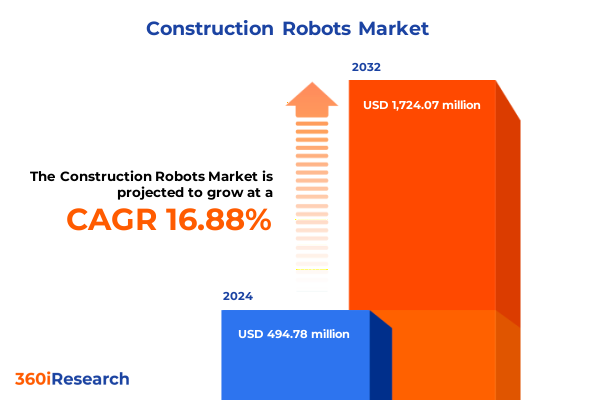

The Construction Robots Market size was estimated at USD 571.51 million in 2025 and expected to reach USD 666.91 million in 2026, at a CAGR of 17.08% to reach USD 1,724.07 million by 2032.

Opening the Gateway to Next-Generation Construction Robotics Through Converging Automation and Industry 4.0 Advancements

The construction sector is facing a convergence of pressures that demand innovative solutions. Escalating labor shortages have driven up project timelines and costs, while the complexity of modern infrastructure tasks has challenged traditional workflows. At the same time, rising safety concerns on job sites underscore the need for technologies that can perform the most hazardous or repetitive tasks with precision. Within this context, robotics is emerging not simply as a novel capability but as a strategic imperative to enhance productivity, reduce risks, and unlock new levels of operational efficiency.

As the sector evolves, construction robots-ranging from autonomous earth-moving machines to collaborative bricklaying arms-are transitioning from experimental pilots to commercially viable tools. Advanced sensors and machine-vision systems now empower these platforms to operate in dynamic and unstructured environments, while real-time data integration links them to project management and process-optimization platforms. Consequently, firms that adopt robotics early stand to differentiate themselves through faster delivery, lower costs, and improved safety records.

This executive summary introduces key topics shaping the construction robotics landscape. Readers will explore the transformative shifts driving innovation, the implications of United States tariffs on global supply chains, critical segmentation lenses for market analysis, regional adoption patterns, leading company strategies, actionable industry recommendations, research methodology, and concluding perspectives on future directions. Each section distills expert analysis to inform strategic decisions and support sustained growth in an era defined by automation and digital transformation.

Navigating the Horizon of Transformative Shifts in Construction Robotics Driven by Digital Twins and Autonomous Innovation

Construction robotics is undergoing a rapid metamorphosis fueled by breakthroughs in artificial intelligence, connectivity, and digital modeling. Digital twins now offer live virtual representations of worksites, enabling robots to plan and adjust tasks in real time. Meanwhile, edge computing and 5G connectivity ensure that robotic systems can process high-resolution sensor data on the fly, maintaining precision even in the harshest environments. This fusion of cyber-physical systems is setting new performance benchmarks for speed, accuracy, and autonomy.

Concurrently, collaborative robots-known as cobots-are reshaping the human-machine interface. Lightweight arms equipped with intuitive safety features are working alongside skilled tradespeople to augment manual tasks such as bricklaying, concrete finishing, and material handling. Meanwhile, fully autonomous platforms are tackling more complex operations like demolition and earthmoving, drawing on advances in perception and path planning to navigate unpredictable terrain.

As these technologies converge, they are unlocking a host of benefits. Enhanced safety emerges as robots assume the most hazardous duties, while sustainability gains traction as precise robotic pouring and placement reduce material waste. Productivity accelerates as parallel workflows become feasible, and new business models such as Robotics-as-a-Service lower the barrier to entry for contractors. Ultimately, these transformative shifts are redefining how projects are conceived, planned, and executed.

Assessing the Cumulative Impact of 2025 U.S. Tariff Revisions on Construction Robotics Supply Chains and Component Cost Structures

The U.S. Trade Representative’s Section 301 tariffs have steadily expanded since their inception, leading to notable increases on critical robotics inputs. On January 1, 2025, semiconductors-a cornerstone of controllers, sensors, and processing units-saw duties rise to 50 percent, while the same date triggered a 50 percent tariff on certain rubber medical and surgical gloves, a proxy for high-precision polymer components used in soft grippers. These measures compound earlier hikes on steel and aluminum, creating a multidimensional cost burden for robotics manufacturers and integrators whose components span electrical, electronic, and mechanical domains.

In parallel, permanent magnets, essential for actuators and servo drives, are slated for a 25 percent increase effective January 1, 2026. In response, stakeholders have pursued exclusion requests under the machinery exclusion process, which remains open until March 31, 2025. Successful petitions can exempt eligible industrial robots and related parts from up to 25 percent in additional duties through May 31, 2025. Nevertheless, the exclusion queue risks lengthening review times, potentially delaying relief for time-sensitive construction projects that depend on rapid equipment deployment.

Consequently, robotics providers are recalibrating supply chains to mitigate these headwinds. Strategies include near-shoring semiconductor assembly, qualifying alternative suppliers in tariff-exempt jurisdictions, and vertically integrating magnet production. Some firms are also accelerating domestic production footprints to align with broader reshoring incentives. As a result, while tariffs have added short-term cost layers and complexity to procurement cycles, they have simultaneously catalyzed a shift toward resilient, diversified sourcing models that promise long-term stability.

Unlocking Strategic Growth through Comprehensive Construction Robotics Market Segmentation across Type, Components, Modules, Applications, Deployment, and End-Use

A multifaceted segmentation framework reveals nuanced opportunities for stakeholders to tailor their strategies across the construction robotics spectrum. When considering types, autonomous machines stand out for large-scale earthmoving and excavation, cobots excel in precision tasks like masonry and painting, and remote-controlled units bridge the gap in demolition and survey operations. Exploring component breakdowns illustrates how hardware subsegments-actuators, controllers, sensors-intersect with services such as consulting and maintenance, while software offerings split between design platforms that streamline robotic integration and operational suites that deliver real-time analytics.

Zooming in on modules highlights further specialization. Communication and control modules orchestrate networked device fleets, manipulation modules ensure dexterous task execution, navigation modules guide platforms through variable terrain, and sensing-feedback modules maintain safety and adaptive performance. Application-level insights reveal distinct value propositions across bricklaying, concrete pouring, demolition, earthmoving, material handling, painting, and surveying, each demanding tailored robotic capabilities. These layers of analysis are enriched by end-use perspectives, wherein commercial developments leverage prefabrication bots, industrial sites deploy heavy-duty excavators, and residential builders integrate agile cobots for finishing work.

Finally, deployment strategies shape market entry decisions. Off-site prefabrication unlocks factory-style efficiency, allowing robots to manufacture modular components in controlled environments. Conversely, on-site deployment addresses the unpredictable conditions of active construction zones, requiring ruggedized platforms and adaptive architectures. By weaving these segmentation insights together, industry participants can pinpoint the highest-impact applications and develop targeted roadmaps to capture emerging value pools.

This comprehensive research report categorizes the Construction Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Components

- End-use

- Deployment

- Application

- Autonomy Level

Unveiling Key Regional Insights in Construction Robotics Adoption Dynamics across Americas, EMEA, and Asia-Pacific Regions

Global adoption of construction robotics exhibits distinct regional dynamics influenced by policy, infrastructure priorities, and labor market conditions. In the Americas, strong investment in innovation hubs and supportive regulatory frameworks have propelled North American contractors to pilot autonomous excavators and collaborative bricklaying platforms. U.S. labor shortages and rising wages further accelerate demand for robotics, while Canada’s modular housing initiatives have showcased off-site robotics for wall panel fabrication.

In Europe, the Middle East, and Africa, urban renewal programs and sustainability mandates are driving demand for precision robotics in heritage site restoration and energy-efficient construction. European Union research grants have financed projects integrating robotic arms with Building Information Modeling, while Gulf mega-projects rely on heavy-duty autonomous haul trucks to accelerate infrastructure timelines. Emerging markets in Africa are beginning to experiment with low-cost drones for site surveying and inspection, signaling broader regional interest in robotics.

Across Asia-Pacific, rapid urbanization and manufacturing prowess have positioned China, Japan, and Australia as robotics innovation leaders. China’s prefabrication factories leverage massive fleets of welding and painting robots to produce modular units, while Japan’s construction cobots focus on high-precision finishing tasks in dense urban centers. Australia’s mining-inspired automation platforms are adapting off-road robotics for large-scale earthmoving. As regional ecosystems mature, cross-continental partnerships are emerging to fuse local expertise with global best practices, accelerating technology transfer and scaling deployment.

This comprehensive research report examines key regions that drive the evolution of the Construction Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting the Vanguard Enterprises Pioneering Innovations and Competitive Strategies in the Construction Robotics Sector

Leading enterprises are charting varied paths to capture the growth opportunities presented by construction robotics. Boston Dynamics continues to refine dynamic locomotion algorithms for uneven terrain, unveiling prototypes that combine bipedal agility with industrial payload capacities. Built Robotics has secured partnerships with major contractors to deploy autonomous excavators, coupling machine-learning models with real-time teleoperations to optimize rock excavation and trenching operations.

Traditional equipment manufacturers are also making strategic moves. Caterpillar’s autonomous haulage systems integrate tightly with fleet telematics, while Komatsu’s Smart Construction initiative bundles drones, site sensors, and robotic bulldozers into end-to-end excavation solutions. Meanwhile, Hilti and Husqvarna have targeted finishing trades, introducing cobots for tasks like drilling precise anchor points and automated concrete polishing.

Emerging challengers such as Fastbrick Robotics and XCMG are driving cost innovation through bricklaying robots that boast rapid build times and reduced material waste. Putzmeister’s remote-controlled concrete pumps have evolved into semi-autonomous rigs, enabling fine-tuned control of flow rates and placement patterns. Across these diverse players, strategic alliances, joint ventures, and targeted acquisitions illustrate the urgency to build capabilities across software, hardware, and service domains, setting the stage for the next wave of competitive differentiation in the construction robotics arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Advanced Construction Robotics, Inc.

- Autonomous Solutions, Inc.

- Boston Dynamics Inc. by Hyundai Motor Group

- Brokk AB

- Built Robotics Inc.

- Caterpillar Inc.

- Conjet

- Construction Robotics, Inc.

- CyBe Construction B.V.

- DroneDeploy, Inc.

- FBR Limited

- Hilti Corporation

- Husqvarna Group

- ICON Technology, Inc.

- Komatsu Ltd.

- KUKA AG

- Liebherr Group

- MX3D B.V.

- Okibo Ltd.

- SZ DJI Technology Co., Ltd.

- Terex Corporation

- TopTec Spezialmaschinen GmbH

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Empowering Industry Leaders with Actionable Recommendations to Accelerate Scalable Implementation of Construction Robotics Solutions

To translate robotics potential into competitive advantage, industry leaders should prioritize scalable technology roadmaps. Initiating pilot programs with modular platforms enables rapid proof-of-concepts without full capital commitments, while iterative data collection refines machine-learning models to suit specific site conditions. Early collaboration with telecommunication providers ensures robust connectivity for edge-AI workloads and facilitates future integration of 5G-enabled autonomy.

Next, strengthening domestic supply chains will mitigate tariff exposure and reduce lead times. Establishing regional assembly hubs for controllers, sensors, and actuators shortens procurement cycles and creates onshore expertise. Simultaneously, engaging with regulatory bodies to shape emerging safety standards for autonomous worksite operations fosters a stable compliance environment and builds stakeholder confidence.

Finally, cultivating workforce skills is essential. Training programs that upskill equipment operators to oversee and maintain robotic fleets enhance adoption rates. Partnering with vocational institutions and leveraging online learning platforms accelerates knowledge transfer, while cross-industry consortiums promote best-practice sharing. By combining these actionable steps-modular piloting, supply chain resilience, regulatory collaboration, and workforce development-organizations can accelerate meaningful adoption of construction robotics solutions.

Demystifying Rigorous Research Methodology Employed to Illuminate the Construction Robotics Market Landscape and Delivery of Actionable Intelligence

This analysis draws on a rigorous multi-layered methodology designed to ensure comprehensive, reliable insights. Primary research included over fifty in-depth interviews with stakeholders across the construction and robotics ecosystems, from C-level executives at major OEMs to operations managers at leading general contractors. These conversations uncovered firsthand perspectives on deployment challenges, technology readiness, and strategic priorities.

Secondary research synthesized public domain sources, including patent filings, regulatory notices, technical white papers, and academic journals. This literature review provided historical context for robotics innovation and mapped the progression of enabling technologies such as LiDAR, machine learning, and collaborative control. Market intelligence databases and supply chain mappings were analyzed to identify emerging component suppliers and service providers.

Quantitative data was triangulated through financial report analysis, identifying investment patterns and cost benchmarks. Findings were validated through Delphi-style workshops, where a panel of subject-matter experts reviewed preliminary conclusions and supplied real-time feedback. This iterative vetting process ensured that the final insights reflect both robust data and the nuanced realities of construction environments. Together, these methods deliver actionable intelligence grounded in empirical evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Robots Market, by Type

- Construction Robots Market, by Components

- Construction Robots Market, by End-use

- Construction Robots Market, by Deployment

- Construction Robots Market, by Application

- Construction Robots Market, by Autonomy Level

- Construction Robots Market, by Region

- Construction Robots Market, by Group

- Construction Robots Market, by Country

- United States Construction Robots Market

- China Construction Robots Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Drawing Conclusions That Synthesize the Evolutionary Advancement and Future Direction of Construction Robotics Across Industry Verticals

Construction robotics stands at a pivotal inflection point in its evolution. The convergence of AI-driven autonomy, advanced sensor suites, and modular construction techniques has unlocked applications previously deemed impractical. Furthermore, global trade dynamics and tariff adjustments have underscored the imperative for resilient supply networks, driving a shift toward domestic and near-shore production of critical components.

As deployment scales, segmentation insights illuminate high-value opportunities across task types, hardware and software modules, and end-use scenarios. Regional patterns reveal adoption corridors-from North America’s pilot projects to Europe’s sustainability-driven restoration efforts and Asia-Pacific’s factory-style prefab innovations. Meanwhile, leading companies demonstrate diverse strategies, from Boston Dynamics’ dynamic mobility to Caterpillar’s integrated fleet telematics and Built Robotics’ site-ready autonomous diggers.

Looking ahead, the most successful organizations will be those that integrate robotics into broader digital ecosystems, fostering connectivity among BIM, IoT sensors, and AI analytics platforms. By aligning technology pilots with clear business outcomes-whether accelerating project timelines, enhancing safety, or reducing waste-industry participants can fully realize the promise of automated construction. This synthesis of innovation, strategy, and tactical execution lays the foundation for the next wave of growth.

Seize Exclusive Access to In-Depth Construction Robotics Market Insights by Engaging with Our Sales Leader Ketan Rohom Today

For decision-makers ready to harness the transformative power of robotics in construction, the comprehensive market research report offers unparalleled insights into technology trends, cost dynamics, and strategic entry points. To gain access to this in-depth analysis and secure your competitive advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to discuss how this report can align with your organization’s growth objectives and innovation roadmap

- How big is the Construction Robots Market?

- What is the Construction Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?