

The Asia Pacific region remains a growth engine for construction materials, driven by unprecedented urbanization and digital infrastructure development. While mature markets like Japan and Australia focus on retrofitting and sustainability transformation, emerging economies in Southeast Asia and India witness rapid industrialization and residential build-outs. Suppliers in this region are leveraging technology innovation and scale efficiencies, as evidenced by multinational expansions into local joint ventures and acquisitions. Notably, Asia Pacific operations have delivered record operating margins for leading materials groups, reflecting strong uptake of premium, sustainable product lines amid intensifying regulatory support for green building standards.

This comprehensive research report examines key regions that drive the evolution of the Construction Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives and Competitive Positions of Leading Construction Material Companies Shaping Innovation Sustainability and Growth Trajectories

Holcim has recalibrated its global footprint through a strategic spin-off of its North American arm, Amrize, positioning it for greater agility in a tariff-volatile landscape. Concurrently, the company’s NextGen Growth 2030 strategy focuses on mergers and acquisitions to expand its sustainable building solutions portfolio and achieve double-digit earnings growth. With net-zero cement plants under construction and a ramped-up circular construction platform aimed at recycling millions of tons of demolition waste, Holcim is aligning decarbonization with profitable growth. Despite uncertainty surrounding import duties, management anticipates limited disruption to local-for-local production models, underscoring confidence in regional self-reliance and resilient domestic demand.

Saint-Gobain has embraced a “Grow & Impact” agenda that marries profitability with sustainability, underpinned by a series of high-profile acquisitions in construction chemicals and advanced materials. Investments in FOSROC and other specialty brands bolster its position in waterproofing, additives and façade systems, while innovations such as low-carbon glass and recycled gypsum products reinforce its sustainable construction credentials. Record operating margins and free cash flow reflect the successful integration of acquisitions and targeted pricing strategies, particularly in North America, Asia and other high-growth markets. The company’s commitment to expanding its sustainable solutions portfolio-covering nearly three-quarters of product sales-underscores a deliberate pivot toward services and systems that capture more value along the construction value chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alghanim Industries

- Ambuja Cements Ltd. by Adani Group

- Anhui Conch Cement Co., Ltd.

- ArcelorMittal S.A.

- Armstrong World Industries, Inc.

- ASIA CEMENT CORPORATION

- Asia Cement Public Company Ltd.

- Atad Steel Structure Corporation

- Athabasca Minerals Inc.

- BASF SE

- BBMG Corporation

- Binderholz Group

- Boral Limited

- Buzzi Unicem S.p.A.

- CEMEX S.A.B. de C.V.

- China National Building Material Group Co., Ltd.

- Compagnie de Saint-Gobain S.A.

- CRH PLC

- Heidelberg Materials

- Holcim Ltd

- James Hardie Industries PLC

- JFE Holdings, Inc.

- JSW Steel

- Kingspan Group PLC

- Knauf KG

- Lindab Group

- LIXIL Group Corporation

- Martin Marietta Materials, Inc

- Memaar Building Systems

- Mitsubishi Chemical Group Corporation

- Nippon Steel Corporation

- Nucor Corporation

- Owens Corning

- Stora Enso Oyj

- Sumitomo Corporation

- Taiheiyo Cement Corporation

- Taiwan Cement Corporation

- Tata Steel Limited

- Vulcan Materials Company

- Wienerberger AG

Delivering Actionable Recommendations for Industry Leaders to Navigate Regulatory Changes Supply Chain Volatility and Emerging Sustainability and Digitalization Trends

Industry leaders should prioritize the development of integrated supply chain ecosystems that enhance visibility from raw material sourcing to final project delivery. By forging collaborative partnerships with domestic producers and investing in data-driven forecasting tools, executives can mitigate the risks of tariff-induced volatility and optimize inventory buffers. A dynamic approach to procurement, leveraging both regional hubs and digital marketplaces, will enable rapid response to market disruptions and reinforce contractual agility.

To capitalize on sustainability mandates, companies must embed low-carbon solutions into core product lines, aligning R&D pipelines with emerging regulatory standards and investor expectations. Strategic investments in circular platforms that reclaim and repurpose construction and demolition waste will not only reduce operational costs but also generate new revenue streams. Moreover, transparent communication of environmental performance through third-party-verified EPDs will crystallize competitive differentiation and facilitate entry into green public tenders.

Digital transformation should extend beyond design and planning to encompass material manufacturing and distribution. Embracing IoT-enabled smart materials and automated analytics will empower organizations to refine quality control, predict maintenance requirements and deliver value-added services. A shift toward platform-based business models-where technical support, warranty services and digital specification interfaces complement physical products-will redefine supplier-customer relationships and unlock recurring revenue opportunities.

Finally, executive teams must cultivate organizational competencies that bridge technical expertise with sustainability leadership. Investing in cross-functional training programs, sustainability metrics dashboards and stakeholder engagement platforms will foster a culture equipped to navigate regulatory change and evolving client requirements. By embedding resilience and innovation at the heart of corporate governance, industry players can pursue long-term growth objectives while fulfilling environmental and social imperatives.

Detailing the Comprehensive Research Methodology Including Primary and Secondary Data Sourcing Validation Techniques and Analytic Frameworks for Market Analysis

This analysis draws on a hybrid research methodology that integrates both primary and secondary data sources to ensure comprehensive coverage of market dynamics. Primary interviews were conducted with senior executives, supply chain specialists and procurement managers across leading construction materials manufacturers and distributors, offering firsthand perspectives on strategic priorities and operational challenges.

Secondary research encompassed the review of authoritative government publications, including U.S. trade proclamations and GSA tariff schedules, as well as peer-reviewed academic journals and industry association reports. Regulatory announcements from the White House and international trade bodies were analyzed to map tariff timelines and policy shifts. Newswire services such as Reuters and Financial Times provided real-time insights into cost movements, corporate strategies and macroeconomic drivers.

Quantitative data analysis employed time-series evaluation of import duty impacts and cost pass-through ratios, while qualitative coding of interview transcripts identified recurring themes around sustainability, digitalization and circular economy adoption. Cross-validation techniques ensured reliability, with triangulation across multiple sources to reconcile discrepancies. The final synthesis leveraged scenario modeling to anticipate future trajectories under varying tariff and regulatory conditions, enhancing the strategic applicability of the findings.

All sources were meticulously vetted to exclude paywalled proprietary market research and maintain strict adherence to data integrity standards. The research framework aligns with recognized best practices in market intelligence, incorporating iterative peer reviews and continuous updates to reflect evolving market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Materials Market, by Material Type

- Construction Materials Market, by Application

- Construction Materials Market, by Form

- Construction Materials Market, by Distribution Channel

- Construction Materials Market, by Region

- Construction Materials Market, by Group

- Construction Materials Market, by Country

- United States Construction Materials Market

- China Construction Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insights into the Evolution of Construction Materials Markets and the Strategic Imperatives for Stakeholders to Drive Sustainable and Profitable Growth

The construction materials sector stands at a confluence of imperatives: cost containment amid tariff headwinds, sustainable innovation driven by climate mandates, and digital transformation reshaping traditional supply chains. Our analysis underscores that success in this environment hinges on the ability to integrate these forces into a unified strategic vision. Companies that excel will be those that leverage localized production resilience, adopt low-carbon materials at scale and harness data-driven insights to anticipate and mitigate disruptions.

Cohesion between procurement, technical and sustainability functions will be vital, as will the cultivation of partnerships that enable circular material flows and shared technological platforms. Moreover, a balanced portfolio-spanning commodity volumes and differentiated specialty products-will allow firms to navigate cyclicality while capitalizing on high-margin segments. As regional dynamics continue to diverge, a nuanced understanding of Americas, EMEA and Asia Pacific idiosyncrasies will guide capital allocation and market entry strategies.

Looking ahead, the collective trajectory of decoding tariff complexities, embedding circular economy practices and orchestrating digital ecosystems will define competitive leadership. Firms that adapt swiftly, innovate responsibly and align their operational models with environmental objectives will set the benchmark for a resilient and profitable construction materials industry. This convergence of economic pragmatism and sustainability commitment represents the strategic frontier for stakeholders to secure long-term value creation.

Encouraging Decision Makers to Engage with Associate Director Ketan Rohom for Customized Market Intelligence and Strategic Partnership Opportunities

For tailored insights that directly address your strategic objectives in the construction materials sector, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the comprehensive findings of this executive summary, discuss customized data solutions, and propose the most relevant research segments to inform your critical business decisions. His expertise will ensure that you leverage the full potential of our market intelligence to drive growth, manage risk, and capitalize on emerging opportunities. Reach out to schedule a consultation and explore how our detailed report can empower your organization’s next steps in an evolving market landscape.

- How big is the Construction Materials Market?

- What is the Construction Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?