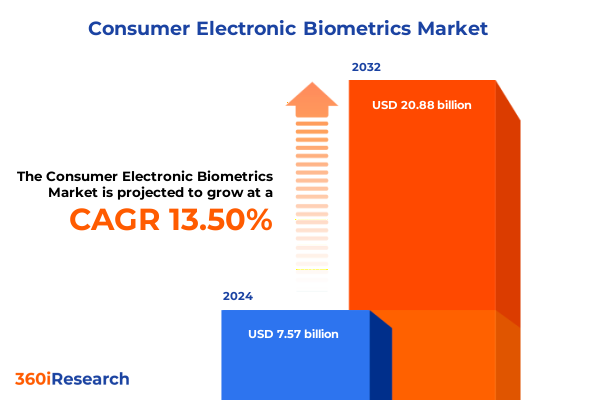

The Consumer Electronic Biometrics Market size was estimated at USD 8.58 billion in 2025 and expected to reach USD 9.73 billion in 2026, at a CAGR of 13.54% to reach USD 20.88 billion by 2032.

Exploring the Progressive Integration of Biometric Technologies within Consumer Electronics and their Strategic Role in Shaping Secure User Experiences

The adoption of biometric technologies in consumer electronic devices has accelerated rapidly as user expectations for seamless and secure interactions continue to evolve. From the first-generation fingerprint sensors embedded in laptops to sophisticated facial recognition systems powering the latest smartphones, biometric capabilities have transitioned from peripheral features to core elements of user engagement and device security. This evolution has been driven by the convergence of miniaturized sensors, advanced algorithms, and increasing computing power capable of processing complex biometric data at the edge. As a result, consumers and enterprises alike are embracing biometric authentication not only for convenience but also for its ability to mitigate risks associated with password-based systems and identity fraud.

Simultaneously, regulatory frameworks and industry standards have begun to crystallize, underpinning the responsible deployment of biometric solutions. Privacy regulations, data protection mandates, and interoperability initiatives are shaping vendor strategies and influencing product roadmaps. In tandem, consumer sentiment toward biometric privacy is maturing, with end users seeking clarity on data usage and governance. Against this backdrop, organizations are compelled to balance technological innovation with ethical considerations and compliance obligations, underscoring the strategic importance of biometric integration in devices spanning smartphones, wearables, tablets, and beyond.

This executive summary synthesizes key transformations within the consumer electronic biometrics landscape. It examines critical shifts in technology and policy, assesses the impact of recent United States tariffs, highlights segmentation and regional insights, profiles leading industry players, and concludes with actionable recommendations for executives and innovators aiming to navigate this dynamic arena.

Examining the Transformational Shifts Driving Innovation in Consumer Electronic Biometrics through Advances in AI Machine Learning and Sensor Technology

Recent years have witnessed a profound transformation in the capabilities of biometric sensors and supporting algorithms. Edge computing architectures now enable on-device processing of complex models, reducing latency and preserving user privacy. Manufacturers are leveraging advanced capacitive and optical sensing technologies to capture higher-resolution fingerprint and facial images, while thermal and ultrasonic approaches are enhancing reliability under challenging conditions. These sensor innovations, when combined with AI-driven analytics, are pushing accuracy rates to new heights and enabling adaptive authentication experiences that adjust to environmental and physiological changes in real time.

In parallel, artificial intelligence and machine learning have become integral to refining biometric performance. Systems now employ deep learning models trained to detect liveness and thwart spoofing attempts, significantly reducing false accept and reject rates. Moreover, multimodal solutions that fuse data from facial, fingerprint, iris, and voice modalities are gaining traction, offering layered security without compromising user convenience. Such convergence of modalities not only addresses the limitations of individual methods but also supports continuous authentication scenarios where user identity is validated throughout a session rather than at a single point in time.

Concurrently, industry stakeholders are responding to evolving policy and interoperability imperatives. Global privacy regulations and standardization efforts, such as the FIDO Alliance’s push for passwordless authentication, are driving cohesive frameworks that facilitate cross-device integration. These developments are fostering an ecosystem where biometric-enabled smart locks, wearables, and mobile devices adhere to consistent security protocols, unlocking new use cases while upholding user trust.

Analyzing the Comprehensive Impact of United States Trade Tariffs Implemented in 2025 on the Consumer Electronic Biometrics Ecosystem and Supply Chains

In January 2025, the Office of the United States Trade Representative finalized significant increases in Section 301 tariffs, raising duties on imported semiconductors to 50 percent and imposing a 50 percent tariff on solar wafers and critical materials such as polysilicon effective January 1, 2025. These measures targeted products deemed essential to U.S. national security and technological leadership, reflecting a broader posture of trade protectionism.

The imposition of higher tariffs on semiconductor components has introduced upward pressure on the bill of materials for biometric sensor modules integrated into consumer electronics. Manufacturers relying on capacitive and optical fingerprint sensors, iris scanners, and advanced biometric cameras have experienced cost increases that erode profit margins or are passed on to end users. As import duties climb, companies are reexamining sourcing strategies, seeking to offset tariff costs through supply chain optimization and regional manufacturing partnerships. The result has been a recalibration of procurement models and a reassessment of vendor relationships to maintain competitive pricing in a landscape constrained by higher input costs.

Trade policy uncertainty has also catalyzed strategic shifts in production footprints. Some organizations have accelerated investments in Southeast Asian and Mexican facilities to diversify manufacturing away from tariff-affected regions, while others are exploring nearshoring opportunities within North America to benefit from tariff exemptions under free trade agreements. This realignment underscores the pervasive influence of trade policy on the consumer electronic biometrics ecosystem, prompting companies to balance resilience against the incremental costs introduced by recent U.S. tariff actions.

Deriving Deep Insights from Detailed Segmentations Covering Modalities Technologies Applications Device Types and End User Verticals within Consumer Biometrics

The consumer electronic biometrics market encompasses a diverse set of modalities that define the foundational approaches to identity recognition. Facial recognition has become prominent in smartphones and smart home devices, while fingerprint authentication remains the most ubiquitous method across laptops and access control systems. Iris recognition, palm scanning, and vein-based identification continue to carve out specialized niches where precision and security requirements supersede cost considerations. Voice recognition, increasingly integrated into virtual assistants and wearable devices, offers a frictionless touchless alternative, particularly valuable in environments where physical interaction is constrained.

Underlying these modalities are sensor technologies that facilitate data acquisition and analysis. Capacitive sensors, both mutual and self-capacitive, lead the market in terms of cost-effectiveness and integration ease, whereas optical solutions provide high-resolution imaging ideal for facial and iris detection. Thermal approaches bolster liveness detection by capturing heat signatures, and ultrasonic technologies-divided into capacitive micromachined ultrasonic transducers and piezoelectric micromachined ultrasonic transducers-offer robust performance in variable lighting and environmental conditions. Software algorithms augment these hardware systems, employing machine learning models that deliver adaptive performance and continuous updating to address evolving security threats.

Biometric solutions span an array of applications, from securing access control and border management to authenticating payments and tracking time and attendance in corporate environments. Device types include smartphones, tablets, and laptops, where under-display fingerprint sensors and structured light facial cameras have become de facto standards. Wearables, both fitness trackers and smartwatches, increasingly incorporate heart rate and ECG modules alongside fingerprint or facial sensors to deliver holistic health monitoring and secure transactions. Finally, end users stretch across banking and financial services, commercial enterprises, consumer electronics, government and defense agencies, and healthcare providers, reflecting the broad applicability and growing strategic importance of biometric authentication across vertical markets.

This comprehensive research report categorizes the Consumer Electronic Biometrics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Modality

- Technology

- Device Type

- Application

- End User

Uncovering Regional Dynamics Shaping Adoption and Growth of Consumer Biometrics in the Americas Europe Middle East Africa and Asia Pacific Markets

The Americas region has emerged as a critical hub for consumer electronic biometrics, driven by robust technology infrastructure, high discretionary spending on smartphones and wearables, and progressive regulatory standards that encourage privacy and interoperability. In North America, initiatives to standardize biometric authentication in financial services have enhanced consumer confidence in mobile payments and digital wallets. Meanwhile, Latin American markets are witnessing rapid adoption of fingerprint and facial recognition in government-led identity programs, accelerating the integration of biometrics into everyday citizen services.

In Europe Middle East & Africa, stringent data protection regulations such as GDPR have shaped the deployment of biometric systems, ensuring that vendors implement robust encryption and consent mechanisms. European telecom operators and automotive OEMs are embedding biometric solutions into connected devices and vehicles, while governments across the Middle East and Africa leverage fingerprint and iris recognition for border security and immigration management. These regional dynamics underscore the balance between innovation and governance, requiring vendors to align product development with evolving privacy frameworks and security mandates.

Asia-Pacific remains the fastest-growing region for consumer electronic biometrics, propelled by national digital ID initiatives in countries like India, widespread adoption of mobile payments in China, and significant R&D investment in Japan and South Korea. Smart city programs infuse biometric authentication into public transit and retail ecosystems, while healthcare providers adopt multimodal solutions to secure patient records and streamline clinical workflows. Across these markets, the confluence of government backing, large-scale private investment, and tech-savvy consumers continues to drive unprecedented growth and diversification of biometric use cases.

This comprehensive research report examines key regions that drive the evolution of the Consumer Electronic Biometrics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations Driving Growth in the Consumer Electronic Biometrics Sector Amid Rapid Technological Advancements

Leading technology players are forging partnerships and pursuing acquisitions to broaden their biometric portfolios and enhance end-to-end solution offerings. Established semiconductor companies have deepened collaborations with sensor specialists and AI startups to accelerate time to market for next-generation modules. Meanwhile, software vendors are integrating biometric engines into identity and access management platforms, enabling organizations to deploy cohesive authentication frameworks across cloud and on-premises environments.

Strategic alliances between device OEMs and cybersecurity firms have become commonplace, aimed at bundling hardware-based biometric security with advanced threat detection and analytics. Such alliances empower corporate and government customers to implement zero trust architectures underpinned by robust biometric controls. In parallel, financial institutions and payment networks are partnering with authentication service providers to embed biometric capabilities into digital wallets and contactless payment terminals, enriching user experience while reinforcing transaction security.

Research and development investments are increasingly focused on multimodal authentication and liveness detection technologies to address evolving threat vectors. Intellectual property portfolios in biometrics have become a key battleground, with leading corporations securing patents related to sensor materials, neural network enhancements, and privacy-preserving processing techniques. As competitive differentiation hinges on accuracy, speed, and privacy safeguards, companies that can seamlessly integrate hardware and software innovations are positioned to capture the largest opportunity in the consumer electronics ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Consumer Electronic Biometrics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Apple Inc.

- Aware, Inc.

- Dermalog Identification Systems GmbH

- FaceFirst, Inc.

- Fingerprint Cards AB

- Fujitsu Limited

- Goodix Technology Inc.

- Google LLC

- HID Global Corporation

- Huawei Technologies Co., Ltd.

- IDEMIA Group S.A.S.

- LG Electronics Inc.

- Microsoft Corporation

- NEC Corporation

- Precise Biometrics AB

- Qualcomm Incorporated

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- Sony Corporation

- Suprema, Inc.

- Synaptics Incorporated

- Thales Group

- Xiaomi Corporation

- ZKTeco Co., Ltd.

Delivering Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends in Consumer Electronic Biometrics for Sustained Growth

Industry leaders must invest in research that enhances sensor accuracy and reliability under diverse conditions, ensuring that biometric systems perform consistently across lighting, temperature, and user demographics. Prioritizing the integration of AI-driven liveness detection will mitigate spoofing attacks and elevate overall system trustworthiness. Organizations should partner with academic institutions and standards bodies to define interoperable protocols and promote adoption of unified security frameworks that simplify cross-device implementation.

To navigate trade uncertainties and higher input costs, companies should diversify manufacturing footprints through strategic alliances with contract manufacturers in tariff-exempt regions. Nearshoring critical component production can reduce exposure to volatile tariff regimes and improve supply chain resilience. Additionally, exploring alternative sensor technologies and materials may uncover cost efficiencies without sacrificing performance, enabling competitive pricing strategies in mature markets.

Engaging proactively with regulators and privacy advocates will foster an environment of transparency and trust. By embedding privacy-by-design principles and adopting consent management platforms, firms can address consumer concerns while complying with global data protection regulations. Finally, forward-looking product roadmaps should embrace multimodal and continuous authentication use cases, positioning organizations to capitalize on emerging applications in healthcare, automotive, and smart home segments.

Outlining the Comprehensive Research Methodology Employed to Gather Primary and Secondary Data Ensuring Rigorous Analysis in the Consumer Biometrics Study

The research methodology underpinning this report combines primary and secondary data sources with rigorous analytical procedures. Primary qualitative research involved in-depth interviews with senior executives at device manufacturers, biometric sensor suppliers, and end-user organizations, providing firsthand perspectives on technology adoption, supply chain strategies, and regulatory challenges. Secondary research encompassed a review of government publications, trade association studies, and peer-reviewed journals to contextualize market dynamics and validate emerging trends.

Quantitative insights were derived through the collection and analysis of industry transaction data, import-export statistics, and public financial disclosures. Data triangulation techniques were applied to reconcile disparities between sources, ensuring robustness and reliability of findings. The study also leveraged case study analysis of key regional initiatives and corporate deployments to illustrate strategic responses to macroeconomic and policy shifts.

A structured framework guided the segmentation of biometric technologies by modality, sensor type, application, device category, and end-user vertical. Each segmentation axis was examined through the lenses of technical maturity, cost structure, adoption barriers, and growth drivers. Finally, expert validation sessions with industry thought leaders corroborated the accuracy of insights and provided forward-looking viewpoints, reinforcing the comprehensive and balanced nature of the analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Consumer Electronic Biometrics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Consumer Electronic Biometrics Market, by Modality

- Consumer Electronic Biometrics Market, by Technology

- Consumer Electronic Biometrics Market, by Device Type

- Consumer Electronic Biometrics Market, by Application

- Consumer Electronic Biometrics Market, by End User

- Consumer Electronic Biometrics Market, by Region

- Consumer Electronic Biometrics Market, by Group

- Consumer Electronic Biometrics Market, by Country

- United States Consumer Electronic Biometrics Market

- China Consumer Electronic Biometrics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Imperatives for Stakeholders Navigating the Evolving Landscape of Consumer Electronic Biometrics in a Digital Future

This report illuminates the critical role that biometrics now play in shaping the consumer electronics landscape, highlighting the seamless convergence of hardware advancements, AI-driven algorithms, and regulatory imperatives. Stakeholders must remain vigilant in adopting sensor technologies that deliver superior accuracy while embedding privacy-by-design principles that align with global data protection frameworks. The influence of U.S. tariffs on supply chains has underscored the importance of manufacturing flexibility and regional diversification to mitigate cost pressures and ensure market agility.

Segmentation analysis reveals that fingerprint and facial recognition dominate device integration, while emerging modalities such as iris and vein recognition are finding traction in specialized applications. Regional dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific showcase varied adoption drivers, from regulatory harmonization to national digital identity programs. Leading companies are capitalizing on partnerships and acquisitions to strengthen their positions, with particular emphasis on multimodal authentication and liveness detection as key differentiators.

Looking ahead, industry leaders that invest in continuous innovation, supply chain resilience, and privacy-centric design will be best positioned to capture growth opportunities across diverse consumer electronics segments. By executing on these strategic imperatives, organizations can sustain competitive advantages and contribute to a future where biometric security is seamlessly woven into every aspect of the digital experience.

Encouraging stakeholders to connect with Associate Director Sales Marketing Ketan Rohom for acquiring the Consumer Electronic Biometrics research report

Engaging directly with Ketan Rohom provides a personalized opportunity to explore the depth and relevance of this comprehensive research report tailored for strategic decision making in consumer electronic biometrics. With a thorough understanding of emerging technologies, regulatory landscapes, and regional nuances, connecting with the Associate Director of Sales and Marketing can help you secure the insights needed to inform your next moves. Whether you’re evaluating partnerships, refining product roadmaps, or navigating evolving trade policies, a conversation with Ketan will ensure you access unparalleled guidance and support. Reach out today to acquire the detailed research report and empower your organization to lead with innovation and confidence.

- How big is the Consumer Electronic Biometrics Market?

- What is the Consumer Electronic Biometrics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?