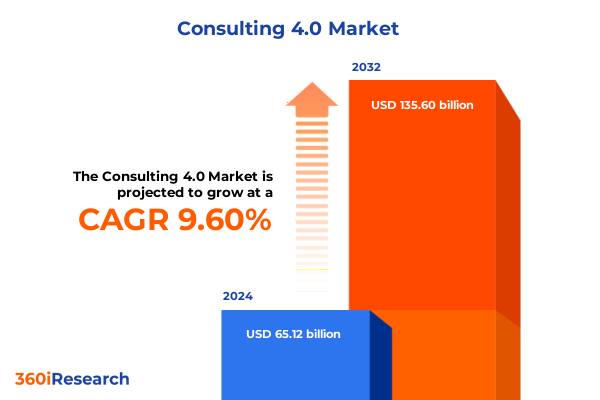

The Consulting 4.0 Market size was estimated at USD 71.45 billion in 2025 and expected to reach USD 77.78 billion in 2026, at a CAGR of 9.58% to reach USD 135.60 billion by 2032.

Establishing the Foundations for Consulting 4.0 in a Rapidly Evolving Business Environment Driven by Technological Disruption and Increasing Client Demands

The rapid convergence of digital technologies, shifting client expectations, and evolving regulatory landscapes has ushered in a new phase of consulting maturity often referred to as Consulting 4.0. In this era, traditional advisory models are being redefined by the pervasive influence of artificial intelligence, advanced analytics, and automated workflows that augment human expertise. Organizations seeking guidance now demand more than high‐level strategic frameworks; they require ecosystem‐aware partners capable of delivering end‐to‐end solutions that drive measurable business outcomes.

Against this backdrop, the imperative for consulting firms is to craft integrated offerings that align agile methodologies with next‐generation platforms, enabling rapid iteration and continuous value delivery. Stakeholders no longer accept siloed insights; they seek holistic roadmaps informed by real‐time intelligence across multiple dimensions of the business. Consequently, consulting practices must embed cross‐functional collaboration, leverage scalable digital infrastructure, and cultivate talent equipped to navigate the complexities of Industry 4.0.

This executive summary provides a concise overview of the transformative shifts influencing consulting services, examines the ripple effects of recent United States tariff policies on global supply chains, and distills strategic recommendations for industry leaders. Through a rigorous segmentation lens and regional analysis, this document illuminates the critical considerations and actionable pathways for organizations intent on thriving in the Consulting 4.0 landscape.

Uncovering the Critical Transformative Forces Reshaping Consulting Practices Through Digital Innovation and Agile Frameworks Suited for Modern Enterprises

Consulting practices are experiencing seismic shifts driven by digital acceleration and the proliferation of data at unprecedented volumes. Digital innovation is no longer an optional enabler; it has become the core of value creation, empowering firms to synthesize vast datasets into predictive insights. Simultaneously, stakeholder expectations have matured beyond periodic strategic advisories to demand continuous, data‐driven engagement models that deliver tangible performance improvements.

Another force propelling change is the integration of agile frameworks within traditional waterfall environments. This blending of methodologies fosters adaptive planning, iterative development cycles, and timely feedback loops that heighten responsiveness to market fluctuations. It also underscores the necessity for multidisciplinary teams capable of weaving technical acumen with functional domain expertise.

Finally, the emergence of ecosystem partnerships is reshaping competitive dynamics. Consulting firms are forging alliances with technology vendors, academic institutions, and niche specialists to co‐innovate solutions and extend their service portfolios. These collaborations not only accelerate go‐to‐market capabilities but also diversify risk and enhance intellectual capital. As a result, the consulting landscape is evolving into a network of interconnected players, each contributing distinct competencies to deliver compounded value.

Analyzing the Far Reaching Cumulative Consequences of 2025 United States Tariffs on Technology Supply Chains and Stakeholder Strategies Across Industries

The introduction of comprehensive United States tariffs in 2025 has imparted a series of cascading effects on supply chain resilience and cost structures within the technology sector. Initially aimed at safeguarding domestic manufacturing, these measures prompted enterprises to reassess sourcing strategies and reevaluate supplier portfolios. Organizations that had optimized for cost efficiency found themselves confronting elevated input prices, while those with diversified manufacturing footprints were better positioned to absorb incremental duties.

As trade barriers tightened, procurement teams accelerated the adoption of nearshoring and reshoring initiatives, seeking to reduce import dependencies and mitigate exposure to punitive levies. This strategic pivot also spurred investment in automation and digital twins to bolster operational agility in newly established facilities. However, the transition introduced its own complexities, including talent redeployment challenges and the necessity for advanced workforce training.

Moreover, downstream stakeholders experienced a ripple effect as component and subassembly costs filtered through value chains, prompting end‐user industries to explore alternative materials and design innovations. Concurrently, consulting advisors have been called upon to guide scenario planning efforts and model the long‐term impacts of evolving tariff regimes on both capital allocation and revenue trajectories. The cumulative influence of these shifts underscores the vital role of data‐driven decision frameworks in navigating geopolitical uncertainties.

Revealing the Deep Insights from Multidimensional Market Segmentation Spanning Product Types, Applications, End Users, Channels, and Technology Layers

An in‐depth examination of market segmentation reveals nuanced growth drivers across diverse product categories and user contexts. Within the product spectrum, smartphones warrant distinction between entry‐level devices that prioritize affordability, midrange offerings balancing performance and cost, and high‐end models equipped with cutting‐edge features. Tablets bifurcate into business‐oriented variants optimized for collaboration and productivity, and consumer models designed for entertainment and personal convenience. Wearable technologies similarly diverge into fitness bands tailored for health metrics tracking and smartwatches that integrate advanced sensor arrays and communication capabilities.

When considering application contexts, the automotive sector has bifurcated into infotainment systems aimed at enhancing passenger experience and telematics solutions focused on vehicle diagnostics and fleet management. Consumer electronics span audio devices prized for immersive soundscapes and television platforms that deliver next‐generation streaming and interactivity. In healthcare, diagnostic tools are revolutionizing patient assessment while therapeutic devices promise more personalized treatment modalities. Industrial applications encompass automation systems driving manufacturing efficiency and monitoring platforms ensuring process compliance and safety.

End users further stratify into large enterprises with complex multiregional operations and small to medium businesses characterized by leaner infrastructure needs. Government end use splits across federal agencies with stringent compliance directives and local authorities prioritizing community services. Distribution channels oscillate between offline pathways leveraging established distribution partners and retail outlets, and online portals encompassing direct brand websites and third‐party e-commerce marketplaces. Finally, technology divides between wired infrastructures offering consistent throughput and wireless solutions leveraging cellular networks for wide coverage and Wi-Fi for localized connectivity.

This comprehensive research report categorizes the Consulting 4.0 market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Distribution Channel

Examining the Strategic Regional Dynamics and Growth Patterns Across the Americas, Europe Middle East Africa, and the Asia Pacific Market Ecosystems

Regional dynamics continue to shape strategic imperatives as organizations calibrate their go‐to‐market approaches across distinct economic zones. In the Americas, advanced North American markets emphasize ecosystem partnerships and sustainability mandates, while Latin American economies are navigating digital infrastructure investments and emerging consumer adoption trends. Corporate players in this region prioritize operational resilience, integrating localized supplier networks to counteract tariff pressures and ensure supply continuity.

Over in Europe, Middle East, and Africa, regulatory heterogeneity presents both opportunities and challenges. Developed European nations lead in regulatory frameworks favoring digital trust and data sovereignty, whereas Middle Eastern economies accelerate diversification through technology hubs and innovation zones. African markets are witnessing the proliferation of mobile‐first solutions driven by high smartphone penetration, with entrepreneurs harnessing fintech and telemedicine to address underserved populations. Cross‐regional collaboration initiatives further enable knowledge transfer and joint ventures.

Meanwhile, the Asia‐Pacific region remains a nexus of manufacturing prowess and rapid digital adoption. East Asian powerhouses continue to advance semiconductor and display technologies, while Southeast Asian markets focus on cloud infrastructure scaling and fintech innovation. Oceania’s business landscape balances mature digital ecosystems with a preference for security‐centric service providers. Taken together, these regional insights highlight the imperative for tailored market entry strategies that respect local conditions and regulatory nuances.

This comprehensive research report examines key regions that drive the evolution of the Consulting 4.0 market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Their Strategic Initiatives Driving Innovation, Partnerships, and Competitive Advantage in the Technology Consulting Arena

Leading companies are redefining competitive thresholds through strategic investments in intellectual property, partnerships, and capability building. Some incumbents have established specialized digital studios that incubate solution prototypes, enabling rapid pilot deployments within client environments. Others have formalized alliances with cybersecurity firms to enhance trust frameworks, ensuring that data protection measures are integrated into every layer of the consulting engagement.

A subset of innovators is leveraging open‐source communities and developer ecosystems to co‐create modular platforms that accelerate client implementation timelines. These modular assets, when combined with proprietary analytics engines, deliver scalable insights across multiple function areas-from finance transformation to supply chain optimization. In parallel, certain challengers are focusing on sectoral depth, building practice units dedicated to verticals such as renewable energy, life sciences, and advanced manufacturing.

Talent strategies among these firms often feature dedicated academies and rotational programs designed to produce hybrid consultants fluent in both domain expertise and technology fluency. This dual emphasis enhances client trust and supports the deployment of complex solutions. Collectively, these company strategies underscore the importance of an ecosystem-centric mindset, where collaboration, platform thinking, and continuous learning accelerate innovation cycles and underpin sustainable differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Consulting 4.0 market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.T. Kearney

- Accenture plc

- Bain & Company

- Booz Allen Hamilton Inc.

- Boston Consulting Group

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- Ernst & Young Global Limited

- IBM Corporation

- Infosys Limited

- KPMG International Limited

- L.E.K. Consulting

- McKinsey & Company

- Oliver Wyman

- PricewaterhouseCoopers International Limited

- Roland Berger

- Tata Consultancy Services Limited

- Wipro Limited

Delivering Actionable Recommendations to Empower Industry Leaders with Practical Roadmaps, Tactics, and Strategic Guidance for Thriving in Consulting 4.0

Industry leaders should prioritize the establishment of cross‐disciplinary innovation labs that integrate data scientists, industry specialists, and client liaisons to co-develop tailored solutions. By embedding these labs within client ecosystems, organizations can iteratively validate hypotheses, de-risk pilot programs, and accelerate time to value. Moreover, leaders must allocate budgetary headroom for experimental proofs of concept, ensuring that high-potential technologies such as generative artificial intelligence and robotic process automation receive structured evaluation.

Another critical recommendation is to architect consulting methodologies around modular delivery models. These frameworks enable flexible engagement scopes, allowing clients to adopt discrete service components based on readiness levels and budget constraints. Such an approach reduces entry barriers for emerging clients and fosters incremental adoption pathways that build toward comprehensive transformation projects.

Finally, establishing robust change management and upskilling initiatives is essential. Industry leaders should design continuous learning curricula that blend on-the-job rotations with targeted certifications in digital disciplines. This not only fortifies workforce resilience but also reinforces the firm’s brand as a talent magnet in a competitive market. Coordinated communication plans will ensure that internal stakeholders remain aligned on strategic priorities and that clients experience a seamless journey from advisory to implementation.

Outlining the Rigorous Multi Stage Research Methodology Employed to Ensure Credibility, Data Integrity, and Insight Validity for Market Analysis

The research underpinning this analysis adhered to a multi-stage methodology designed to ensure both breadth and depth of insight. The initial phase involved an exhaustive landscape scan leveraging proprietary databases and public disclosures to map out technology investments, partnership ecosystems, and regulatory changes. This foundational work was complemented by expert interviews with senior executives, enabling the triangulation of quantitative data with firsthand perspectives on emerging challenges and opportunities.

Subsequently, the study employed thematic coding techniques to distill key patterns from qualitative inputs, ensuring that anecdotal insights were rigorously validated against documented trends. Advanced analytics tools were then utilized to identify correlations between external variables-such as trade policy shifts-and internal performance metrics across leading organizations. These findings were stress-tested through scenario planning workshops, incorporating sensitivity analyses to account for potential market perturbations.

Throughout the process, strict data governance protocols were enforced to preserve confidentiality and guarantee the integrity of source materials. Cross-functional review committees provided oversight at each stage, ensuring methodological consistency and mitigating bias. The cumulative effect is a robust framework that marries empirical evidence with strategic foresight, equipping decision makers with reliable, actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Consulting 4.0 market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Consulting 4.0 Market, by Product Type

- Consulting 4.0 Market, by Technology

- Consulting 4.0 Market, by Application

- Consulting 4.0 Market, by End User

- Consulting 4.0 Market, by Distribution Channel

- Consulting 4.0 Market, by Region

- Consulting 4.0 Market, by Group

- Consulting 4.0 Market, by Country

- United States Consulting 4.0 Market

- China Consulting 4.0 Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing the Pivotal Findings and Strategic Implications That Define the Future Trajectory of Consulting Services Amid Technological Transformation

This executive summary has articulated the critical inflection points redefining consulting services in an era marked by technological acceleration and geopolitical volatility. By examining the transformative forces of digital innovation and agile frameworks, it outlined how firms can respond to evolving client demands with data-driven, modular delivery models. The analysis of 2025 tariff policies underscored the necessity of supply chain diversification and scenario planning to safeguard business continuity.

Through a rigorous segmentation lens, the report revealed the diverse needs of product categories, application contexts, and end-user segments, while regional insights highlighted the distinct regulatory and infrastructure dynamics at play in the Americas, EMEA, and Asia-Pacific. Leading companies were profiled for their ecosystem-centric strategies, and actionable recommendations were proposed to help organizations establish innovation labs, modular methodologies, and continuous learning platforms.

Collectively, these findings affirm that the future of consulting hinges on an integrated approach that bridges technology, talent, and methodology. By harnessing these insights, decision makers are better positioned to architect resilient strategies, capture emerging opportunities, and secure sustainable competitive advantage in the Consulting 4.0 landscape.

Engage with Associate Director Ketan Rohom to Acquire Comprehensive Market Intelligence and Tailored Insights That Drive Strategic Decision Making

If your organization is poised to leverage the insights uncovered in this report, engage directly with Associate Director Ketan Rohom to secure comprehensive market intelligence tailored to your strategic imperatives. By partnering with Ketan, stakeholders gain personalized briefings, deep-dive consultations, and ongoing advisory support designed to translate complex data into actionable roadmaps. This engagement ensures that decision makers are equipped with the nuanced context required to navigate disruptive forces, optimize investment priorities, and outmaneuver competition. Reach out today to transform insights into impact with a bespoke service calibrated to your unique challenges and growth ambitions.

- How big is the Consulting 4.0 Market?

- What is the Consulting 4.0 Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?