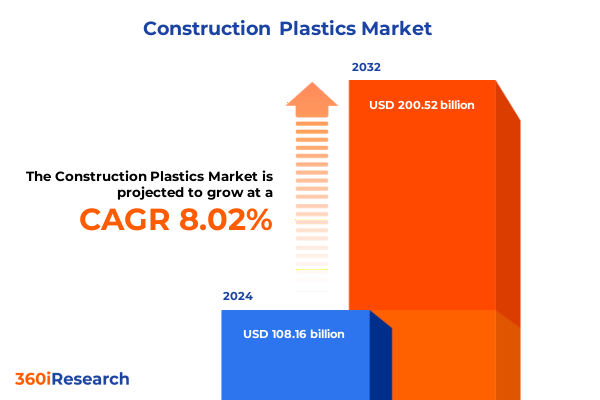

The Construction Plastics Market size was estimated at USD 116.94 billion in 2025 and expected to reach USD 126.44 billion in 2026, at a CAGR of 8.00% to reach USD 200.52 billion by 2032.

Unveiling the Critical Role of High-Performance Plastics in Reinventing Modern Building Techniques

The construction industry is at a critical juncture as materials architects, builders, and specifiers pursue novel solutions to address demands for cost efficiency, sustainability, and performance. With growing pressures to reduce carbon footprints and meet increasingly stringent building codes, plastic materials have emerged as versatile enablers for innovative design and durable infrastructure. This executive summary presents a deep dive into the dynamics shaping the construction plastics sector, guiding decision-makers toward informed strategies and resilient supply chain models.

Throughout this discussion, we explore transformative shifts in production technologies, regulatory impacts, and strategic segmentation insights that illuminate the nuanced behaviors of market participants. By adopting an integrative perspective-encompassing regional considerations, tariff implications, and corporate strategies-stakeholders can position themselves at the forefront of a market poised for continued evolution. As the landscape evolves, this introduction sets the stage for a comprehensive analysis of drivers, challenges, and opportunities specific to construction-grade plastics.

Exploring the Convergence of Sustainable Innovation and Supply Chain Reinvention in Construction Plastics

In recent years, the landscape of construction plastics has transformed dramatically, driven by the convergence of environmental stewardship and technological innovation. The proliferation of sustainable materials has accelerated researchers’ focus on bio-based polymers and enhanced recyclability, prompting manufacturers to integrate closed-loop systems into their operations. Advanced extrusion and additive manufacturing techniques now enable the production of complex geometries and hybrid components, enriching architectural possibilities while reducing material waste.

Supply chain resilience has likewise undergone a renaissance as firms diversify sourcing strategies to mitigate geopolitical risks and logistical disruptions. Partnerships with regional compounders and strategic consolidation among distributors have fortified market stability, even as regulatory frameworks tighten around chemical compositions and emissions. These collective shifts underscore an industry in flux-one that demands agility and foresight from material suppliers and construction firms alike.

Analyzing the Ongoing Cost and Supply Chain Transformations Triggered by the 2025 U.S. Tariff Measures

The U.S. administration’s 2025 tariffs on select imported construction plastics have driven pronounced changes in cost structures and procurement strategies. Imposed on certain polymer categories to bolster domestic manufacturing, these duties have compelled end users to reevaluate supplier portfolios and prioritize regional sourcing. Domestic compounders have expanded capacity investments to address surging demand, while importers have restructured contract terms to cushion the impact of escalating duties on builders and fabricators.

Concurrently, manufacturers have accelerated optimization programs to offset tariff-related cost pressures through leaner production methodologies and improved material yield. Enhanced compounding technologies have delivered higher percentages of recycled content at consistent performance levels, aligning with parallel sustainability mandates. Despite the transitional overhead, firms that have swiftly adapted their logistics frameworks and engaged in collaborative planning with trading partners have effectively managed volatility, sustaining project pipelines and protecting margins.

Illuminating Nuanced Market Behaviors Across Polymer Types Applications and Form Factors Without Conventional Categorization

Examining construction plastics through the lens of product type reveals a diversified market spanning PET, polyethylene, polypropylene, and PVC, with polyethylene further differentiated into high-density (HDPE) and low-density (LDPE) grades, each serving distinct performance requirements. Flooring and wall coverings leverage film and sheet applications for seamless installations, while insulation solutions exploit foamed variants of PVC and polyethylene to deliver thermal efficiency. Critical infrastructure components such as pipes and fittings predominantly rely on both HDPE and PVC for corrosion resistance and structural integrity, whereas roofing membranes integrate ethylene-based copolymers for enhanced weather resilience. Window and door profile systems favor rigid PVC for dimensional stability and long-term durability, with polypropylene interventions beginning to emerge for specialized use cases.

End-use segmentation underscores the varying adoption rates across commercial, industrial, infrastructure, and residential construction, where high-rise developments demand flame-retardant compounds and residential projects increasingly embrace recyclable formulations. From a form perspective, extruded profiles deliver precision cross-sections for piping systems, while molded components cater to bespoke architectural elements. Films and sheets find universal applications from vapor barriers to decorative facades, and powder forms power additive manufacturing of complex connectors. Distribution channels split between direct procurement agreements for large-scale project developers and an indirect network of distributors and retailers-where sub-tiers of distributors and retailers play a pivotal role in ensuring just-in-time availability for smaller contractors and maintenance specialists.

This comprehensive research report categorizes the Construction Plastics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Distribution Channel

- Application

- End-Use

Deciphering Regional Market Drivers and Regulatory Forces Shaping Construction Plastics Adoption Across the Globe

Regional dynamics in the Americas are characterized by robust infrastructure investments coupled with a push toward sustainability in both public and private construction projects. North American specifications have heightened emphasis on product certifications related to recycled content and embodied carbon, while Latin American markets are seeking greater standardization to attract foreign investment in commercial developments.

In Europe, Middle East & Africa, regulatory harmonization under the European Construction Products Regulation has elevated baseline material requirements, prompting manufacturers in the region to refine formulations for compliance. The Gulf states continue to invest heavily in landmark projects that leverage advanced polymeric roofing and facade systems, whereas African markets are in early stages of integrating modern plastic piping networks to replace aging metallic infrastructure.

Across Asia-Pacific, rapid urbanization in Southeast Asia and India fuels demand for cost-effective and scalable plastic building products, with Japan and Australia leading in sustainability initiatives around closed-loop recycling. Collaborative programs between material producers and local governments are driving pilot schemes in circular economy models, indicating a high potential for scalable adoption of reclaimed polymers in large-scale developments.

This comprehensive research report examines key regions that drive the evolution of the Construction Plastics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing How Market Leaders and Agile Innovators Are Redefining Competitive Advantage Through R&D and Strategic Alliances

Leading companies across the construction plastics landscape have leveraged strategic investments to fortify their positions. One major producer has prioritized expansion of its compounding operations in the United States to capture tariff-induced demand shifts, while another global chemical supplier has deepened R&D collaborations focusing on bio-sourced feedstocks. A third industry incumbent has pursued vertical integration by acquiring distribution networks in emerging economies, enabling tighter control over logistics and customer service.

Meanwhile, innovative mid-tier compounders are disrupting traditional supply chains through specialized formulations tailored for modular construction and 3D-printed components. These agile players often partner with construction technology firms to co-develop plug-and-play systems, accelerating time to market and enhancing design flexibility. Collectively, these corporate maneuvers illuminate the growing interplay between material science advances and strategic positioning, highlighting the importance of agility, capital investment, and cross-industry collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Plastics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdrecoPlastics

- AGC Inc.

- Asahi Kasei Corporation

- BASF SE

- Berry Global Inc.

- Borealis AG

- Chevron Phillips Chemical Company LLC

- Covestro AG

- CS Hyde Company

- Dow Inc.

- Eastman Chemical Company

- Formosa Plastics Corporation

- INEOS Group Holdings S.A.

- LG Corp.

- LyondellBasell Industries Holdings B.V.

- New Process Fibre Company, Inc.

- Panchmal Plastics

- Profile Plastics, Inc.

- Saudi Basic Industries Corporation

- Shin-Etsu Chemical Co., Ltd.

- Solvay S.A.

- Telko Ltd. by Aspo PLC

- Trelleborg AB

- Westlake Chemical Corporation

Mapping Strategic Pathways for Industry Executives to Drive Sustainable Growth Through Circularity and Geographic Diversification

Industry leaders should prioritize integration of circular economy principles, embedding recycled content targets at each stage of the production cycle to meet both regulatory mandates and corporate sustainability goals. This requires forging partnerships with waste management and recycling enterprises to secure reliable streams of reclaimed polymers. Concurrently, firms must invest in advanced compounding technologies that enhance material performance even as feedstock compositions diversify.

To mitigate future tariff risks, establishing multi-regional manufacturing footprints offers a hedge against evolving trade policies. By aligning capacity expansions with high-growth regions and developing flexible supply agreements, companies can optimize global cost efficiency while maintaining rapid responsiveness to local demand. In parallel, leveraging digital tools for supply chain visibility and predictive maintenance will enable proactive management of production bottlenecks.

Finally, engaging in co-innovation forums with construction technology providers will accelerate the adoption of automated installation and prefabrication systems, unlocking new applications for high-performance plastics. Strategic investments in educational initiatives and certification programs will further reinforce market credibility and streamline approval processes in complex regulatory environments.

Detailing a Comprehensive Research Framework Fusing Secondary Intelligence Primary Interviews and Data Triangulation

The research methodology underpinning this market analysis combined extensive secondary research with targeted primary interviews and rigorous data triangulation. Secondary inputs included academic publications, trade association reports, and regulatory databases to construct an accurate baseline of material properties and compliance standards. Primary insights were gathered through in-depth interviews with polymer scientists, procurement directors at construction firms, and logistics specialists, ensuring diverse perspectives on supply chain dynamics.

Quantitative data was cross-verified against proprietary shipment and trade volume records, while qualitative findings were validated through expert panel reviews. This iterative approach enhanced the robustness of our segmentation assessments and regional analyses. The final outputs underwent multiple rounds of internal peer review to ensure clarity, accuracy, and relevance, providing stakeholders with a trustworthy foundation for strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Plastics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Plastics Market, by Product Type

- Construction Plastics Market, by Form

- Construction Plastics Market, by Distribution Channel

- Construction Plastics Market, by Application

- Construction Plastics Market, by End-Use

- Construction Plastics Market, by Region

- Construction Plastics Market, by Group

- Construction Plastics Market, by Country

- United States Construction Plastics Market

- China Construction Plastics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing the Synthesis of Market Transformations Supply Chain Adaptations and Sustainable Innovations

As construction markets worldwide embrace sustainability and performance-driven innovation, plastic materials have secured a pivotal role in the evolution of modern building practices. The USD tariffs introduced in 2025 have underscored the importance of supply chain resilience and diversified sourcing, while transformative shifts in manufacturing and regulatory landscapes are redefining competitive dynamics. Through targeted segmentation and regional analysis, decision-makers gain a nuanced understanding of application-specific drivers and end-use behaviors.

By synthesizing corporate strategies and actionable recommendations, this executive summary equips stakeholders with the insights required to navigate volatility, harness emerging technologies, and establish sustainable growth pathways. As the sector continues to evolve, proactive adaptation and investment in circular practices will distinguish market leaders from the rest, ultimately elevating the role of high-performance plastics in tomorrow’s infrastructure.

Initiate Strategic Growth by Securing a Tailored Construction Plastics Market Report with an Industry Expert at Your Side

To acquire unparalleled insights into the evolving construction plastics market and capitalize on emerging growth opportunities, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report tailored for strategic decision-making and sustained competitive advantage

- How big is the Construction Plastics Market?

- What is the Construction Plastics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?