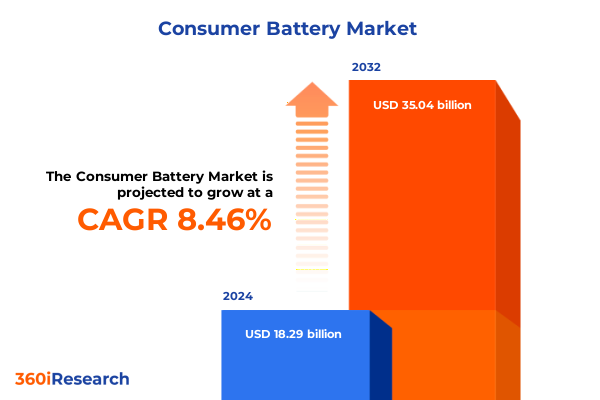

The Consumer Battery Market size was estimated at USD 19.48 billion in 2025 and expected to reach USD 20.75 billion in 2026, at a CAGR of 8.74% to reach USD 35.04 billion by 2032.

A strategic orientation to consumer battery dynamics that connects evolving consumer expectations, product design choices and commercial imperatives

The consumer battery landscape is at a critical inflection point where everyday purchasing habits meet fast-moving technological and regulatory change. Consumers expect lighter form factors, faster recharge cycles and longer runtime, while retailers and OEMs face growing pressure to minimize environmental impact and demonstrate traceability across the battery life cycle. In this environment, product design choices-chemistry, voltage and rechargeability-are no longer purely engineering decisions but strategic levers that shape distribution models, warranty policies and after‑sales services.

As a result, commercial leaders are recalibrating roadmaps that previously prioritized lowest unit cost toward those that balance total cost of ownership, safety profiles and circularity commitments. This shift is visible across retail assortments, where offline and online channels are evolving different propositions for sealed primary cells versus rechargeable packs. Downstream, service models such as warranty extensions and swap-and-recycle programs are emerging as differentiators that influence repeat purchase and brand trust. Taken together, these dynamics create both risk and opportunity: companies that accelerate integration across product, channel and end‑of‑life systems will capture outsized strategic advantage, while more narrowly focused players will see margin pressure and inventory disruption.

A concise synthesis of the multiple transformative shifts across chemistry, distribution, circularity and sourcing that are reshaping product and channel strategies

Over the past 18–30 months, a set of converging shifts has remapped where and how value is created in the consumer battery ecosystem. Chemistry innovation continues to favor secondary (rechargeable) systems for high-performance applications, while incremental improvements in cell form factor and energy density are enabling new use cases from compact wearable devices to high-capacity portable power banks. At the same time, distribution is bifurcating: digital channels accelerate velocity and narrow the window for consumer decision, while large-format retail remains the dominant channel for low-cost primary cells and impulse purchases. These parallel developments are forcing manufacturers to run dual playbooks-one optimized for frequent, high-margin rechargeable sales and another for low-cost, high-volume primary replacements.

Additionally, regulatory and corporate commitments to circularity are changing product economics; manufacturers and retailers are now being held accountable for end-of-life flows, which in turn raises the value of designs that simplify disassembly and material recovery. Supply chain resilience has become a second-order strategic requirement. Sourcing choices for critical inputs such as graphite, nickel and lithium are being reframed by nearshoring conversations and selective supplier qualification. Consequently, companies that invest early in modular designs, standardized packs and transparent supplier scoring systems will realize both cost and reputational upside. This is not a gradual transition-rather, it is a multi-front compression of product, channel and policy forces that demands decisive, integrated responses from senior leadership.

A focused analysis of how 2024–2026 U.S. tariff actions and legal uncertainty are altering landed costs, sourcing calculus and supply chain exposure for batteries

Policy shifts enacted between 2024 and 2026 have materially changed the import calculus for battery components and finished cells, and they require commercial strategies that explicitly model tariff layers and legal uncertainty. Executive actions introduced additional ad valorem duties beginning in early April 2025 and modified Harmonized Tariff Schedule entries that apply to a wide range of battery-related HTS subheadings. These actions establish a baseline additional duty across imports and set country‑specific ad valorem rates that came into effect in April 2025, creating immediate cost implications for finished cells, battery parts and certain critical minerals. This regulatory foundation has been supplemented by U.S. Section 301 increases finalized in 2024 that raised duty rates for specific battery parts and lithium-ion EV batteries, with further increases scheduled to roll through 2025 and into 2026.

Beyond headline duty changes, commercial teams must account for cumulative and overlapping levies-standard NTR duties, Section 301 additions and the administrative reciprocal tariffs-because they compound at invoice reconciliation and materially reduce the competitiveness of certain origin points for both finished batteries and upstream materials. The practical consequence is a re-pricing of global supply pools: sourcing strategies that previously prioritized cost and scale now require a deeper overlay of tariff exposure, landed cost sensitivity and transshipment risk. Adding to this complexity, recent judicial review and appellate decisions have introduced legal uncertainty that could alter implementation timelines; this litigation environment leaves companies with a planning imperative to model both the tariff scenarios in force and contingency pathways if those duties are stayed or remanded.

Segment-centric perspectives across chemistry, configuration, voltage ranges, distribution channels and specific device applications that drive product, channel and lifecycle choices

The market is shaped by clear segmentation lenses that determine buyer behavior, product design and channel economics. Based on Types, the market is studied across Primary Batteries and Secondary Batteries; that distinction matters because primary chemistries continue to serve low-drain and long-shelf-life applications, while secondary systems dominate higher-energy, higher‑use devices. Based on Battery Chemical, the landscape is divided between Alkaline Based, Lithium-ion Based, Nickel Based, and Zinc-carbon Based chemistries, with the Nickel Based category further differentiated between Nickel Cadmium and Nickel Metal Hydride-each chemistry carries distinct safety, performance and recycling attributes that influence packaging, shelf regulation and return logistics. Based on Configuration, products are classified as Non-rechargeable and Rechargeable, and this classification has direct implications for warranty policy, aftermarket service and consumer education investments.

Further granularity emerges from voltage and distribution lenses. Based on Voltage Range, the market is studied across High Voltage (>3V), Low Voltage (<1.5V), and Medium Voltage (1.5V–3V), which guides product fit for specific device classes and informs safety testing and labeling obligations. Based on Distribution Channel, the market is studied across Offline and Online, with the Offline channel further studied across Electronics & Gadget Stores and Supermarkets & Hypermarkets; this channel split defines stocking strategies, promotional cadence and return handling flows. Finally, Based on Application, demand drivers vary widely across Calculators, Cameras, Flashlights/Lamps, Mobile Phones, Personal Care Devices, Portable Power Banks, Power Tools, Radios, Smart Watches, Tablets & Laptops, and Toys, each of which imposes different lifecycle, performance and regulatory requirements. These segmentation frames are not decorative-they should be the starting point for SKU rationalization, retail assortment engineering and targeted lifecycle programs that align chemistry choice with end‑use economics.

This comprehensive research report categorizes the Consumer Battery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Battery Chemical

- Configuration

- Voltage Range

- Distribution Channel

- Application

A practical regional view of how Americas, Europe Middle East & Africa and Asia‑Pacific differences determine sourcing, compliance and channel strategies

Regional dynamics vary sharply and create differentiated routes to market and sourcing tradeoffs. In the Americas, buyers prioritize convenience, warranty clarity and regulatory compliance tied to recycling programs, while U.S. procurement teams increasingly scrutinize origin and tariff exposure as part of total landed cost analysis. This regional focus places a premium on near-term inventory planning and supplier qualification that can tolerate tariff volatility. In the Europe, Middle East & Africa cluster, regulatory intensity around battery labeling, recycled content and producer responsibility is higher and enforces additional compliance layers; European importers and brand owners are accelerating circular models and supplier audits to meet evolving legal thresholds and consumer expectations. In the Asia-Pacific context, manufacturing scale and cost competitiveness remain dominant levers, but regional policy shifts and trade measures are motivating dual‑sourcing and selective investment in local downstream assembly to mitigate cross-border risk.

Taken together, those three regional groupings create distinct strategic challenges: commercial teams must optimize assortments and supplier portfolios for local channel economics while preserving optionality should tariff lines or compliance rules change. Operationally, this implies segmented inventory strategies, differentiated packaging and labeling workflows, and explicit contractual terms that allocate tariff and regulatory risk across the supply chain. Moving from a single global playbook to a regionally nuanced operating model is therefore essential for sustaining availability, warranty performance and margin resilience.

This comprehensive research report examines key regions that drive the evolution of the Consumer Battery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How brand incumbency, contract manufacturing, material suppliers and recyclers are converging to reshape competitive advantage and capability priorities

Competitive landscapes in the consumer battery space now span broader capability sets than product pedigree alone. Traditional brand owners retain advantages in retail relationships, consumer recognition and large-scale purchasing, but they face increasing pressure from specialist contract manufacturers and battery pack assemblers that can move faster on design-to-market cycles. Component suppliers for anodes, cathodes and separator materials are assuming greater leverage because concentration and domestic capacity decisions directly affect producers’ ability to offer assured lead times under tariff pressure. Parallel to these forces, the rise of dedicated recyclers and materials-recovery specialists introduces new value pools: firms that can efficiently reclaim lithium, nickel and cobalt command strategic importance to OEMs seeking to stabilize input costs and meet recycled content goals.

For senior executives, the implication is that competitive advantage will be a composite of vertical alignment, supplier diversification and demonstrable sustainability credentials. Investment priorities that matter include qualification of alternate chemistry suppliers, contractual clauses that allocate tariff risk, and partnership models with recyclers that guarantee feedstock volumes and quality. In short, winning portfolios will combine trusted consumer-facing brands with flexible, traceable upstream supply and reliable downstream recovery capabilities to close both performance and environmental loops.

This comprehensive research report delivers an in-depth overview of the principal market players in the Consumer Battery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amperex Technology Limited

- Clarios Holdings Inc.

- Contemporary Amperex Technology Co. Limited

- Duracell Inc.

- E-One Moli Energy Corporation

- Energizer Holdings, Inc.

- EVE Energy Co., Ltd.

- Exide Technologies Holdings Inc.

- GP Batteries International Limited

- Leclanché SA

- LG Energy Solution Inc.

- Maxell Holdings, Ltd.

- Monbat Holding Group Plc

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- PolyPlus Battery Company Inc.

- Saft Groupe S.A.

- Samsung SDI Co., Ltd.

- Servotech Renewable Power System Ltd

- SK Innovation Co., Ltd.

- Sony Corporation

- Tianjin Lishen Battery Joint-Stock Co., Ltd.

- Toshiba Corporation

- VARTA AG

Actionable near-term steps for procurement, product and commercial teams to hedge policy risk, secure inputs and build circular operations that protect margin

Leaders should take a sequence of practical, measurable actions to reduce exposure and capture upside. First, embed tariff-scenario modeling into procurement decision rules so every supplier evaluation includes an assessment of HTS classification exposure, country-specific ad valorem overlays and transshipment risk; this turns policy volatility into quantifiable procurement inputs. Second, prioritize chemistry and product modularity that simplify repair, disassembly and material recovery, because operational circularity reduces dependence on volatile raw-material markets and creates defensible margin improvement over time. Third, align channel strategies: set a differentiated assortment for Offline channels that favor commoditized primary cells and a premium, rechargeable-forward assortment for Online channels that supports higher lifetime value and service revenue.

Fourth, negotiate supply contracts with explicit clauses for tariff pass-through, force majeure that contemplates trade-policy shifts, and joint inventory buffers that can be released or pooled across regional distributors. Fifth, accelerate partnerships with certified recyclers and invest in collection infrastructure or reverse-logistics pilots to secure feedstock and demonstrate compliance readiness. Finally, institute a cross-functional policy monitoring forum-commercial, legal, procurement and operations-that meets on a fixed cadence to re-run scenario analysis and update hedging and sourcing choices. These steps are deliberately pragmatic: they prioritize actions that reduce short-term cost volatility while building structural advantages around sustainability and traceability.

A clear explanation of primary interviews, HTS mapping, secondary source validation and data‑triangulation steps that support traceable and actionable findings

This research synthesizes primary interviews, targeted supply‑chain mapping and structured secondary-source validation to produce evidence-based insights. Primary research included semi-structured interviews with procurement leads, product managers and channel directors across brands, retailers and upstream component suppliers, combined with HTS-level mapping to trace the tariff exposure of finished cells and subcomponents. Secondary research drew on federal executive orders, public HTS modifications and industry commentary to validate timelines and interpret legal outcomes. Data triangulation was applied through cross-referencing customs and tariff filings, public policy notices and company disclosures to ensure alignment between reported volumes, declared origins and contractual treatments.

Quality controls included dual‑coder reconciliation of interview transcripts, HTS crosswalk verification by independent customs specialists, and scenario stress testing of tariff impact models. Wherever possible, assertions were corroborated by primary informants and public policy documents; when gaps remained, conservative assumptions were applied and explicitly noted so that downstream users can substitute their own inputs. The combination of qualitative sourcing intelligence and HTS-level mapping produces a traceable evidence chain that supports implementation decisions and bespoke datacuts for commercial or procurement teams.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Consumer Battery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Consumer Battery Market, by Type

- Consumer Battery Market, by Battery Chemical

- Consumer Battery Market, by Configuration

- Consumer Battery Market, by Voltage Range

- Consumer Battery Market, by Distribution Channel

- Consumer Battery Market, by Application

- Consumer Battery Market, by Region

- Consumer Battery Market, by Group

- Consumer Battery Market, by Country

- United States Consumer Battery Market

- China Consumer Battery Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

A concise strategic synthesis aligning product, sourcing and policy priorities to convert market disruption into long-term resilience and competitive advantage

The consumer battery sector is navigating a period of compressed transformation driven by technology, channel evolution and intensifying policy intervention. Chemistry and configuration choices are now strategic levers that shape not only device performance but also regulatory compliance and circularity economics. Distribution channels respond to those product choices differently, creating a need for differentiated assortment and aftercare strategies. At the same time, recent tariff actions and the legal reviews that have followed have elevated landed cost and origin risk to board-level concerns, pushing procurement and product teams to mesh commercial negotiations with policy scenario planning.

Looking forward, organizations that integrate tariff sensitivity into sourcing rules, accelerate modular and recyclable product design, and formalize partnerships with qualified recyclers and downstream service providers will be best positioned to protect margin and capture value. Cross-functional governance that links policy monitoring to purchasing, product and channel decisions will convert volatility into competitive advantage. The most important takeaway for leaders is that resilience is not a single initiative but a portfolio of coordinated actions across design, supply and after‑use logistics.

Contact Ketan Rohom Associate Director Sales & Marketing to secure the full consumer battery research package and tailored executive briefings for immediate strategic use

To obtain the full consumer battery market research report, request a tailored executive briefing and purchase options directly from Ketan Rohom, Associate Director, Sales & Marketing. Ketan will coordinate a concise discovery call to align the report’s scope with your strategic priorities, identify the specific chapters and data tables that matter most to your executive team, and outline value-add services such as custom datacuts, competitive benchmarking, and on-site or virtual briefings. In addition to standard report delivery, Ketan can arrange targeted slide decks for board-level presentations and scheduled follow-ups to ensure your team realizes actionable next steps.

Reach out to arrange a confidential, no-obligation preview that highlights the research methodology, chapter structure, and the specific insights that apply to your product lines, distribution channels, or regional operations. This engagement is designed to accelerate decision making: it provides cause-and-effect linkage between tariff developments, supplier options, and product-level margin sensitivities, and it fast-tracks access to the underlying HTS-level mapping and supplier intelligence that underpins the analysis. Contacting Ketan is the most efficient way for procurement, product and strategy leads to obtain a purchase proposal, licensing terms, and bespoke consulting add-ons tailored to implementation timelines.

Act now to secure the research assets most relevant to procurement and commercial planning so your organization can move from reactive mitigation to proactive advantage in a rapidly shifting policy and technology environment.

- How big is the Consumer Battery Market?

- What is the Consumer Battery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?