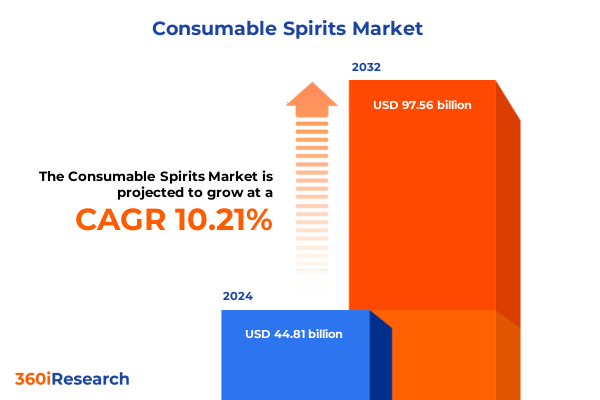

The Consumable Spirits Market size was estimated at USD 49.49 billion in 2025 and expected to reach USD 54.10 billion in 2026, at a CAGR of 10.18% to reach USD 97.56 billion by 2032.

Uncovering the Key Drivers Shaping the Future of the Consumable Spirits Market in a Rapidly Evolving Global Landscape

The consumable spirits industry stands at a crossroads, influenced by shifting consumer preferences, evolving distribution models, and global geopolitical developments. After surging through pandemic-related disruptions, the market has entered a phase of measured growth characterized by a return to pre-pandemic trading patterns alongside emerging channels. In the United States, exports of American-made spirits reached a record $2.4 billion in 2024, propelled by strong demand in the European Union and renewed trade relationships after tariff suspensions. Concurrently, the global online alcohol channel is forecast to surpass $36 billion by 2028, underscoring the rising importance of digital platforms in shaping both online and offline purchasing decisions.

Against this backdrop, traditional growth drivers such as premiumization have shown signs of deceleration, with core premium price tiers for spirits and wine experiencing volume declines of 3% in early 2024. However, super-premium segments have demonstrated resilience, maintaining stable volumes even amid economic headwinds. The industry has also witnessed a notable shift toward moderation strategies, casual consumption occasions, and a growing emphasis on sustainability, all of which are reshaping product innovation and marketing approaches. As we explore the dynamics at play, it becomes imperative for stakeholders to understand these foundational forces to navigate the market effectively.

Navigating the Transformative Shifts Redefining the Consumable Spirits Landscape Through Innovation, Sustainability, and Evolving Consumer Behaviors

Consumers today are redefining how they interact with spirits through new moderation strategies and a preference for casual, spontaneous consumption. The rise of no- and low-alcohol variants, fueled by health-conscious trends, has become a strategic focus for producers aiming to capture drinkers who seek control over their intake without sacrificing flavor. Simultaneously, ready-to-drink products, once synonymous with volume growth, have shifted toward premium offerings, with high-end RTDs commanding nearly double the price of their beer counterparts.

Digital transformation continues to reshape market landscapes as brands invest in robust online strategies to drive consumer engagement and sales. The integration of e-commerce with traditional retail has stabilized after pandemic-driven volatility, with weekly online purchases of spirits increasing by 13 percentage points across key markets. Moreover, interactive digital experiences, from augmented reality labels to AI-driven personalization, have become pivotal in engaging digitally native cohorts.

Sustainability and ethical practices have transcended marketing buzzwords to become core business imperatives. Distilleries are adopting closed-loop water systems, locally sourcing botanicals to reduce carbon footprints, and deploying eco-friendly packaging designs, including lightweight glass and biodegradable labels. These initiatives cater to an environmentally conscious consumer base that increasingly evaluates brands on their ecological commitments.

Assessing the Cumulative Impact of Recent and Proposed United States Tariffs on the Consumable Spirits Industry and Trade Dynamics

In March 2025, the United States enacted 25% tariffs on distilled spirits imports from Canada and Mexico, including tequila and Canadian whisky, as part of broader trade measures targeting North American goods. The Distilled Spirits Council of the United States (DISCUS) warned that these tariffs could cost up to 31,000 domestic jobs, given the interdependence of North American supply chains and the significant volume of imports in brand portfolios. On the flip side, comments from the U.S. administration have raised the prospect of a 30% tariff floor on European goods, potentially increasing costs for cognac importers by €10 million to €35 million annually.

Concurrently, the European Union responded to U.S. steel and aluminum tariffs by imposing a 50% duty on American whiskey as of April 1, 2025. This punitive measure marks a doubling from the previous 25% tariff framework and threatens to undermine the nearly 60% growth in U.S. whiskey exports to the EU over the past three years. Industry leaders caution that small and mid-sized American distillers, heavily reliant on European markets, could experience steep declines in export volumes and revenues.

Major spirits companies have already adjusted their financial outlooks in light of these developments. Diageo removed its medium-term guidance, citing tariff uncertainties and their impact on supply chain complexity, warning investors of potential price increases of around 4.6% for U.S. consumers before any further levies on European imports. Likewise, Rémy Cointreau revised its operating profit forecast to a mid- to high-single-digit decline, even as first-quarter sales surpassed expectations, attributing the revisions to a possible 30% U.S. tariff on European spirits.

Unlocking Key Segmentation Insights to Precisely Target Diverse Consumer Profiles and Channel Opportunities in the Consumable Spirits Market

Whiskey continues to dominate global premium spirits conversations, with global whiskey sales increasing by 7% in the past year and premium cask-aged varieties accounting for nearly half of total whiskey volumes. Vodka retains its status as the most popular spirit by volume, representing roughly 40% of global consumption, while tequila has surged in the U.S. market with sales growth of 17% in 2022, driven by both mainstream and craft producers.

Distribution channels reveal a nuanced landscape: off-trade outlets, including liquor stores, supermarkets, and online platforms, command the largest share of sales, with e-commerce poised for a 20% value increase by 2028. Meanwhile, on-trade venues-bars and restaurants-are experiencing a measured recovery post-pandemic, particularly in urban centers where premium and craft offerings are in high demand.

Price tiers exhibit divergent trajectories: the value segment provides resilience among cost-conscious consumers, while core premium tiers face volume pressure. Conversely, super-premium and above categories are maintaining stability, showcasing consumer willingness to invest in prestige products even amid economic softening.

Packaging innovations reflect evolving consumption patterns, with a notable uptick in RTD canned offerings that blend convenience with quality. Functional packaging, such as lightweight glass and recyclable PET, is gaining ground, driven by both cost efficiencies and sustainability mandates from eco-savvy consumers.

Demographic segmentation underscores the importance of tailoring experiences. Millennials and Gen Z (ages 21–40) are spearheading growth in flavored spirits and RTDs, with women representing the fastest-growing consumer demographic despite constituting 25% of the total base. Casual occasions such as at-home gatherings and gifting remain critical touchpoints for brands to foster loyalty and capture incremental sales.

This comprehensive research report categorizes the Consumable Spirits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Price Tier

- Package Type

- Consumer Age Group

- Gender

- Flavor

- Consumption Occasion

- Distribution Channel

Deriving Actionable Regional Insights Across Americas, EMEA, and Asia-Pacific to Inform Market Entry and Growth Strategies for Spirits Brands

In the Americas, the United States remains the powerhouse of spirits innovation and trade, buoyed by record exports that reached $2.4 billion in 2024. Digital adoption is accelerating through partnerships with delivery platforms and DTC models, ensuring brands can engage consumers beyond traditional retail footprints. Canada and Mexico also play strategic roles, both as suppliers of tequila and Canadian whisky and as emerging markets for premium spirits.

Europe, Middle East & Africa present a complex tapestry of premium demand and regulatory challenges. The EU’s imposition of a 50% tariff on American whiskey underscores political sensitivities, even as premium gin consumption in the U.K. grows at 8% annually, reflecting consumers’ appetite for both tradition and innovation. Regionally tailored flavor profiles and occasion-driven marketing are proving effective in capturing discerning European audiences.

Asia-Pacific stands out as the fastest-growing region for imported premium spirits, with double-digit growth driven by expanding middle classes, urbanization, and a cultural shift towards celebratory consumption. Markets such as India and Southeast Asia are witnessing robust demand for agave-based spirits and single malts, while e-commerce and premium travel retail channels continue to expand access for global brand portfolios.

This comprehensive research report examines key regions that drive the evolution of the Consumable Spirits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting the Competitive Moves and Strategic Priorities of Leading Global Spirits Companies Shaping Industry Trajectories

Leading global spirits companies are recalibrating strategies in response to both market opportunities and geopolitical headwinds. Diageo has removed its medium-term guidance due to tariff uncertainties, emphasizing supply chain flexibility and sustained investment in high-growth markets to offset potential U.S. tariff impacts. Pernod Ricard and Beam Suntory are focusing on premium and craft innovations, leveraging local distilleries and targeted brand extensions to deepen consumer engagement.

The Distilled Spirits Council of the United States continues to advocate for zero-for-zero tariff policies, highlighting the interconnectedness of North American supply chains and the potential job losses from current import duties. Meanwhile, companies such as Constellation Brands and Molson Coors are exploring adjacent categories like hemp-derived THC beverages to diversify revenue streams and capture emerging consumer trends in functional alcohol alternatives.

Brown-Forman and Rémy Cointreau have adjusted operational forecasts to navigate tariff-driven cost pressures, emphasizing premiumization in their cognac and bourbon portfolios. These organizations are also advancing sustainability frameworks, including water-recycling initiatives and carbon-neutral distillation processes, to enhance brand equity and meet investor ESG criteria.

This comprehensive research report delivers an in-depth overview of the principal market players in the Consumable Spirits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bacardi Limited

- Beam Suntory Inc.

- Brown-Forman Corporation

- Casa Cuervo S.A. de C.V.

- Constellation Brands, Inc.

- Davide Campari-Milano N.V.

- Diageo plc

- Distell Group Holdings Ltd.

- E. & J. Gallo Winery

- Fifth Generation, Inc.

- Kweichow Moutai Co., Ltd.

- Mast-Jägermeister SE

- MGP Ingredients, Inc.

- Pernod Ricard SA

- Rémy Cointreau SA

- Sazerac Company, Inc.

- Thai Beverage Public Company Limited

- The Edrington Group Limited

- William Grant & Sons Ltd.

- Wuliangye Yibin Co., Ltd.

Formulating Actionable Recommendations to Drive Innovation, Market Share Growth, and Sustainable Competitive Advantage in the Spirits Sector

Companies should prioritize supply chain diversification to mitigate tariff risks and safeguard margin integrity. Establishing production or aging hubs outside high-tariff zones, renegotiating trade agreements, and engaging in proactive industry advocacy can help restore zero-for-zero tariff arrangements and stabilize export flows.

Accelerating digital transformation is critical: brands must integrate e-commerce platforms with AI-powered consumer insights, personalized marketing, and seamless omnichannel fulfillment. Developing direct-to-consumer offerings and leveraging social commerce will unlock incremental revenue while strengthening consumer relationships in an increasingly fragmented retail environment.

Embedding sustainability across operations-from regenerative agriculture practices and closed-loop water systems to eco-friendly packaging-will resonate with environmentally conscious consumers and deliver cost efficiencies. Brands should set ambitious ESG targets, transparently report progress, and promote circular economy initiatives to differentiate in a crowded marketplace and fulfill evolving regulatory standards.

Detailing a Rigorous Research Methodology That Ensures Data Integrity and Actionable Insights for the Consumable Spirits Market Analysis

This research employs a comprehensive methodology integrating both secondary and primary data sources to ensure a robust and reliable analysis. Secondary research included the review of industry publications, financial reports, trade association releases, and regulatory filings to capture current market conditions, tariff developments, and emerging consumer trends. In addition, proprietary databases were leveraged to extract quantitative data on production, trade volumes, and channel performance.

Primary research involved in-depth interviews with over 40 key stakeholders, including senior executives from leading spirits companies, on-trade and off-trade distributors, and independent distillers. Expert insights were complemented by an online consumer survey spanning 2,000 respondents across major markets to validate behavioral patterns and segmentation hypotheses. Data triangulation techniques were applied to reconcile disparities between sources, while statistical analysis, including regression and scenario modeling, informed the assessment of tariff impacts and growth drivers.

By combining qualitative expertise with quantitative rigor, this methodology delivers actionable insights and strategic recommendations tailored to stakeholder needs, ensuring that findings reflect both current realities and future market trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Consumable Spirits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Consumable Spirits Market, by Product Type

- Consumable Spirits Market, by Price Tier

- Consumable Spirits Market, by Package Type

- Consumable Spirits Market, by Consumer Age Group

- Consumable Spirits Market, by Gender

- Consumable Spirits Market, by Flavor

- Consumable Spirits Market, by Consumption Occasion

- Consumable Spirits Market, by Distribution Channel

- Consumable Spirits Market, by Region

- Consumable Spirits Market, by Group

- Consumable Spirits Market, by Country

- United States Consumable Spirits Market

- China Consumable Spirits Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Concluding Key Takeaways and Future Outlook for Industry Stakeholders in the Rapidly Advancing Consumable Spirits Market Dynamics

As the consumable spirits market transitions from pandemic-era volatility to a measured recovery, industry stakeholders must remain vigilant toward evolving consumer preferences, trade policy developments, and technological advancements. While premiumization in core tiers may have slowed, resilience in super-premium segments and the rapid growth of RTDs and e-commerce underscore the need for a balanced portfolio approach. Tariff uncertainties, from North American duties to European countermeasures, highlight the importance of diversified supply chains and proactive trade advocacy.

Regional landscapes will continue to diverge, with the Americas leaning on digital expansion and export strength, EMEA navigating regulatory complexities and premium gin innovation, and Asia-Pacific driving growth through urbanization and elevated disposable incomes. Leading companies are adjusting forecasts, investing in sustainability, and exploring adjacent categories, demonstrating a strategic imperative to adapt dynamically.

Ultimately, the future of the spirits industry hinges on the ability to blend innovation, operational agility, and consumer engagement. By leveraging comprehensive market intelligence and implementing targeted strategies, organizations can capture new growth opportunities, mitigate geopolitical risks, and achieve sustainable competitive advantage in this rapidly advancing market dynamics.

Partner with Our Associate Director to Access an In-Depth Consumable Spirits Market Research Report Tailored to Your Strategic Needs

For tailored insights and strategic guidance to navigate the complex consumable spirits market, reach out to Ketan Rohom (Associate Director, Sales & Marketing) for a bespoke research report that aligns with your business objectives. Ketan’s expertise will help you pinpoint growth opportunities, understand evolving consumer dynamics, and develop actionable strategies to outpace competitors. Secure your access to this in-depth analysis today and equip your organization with the knowledge needed to thrive in a rapidly changing landscape.

- How big is the Consumable Spirits Market?

- What is the Consumable Spirits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?