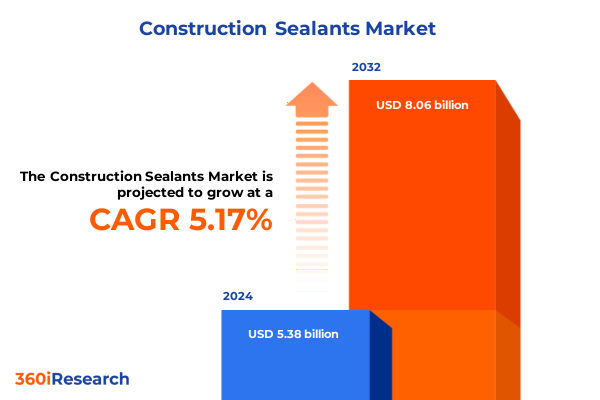

The Construction Sealants Market size was estimated at USD 5.65 billion in 2025 and expected to reach USD 5.92 billion in 2026, at a CAGR of 5.21% to reach USD 8.06 billion by 2032.

Revealing the Critical Importance of Construction Sealants in Modern Infrastructure Durability and Performance Optimization Across Diverse Building Sectors

The critical role of construction sealants extends far beyond simply filling gaps or preventing moisture infiltration; these versatile compounds are foundational to building resilience and enhancing structural longevity in modern construction. From towering high-rise façades to intricate residential assemblies, sealants provide a dynamic barrier that adapts to temperature fluctuations, differential movement, and weather extremes. As construction projects evolve to meet sustainability and efficiency benchmarks, sealants have emerged as a key enabler for achieving airtight envelopes, mitigating energy loss, and ensuring occupant comfort throughout a structure’s lifecycle.

Moreover, the convergence of advanced chemistries and rigorous performance standards has accelerated innovation in the sealant industry. Recent developments in polymer science have yielded formulations that deliver superior adhesion, UV resistance, and longevity under challenging conditions. These breakthroughs are driving new adoption in applications ranging from façade glazing to heavy civil infrastructure, where durability and reliability are nonnegotiable. Consequently, stakeholders across the value chain-from architects and engineers to general contractors and facility managers-are prioritizing sealant selection as a critical decision point in project specifications.

Furthermore, heightened regulatory scrutiny around volatile organic compound emissions and sustainable materials sourcing has elevated the strategic importance of construction sealants. As legislation tightens and green building certifications gain prominence, product portfolios that harmonize environmental compliance with high performance are in higher demand. This intersection of functionality, durability, and sustainability underscores why industry leaders are investing significantly in research and development to deliver next-generation sealant solutions that safeguard both structures and the environment.

Examining the Revolutionary Shifts in Sustainability Standards, Digital Integration, and Regulatory Landscapes Shaping the Construction Sealant Market

In recent years, the construction sealant landscape has undergone transformative shifts driven by evolving sustainability mandates, digital integration, and regulatory changes. Sustainability considerations are now at the forefront, with environmental certifications such as LEED and WELL requiring low-emission formulations and responsibly sourced raw materials. As a result, manufacturers have accelerated the development of water-based acrylics and neutral-cure silicones that align with stringent emissions thresholds, simultaneously reducing carbon footprints and enhancing on-site safety.

Concurrently, digital integration has reshaped how stakeholders engage with sealant solutions throughout project lifecycles. Building information modeling ecosystems now incorporate sealant specifications, enabling real-time collaboration between architects, engineers, and suppliers. This integration optimizes material take-off accuracy, reduces waste, and enhances procurement efficiencies. Furthermore, the adoption of cloud-based quality management platforms empowers site teams to monitor sealant application performance and compliance metrics, reinforcing the drive toward data-driven construction practices.

Regulatory dynamics have also evolved, with a renewed focus on domestic supply requirements and increased scrutiny on imported chemical inputs. In particular, government initiatives aimed at bolstering domestic production capabilities have spurred investments in local manufacturing and R&D infrastructure. These policy shifts, coupled with the emergence of stricter performance standards in seismic zones and harsh climates, are collectively reshaping the competitive arena. Industry participants who can navigate these evolving requirements by offering compliant, high-performance sealant solutions are poised to capture the next wave of market growth.

Analyzing the Cumulative Effects of 2025 United States Trade Tariffs on Raw Material Costs, Supply Chain Dynamics, and Competitive Positioning

The implementation of new United States tariff measures in 2025 has generated a profound ripple effect across the construction sealant supply chain. Tariffs imposed on key raw materials such as specialty polymers, crosslinkers, and additives have elevated input costs, prompting suppliers to reassess sourcing strategies. In response, several manufacturers have pursued nearshoring initiatives and forged strategic partnerships with domestic chemical producers to mitigate exposure to escalating import duties. This strategic pivot underscores a broader trend toward supply chain resilience and localized production.

Moreover, the heightened cost structure induced by tariffs has compelled downstream stakeholders to explore formulation adjustments and alternative chemistries. For instance, certain sealant manufacturers have intensified R&D efforts to develop high-performance MS polymer blends that deliver equivalent durability at a lower raw material cost basis. While these innovations have shown promise, they also necessitate rigorous performance validation to ensure compliance with industry standards and application requirements.

Furthermore, the cumulative effect of tariff-driven cost pressures has intensified competitive tensions within the market. Established global players with diversified supply chains are leveraging economies of scale to absorb duty fluctuations, while smaller regional manufacturers are seeking niche specializations to differentiate their offerings. This dynamic environment has reinforced the importance of strategic procurement, collaborative supplier relationships, and proactive cost management to safeguard margin profiles and maintain competitive positioning.

Unveiling Deep Dive Segmentation Perspectives Spanning Product Types, Application Areas, End Uses, and Technological Configurations for Construction Sealants

When dissecting the market through a product-type lens, an intricate spectrum of chemistries emerges encompassing acrylic, MS polymer, polysulfide, polyurethane, and silicone technologies. Acrylic sealants are further differentiated into solvent-based and water-based variants, each suited to specific environmental conditions and performance benchmarks. Water-based acrylics have gained traction due to their low VOC content and ease of application, while solvent-based formulations continue to excel in demanding exterior joint sealing applications. Within the polyurethane domain, segmentation into high-modulus and low-modulus grades highlights a balance between movement accommodation and structural support, with high-modulus systems frequently specified for load-bearing façade joints and low-modulus for general-purpose gap filling.

Transitioning to application insights, glazing systems remain a dominant use case, leveraging silicone and hybrid MS technologies to ensure airtight, weather-resistant seals in curtain walls and storefront assemblies. Joints and gaps applications account for a wide array of scenarios from perimeter sealing in tilt-up concrete panels to expansion joint management in road bridges, where polysulfide formulations maintain elasticity over extensive movement cycles. Roofing sealants, typically based on polyurethane or silicone chemistries, must endure constant UV exposure and thermal cycling, whereas waterproofing adhesives tailored for subterranean and wet-area installations demand specialized curing profiles and adhesion to diverse substrates.

Evaluating end-use drivers reveals that commercial construction fuels demand for high-performance sealants that deliver long-term reliability and aesthetic consistency, particularly in large-scale retail and office developments. Industrial end-use applications prioritize chemical resistance and heavy-duty durability, exemplified by sealants used in petrochemical and manufacturing facilities. Infrastructure projects, encompassing bridges, tunnels, and transit systems, rely on polysulfide and high-modulus polyurethanes to withstand environmental stressors and dynamic loads. Residential segments often favor user-friendly one-component technologies that facilitate rapid installation and minimal maintenance, balancing cost efficiency with acceptable long-term performance.

Finally, technology segmentation distinguishes one-component systems, valued for ease of use and reduced labor complexities, from two-component formulations that deliver superior mechanical strength and accelerated cure profiles. While one-component sealants dominate general-purpose applications, two-component solutions are steadily expanding into premium market niches where higher chemical resistance and enhanced durability justify the additional application steps.

This comprehensive research report categorizes the Construction Sealants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End Use

Illuminating Key Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets Impacting Construction Sealant Demand and Adoption

Regional analysis underscores pronounced contrasts in adoption patterns and regulatory environments across three major geographies. In the Americas, strong renovation and retrofitting activities in North America have fueled demand for low-emission, water-based sealants that align with stringent state-level environmental standards. Meanwhile, Latin American markets are witnessing accelerated infrastructure investments in transportation and energy sectors, driving growth opportunities for high-performance joint sealing solutions that can tolerate harsh climatic conditions and limited maintenance intervals.

Across Europe, the Middle East, and Africa, environmental compliance and green building initiatives have catalyzed the advancement of eco-friendly formulations. The European Union’s Emissions Trading System and national VOC regulations have propelled manufacturers to prioritize neutral-cure silicones and hybrid polymer technologies. In the Middle East, rapid urbanization and landmark construction projects have increased demand for UV-stable sealants capable of withstanding intense solar exposure, while Africa’s emerging markets are beginning to integrate quality sealant standards into public infrastructure development plans.

In the Asia-Pacific region, urbanization and industrialization continue to drive robust demand for both residential and infrastructure applications. Rapid expansion in commercial real estate across China, India, and Southeast Asia has elevated the need for reliable glazing and façade sealants. Simultaneously, infrastructure megaprojects are generating significant uptake of polysulfide and two-component polyurethane systems designed for large-scale bridge and tunnel sealing. This region’s emphasis on cost-effective local manufacturing combined with international joint ventures has resulted in a dynamic landscape where innovation and scalability converge.

This comprehensive research report examines key regions that drive the evolution of the Construction Sealants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Construction Sealant Manufacturers Highlighting Strategic Initiatives, Innovations, and Competitive Differentiators Driving Market Leadership

Leading participants in the construction sealant arena have advanced differentiated strategies to fortify their market positions. Global chemical conglomerates continue to leverage extensive R&D infrastructures to introduce next-generation hybrid polymers that bridge the performance gap between silicones and polyurethanes. Concurrently, specialized regional producers are carving out niches by focusing on tailored formulations for seismic-designated zones or extreme temperature environments.

Strategic collaborations and acquisitions have further reshaped competitive contours. Major players have acquired specialty adhesive startups to enhance their product portfolios and expedite entry into high-growth application segments such as modular construction and E-mobility battery enclosures. Investments in pilot plants and dual-use manufacturing lines reflect a concerted effort to secure supply of critical raw materials while maintaining flexibility to respond rapidly to market shifts.

Innovation pipelines are also enriched through cross-industry partnerships. For example, alliances between sealant manufacturers and facade engineering firms have yielded integrated sealing solutions optimized for unitized curtain wall systems. Similarly, digital label technologies that embed QR codes on sealant cartridges enable real-time traceability and application guidance, exemplifying how leading suppliers are embracing the Internet of Things to add value beyond traditional product offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Sealants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Accumetric Silicones Pvt. Ltd.

- American Sealants Inc.

- Arkema Group

- Astral Adhesives

- BASF SE

- Coastal Construction Products

- Compagnie de Saint-Gobain

- Dow Chemical Company

- Elkem ASA

- General Electric Company

- H.B. Fuller Company

- Hardex Corporation

- Henkel Corp.

- HP Adhesives Limited

- IKK Group

- Mapei Construction Products India Pvt. Ltd.

- Pecora Corporation

- Pidilite Industries Limited

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Sprayon

- UKFS Group Ltd.

- Wacker Chemie AG

- Wolf Group OÜ

Strategic Actionable Recommendations Empowering Industry Leaders to Navigate Emerging Trends, Optimize Operations, and Capitalize on Growth Opportunities in Construction Sealants

Industry leaders should prioritize accelerated investment in low-emission, sustainable sealant chemistries to meet tightening environmental regulations and growing customer demand for green building credentials. By integrating bio-based raw materials and reducing solvent content, companies can differentiate their portfolios and secure early mover advantages in Eco-certified project pipelines.

Additionally, developing robust back-integration strategies or strategic partnerships with domestic polymer producers can mitigate the volatility associated with international trade tariffs. This approach enhances supply chain resilience and fosters collaborative innovation in raw material formulations. Complementing this, digitalization of quality management-from specification through installation-can drive operational efficiencies and reduce on-site rework, ultimately bolstering contractor satisfaction and repeat business.

Finally, cultivating cross-functional alliances with architects, façade consultants, and construction technology providers can position sealant manufacturers as strategic advisors rather than commodity suppliers. Through joint pilot programs and co-developed application protocols, organizations can solidify long-term relationships, accelerate specification cycles, and capture incremental revenue streams via service-based offerings such as training, inspection, and certification.

Detailing a Robust Multimethod Research Methodology Combining Qualitative Insights, Quantitative Analysis, and Expert Validation Processes for Rigorous Market Understanding

This analysis is grounded in a multimodal research methodology that integrates primary expert interviews, extensive secondary data synthesis, and rigorous quantitative validation. Initially, qualitative insights were garnered through in-depth discussions with chemical engineers, application specialists, and procurement leaders spanning global markets. These interviews provided firsthand perspectives on performance requirements, sourcing challenges, and emerging application opportunities.

Subsequently, a systematic review of technical white papers, regulatory filings, and patent databases informed the competitive benchmarking and innovation assessment. Core performance attributes and compliance thresholds were compiled to evaluate each product segment against industry standards. Quantitative data points from publicly accessible financial reports and industry association publications were triangulated to validate emerging trends and adoption rates across geographic regions.

Finally, the findings were subjected to a structured expert validation process involving a panel of third-party consultants and end-user representatives. This step ensured that strategic recommendations align with real-world application dynamics and anticipated market shifts. The resulting framework delivers a comprehensive, actionable understanding of the construction sealant ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Sealants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Sealants Market, by Product Type

- Construction Sealants Market, by Technology

- Construction Sealants Market, by Application

- Construction Sealants Market, by End Use

- Construction Sealants Market, by Region

- Construction Sealants Market, by Group

- Construction Sealants Market, by Country

- United States Construction Sealants Market

- China Construction Sealants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Insights Emphasizing Key Findings, Strategic Imperatives, and Future Outlook for Stakeholders in the Construction Sealant Ecosystem

In conclusion, the construction sealant sector stands at the nexus of innovation and regulation, driven by the imperatives of sustainability, supply chain resilience, and performance excellence. Key takeaways include the rapid adoption of low-emission water-based and neutral-cure formulations, the strategic realignment of raw material sourcing in response to tariff pressures, and the growing significance of digital integration throughout project lifecycles.

Stakeholders equipped with these insights can proactively adapt to shifting technical standards and regulatory landscapes, enhance collaboration across value chains, and develop strategic roadmaps that capture emerging growth avenues. Ultimately, success will hinge on the ability to balance cutting-edge product development with agile operational frameworks, ensuring that sealant solutions continue to protect and elevate the built environment under ever-evolving conditions.

Connect With Ketan Rohom, Associate Director of Sales & Marketing, to Secure Your Comprehensive Construction Sealant Market Research Report Today

To gain a deeper competitive edge and unlock the comprehensive insights contained within this report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who is poised to guide you through the wealth of actionable data and strategic guidance tailored to your organization’s needs. By connecting with Ketan, you can discuss bespoke research packages, secure exclusive access to the latest findings, and explore customized extensions such as in-depth regional deep dives, technology spotlight analyses, and executive workshops. Don’t miss this opportunity to transform your approach to the construction sealant market; contact Ketan today to ensure your team can swiftly implement the critical learnings and maintain leadership in an evolving competitive landscape.

- How big is the Construction Sealants Market?

- What is the Construction Sealants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?